Svetlana_Angelus/iStock Editorial via Getty Images

Overview

Most companies in the world today will have mission statements, which are supposed to be the north star of any company. Any employee should be able to look at whatever they’re working on, and think ‘yeah, this is helping us to achieve our mission’. Often, mission-driven companies end up being more successful than their counterparts, as they attract and retain high-quality employees, customers, and long-term investors who can all get behind the mission.

But not all mission statements are created equal, and not all companies live up to this. I’ll give a couple of examples.

‘To responsibly lead the transition of adult smokers to a smoke-free future’ is the mission statement of cigarette manufacturer Altria (MO), formerly Philip Morris. Can an employee coming up with the latest marketing strategy to sell their Marlboro cigarettes look at that mission statement and think they’re achieving that? Absolutely not. It sounds like a great mission statement, but it is quite frankly ridiculous.

How does ‘To provide the highest level of service, the broadest selection of products and the most competitive prices’ sound? I mean… this could be applied to literally any retailer; it’s an awful mission statement, and certainly isn’t going to inspire any employees. 10 points for whoever can guess the company behind this terrible mission statement in the comments.

Done correctly, a mission statement should be simple and inspirational whilst also being a north star that a company can look at to ensure it’s on the road to accomplishing all that it wishes to achieve. Here’s an example of a brilliant mission statement:

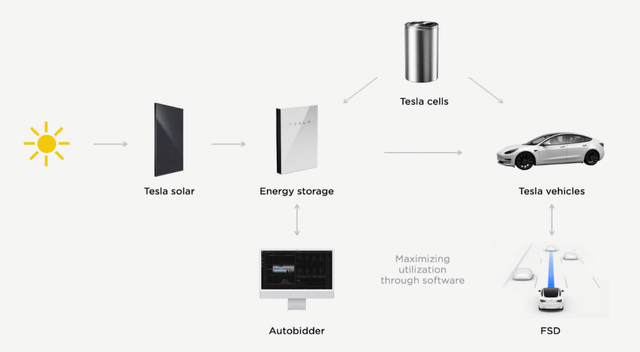

To accelerate the world’s transition to sustainable energy

This, of course, is the mission statement of Tesla (NASDAQ:TSLA). It is simple (any employee would be able to recite it), inspirational (doing good for the planet), and can also be used as a north star, even as Tesla has diversified across industries (cars, energy, AI). As we saw with Altria, some companies have mission statements that sound great, but are not a ‘north star’ – yet with Tesla, we have a company that does everything with its mission statement in mind, and I think that investors will reap the rewards over the years ahead.

Unmistakably Mission-Driven

There are numerous examples of Tesla taking actions that are not only mission-driven but have also been beneficial to the business. Some investors think that taking a mission-driven approach and trying to do some good in the world is just a company being ‘woke’, but Tesla proves that taking actions to accelerate the world’s transition to sustainable energy can also drive business performance to new heights.

Back in June 2014, CEO Elon Musk wrote a blog post entitled All Our Patent Are Belong To You, and I’m sure the phrasing is a pop-culture reference that I’m missing.

In doing so, he announced that Tesla would apply an open source philosophy to its patents for the advancement of electric vehicle technology. Tesla vowed not to initiate patent lawsuits against anyone who, in good faith, wanted to use its technology for their own development of electric vehicles. This is primarily because Tesla saw its main competition as the number of ICE vehicles on the road – not electric car programs from major car manufacturers.

This decision made 8 years ago clearly has not harmed Tesla, but it successfully contributed to their mission. In fact, the company also calls out that it isn’t patents that will continue to give them a competitive advantage:

Technology leadership is not defined by patents, which history has repeatedly shown to be small protection indeed against a determined competitor, but rather by the ability of a company to attract and motivate the world’s most talented engineers. We believe that applying the open source philosophy to our patents will strengthen rather than diminish Tesla’s position in this regard.

Turns out, they were absolutely right – but this is only the start.

In 2017, Tesla Motors changed its name to Tesla, reflecting the company’s expansion beyond cars into batteries and solar energy. Clearly a jump into different industries, but once again with the aim of achieving its mission – particularly thanks to the 2016 acquisition of SolarCity.

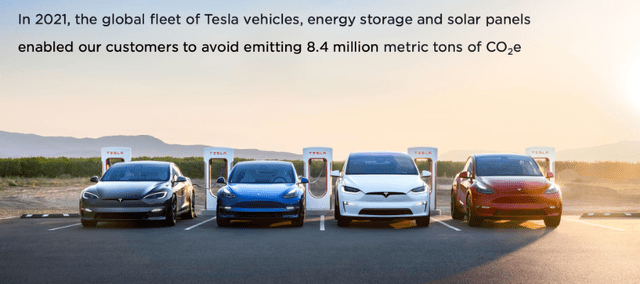

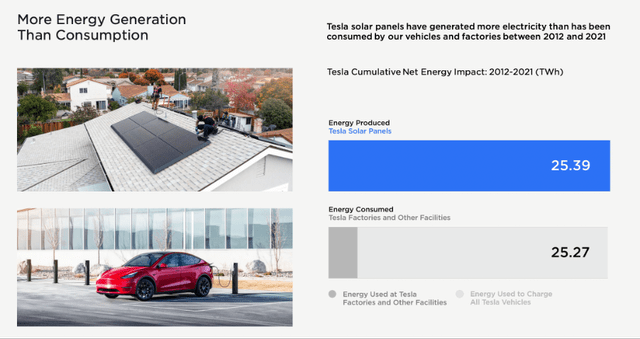

Nowadays, Tesla offers a range of additional products for solar energy generation and storage. These include Powerwall, a lithium-ion battery storage product designed for a home; Megapack, an energy storage solution for much larger facilities; and Solar Roof, which is well… a solar powered roof. By making this change to the company, Tesla opened up a whole new avenue in which it can generate value for shareholders, all whilst taking another step closer to achieving its mission. In fact, Tesla solar panels have generated more electricity than has been consumed by its vehicles and factories from 2012 through to 2021.

These are just a few examples of Tesla expanding the business to both achieve its mission and also deliver shareholder value. Others include:

- Open Supercharger Network: More cars using these superchargers provide additional revenue for Tesla, plus it also enables greater efficiency and broader expansion opportunities.

- Autonomous Driving: Gives an additional incentive to use Tesla cars, and the opportunity for robotaxis will clearly result in more Tesla EVs on the road.

- Battery Recycling: Creates less waste in the supply chain but also enables Tesla to repurpose components of old batteries when creating new ones, particularly when it comes to harder-to-obtain minerals such as lithium.

- Production & Supply Chain Localisation: Reduces emissions whilst also reducing the cost of transporting finished goods across the globe.

Why Does It Matter?

We can see past instances where Tesla’s mission-driven approach has led to changes in the company, but what are the implications for shareholders?

Firstly, there’s no denying that one of Tesla’s strongest economic moats is its brand. Whilst this is in part driven by its technical expertise, Tesla has also managed to appeal to the ever-more conscientious consumer who cares about this transition to sustainable energy.

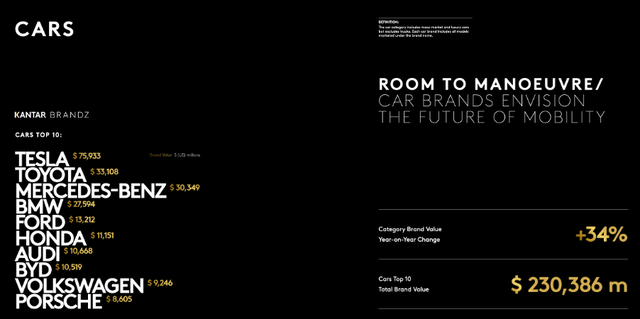

The company’s eco-friendly mission has accelerated the value of Tesla’s brand substantially, with Tesla now being the world’s 29th most valuable brand according to Kantar BrandZ – notably, the highest rating for a car brand, with its closest competitor being Toyota, ranked 66th.

Kantar BrandZ Most Valuable Global Brands 2022

Strong brands have a history of delivering impressive shareholder returns, and Tesla has been no different. Its ability to deliver on its inspirational mission should only further help to supercharge growth for the company.

But it’s not just about enhancing the brand; Tesla’s mission-driven approach will continue to drive the company forward in ways that cannot yet be foreseen – although perhaps there is one aspect that we can dive into further.

Tesla recently announced that it was piloting an open Supercharger network throughout some European countries. On the face of it, this decision will take Tesla one step closer to achieving its mission but will be detrimental to the company. I believe that another smaller economic moat possessed by Tesla relates to its switching costs for the Supercharger network – without a Tesla, you cannot access it – and it feels like Tesla might be forgoing this moat in the name of its mission, thereby weakening the business.

But dig a little deeper, and the potential switch away from a closed Supercharger network makes a lot of sense. As it stands, Tesla is somewhat limited in the amount of Supercharger stations that it can build – is there any point building out some if there are just 100 Teslas in a town? Yet… what if there are 100 Teslas, but 1,000 electric or hybrid vehicles? Tesla’s Superchargers are the best in the business according to JD Power, and so the demand would be there from non-Tesla owners to utilise these rapid charging stations.

Then take it one step further and consider the direction the world is heading in. We will all be driving electric vehicles eventually, whether that’s in 10, 20, or 50 years, and these EV charging stations will be the norm, just as gas stations are today. But could you imagine General Motors (GM) owning a bunch of gas stations at which you could only refuel GM cars? It would seem silly and inefficient, and I believe this is what the Tesla Supercharger network would turn into if it failed to open up.

This is just one example of something that is only being piloted right now, but it shows how Tesla’s mission statement combined with the tailwinds driving the transition to sustainable energy can result in this company being ahead of the game – as it always has been, and I hope it will continue to do so.

Tailwinds Pushing This Mission Forward

Let’s reiterate once again: Tesla’s mission statement is to accelerate the world’s transition to sustainable energy.

Another aspect shareholders should love about this mission statement is the number of tailwinds behind it. Governments across the globe are incentivised to transition from fossil fuels to sustainable energy sources, and there is more and more pressure being put on these governments to take action. This should only help Tesla’s growth to accelerate – but don’t just take my word for it.

According to Facts and Factors, the global EV market is expected to grow from a size of $185B in 2021 to $980B in 2028, implying a 24.5% CAGR.

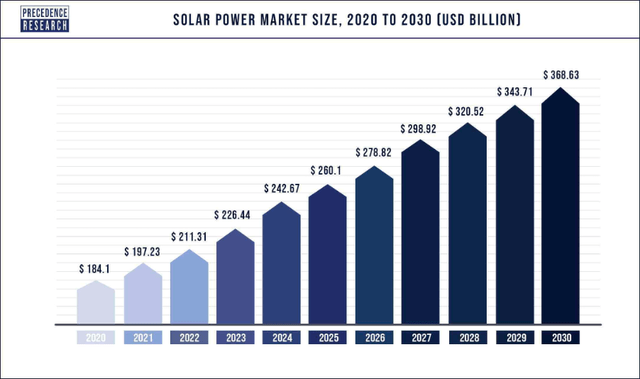

According to Precedence Research, the global solar power market is poised to grow at a 7.2% CAGR from 2021 through to 2030, reaching a size of $368B.

Finally, according to Fortune Business Insights, the EV charging station market is expected to grow at a 30.26% CAGR from 2021 through to 2028, achieving an overall market size of $111.9B.

What’s the takeaway? Not only is Tesla able to improve its business performance by achieving its mission, but the mission-driven avenues that this company is exploring are growing market opportunities.

This is a perfect mission to inspire employees and create customer loyalty, but it is also a brilliant mission when it comes to expanding the business into new, emerging trends and potentially huge market opportunities. Talk about a win-win!

Valuation

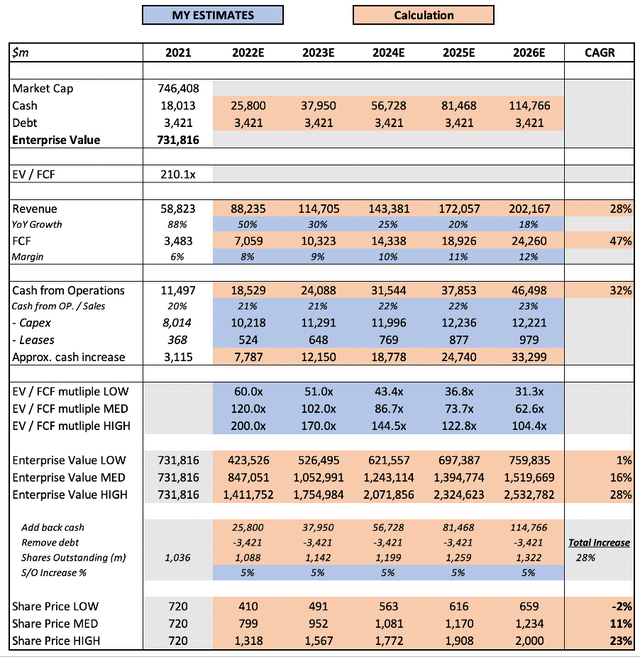

I know, I know… I had to ruin it by talking about valuation. Yet Tesla’s valuation may not be as unreasonable as some in the financial media like to make out. I explained the full rationale behind my valuation model in my previous article, and nothing has changed since (apart from the current market capitalisation).

Basically, I think shares are reasonably priced, particularly if you believe that Tesla can achieve a revenue CAGR of over 28% through to 2026 (spoiler alert – I do).

Bottom Line

Mission statements can be meaningless platitudes, or they can help transform the world. I strongly believe that Tesla’s mission statement is not only going to change the world but it is also going to reward shareholders whilst doing so. For me, the current share price seems reasonable enough to invest in the world’s transition to sustainable energy.

Be the first to comment