Xiaolu Chu

Last week, I detailed how shares of electric vehicle giant Tesla (NASDAQ:TSLA) were looking to find a bottom. While Fed rate hikes have hurt the stock throughout this year, Elon Musk’s Twitter (TWTR) purchase and subsequent drama have caused the latest leg down, with a new 52-week low being hit last Friday. As we get ready to close out the year, I’m here today to discuss three of the biggest risks I’m watching for the name, outside of what I talked about previously.

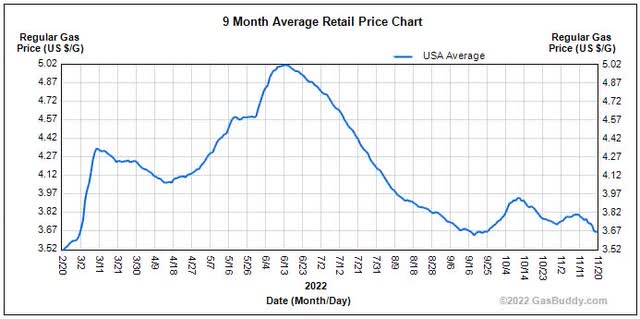

One interesting item to follow currently is what is happening in the energy markets. Last week, WTI oil fell below $80 as worries over a US recession and China’s reopening policies have increased. While prices at the pump will take a little time to catch up, we are likely to see the national average for gasoline down more than 30% from its peak before too long. As the chart below shows, that means that consumers could soon be paying less than they did before the Russia invasion of Ukraine started.

US Gasoline Prices (gasbuddy.com)

I know that gasoline savings won’t always be the number one reason why a consumer will shift to an electric vehicle, but it is certainly on the list. When the national average was at its $5 peak and some stations around the country had prices nearly double that, all you were hearing about was electric vehicles. That meant Tesla was in major focus in the US, but that share of voice has certainly come down as gas prices have dropped. Should the national average fall back into the $2s early next year, it likely will take a bit of enthusiasm out of the major EV incentives coming from the Inflation Reduction Act, and there are still questions as to how many Tesla models will actually qualify.

At the same time that the US is about to have a major program to help out with electric vehicle sales, Tesla will face headwinds in a number of foreign countries. While China has announced it will keep its sales tax exemption in place for next year, the electric vehicle subsidy is currently slated to expire, a benefit of more than 3% right now. I mentioned last week that delivery times in China have dropped, and some key Tesla watchers are worried that prices may have to come down further as production exceeds demand.

In Europe, Norway is set to finally put the axe to its electric vehicle value added tax exemption. This will result in a 25% tax on the price of an EV over 500,000 krone. The Model 3 performance variant starts above this threshold, and the long range version can top that with added options. Currently, all three versions of the Model Y start above that level, meaning without a price cut from Tesla, consumers will face the tax for the popular vehicle. In Germany, electric vehicle subsidies will also be reduced at the start of next year, depending on the price of the vehicle. This comes at a time when Tesla is ramping production significantly at its Berlin area factory.

One item that has helped Tesla this year has been the rise in used vehicle prices. Unfortunately, the price surge peaked in late July, and currently used Tesla price trends are heading lower much faster than the overall market. As the graphic below shows, the average used Tesla is down almost 6% just in the past 30 days and well into the double digits for the past three months. This could pressure Tesla’s margins on used vehicles moving forward, and it also can provide a headwind to new vehicle sales if these trends continue.

Used Tesla Price Trends (CarGurus)

Tesla has been expected to hit a quarterly production run rate of 500,000 vehicles by the end of this year. The Berlin and Austin factories will continue to ramp throughout 2023, which is why some of the big bulls are calling for total deliveries to top 2 million vehicles next year. Tesla is slated to deliver the first set of Semis next month, with the Cybertruck’s delivery launch to occur in the next couple of quarters. If some of the above headwinds do provide a material challenge, Tesla may have to cut prices a bit on its current models, primarily the Model 3 and Y, to drive this increased level of demand, especially in certain foreign markets.

I mentioned last week how Tesla shares have been rather weak, and that process continued with the stock hitting a new multi-year low on Friday. The 50-day moving average is currently heading lower, and should be under $230 by the end of this week. That key trend line could provide resistance to any rally, but it’s hard to see the stock hitting it anytime soon unless we get a major catalyst or an extreme market rally. We still haven’t received any firm statement from Elon Musk that he’s done selling shares, primarily in regards to the Twitter situation, which is providing a short-term overhang on the stock.

As we get set to close out 2022, there are a couple of risks worth watching around Tesla. US gasoline prices have come well off their yearly highs, which may dampen some enthusiasm for electric vehicles despite the Inflation Reduction Act getting ready to kick in. While certain EV benefits are set to jump in the US, they are set to decline or be eliminated in a number of other countries when the new year starts. Prices of used Teslas are also dropping quite fast, which will hurt the company’s services and other segments, while potentially adding competition for new vehicle sales. While none of these risks will kill Tesla on their own, they could make it a lot tougher for the company to reach some of the lofty targets the bulls are hoping for in 2023.

Be the first to comment