Xiaolu Chu

My level of respect for Elon Musk and what Tesla (NASDAQ:TSLA) has accomplished is a 10/10. Against all odds, Mr. Musk led TSLA through what was thought to be an impenetrable barrier, took on the auto manufacturers, and changed the auto industry. This is much different than a SaaS company creating a better software system. TSLA revolutionized automobile manufacturing, redefined the engineering process, and disrupted an industry through vision and innovation. TSLA didn’t listen to the negativity and believed in the vision when others told them what they were trying to achieve wasn’t possible. TSLA has grown into a revolutionary company that has captured the hearts of countless followers and achieved something very few companies have succeeded at. I would argue that domestically TSLA has created a following that could only be matched by several companies.

I have often said that I believe TSLA is a phenomenal company, but I disliked the valuation of its stock. TSLA is a special company that actually has tremendous future potential, and they displayed it during the Q2 earnings release. I have never doubted this, I just couldn’t get behind the valuation of a free cash flow or P/E basis. Nobody can dispute that TSLA has succeeded in its journey and has become an incredibly profitable company as they just posted another $2.27 billion of net income in Q2 2022. I’m changing my rating to hold because TSLA has proven time and time again to never count them out, and not bet against them. While the numbers weren’t spectacular, and QoQ growth slowed down across every major financial metric in my eyes, this quarter is about a different story. I will no longer say that TSLA is just an automobile company because for the first time they just posted a quarterly gross profit from both the Energy generation and storage and Services and Other business segments. While I don’t agree with the current valuation, TSLA showed me that they really could become more than just an auto company on this report, and I tip my cap to them.

Tesla proved it could make money from business segments outside of Auto, and this is a big deal

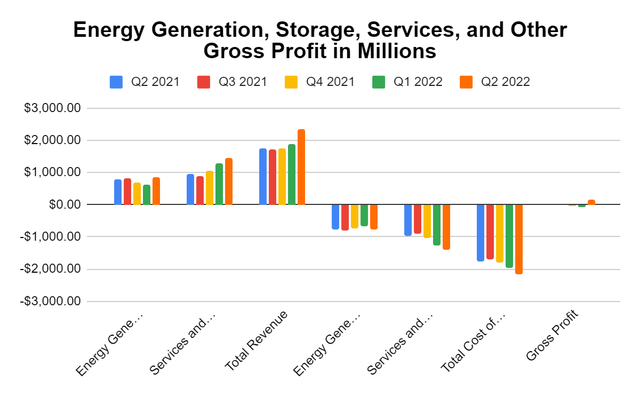

Q2 2022 will mark the quarter that TSLA proved it’s not just an auto company. The majority of TSLA’s revenue and 100% of its gross profit have always derived from its automotive segments. TSLA’s revenue is generated from automotive sales, automotive leasing, automotive regulatory credits, energy generation & storage, and services & other. When you look at automotive as one basket, then energy generation, storage, services, and other as another basket, the energy generation, storage, services, and other has never generated a positive gross profit prior to Q2 2022. In Q1 2022, 89.9% of its revenue and 100% of its gross profit came from automobiles, while in Q4 of 2021, 90.1% of its revenue and 100% of its gross profit came from automobiles.

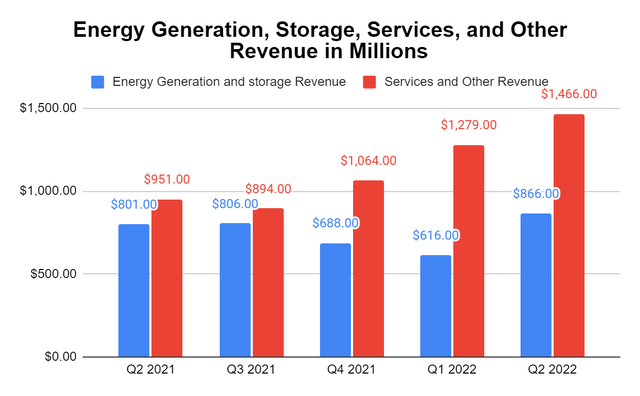

TSLA has worked on growing its energy generation & storage and Services & other business segments but could never get them to generate gross profits at the same time. This is the first quarter in the past year where both segments increased their revenue QoQ. Energy Generation and Storage grew by $250 million (40.58%) QoQ, while Services and Other grew by $187 million (14.62%) QoQ.

My largest critique of TSLA’s business segments outside of automobiles was that they had been perpetual loss factors. Every quarter the combination of energy generation, storage, services, and other had a negative gross profit. No matter how much capital was deployed to operate these businesses, TSLA lost money doing so. This is no longer the case, as the combined gross profit of these businesses came in at $153 million compared to a -$79 million loss in Q1 of 2022. These businesses are now on the board, representing 3.61% of TSLA’s Q2 2022 $4.23 billion of gross profit. While this is a small fraction, it’s a powerful indication of future possibilities.

The 3.61% gross profit mix may be just the beginning. Energy storage deployments decreased by -11% YoY in Q2 to 1.1 GWh due to semiconductor challenges. TSLA disclosed that there’s a greater impact on their energy business than automobile business from these hardships. Demand for TSLA’s storage products exceeds their ability to produce the supply, which is a good problem to have. This indicates that there’s still a strong market for these products and TSLA’s Megapack factory should be well received. Solar deployments increased by 25% YoY to 106 MW in Q2.

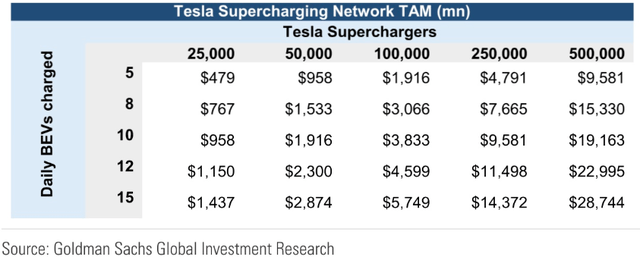

Services and Other is really starting to flourish. TSLA has been growing its merchandise, TSLA-owned collision centers, and related services. The Supercharger business is part of Services and Other, which has just grown to roughly 4,000 global TSLA supercharger locations. The Supercharger network could be a hidden gem in the future as TSLA indicated they are excited to open up the Supercharger network to other EV customers. Goldman Sachs (GS) crunched the numbers, and at the time, TSLA had roughly 3,000 Supercharger locations with 25,000 stalls. They believe that if TSLA can grow this network to 500,000 stalls and open it up to other EVs, there is a potential to generate $25 billion or more in annual revenue from this business segment. There are certainly many variables that would come into play here, but I wouldn’t bet against TSLA hitting their target of Supercharger locations, whatever that number may be.

Currently, TSLA has a 3.82% gross profit margin in the Services and Other segments. At the current margin, TSLA would generate $954.98 million in gross profit from $25 billion of revenue generated from this segment. This is a very interesting take because if margins improved this segment in the future could certainly impact EPS and net income in a positive way.

The opportunity in Energy

Now that TSLA is back to generating a gross profit on Energy Generation and Storage, I want to address this opportunity which is massive. Over the past five quarters, this segment has generated -$3 million in gross profit as Q4 2021 and Q1 2022 were significantly in the red. Q2 2022 was a different story as this segment generated $97 million in gross profit for an 11.2% margin.

|

Energy Generation and Storage Revenue |

Energy Generation and Storage Cost |

Gross Profit |

|

801 |

781 |

20 |

|

806 |

803 |

3 |

|

688 |

739 |

-51 |

|

616 |

688 |

-72 |

|

866 |

769 |

97 |

|

-3 |

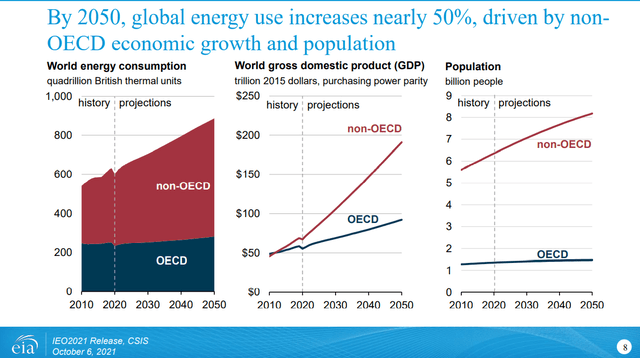

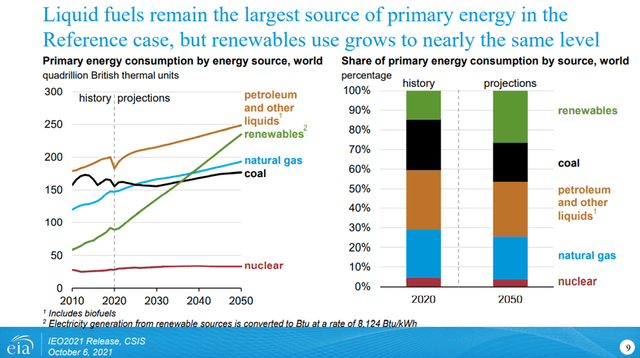

The EIA’s latest international energy outlook has bullish indications for renewable energy over the next several decades. The EIA is projecting that on a global scale, energy demand will increase by roughly 50% over the next three decades. As the population increases, so will the demand for energy. The equation is simple, increased demand for energy will require additional sources of energy.

On a global scale, renewables will increase their position in the global energy mix more than any other fuel source over the next three decades. The EIA is projecting that renewables can grow to roughly 235 quadrillion Btus from around 95 Btus. When you think about exponential growth, the line formed on the renewable projection by the EIA is a perfect example. There are substantial tailwinds for TSLA in the renewable space. The question becomes how will TSLA monetize the opportunity? One of the largest renewable energy companies is NextEra Energy (NEE). They generated $17.07 billion of revenue in 2021 and have a $155.06 billion market cap. NEE operates dozens of universal and small-scale solar projects in 27 states across the U.S., generating approximately 3,160 MW.

The next decade will be interesting for TSLA when it comes to renewables. TSLA is a hardware maker but also could become a facilitator also. It’s inevitable that there’s going to be a growing demand for solar panels and battery packs. I wouldn’t be surprised if TSLA creates a storage as a service segment and looks at energy storage in the same way individuals look at cloud storage space. Since the demand for energy is expected to continue increasing, TSLA could create a business within a business, build off-site storage, and charge a storage fee for utility companies to store their energy with TSLA. Instead of building out energy storage facilities, TSLA may be able to utilize economies of scale, offer it as a service, and tie it right into the grid.

Tesla’s Q2 numbers were good but the decelerating trend is alarming and doesn’t help the valuation case

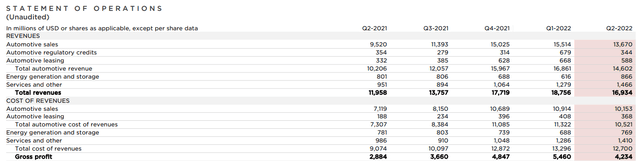

TSLA generated $16.93 billion of revenue, $4.23 billion of gross profit, and $2.27 billion of net income in Q2 2022. These are great numbers for a period of three months, and not many companies are in the same boat. Looking at the statement of operations which I inserted below, this is the first quarter in a year where growth decelerated QoQ in every major category. Q2 revenue declined by -$1.82 billion (-9.71%) QoQ, while gross profit declined -$1.23 billion (-22.45%), and net income declined -$1.01 billion (-30.82%). TSLA’s gross margin declined -4.11% to 25%, while its profit margin declined to 13.4%, a loss of -4.09%.

What may have been more alarming for me was the decline in FCF. In Q1 TSLA generated $2.23 billion of FCF, but in Q2 they posted $621 million of FCF. This was a -$1.61 billion decline or -72.13%. This is now the second straight quarter TSLA’s cash from operations has declined, and the drop was substantial. TSLA had generated $4.59 billion in cash from operations in Q4 2021, then $4 billion in Q1 2022, and now $2.35 billion in Q2. Their operating expenses didn’t change much, so the decline in FCF is not for an increased amount of capex. Their capex declined from $1.77 billion to $1.73 billion, so this was not a negative reflection in TSLA’s FCF. TSLA is generating less cash from its businesses which is resulting in diminished amounts of FCF.

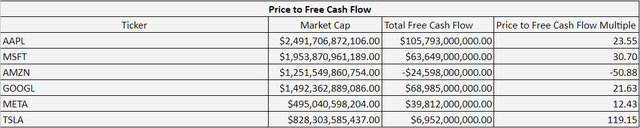

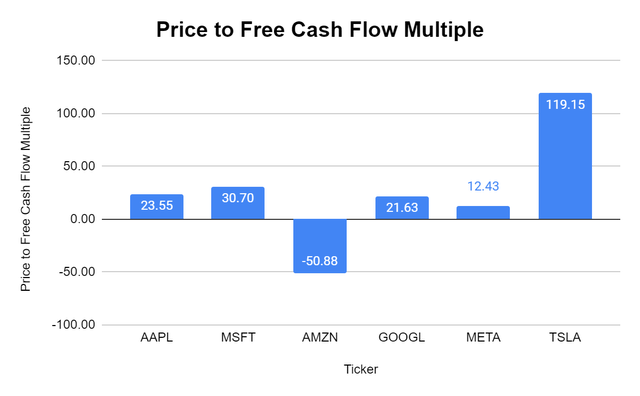

Maybe TSLA will never trade at what I consider a realistic valuation, but these numbers are still dicey to me. TSLA has been the first to report out of the largest companies in America, as the rest will report next week, but the current valuation is not flattering. TSLA has a market cap of $828 billion and is trading at 119.15x its FCF. In the TTM, Alphabet (GOOG) (GOOGL) has generated $69 billion in FCF and trades at 21.63x.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Conclusion

There’s no question that TSLA is a great company that has shattered every obstacle in its path. This quarter was about more than just numbers, in my opinion, it was about TSLA’s ability to diversify its gross profit and truly monetize its businesses outside of the automotive sector. TSLA’s metrics have resulted in great YoY growth but a QoQ decline. I’m a shareholder of TSLA by proxy, as my wife had invested in them a while back. I still can’t wrap my brain around the valuation at today’s level, and I still believe it’s outrageous, but TSLA could certainly grow into the valuation in the future. TSLA has tremendous potential in the energy sector, supercharges, and still in automotive. The next several years will be pivotal, but it’s hard to discount TSLA’s accomplishments or the team’s execution. I can’t believe I’m starting to change my stance on TSLA, and while it’s not a buy, in my opinion, I don’t think it’s a sell either. There’s tremendous demand for their products, and the stock has never traded on fundamentals. My view has changed to TSLA is now a hold because they have shown tremendous progress outside of automotive, and the future landscape sets up well for their businesses. If TSLA can deliver on its future plans, the valuation should become more realistic, but that’s a subject I will need to revisit.

Be the first to comment