Drew Angerer/Getty Images News

Investment Thesis

NIO Inc. (NYSE:NIO) reported solid FQ4 results, but Q1 delivery guidance came below estimates. In addition, the company highlighted macroeconomic uncertainties exacerbated by the increasing COVID-19 lockdowns in China. Therefore, the market initially reacted by sending the stock plunging. However, it didn’t lead to a downward spiral as dip buyers absorbed the impact.

Furthermore, NIO stock has continued to stabilize around the current levels despite these near-term headwinds. In addition, we also discussed in our previous article that NIO stock’s growth valuation had been burst. The reaction post-earnings corroborated our observation that investors are starting to move beyond near-term headwinds. Furthermore, the company also telegraphed that it’s expected to achieve breakeven by Q4’23.

Therefore, we believe that the case for adding exposure to NIO stock has improved tremendously. It’s time for the bulls to raid the bearish bets on NIO stock and help it recover its mojo. Still, until the line of sight to profitability becomes clearer, NIO stock would remain a speculative bet in our portfolio.

What To Expect After Earnings?

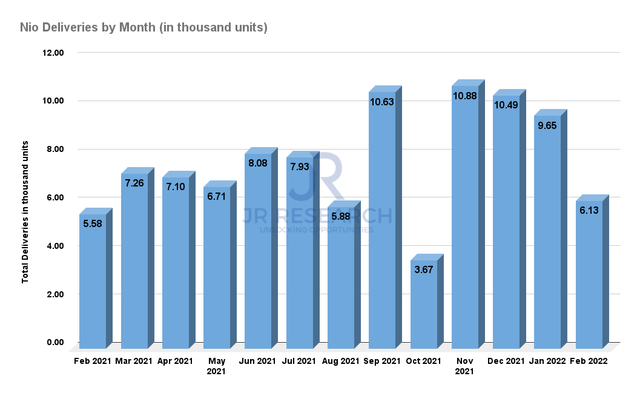

NIO deliveries by month (Company filings)

NIO reported FQ4 revenue of 9.9B yuan, or $1.6B, up 49.1% YoY. It was also above consensus estimates of $1.5B. However, its consolidated gross margins fell to 17.2%, lower than consensus estimates of 17.6%. But, its vehicle gross margin remained robust, as it improved to 20.9%. It also improved against FQ3’s 18% and last year’s 17.2%. Notably, NIO’s robust vehicle margins came amid the current uncertainties in its supply chain, as NIO CEO William Li highlighted (edited): “Although the user demand and order momentum remains strong, the production and delivery have been affected by COVID and the volatility of the supply chain.”

As a result, NIO telegraphed only 25.5K (mid-point) in deliveries for CQ1’22, ending in March. NIO had posted deliveries of 9.65K in January and 6.13K in February. Therefore, its guidance implies March’s deliveries of 9.72K, which alluded to pretty tepid momentum. Nonetheless, we concur that NIO needs to be more circumspect with its estimates, given recent flaring COVID-19 cases in China. Therefore, it could continue to affect its delivery momentum in the near term.

NIO Stock Key Metrics

NIO stock EV/NTM Revenue (TIKR)

Nevertheless, we believe that NIO’s growth premium has been digested over the past year. It’s trading broadly in line with its peers, XPeng (XPEV) and Li Auto (LI), and also China’s leading EV and battery maker, BYD Company (OTCPK:BYDDF). Hence, we think the bears are running out of space to run since the massive capitulation in Chinese EV stocks two weeks ago. It demonstrated clearly that investors are ultimately still rational actors. Therefore, we believe that NIO investors are turning their attention to its long-term outlook moving ahead, despite near-term headwinds.

What is NIO’s Long-Term Outlook?

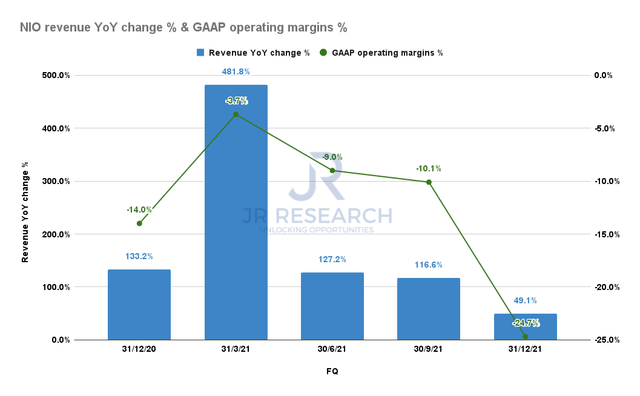

NIO revenue YoY change % & GAAP operating margins % (S&P Capital IQ)

NIO’s 49.1% revenue growth represented a marked deceleration against last year’s phenomenal metrics. Furthermore, its aggressive investments in SG&A and R&D spending have also overshadowed its gains in revenue. NIO highlighted that R&D grew 120.5% YoY, and SG&A expenses increased by 95.4% YoY. Nevertheless, NIO is still very much in growth mode. Therefore, investors should not be surprised that the company continues to dedicate significant resources to expanding its R&D capability and footprint. Notably, the company’s European experiment has proven to be highly successful. Li articulated (edited):

In the global market, ES8 has gained popularity with our customers in Norway. This year, our monthly deliveries have ranked within the top 2 among the 6-seater or 7-seater passenger cars. Therefore, we are confident in expanding our footprint. In 2022, NIO will bring its products and comprehensive services to Germany, the Netherlands, Sweden, and Denmark. (NIO’s FQ4’21 earnings call)

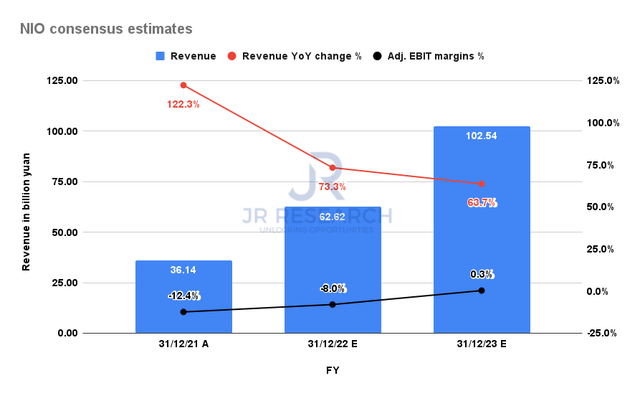

NIO consensus estimates (S&P Capital IQ)

Therefore, investors need to exercise patience and afford more time for the company as it penetrates the massive European EV market further. Consequently, NIO accentuated that it would “step up” its R&D spending in 2022. It sees tremendous opportunities to invest in core technologies and adapt its products to fit its markets better. Notably, the company expects these investments to improve its leverage significantly. Therefore, NIO has targeted FQ4’23 for breakeven and reaching profitability in FY24.

Consensus estimates also concur with NIO’s guidance. Furthermore, the Street expects NIO to turn profitable on adjusted EBIT terms in FY23, a year ahead of the company’s guidance. The company is still expected to post significant topline growth, up 73.3% in FY22. Therefore, we believe that the company’s ability to optimize its operating efficiencies will depend greatly on meeting those aggressive estimates.

Is NIO Stock A Buy, Sell, Or Hold?

We consider NIO a speculative investment, given its lack of GAAP operating profitability, and aggressive growth estimates. Furthermore, we need to observe a strong manufacturing ramp and delivery cadence on its new ET7, upcoming ET5, and ES7. These three products would be critical in helping NIO refresh its offerings and lift its delivery outlook in H2’22 and into FY23.

Therefore, we encourage investors to continue paying attention to its supply chain developments in China. We expect the European market to offer long-term potential but is unlikely to move the needle much in the near term.

Nonetheless, we believe that a significant level of pessimism has been baked into NIO stock. As such, we think it’s time for the bears to get out of NIO or risk getting marauded subsequently.

Consequently, we reiterate our Buy rating on NIO stock.

Be the first to comment