Risto0/iStock Editorial via Getty Images

Investment Thesis

Nokia Oyj (NYSE:NOK) is successfully turning around its business. The company is facing some key headwinds. These include supply chain issues, an uncertain economic environment, and declines in its most profitable segment.

However, the company is improving its margins and issuing promising guidance. The company’s leadership has highlighted a strong order backlog and high demand for its products. The company is trading at a cheap valuation, too. I believe the risk to reward is favorable, and I’m bullish on Nokia’s shares.

Margins keep expanding

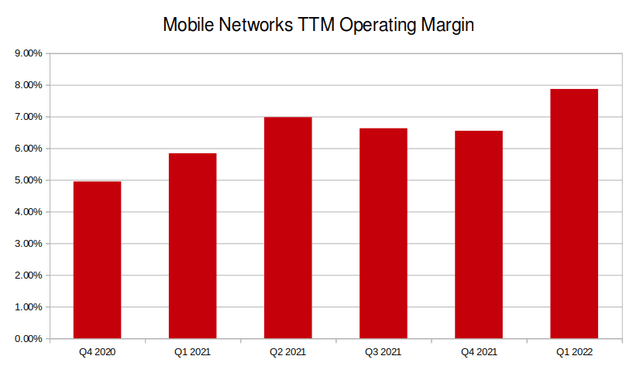

One of Nokia’s key growth drivers is its expanding margins. The company has been consistently improving its profitability. This is one of the key reasons I’m bullish on the stock.

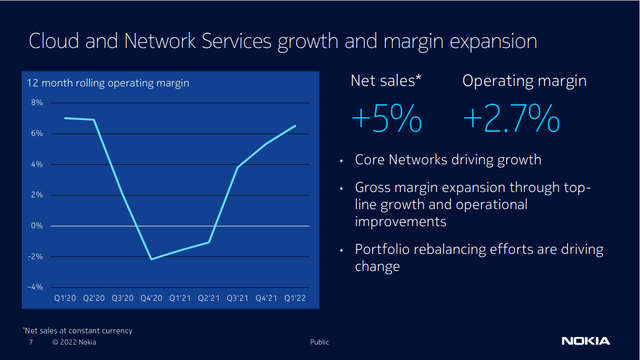

Nokia Q1 2022 Earnings Presentation

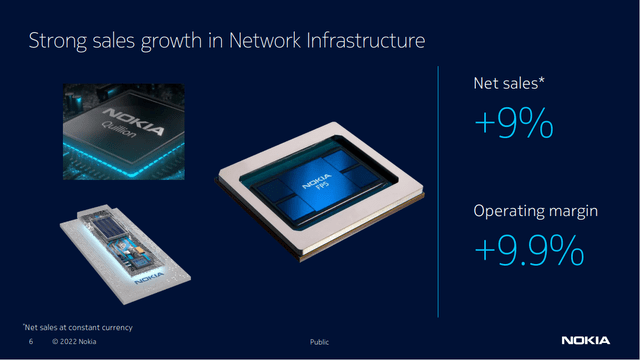

Nokia has improved its margins across its segments since the start of its turnaround in late 2020. The mobile networks segment increased its operating margin by 4.1 percentage points year-over-year. Margins for cloud services increased by 5.7 percentage points YOY. Some slight weakness in network infrastructure margins was offset by revenue growth.

Nokia Q1 2022 Earnings Presentation

The company generated its highest profit increase from its mobile network segment. The company improved gross margins by 6.6 percentage points even though constant currency revenue was down 4% year over year. The segment’s operating margin more than doubled.

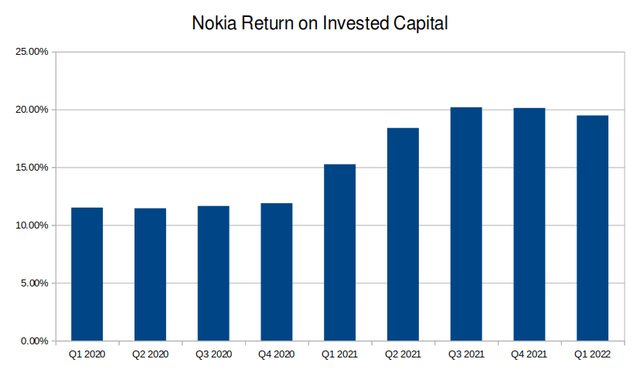

Created by author using data from 10-K and 10-Q filings

I don’t believe the segment’s revenue is in secular decline, either. It’s common for companies with declining revenues to boost margins. But Nokia attributes the segment’s negative growth to a tough supply chain situation. On their last earnings call, management stressed that their products have a strong order backlog. Their products are still in high demand. I think it’s good that Nokia is able to boost margins now. This will likely enable the company to generate even more profit from these orders when the supply chain catches up.

Sales were disappointing in optical networks and enterprise businesses. But these declines are also related to supply chain issues. These should create a tailwind as the situation normalizes.

| Product Segment | Full Year Guidance | First Quarter Results |

| Mobile Networks | 6.5 to 9.5% | 7.5% |

| Network Infrastructure | 9.5 to 12.5% | 9.9% |

| Cloud and Network Services | 4.0 to 7.0% | 2.7% |

The company’s forward margin guidance is promising. Management’s outlook suggests there’s much more room for growth in all their product segments’ margins.

Will Nokia Technologies bounce back?

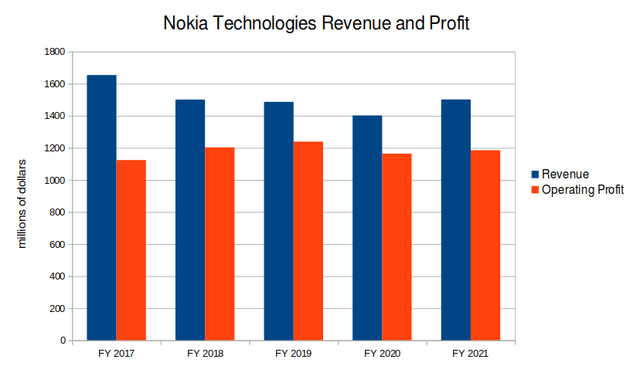

Another segment to watch is Nokia’s patent and intellectual property segment. Nokia calls this Nokia Technologies. This is Nokia’s most stable and most profitable segment. In the last fiscal year, the segment made up just under 7% of revenue. However, it was also responsible for almost 43% of the company’s operating profit. Operating margins are consistently near 80%.

Created by author using data from 10-K and 10-Q filings

During Nokia’s last quarter, the segment took a hit. Its revenue was down 17% YOY in constant currency. The segment was the only one that declined year over year in either sales or operating profit. Management addressed this on their earnings call:

And then the fourth of our businesses, which is Nokia Technologies here you see the quarterly top line in Nokia Technologies. And yes there was a 17% decline year-over-year in Q1. This was primarily a timing issue. We had two contracts that expired last year that are currently in litigation and in renewal discussions obviously with these customers. So that affected the top line in the quarter. Another factor was that there is another customer whose license has expired, but they have exited the smartphone market. So obviously that will not continue. But we continue to be confident in the strength of our portfolio.

Thank for the question. We believe that we are returning back to 1.4 billion, 1.5 billion run rate and this is in our guidance as well. Remember that, we also had one customer that exited the device side, but we’ve been quite successful in automotive. Also, if you look at consumer electronics side and also we are working on IoT side to get new customers, to see what opportunities we have going forward. And we have guided on the technology side that that would be stable year-on-year. And we believe that that’s going to be the case this year as well.

This is an important segment to anchor Nokia’s turnaround. I’m hoping to see the segment’s revenue and profit bounce back as management predicted.

What’s Nokia’s guidance?

The company has discussed its long term guidance in detail on its Q4 2021 report. The business guides for long term operating margins of above 14%. About 55% to 85% is expected to convert to free cash flow. With all else remaining the same, these margins would increase Nokia’s operating profit by over 50%. Free cash flow would jump 70%. This margin expansion would be exciting for a company trading at such a cheap valuation.

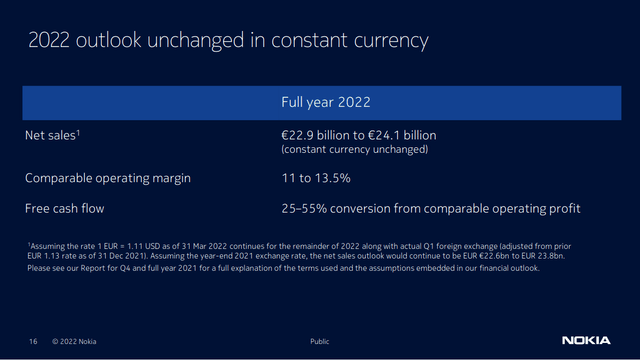

However, the company’s more immediate guidance concerns me.

Nokia Q1 2022 Earnings Presentation

This guidance is very vague and has a wide range, especially for free cash flow (“FCF”). These results put the company’s comparable FCF anywhere between 630 million and 1.79 billion euros. This would put the company’s forward price to FCF anywhere from 14 (cheap) to 40 (expensive).

I expect more clarity on this in the next earnings report, expected on 21 July 2022. I think the types of products Nokia sells are more resilient in a recession. Internet infrastructure and 5G are long term growth trends. But there is a risk that cost inflation and supply chain issues will create margin pressure.

Nokia’s valuation is cheap

I think Nokia’s current valuation is cheap. The company is trading at a GAAP price to earnings of 15 and a price to free cash flow of 12. However, I need to account for the fact that Nokia’s top line is unlikely to grow much over the next few years. The company’s only long-term guidance for revenue is to “grow faster than the market.” As of Nokia’s last quarterly presentation, market growth is expected to be about 4% in constant currency.

I think increased adoption of 5G will create a long term opportunity for revenue growth. But it’s too early to tell when this will happen or how profitable it will be.

I believe Nokia’s primary driver of increased free cash flow is going to be increased margins. Revenue is likely to be at least consistent, considering Nokia’s extensive order backlog. The company is also making progress on its turnaround and becoming better at allocating capital.

Created by author using data from 10-K and 10-Q filings

The company has become much more efficient over the past two years. Return on invested capital has increased significantly. Based on this and the company’s cheap valuation, I think Nokia’s shares are undervalued.

Currency Headwinds

International companies are experiencing headwinds because of fluctuations in currency exchange rates. The U.S. dollar (USDOLLAR) has been very strong, briefly reaching parity with the Euro last week. This will affect Nokia, which manages its finances in euros. I think it’s important to watch how Nokia’s management updates guidance to account for these headwinds.

When it comes to the company’s top line, I feel Nokia has solid geographic diversification. During the last quarter, revenue from Europe made up less than 30% of Nokia’s revenue. Detailed discussions about foreign exchange markets are out of the scope of this article. However, I think some investors may be able to get international exposure at an extra discount.

Final Verdict

Nokia is executing on its turnaround. The company is becoming more efficient at allocating capital, and its margins are increasing. There is strong demand for its products that will only increase as 5G adoption accelerates.

There are some short term headwinds to some of its segments. I’m keeping an eye on the Nokia Technologies segment as well as management’s commentary on supply chain issues. But I believe the company will be able to increase its earnings and free cash flow in the long term. I think the risk to reward is very favorable at such a cheap valuation, and I’m bullish on the stock.

Be the first to comment