Ryan Fletcher/iStock Editorial via Getty Images

On the first day of the Farnborough International Airshow, The Boeing Company (NYSE:BA) was the clear winner, with a groundbreaking order from Delta Air Lines (DAL) for the Boeing 737 MAX. On the second day of the airshow, Boeing maintained momentum, as I discuss in this continuing coverage.

Boeing Maintains Momentum

Flair operates one of the Boeing 737 MAX ordered by 777 Partners (Flair)

On the second day of the Farnborough Airshow, Boeing maintained momentum, announcing an order for up to 66 Boeing 737 MAX aircraft from private equity firm 777 Partners. The deal includes 30 orders for the Boeing 737 MAX 200, the high capacity variant of the Boeing 737 MAX 8. The deal also includes an unspecified number of MAX 8 aircraft.

From the wording of Boeing’s press release it was not immediately clear whether the remaining 36 aircraft were options or part of a Letter of Intent. Upon reaching out to Boeing, the jet maker was unable to clarify the matter, and as a result I have interpreted the commitment for the 36 jets as a Letter of Intent. It is, needless to say, that it is rather disappointing that a jet maker such as Boeing refuses to provide clarity and instead leaves room for interpretation of their press releases.

The jet maker also saw VietJet reaffirming orders for 200 Boeing 737 MAX aircraft placed in 2016 and 2018, and Aviation Capital Group was identified as the customer for 12 Boeing 737 MAX 8 aircraft. Interesting to note is that data analytics solutions from The Aerospace Forum show that the lessor has cancelled 84 MAX orders since 2020. So, Boeing has a lot of business to win back from the lessor. Boeing also saw continued demand for its converted freighter product, signing a firm agreement with BBAM for 9 Boeing 737-800BCFs. Boeing, however, will be happier with the firm order it received from AerCap (AER) for 5 Boeing 787-9s, displaying confidence in the road ahead for the Dreamliner and the value proposition the jet offers.

ATR Continues Winning Business

Abelo ATR aircraft (ATR Aircraft)

Whereas Airbus has not been able to impress during the first two days of the airshow. ATR saw continued orders and commitments on the second day of the airshow:

- Oriental Air Bridge ordered 1 ATR 42-600.

- Lessor Abelo signed a firm order for the ATR 42-600, which is the short take off and landing variant of the ATR 42-600, with a heads of agreement (Memorandum of Understanding) for 10 ATR 72-600 turboprops.

A Big Day For Embraer

Embraer (ERJ) had nothing to announce on the first day of the airshow, but the jet maker tends to schedule most of its announcements on a single trade day, which likely was the second day of the airshow. The jet maker released its forecast for the coming 20 years anticipating demand for 10,950 aircraft with up to 150 seats. Turboprops will account for 20% of the orders and 80% will be covered by jets. The Brazilian jet maker also announced that to date it has accumulated Letters of Intent for 250+ next generation turboprop aircraft if the aircraft program is officially launched.

Furthermore, Embraer announced an order from Porter Airlines for 20 Embraer E195-E2 jets and 8 Embraer E175s and options for another 13 from Alaska Airlines to be operated by Horizon Air under a capacity agreement. Embraer’s subsidiary announced a Letter of Intent with BAE Systems for exploring the deployment of up to 150 eVTOLs (electronic vertical take off and landing) aircraft for application in the Defense market, for which BAE Systems also signed a Memorandum of Understanding.

Conclusion

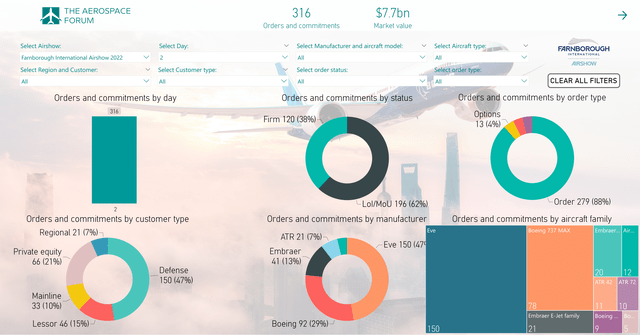

Farnborough International Airshow Day 2 orders and commitments (The Aerospace Forum)

Boeing, measured by order value, once again was the winner of the day, but Embraer together with Eve will be happy with their numbers as well. Airbus (OTCPK:EADSF, OTCPK:EADSY), once again was a no-show, only announcing a partnership with CFM to test open fan technology.

In total, all orders and commitments had a value of $7.7 billion for 317 aircraft (including eVTOLs) with firm orders covering 83 aircraft valued $3.7 billion and tentative agreements for 196 aircraft valued $2.5 billion. As one might notice, these values do not add up to the total presented, as there also were customer reveals and options which typically have a significant timeline before they are firmed if even that happens.

So, at all times it remains important to not just scan the headlines but also dig deeper to see what actually adds value, and what might seem to be adding value but in fact does not. That is what we visualize using the TAF Airshow Order Tracker, which showed that, compared to the second day of the previous edition of the airshow, there were 444 firm orders and tentative agreements valued at $43.6 billion. So, there is a decline in order value which is caused by the absence of Airbus in the announcement mix and just overall the market being materially different from the previous Farnborough Airshow, with more macro uncertainty and supply chain pressures.

Boeing has had two strong days during the trade show, which could be enough to overtake Airbus in the annual order battle, but we are assuming that Airbus still has some announcements up its sleeve.

Be the first to comment