mi-viri/iStock via Getty Images

Madrigal

“The most important quality for an investor is temperament, not intellect.” – Warren Buffett

In biotech investing, a Phase 3 data report can substantially move the needle on your stock. When it comes to a data release for its lead drug in a narrow pipeline, that development is considered a binary (i.e., make or break) event. As such, it’s important that you forecast and anticipate the upcoming outcomes.

On that note, Madrigal Pharmaceuticals (NASDAQ:MDGL) is poised to release the results of its Phase 3 (MAESTRO-NASH) trial this month. As such, the upcoming so-called binary development determines the fate of Madrigal. In this research, I’ll feature a fundamental analysis of Madrigal and share with you my expectation of this growth equity.

Figure 1: Madrigal chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, you should skip to the next section. I noted in the prior research,

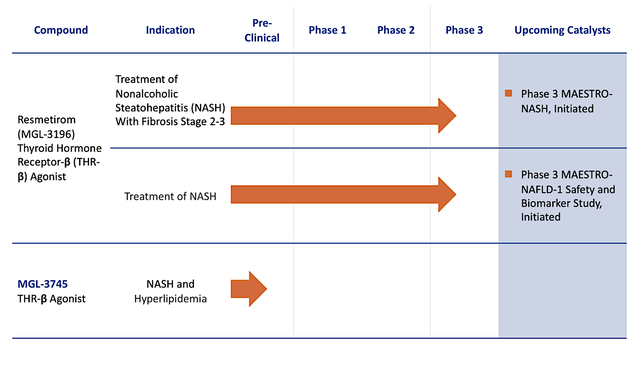

Headquartered in Conshohocken, Pennsylvania, Madrigal is focused on the innovation and commercialization of stellar medicine to serve the unmet needs in heart and liver diseases. In executing a laser-beam-focused approach, Madrigal is innovating only two powerful medicines for non-alcoholic steatohepatitis (i.e., NASH) and related conditions. As the crown jewel, resmetirom (i.e., Resme) is a thyroid hormone receptor-beta (THR-B) designed to treat NASH. Due to the robust data, it has the opportunity to become the first approved medicine for this untapped market.

Figure 2: Therapeutic pipeline

Disease Context: Non-alcoholic Steatohepatitis

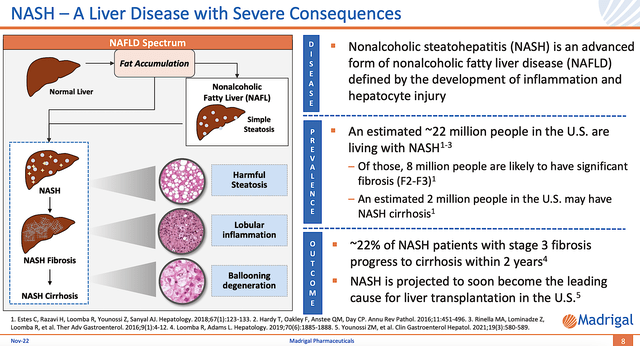

Shifting gears, you should focus on the Disease Context (i.e., DC) of NASH. After all, it can help you forecast the upcoming clinical reporting. Notably, you can see from the figure below that NASH occurs on a spectrum of non-alcoholic fatty liver disease (NAFLD).

In the earlier stage, fatty liver accumulation is the dominant characteristic of NASH. For the later phase, the diseased liver would experience NASH fibrosis with fibrotic (i.e., scar) tissue buildup. And, the degree of fibrosis is graded from F2 to F4 level. In the last stage, the NASH liver becomes cirrhotic and thereby loses its function.

Figure 3: NASH disease context

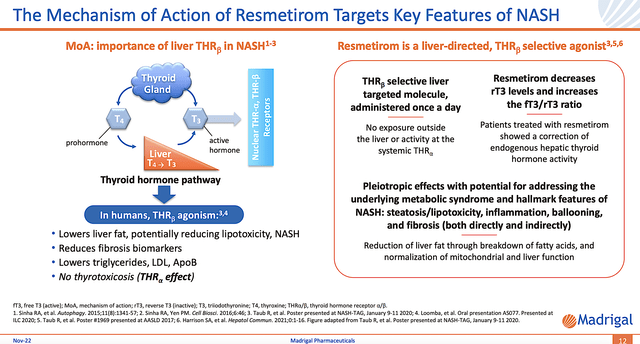

Mechanism of Action: Resmetirom

Since Resme is the likely answer for NASH, you should analyze its mechanism of action (i.e., MOA). Accordingly, Resme works by ramping up the thermostat of your liver. That is to say, beta-thyroid activation boosts the liver’s fat-burning capability.

By removing the excess fat with Resme, the liver’s innate healing capability kicks in to shift the balance toward regeneration. As you can appreciate, the DC and MOA fit together like matching puzzle pieces that would indicate positive clinical future data.

Figure 4: Resme’s mechanism of action

Upcoming Clinical Catalyst: MAESTRO-NASH

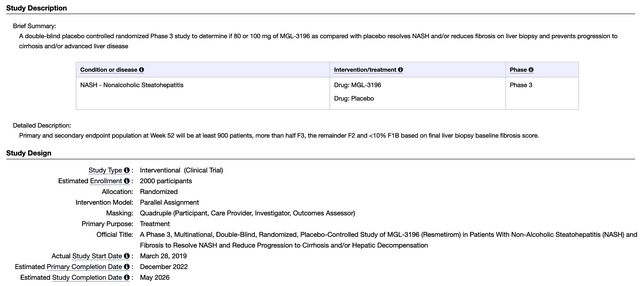

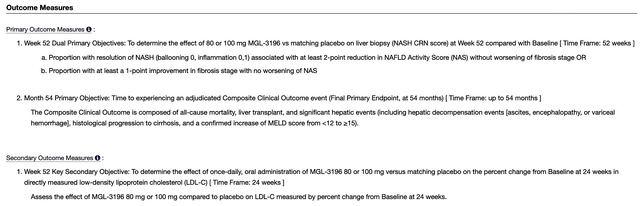

As you know, the most important event (i.e., clinical catalyst) for Madrigal is the upcoming data release for MAESTRO-NASH this month. As a high-quality, randomized, placebo-control Phase 3 trial, MAESTRO-NASH assesses the efficacy and safety of Resme in roughly 2000 patients afflicted by NASH.

Figure 5: MAESTRO-NASH design

Viewing the figure below, you can see the MAESTRO-NASH has dual primary endpoints: (1) NASH resolution without worsening of fibrosis stage or at least a 1-point improvement in fibrosis stage without worsening NAS and (2) Composite clinical outcome. As to the secondary endpoints, they entail biomarkers associated with the said disease.

Figure 6: MAESTRO-NASH outcomes

As you can imagine, both primary and secondary outcomes are not easy to clear. That is to say, they are high hurdles for a drug to overcome. As such, they have not been any other drugs that have passed a Phase 3 trial besides Resme. If you recall, Resme already delivered positive MAESTRO-NALFD-1 data. That aside, the Obeticholic acid of Intercept Pharmaceuticals (ICPT) came close yet its data is not clear-cut convincing.

Estimated Market

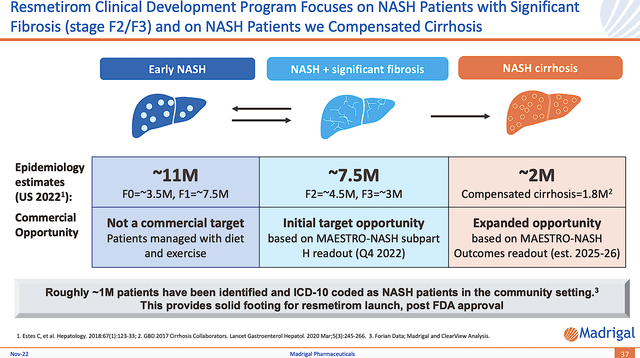

Though there are approximately 20.5M patients suffering from NASH, only 9.5M would be managed with medications. After all, the early-stage NASH (i.e., 11M) can be treated with diet and exercise. Notwithstanding, most of those patients will progress toward needing medication. Due to the aforesaid statistics, this market is growing extremely fast at 58.6% CAGR and is estimated to reach $180.09B by 2031.

Figure 7: NASH spectrum

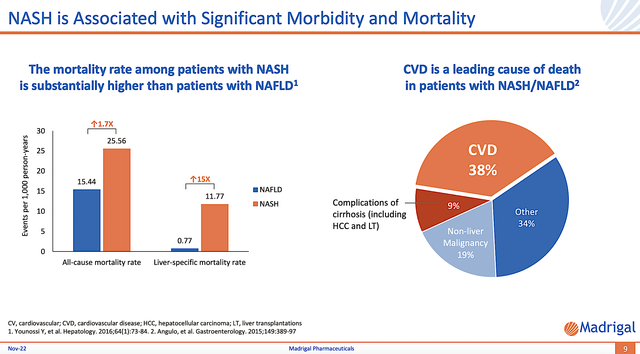

As NASH is associated with significant illness/death (i.e., morbidity and mortality), there would be a strong demand for Resme. Coupled with the fact that there is no approved therapeutics, the demand for Resme is extremely high. Riding a heightened demand without a solution, the FDA would be much inclined to approve Resme. That is, if and only if, the drug can clear its Phase 3 (MAESTRO) study.

Figure 8: Significant morbidity and mortality associated with NASH

Launch Preparation

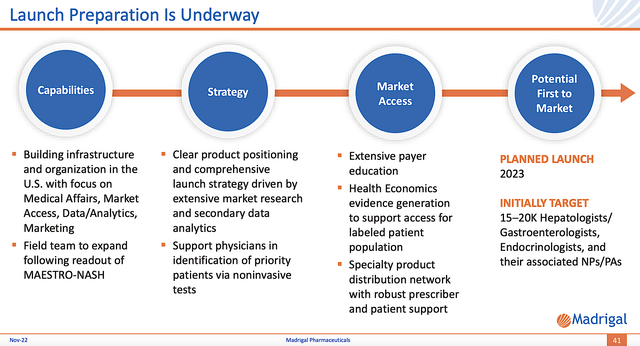

Before getting its Phase 3 data, I believe that Madrigal is proactive and confident enough in its medicine to start the launch preparation process. Precisely speaking, the company is already building its field team (readying to expand following the data readout). Moreover, medical affairs and various commercialization structures are being implemented.

It’s also interesting to note that Madrigal completed its primary market research. In the survey, 91% of specialists stated that Resme has extremely high utility for NASH. More importantly, 49% of those docs are eager to prescribe Resme immediately after approval.

Figure 9: Resme launch preparation

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 3Q2022 earnings report for the period that ended on September 30.

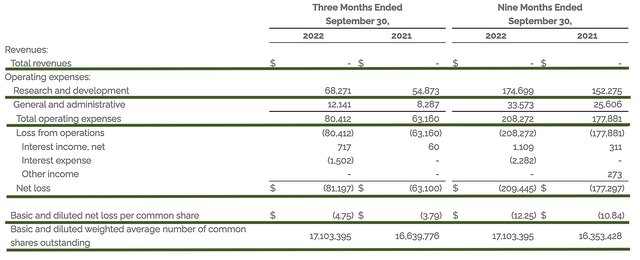

Like other developmental-stage companies, Madrigal has yet to generate any revenue. Therefore, let’s analyze other more meaningful metrics. On that note, the research and development (i.e., R&D) registered at $68.2M compared to $54.8M for the same period a year prior. I viewed the 24.4% R&D increase positively because the money invested today can turn into blockbuster results. After all, you have to plant a tree to enjoy its fruits.

That aside, there were $81.1M ($4.75 per share) net losses compared to $63.1M ($3.70 per share) declines for the same comparison. On a per-share basis, the bottom line depreciated by 28.3%. That made sense because the company invested more into R&D as well as getting Resme reading for potential commercialization.

Figure 10: Key financial metrics

Regarding the balance sheet, there were $153.2M in cash, equivalents, and investments. Against the $80.4M quarterly OpEx, there should be adequate capital to fund operations for another two quarters (i.e., into 1Q2023) prior to the need for additional financing. Simply put, the cash position is weak relative to the burn rate. Consequently, you’re likely to see Madrigal raise capital soon.

While on the balance sheet, you should check to see if Madrigal is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 16.6M to 17.1M, my math reveals a 3.0% annual dilution. At this rate, Madrigal easily cleared my 30% cut-off for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with an investment regardless of its strength. At this point in its growth cycle, the most imperative concern for Madrigal is whether MAESTRO-NASH can generate positive results by Q4. The risk here is mostly concentrated because Madrigal has only one advanced asset in its pipeline. In case of a failed data report, you can expect Madrigal to tumble over 80%. On the upside, the stock is likely to rally by 50% for positive data reporting.

Conclusion

In all, I maintain my strong buy recommendation on Madrigal with 4.7/5 stars. After years of diligence, sacrifices, and hard work, Madrigal is witnessing what can be Resme’s history in the making. Though the NASH space is crowded with countless innovators, Madrigal is the only firm that delivered positive Phase 3 data thus far. As you know, the MAESTRO-NAFLD1 trial results were strongly positive. Next up is the most important of all NASH studies (i.e., MAESTRO-NASH). If positive, Resme would likely go on to become the first therapeutic to enter a monopoly market.

You do not have to wait much longer because Madrigal is anticipated to report data this month. And strong Phase 3 results could be like an early Christmas (or Hanukah) present to shareholders. If good fortune occurs, Madrigal would file its application with approval to come in Q3 next year. If negative, your investment in Madrigal would go bust. Hold on to your seat on this one. The shares are on for a ride.

Be the first to comment