FG Trade/E+ via Getty Images

iBuying: the goal of simply selling homes online while making a profit. This is the objective of Opendoor (NASDAQ:OPEN), the leader in a market with little competition and some unanswered questions.

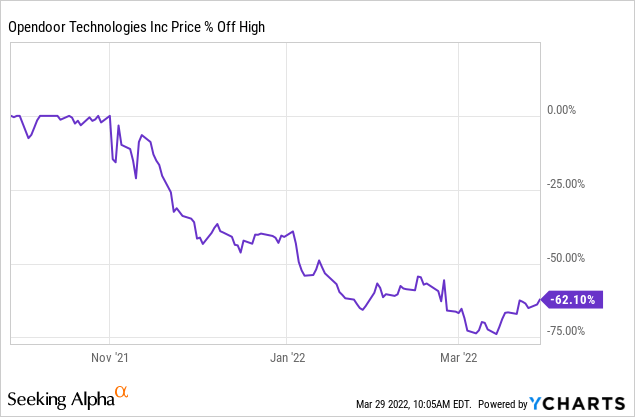

An investment in Opendoor might appeal to a naive investor because of the drop in price in recent months.

Does it mean this is a good investment? Not necessarily.

Therefore, in today’s article, we want to share our research on iBuying and Opendoor and our opinion on today’s price.

iBuying

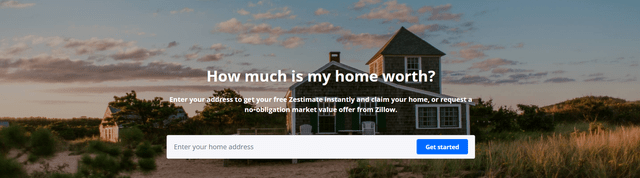

The history of iBuying starts in 2006 with Zestimate. Of course, it wasn’t a tool to buy and sell houses quickly online, but it was a beginning. Zestimate gives the possibility to calculate the value of one’s own house with a median error to date of 1.9%.

Over the years, this technology developed, transforming the iBuying market into a relevant share of the U.S. Real Estate secondary market: today, the iBuying market represents about 1% of the US’s home buying and selling market.

Opendoor’s goal is to bring iBuying from 1% of sales to the norm.

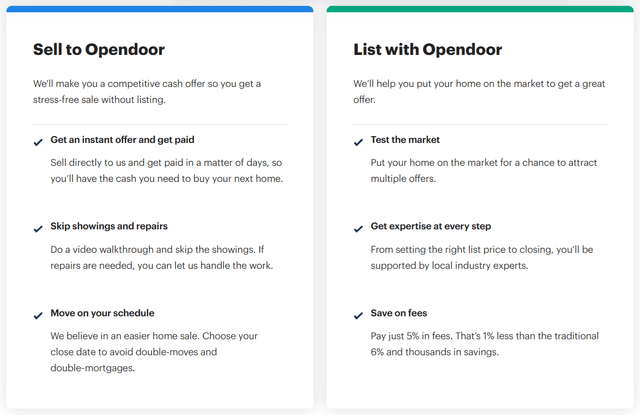

Simply put, iBuying is a technology that gives you the ability to buy and sell your real estate property directly online without the need for a realtor. Opendoor works in two ways:

- Sell to Opendoor: with this feature, the client gets an instant offer and get paid. A video walkthrough allows the owner to skip the showings totally, and if repairs are needed, Opendoor handles the work. Moreover, Opendoor lets the owner choose the closing date to avoid double mortgages or double moves.

- List with Opendoor: this is a simple listing feature on the Opendoor platform. The owner pays 5% in fees, slightly lower than the U.S. average.

Pros Of iBuying

There are certainly many positive features in the iBuying, compared to the classic property sale:

-

Time: people always need time. What can buy you more time than the ability to buy/sell a home online, with a tool that appraises your home and is willing to buy it “immediately”? That is an amazing feature, considering that Opendoor pays a fair value for the house and does not try to offer a discount price.

-

New generations: the new generations are increasingly inclined to quick solutions and technology and lack the need to interface with different interlocutors. We expect that to be positive for Opendoor to increase its market share through the next ten years and more.

-

Savings: commissions are competitive and lower than the US average of realtor commissions.

-

Visits: a house can always be visited virtually, at any time: there is no need to schedule a visit, and there is no need for the owner to be present. This is a great feature that might push more people toward iBuying than traditional transactions.

Opendoor And Real Estate Market

Opendoor was born in 2014 with the idea of a digital transition through artificial intelligence to buy and sell homes faster, using fewer resources and being priced more appropriately.

In the 10-K, the total addressable for real estate transactions in the U.S. is quantified as about 2.3 trillion in 2021. That means a market of about 1.6 trillion for Opendoor in the future. Indeed the goal of Opendoor is to reach 70% of the population in the United States. After that, it might try to expand further to cover a higher percentage of the United States or even other countries internationally. We expect the addressable market to increase at about 3.8% per year, in line with a real 1% home appreciation and a 10-year inflation expectation of 2.8%.

As of the 31st December 2021, Opendoor is active in 44 markets.

The Good

We can easily spot some good features in the business.

First, we know how important data is these days. Opendoor has conducted over 180,000 inspections and has collected over 100 data points on each property.

Secondly, thanks partly to the sheer volume of data, Opendoor can price what it buys properly. The models are adjusted to react to leading indicators that may foreshadow changes from a micro and macroeconomic perspective. These models need to be tested with a real black swan before we safely believe in the results.

pexels.com

Another positive situation is represented by the housing market and the innovative technology of Opendoor. As an innovative company with a unique product on the market, we expect Opendoor to be able to quadruple its market share within the next ten years.

The Bad

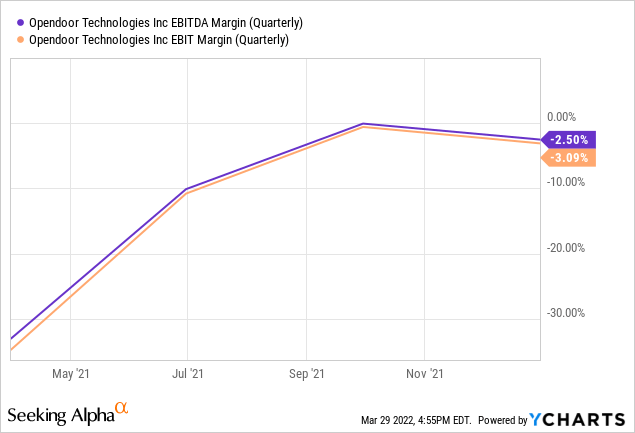

The bad we see is directly connected to pricing. Opendoor has been consistently improving its margins over the past year.

That, however, came with one of the best years for the U.S. real estate market.

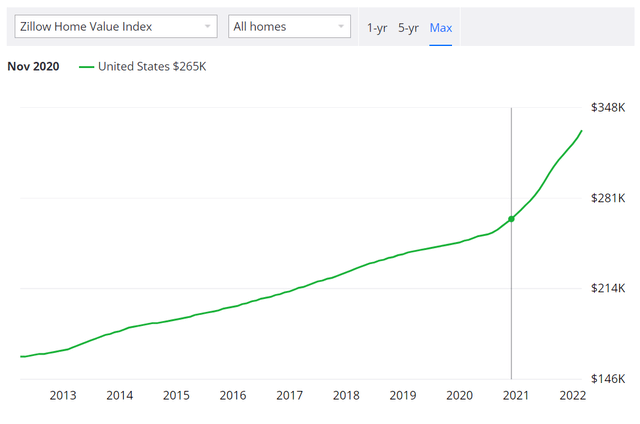

The Zillow Home Value Index estimates that the U.S. market grew about 20% last year. So what does it mean for Opendoor? Basically, Opendoor buys houses and list them on the platform. With a strong real estate market, they can easily bump their margins thanks to the higher prices in the market. That avoids Opendoor being stuck with overpaid houses in case of any misjudgment of the algorithm and selling at even higher prices.

The real estate market’s performance has heavily influenced margins over the past year. Clearly, being a cyclical industry, you have to expect the gross margin to go down in a negative market for real estate. That’s why I expect the business to become profitable in the next ten years but to remain with a low marginality in the long run.

The Ugly

In our opinion, Opendoor’s business is left with an even bigger question mark: investments.

We see iBuying as a capital-intensive industry, where it’s difficult to have a high capital turnover. Last year, we saw this when the company invested in creating more and more inventory, reaching $6.1B in value. Although, as it stands right now, Opendoor’s sales-to-capital ratio is around 1.1, this can certainly increase with an increase in business efficiency. Still, on the other hand, it could also decrease in case of a slowdown in the real estate market, with more homes remaining unsold for longer than 120 days, compared to only 8% of inventory obtained last quarter.

To see the stock undervalued today, we need either a strong increase in our marginality estimates or a big improvement in capital efficiency to increase ROIC by growing revenue without huge investments.

Conclusions

Opendoor operates in a new and interesting market. There are many positives in iBuying, and that might be the future of house buying and selling, and Opendoor has a great share of that market. However, there are too many uncertainties around OPEN’s business. For example, how could the company behave in a bear real estate market? Can the company scale without requiring ever-larger house listings and, therefore, more and more investments? These are unanswered questions from our side, and for this reason, we remain neutral on OPEN for the time being.

Be the first to comment