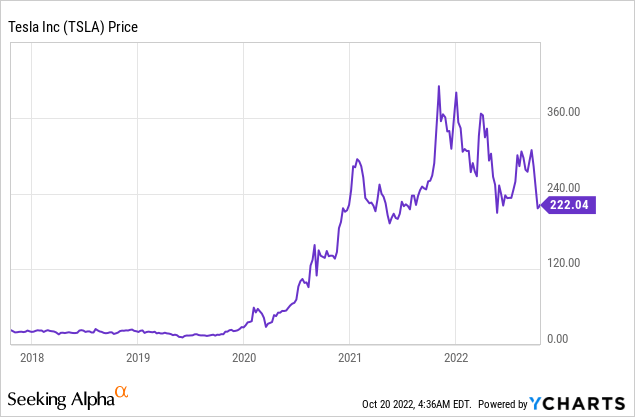

Tesla (NASDAQ:TSLA) is the world’s largest electric vehicle maker and an absolute powerhouse when it comes to innovation, AI and execution. The company recently announced mixed financial results for the third quarter of 2022, as Tesla missed revenue estimates. However, the company still generated record sales across all segments and the long-term story is still strong. In fact, Elon Musk believes Tesla could be “worth more than Apple and Saudi Aramco combined”. Now of course, we should take Musk’s exuberance with a “pinch of salt” but the financials and order volume don’t lie. There are approximately 2 billion cars and trucks on the road and around 3.5 million are Teslas, which is 1% of the global amount. If Tesla can continue to grow at its current rate and bring its total vehicles to just 3%, then that is a 3X increase from where we are today. Thus, in this post, I’m going to break down the recent financial results, and the valuation, let’s dive in.

Maja Hitij/Getty Images News

Third Quarter Breakdown

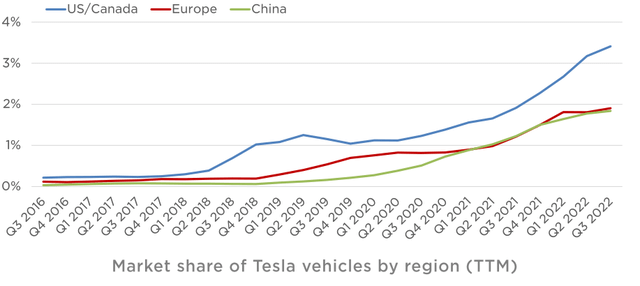

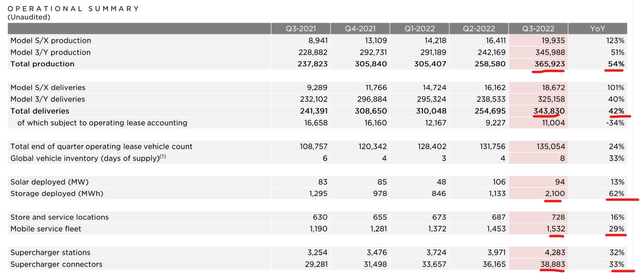

Tesla generated mixed financial results for the third quarter of 2022. Revenue was $21.45 billion, up 56% year over year, which was a record but still missed analyst consensus estimates of $21.96 billion. This miss was primarily impacted by foreign exchange headwinds as the US Dollar strengthened against other foreign currencies. This has caused a hit to Tesla’s international revenue. The primary revenue growth was driven by an increase in vehicle deliveries, which popped by 42% year over year to 343,830 vehicles. These mainly consisted of the Model Y, followed by the Model S. Production also ramped up by 54% year over year to 365,923 vehicles. This was a result of record production rates across all factories. The market share of Tesla vehicles by region are just under 2% in Europe and China and ~3.5% for the USA. Therefore, Tesla has plenty of runways to grow. Even if the company increased its China market share to 6% this would be triple the current share and drive major revenue.

Market share by Tesla (Q3 Investor Report)

Across US facilities, production of the 4680 cells increased by three times sequentially, which was fantastic. While in Shanghai, production ramped up in the third quarter after a slowdown in the second quarter. The Shanghai factory is forecasted to be a strong strategic asset for Tesla as this factory will supply the bulk of vehicles outside the USA. In Europe, the Berlin factory production rate improved and produced 2,000 model Y vehicles, although this is still in its early stages.

Tesla Deliveries (Q3 Earnings Report)

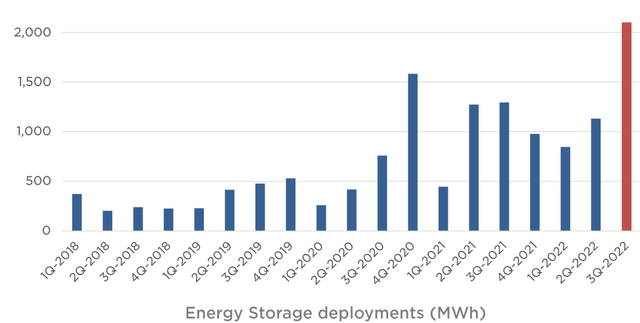

In Tesla’s Solar roof segment, Solar Deployed also increased by a modest 13% year over year to 94 MW. This fairly slow growth is driven by the volatile demand of the commercial solar sector. Whiles Storage deployed through products such as the Tesla power wall increased by a rapid 62% year over year to 2,100 MWh. This was a record level and currently “demand outstrips supply” as the business is held back by semiconductor shortages. Tesla is ramping up its 40 GWh Megapack factory in California to meet the surging demand.

Energy Storage (Tesla Q3 Earnings)

Supercharger stations also increased by 32% and connectors by 33%, as Tesla continues to build out its vast EV charging infrastructure.

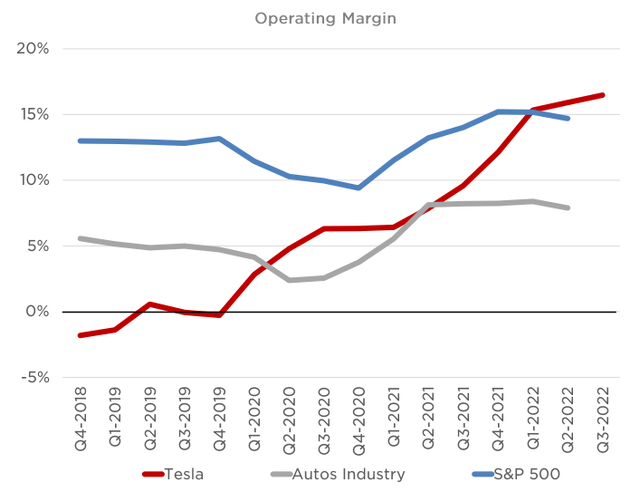

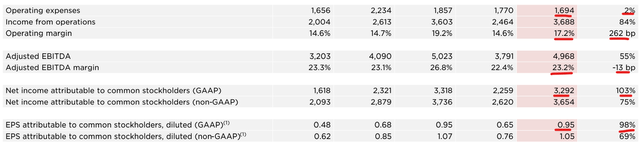

Back to the financials, Tesla’s third-quarter gross margin for the automotive segment was 27.9%, which was down from the 30.5% in the equivalent quarter last year. This was mainly driven by the aforementioned FX headwinds. Despite inflationary headwinds, operating expenses only increased by 2% to $1.69 billion, which wasn’t bad given the macroeconomic picture. Tesla’s operating margin actually increased to 17.2%, up 262 bp, driven by a higher average selling price. Tesla’s operating margin is over double the automotive industry average, which really does certify that Tesla is a “technology company” not just an automotive company.

Operating Margin (Q3 Earnings Report)

Adjusted EBITDA increased by 55% year over year to $4.97 billion. Although the Adjusted EBITDA margin did decline slightly by 13 basis points, which was likely driven by slightly higher operating expenses. Overall net income popped to $3.3 billion, up a blistering 103% year over year. While Earnings per share, popped by 98% year over year.

Tesla financials (Q3 Earnings Report)

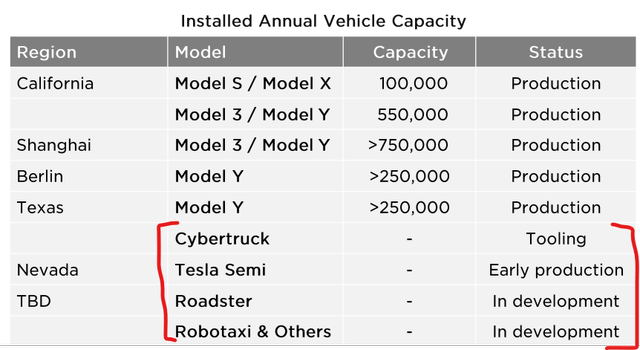

Tesla’s net cash from operating was $5.1 billion, which popped by 62% year over year. Capex declined slightly (-1%) to -$1.8 billion. As Tesla has built out the majority of its facilities, I do expect Capex to decline slightly over time at least for its core models. While extra capital expenses will be required for its Cybertruck, which is in the “tooling” phase but has already shown to have demand via Tesla’s waiting list. Free cash flow was $3.3 billion, which increased by a spectacular 148% year over year. While the company’s cash position increased to $21.1 billion up 31%. Tesla has long-term debt of ~$2 billion and short-term debt of $1 billion, which is easily manageable.

Tesla financials (Q3 earnings report)

Tesla announced a roadmap for its vehicle production capacity and new models. The Tesla semi truck is in early production and could solve the truck driver shortage problem, which is common thanks to the boom in e-commerce and logistics. A Tesla Roadster is also in development as is a “Robotaxi” which I’m sure will create a huge amount of buzz when online. I imagine this will be similar to Google’s Waymo, but hopefully better looking.

Tesla vehicles (Q3 earnings report)

Self-Driving Vehicles And AI Culture

During Tesla AI Day, Elon Musk gave an update on the full self-driving project and even showcased a prototype humanoid robot called Optimus. I covered more on this in my prior post on Tesla. Elon Musk may seem like an unnecessary showman, but the community he has built around Tesla helps with both sales, product improvements and even recruiting. In the third quarter earnings call, Musk announced Tesla had received a “massive influx” of job resumes from world-class Artificial intelligence engineers and scientists. As a company is just a collection of people, processes and technology, the best people make the greatest companies. A prime example is the FAANG (Facebook, Amazon, Apple etc) companies or I should probably call them the TAANG stocks (you heard it here first). If a company attracts great talent organically it means it rarely has to pay expensive recruiting fees and this creates a positive flywheel of company success.

Tesla Optimus (Tesla, with Not a Tesla App Edit)

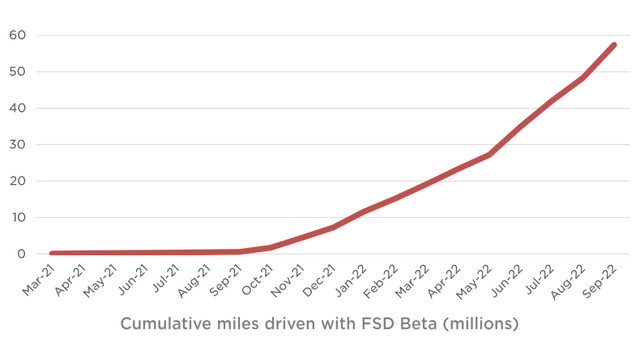

Tesla’s self driving program is also a project which has a positive data-driven flywheel of success. Its Full Self Driving Beta program has racked up close to 60 million miles from volunteer drivers who opt into the program (another benefit of the community).

Full Self Driving (Q3 earnings)

The full self-driving program also acts as a sales prompt to entice customers to purchase the package earlier. As customers can lock in the lower price before the system is fully functional. Elon Musk stated in the Q3 earnings call that;

“The safety that we’re seeing when the car is in FSD mode is actually significantly greater than the safety we’re seeing when it is not, which is a key threshold for going to a wide Beta.”

The self-driving functionality adds tremendous optionality to Tesla, as it can be rolled out across Tesla’s fleet of vehicles with a simple software update. In addition, it has the potential to disrupt many industries from ridesharing to car rental.

Advanced Valuation

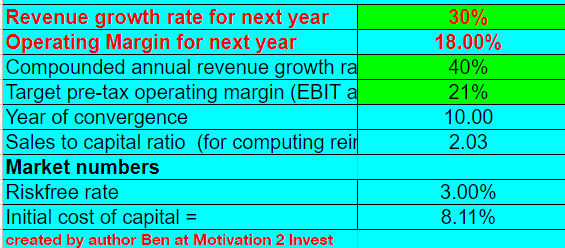

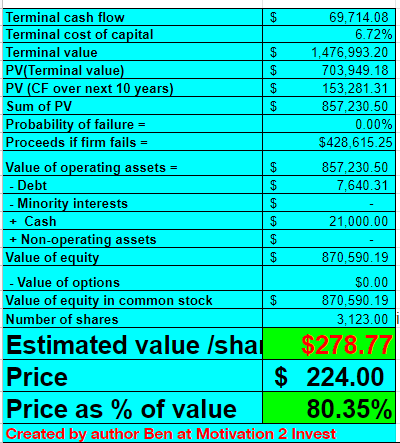

In order to value Tesla, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted revenue growth rates to decline slightly next year to 30% given the macroeconomic environment. In years 2 to 5, I am forecasting a 40% growth rate per year in revenue, as the new models come online.

Tesla stock valuation 1 (created by author Ben at Motivation 2 Invest)

Tesla has a solid operating margin of ~17%, I expect this to grow to 18% by next year and 21% over the next 10 years. I forecast this to be driven by a cyclical change in the foreign exchange rate situation, in addition to new software features such as full self-driving. In order to increase the accuracy of the valuation, I have also capitalized R&D expenses.

Tesla stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $278 per share, the stock is trading at $224 per share at the time of writing and thus is ~19% undervalued.

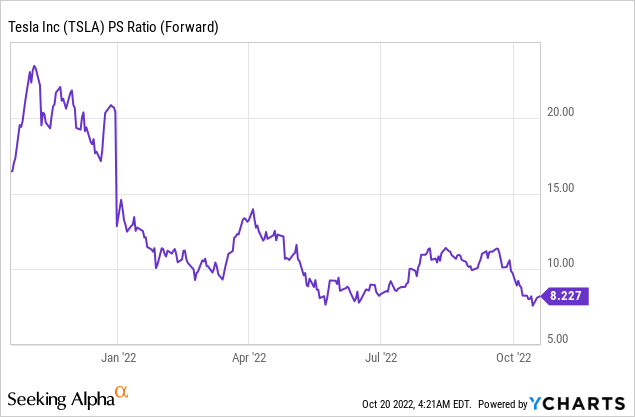

Tesla is also trading at an EV to Sales = 8 which is “fairly valued” relative to its 5-year average.

Risks

Macroeconomic Issues/Competition

Elon Musk is an incredible entrepreneur and also a spectacular salesman, which is also why investors and customers tend to follow his every word and move. However, despite the talk of robots, full self-driving, and AI, the company still makes the lion’s share of its revenue from its automotive sales. Given the high inflation and rising interest rate environment, the consumer is being squeezed, thus they may be reluctant to purchase a new vehicle. In addition, Tesla now faces substantial competition in the EV market. For example, the Ford F-150 pickup truck, which was the most sold vehicle in the US, has an electric version. In addition, we have Tesla “copy cats” like Lucid (LCID), which are enticing in the luxury vehicle market. Elon Musk may have spearheaded the popularity of “cool EVs” but other automakers are not sitting back. Even in China, we have Nio, Xpeng, and many more Tesla-like EV vehicles.

Final Thoughts

Tesla is a spectacular company that is executing strong and taking investors along for the ride. Despite the mixed third-quarter financial result, the long-term story is still strong and demand is red-hot. The stock is surprisingly undervalued and although the company may face some short-term headwinds due to the macro picture, it could be a great long-term investment.

Be the first to comment