Justin Sullivan/Getty Images News

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) stock had a fantastic eight-day winning streak that finally ended on Friday. Tesla’s re-entry into the trillion-dollar club may have surprised some bearish investors. However, we have been watching it closely and added TSLA stock through the recent bear market. Furthermore, the stock may have staged its bottom a month ago, when the Russia-Ukraine conflict commenced.

Hence, we are not surprised that the stock rose in March despite the threat of inflation, higher commodity costs, raw material prices, and higher interest rates. Conventional wisdom tells you that these are perilous times to own growth stocks like TSLA. But, investors also need to consider that the market could have already priced in such risks. Furthermore, the surge in oil and commodity prices seems to be benefiting Tesla. Tesla demonstrated its pricing leadership and raised prices. But, instead of crimping demand, Tesla is struggling to cope with more demand. Electrek reported recently that Tesla’s order books in the US are full till 2023.

Furthermore, Caixin also reported that Tesla added a clause in its China sales. It’s intended to prevent bulk buyers from reselling their purchases within 12 months. Caixin also reported that bulk buyers accounted for 30% of recent sales. Such a rule was designed to minimize resale market speculation that could drive its car prices higher. Whether Tesla can enforce the contract is another matter. But, the crux is these buyers were so confident that they could resell their purchases that they didn’t mind taking the risk of buying in bulk.

Therefore, we believe Tesla’s scale and pricing leadership have benefited immensely from the current macro and geopolitical climate. As a result, we believe that the stock could potentially return to its October highs in the next 12-18 months, as the rest of its competitors falter on their production.

Nevertheless, we consider the recent recovery too fast to add more exposure at this level. We prefer to see some of its current price action digested by sellers first before adding further. As such, we revise our rating on TSLA stock from Buy to Hold.

Why Was Tesla Stock Going Up So Much?

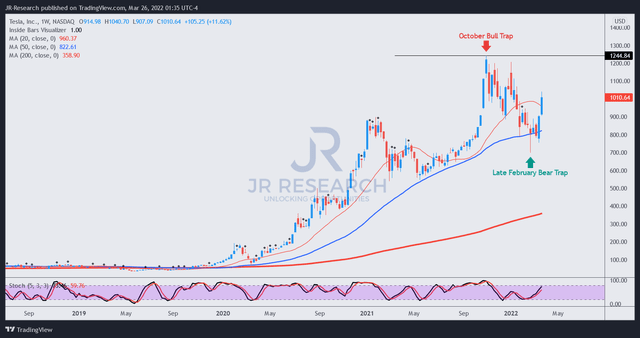

TSLA stock price action (TradingView)

As seen above, we emphasized earlier that TSLA’s stock bottomed in late February. The bear trap was designed to weed out bearish investors who thought the stock would suffer the same fate as some of its unprofitable peers or growth stocks.

But, TSLA is a profitable company on both GAAP EBIT and free cash flow terms. Moreover, despite the surge in raw material battery costs, especially in lithium carbonate and nickel, Tesla raised prices to protect its margins. That gave investors confidence that Tesla could defend its profitability amid the supply chain snarls afflicting its competitors. Notably, several top legacy automakers have already indicated production suspensions/guidance reduction. These include Volkswagen (OTCPK:VWAGY), Toyota (TM), Ford (F), and General Motors (GM). Moreover, the automotive industry has already been buffeted by COVID-19 lockdowns and underinvestment by chipmakers. Therefore, the raw material costs driven by geopolitical uncertainty have exacerbated the crisis.

What about Tesla? Not only did the company christen Giga Berlin successfully, but it’s also slated to roll off its first vehicles from Giga Texas in April. While Tesla has not been spared from chip supply problems, the company has a robust vertically-integrated stack. As a result, it has proven its effectiveness again as Tesla navigates the current crisis with aplomb ahead of its keen competitors. The crisis has critically lifted Tesla’s demand. Moreover, it has allowed the company to raise prices confidently.

Furthermore, supply chain checks also show that Tesla’s CQ1’22 deliveries seem to be trending ahead of previous estimates. Famed Wedbush analyst Dan Ives weighed in (edited):

We believe unit deliveries are trending well ahead of Street expectations for Tesla in Q1’22. China and Europe, in particular, are tracking at least 15%+ ahead of Street estimates. Combined with US Model Y-driven strength, Tesla could now be on a 2M unit run-rate exiting 2022.

In addition, Tesla now back above the $1T market cap is a telling tale of the confidence the Street has in this generational growth story. Musk is flexing his muscles with the Berlin and Austin build-outs and within the EV landscape. At this point, it’s Tesla’s world and everyone else is paying rent. (Dan Ives’ Twitter, Teslarati)

Is Tesla Stock Expected To Rise Further?

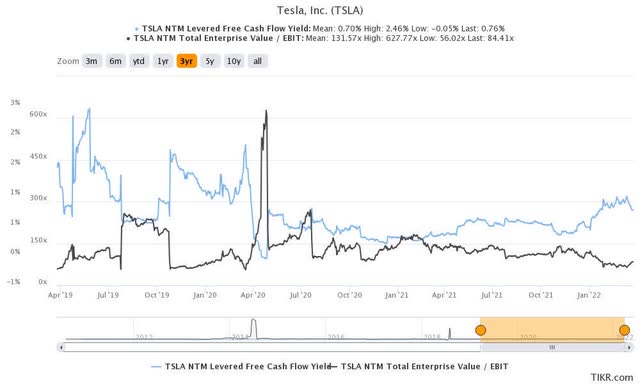

TSLA stock NTM EBIT & NTM FCF yield % (TIKR)

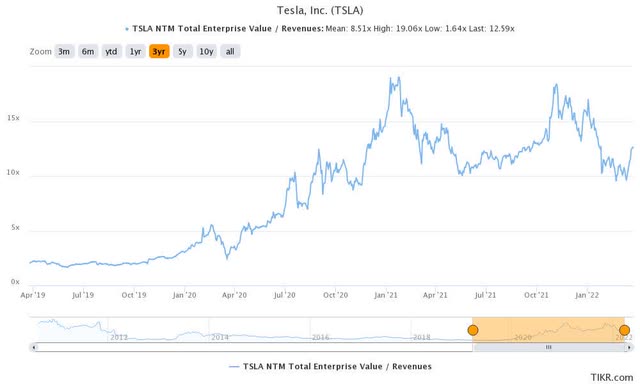

TSLA stock NTM Revenue (TIKR)

We expect TSLA stock to recapture its highs above $1,200 within the next 12-18 months. Nevertheless, we expect some volatility along the way as the market parses Tesla’s premium valuation.

TSLA stock is trading at an NTM revenue multiple of 12.6x, well above its 3Y mean of 8.5x. Notably, the stock has found support whenever its revenue multiple fell to 10x over the past year.

Moreover, even though Tesla is profitable, its NTM FCF yield of 0.76% could be a worrying prospect for some investors. TSLA FCF yield is reminiscent of a growth stock multiple, and therefore, investors should not take their eyes off its ability to ramp production and deliveries. However, if Tesla faltered along the way and failed to meet expectations, the potential value compression could be significant.

Therefore, we need to highlight that TSLA stock is only suitable for investors with high conviction on CEO Elon Musk & Team.

But, we believe the past two years of automotive supply chain snafus have proven the capability of Tesla’s vertical integration. Furthermore, it also has the capability to build its battery cells, and we are awaiting the delivery of its 4680 battery pack from Giga Texas. Tesla has also been securing critical long-term supplies of raw materials for its battery supply chain, future-proofing its production visibility. It has inked long-term deals with China’s Ganfeng Lithium. It has also secured long-term contracts with Australia’s Syrah Resources.

Furthermore, investors sometimes understate the competence of Tesla’s battery manufacturing prowess and scale. Tesla’s legacy competitors have secured partnerships with South Korean battery manufacturers. But, the relationship is less straightforward than understood. For example, Nikkei reported (edited):

Discord is being revealed within alliances between big US automakers and top South Korean battery manufacturers as the carmakers accelerate their electric vehicle push while the battery producers look to safeguard their key technologies.

The automakers want more sharing of battery technology, but the South Korean suppliers are unwilling to part with their trade secrets, according to people familiar with the matter. The battery manufacturers are concerned that proprietary information may leak to rivals as the automakers deal with more suppliers. – Nikkei

Notably, General Motors works mainly with LG Energy Solution, while Ford works primarily with SK Innovation. Furthermore, Samsung SDI (OTCPK:SSDIY) rebuffed Rivian’s request for technology transfer in January and ended the opportunity to work in partnership with the fledgling EV maker.

Technology transfer is highly sensitive to the South Korean battery makers. The government also considers such technologies as “national core technologies.” Its parliament even passed a law recently “aimed at protecting these strategic industries. Its industrial policy applies to overseas joint-venture plants as well, and South Korean authorities have voiced concern about the US companies’ demand for technology sharing.”

Therefore, we are assured that Tesla has scale in its battery manufacturing. Furthermore, it doesn’t seem to face similar issues as the legacy makers. Its key battery supplier Panasonic (OTCPK:PCRFY) is even gearing up to be Tesla’s leading supplier for its 4680 battery.

Companies know that Tesla has robust end-demand and production scale. Therefore, Tesla would continue to receive massive attention from battery makers keen to partner with it. Even CATL, the world’s leading battery maker, has announced plans to set up a monolithic 80GWh factory in the US. It “would produce a mix of nickel-manganese-cobalt and LFP cells, and supply both Tesla and other automakers.” CATL is a crucial partner of Tesla in China, supplying LFP batteries for its vehicles from Giga Shanghai. It would be unthinkable that LFP would not prioritize Tesla’s orders in the US ahead of the rest. Therefore, we believe that Tesla has a critical lead and battery supply security ahead of the other automakers.

These winning traits would likely continue to support the bullish thesis in TSLA stock over time. Hence, we firmly believe that Tesla can retake its October highs.

Is TSLA Stock A Buy, Sell, Or Hold?

TSLA stock consensus price targets Vs. stock performance (TIKR)

Given its robust recovery from its February bottom, TSLA stock has surpassed its average consensus price targets (PTs). It’s also above our fair value estimates. Therefore, we believe that the stock can do with some digestion.

Nevertheless, the average PTs have also been strong support levels for TSLA stock. Therefore, investors can exercise patience and wait for some volatility in the stock if they desire a reasonable margin of safety.

While we remain confident that Tesla will report a solid Q1 slate of deliveries, we believe it has been priced in.

As such, we revise our rating on TSLA stock from Buy to Hold.

Be the first to comment