Justin Sullivan/Getty Images News

All eyes will be on electric vehicle maker Tesla (TSLA) when the company reports its Q4 and full-year 2021 results Wednesday after the close. In recent weeks, analysts have been scrambling to hike their ridiculously low estimates after completely missing the mark on Q4 deliveries. Investors are looking for the company to beat again and provide a strong forecast for this year that will help the stock rally to new highs. Today, I’ll look at the three major earnings questions that need to be answered.

The street’s average Q4 delivery estimate, as sent out by Tesla IR in the link above, was more than 40,000 units below what actually happened. Thus, we’ve seen the average revenue estimate jump by more than $1.55 billion to $16.65 billion since. However, the current figure is still being dragged down by a low of $14 billion, which implies almost no sequential growth despite the massive jump in deliveries from Q3. Take that estimate out, and the street average rises by another roughly $120 million.

I will point out that Tesla has beaten revenue estimates in eight straight quarters, and non-GAAP EPS estimates in 8 of the past 9 quarters. Thus, the biggest financial question I have for earnings is margins. Tesla’s gross margins have expanded nicely in recent quarters and significantly beat street estimates. Management did mention some headwinds on the Q3 conference call, as we’ve certainly seen some ugly inflation numbers recently, so was Tesla able to increase margins much further in Q4? I would think so, although not as much as the two percentage point jump we saw from Q2 to Q3. My base case assumes 50 basis points of improvement for automotive GAAP margins.

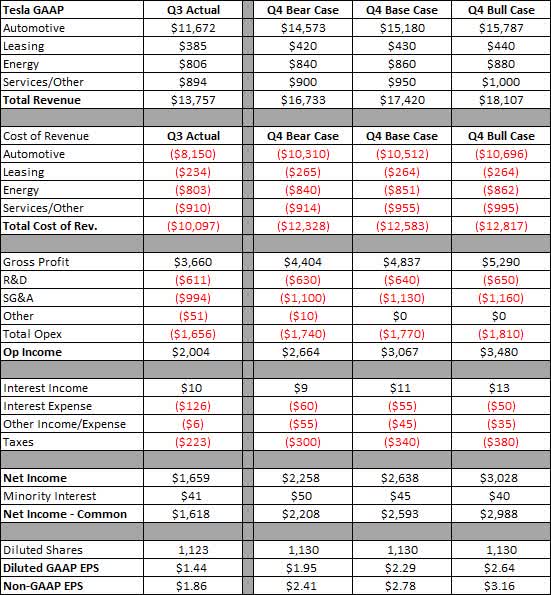

In the graphic below, I’ve provided my usual three earnings cases for the quarter to be reported against Q3’s actual results. My base case represents what a reasonable beat could look like, given the street’s lowballing of Tesla numbers in recent periods. Analysts may not have fully priced in the price raises we saw throughout 2021, plus the margins that the Shanghai factory appears to be delivering. I also see Tesla delivering more operating expense improvement as a percentage of revenue from Q3 levels. The current street average estimate calls for $2.36 on the adjusted bottom line.

Q4 Earnings Model Author Estimates, Tesla Q3 Actual Results

With another decent profit and large sequential rise in production, we’re likely to see the usual balance sheet impacts. Tesla will report a strong operating cash flow number, as some of its key short-term liabilities will surge along with production. That number will be partially offset by growing capital expenditures as the company continues to build out new facilities. Some investors also want to see Tesla get rid of its Bitcoin position, but I don’t think we’ll see that reported this week. The company has enough cash right now to fund its short to medium term growth plans, but if the cash flow pattern changes or the company wants to do some things sooner, it could certainly be opportunistic and raise some capital from a position of strength.

The second major item investors are looking for is a strong growth forecast for this year. When Tesla IR sent out the Q4 estimates graphic, it detailed an average street analyst delivery estimate of 1.277 million vehicles for 2022. Most people that follow Tesla closely like myself knew that was extremely low, and estimates have come up since to almost 1.5 million. That would approximate Tesla’s long term 50% growth plan, but there are hopes from the ultra bulls that the openings of two new factories can get Tesla closer to 2 million this year. Austin looks to be starting production before Berlin, which will benefit US Model Y sales in the short term. I think most whisper numbers currently are going to be around the 1.6 million figure, and noted Tesla watcher Troy Teslike’s first estimate came in at 1.64 million.

Along with delivery guidance for this year, investors want some major updates on other Tesla products and services in the pipeline. The Semi is more than two years late at this point, so initial deliveries could start this year. More importantly, there have been rumors of the Cybertruck being delayed to 2023 after its 2022 production start wording was removed from Tesla’s site recently. Given the substantial increases in certain battery metals and other key materials since the 2019 unveil, Tesla is likely looking at a higher starting price point when it updates the Cybertruck lineup. Investors and consumers also want to hear more updates about the full self-driving program, since Tesla still doesn’t have any robo-taxis on the road. Additionally, there is a lot of full self-driving revenue that has not been recognized yet as FSD is not feature complete to the entire fleet yet.

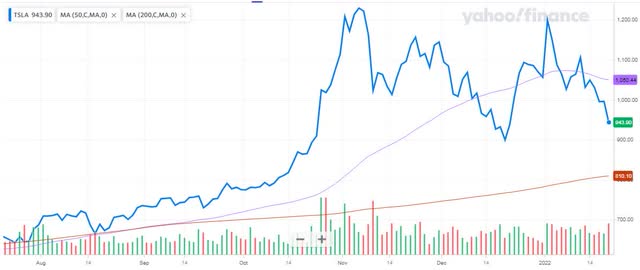

Tesla shares head into this earnings report at an interesting place. Like many high growth names, the stock has sold off recently thanks to higher interest rates and a risk off trade. As a result, shares finished Friday just a few dollars below the street’s average price target, something we haven’t seen that often lately. As the chart below shows, the stock is about halfway between its 50-day (purple line) and 200-day (orange line) moving averages, so the post-earnings move could have a major impact on the technical picture for the next few months. A report that sends shares higher could get the 50-day rising again and lead to new highs, but if shares fall, the 200-day is definitely in play.

6-month Tesla Chart Yahoo! Finance

There will certainly be a lot of eyes on Tesla this Wednesday when the company reports Q4 results. A record quarter of deliveries could send revenues to more than $17 billion, while investors look to see if margins improved despite numerous inflation headwinds. Everyone is looking for major updates on Tesla’s two new factories and the Cybertruck, which are expected to provide the majority of the growth story for the next two years. Tesla shares have been hit recently, but they aren’t massively off their highs like some of their growth peers. Bulls are hoping that this report sends the stock to a new all-time high, while bears want to see the recent pain continue.

Be the first to comment