Scott Olson

Let’s start with company updates

Following my article on Palantir (PLTR), I suspect that this will be another article that not many will enjoy reading on SA, so I’ll start with Tesla’s (NASDAQ:TSLA) recent performance to warm up the conversation. On 10/2, Tesla reported below-expectation 3Q22 deliveries of ~344k vehicles (+35% QoQ / +42% YoY) vs. ~360k consensus. While deliveries were a record high, the ~4% disappointment against analyst estimates was concerning enough for investors to send shares down 8% in one day. The company blamed logistic issues for the miss as vehicle transportation capacity was constrained amidst larger production volumes. The good news, however, is that weekly production has been spread out more evenly across regions so vehicles that have been ordered by customers were already in transit at the end of Q3. Tesla will report 3Q22 results after market closes on 10/19.

In 3Q22, Model 3/Y deliveries of 325k increased 36% QoQ and 40% YoY, and Model S/X deliveries of 19k increased 16% QoQ and 100% YoY. Lease represented 3% of total deliveries vs. 4% in 2Q22.

And some macro

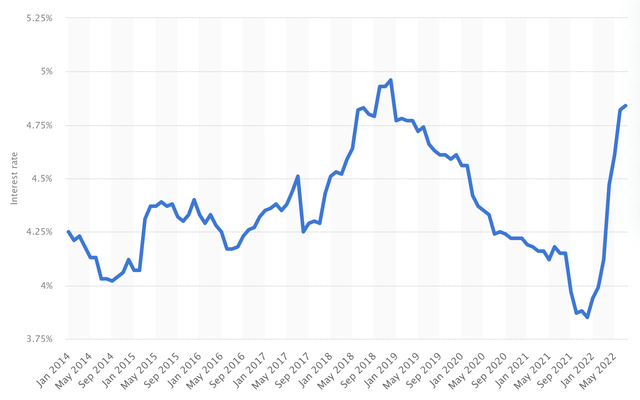

While the gap between deliveries and expectations can be explained by supply chain issues, investors may begin to question the demand side of the equation as the economy steps into a recession. Yes, chip shortages are abating and dealers are receiving more inventory leading to higher sales, but rising interest rates are beginning to sour the mood for buying a car. In the US, interest rates on a 5-year (60-month) loan for purchasing a new car have been on a steady increase from 3.85% in December 2021 to 4.8% in July 2022.

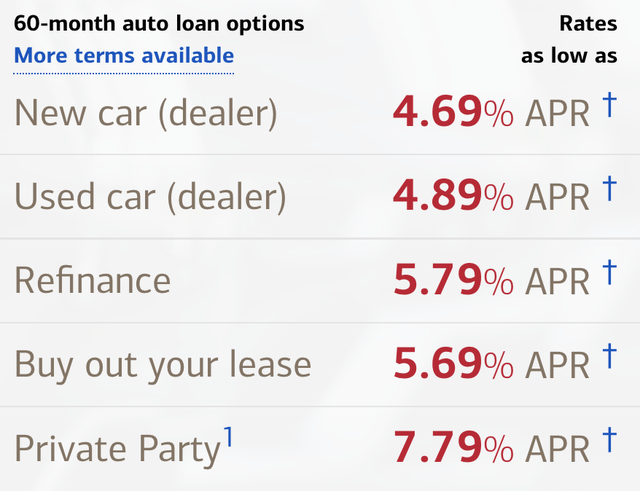

Per Bank of America, a new car loan in California now has a 4.69% APR, while the rate to refinance currently sits at 5.79%. On an average 5-year loan, a 1% increase in interest rate would easily add >$20 in monthly payment or at least $240 in additional payment per year.

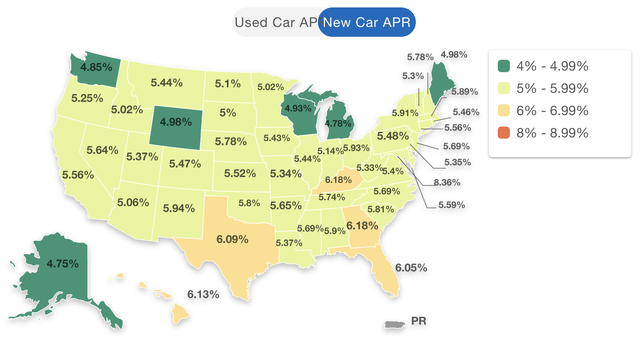

When purchasing power diminishes in an inflationary environment, consumers tend to increase the payback period which comes with the cost of higher rates. According to data from edmunds.com, the 6-year/72-month new car APRs for most US states are already between 5%-5.99% in September (vs. 4.69% 5-year new car APR per BofA), with certain states like Texas and Florida seeing APRs above 6%. In 3Q22, the average financing per vehicle was ~$41k vs. $38k in 2021. Recently, Edmunds lowered 2022 US auto sales forecast to 13.7 million new cars, down 9% from 2021.

On 9/29, used car retailer CarMax (KMX) reported highly disappointing results with just 2% revenue growth while profits tanked 50% in the August quarter. Here’s what CEO Bill Nash had to say during the conference call:

This quarter reflects wide-spread pressure the used car industry is facing. Macro factors, including vehicle affordability that stems from persistent and broad inflation, climbing interest rates, and low consumer confidence, all led to a market-wide decline in used auto sales. – KMX FY2Q23 earnings transcript

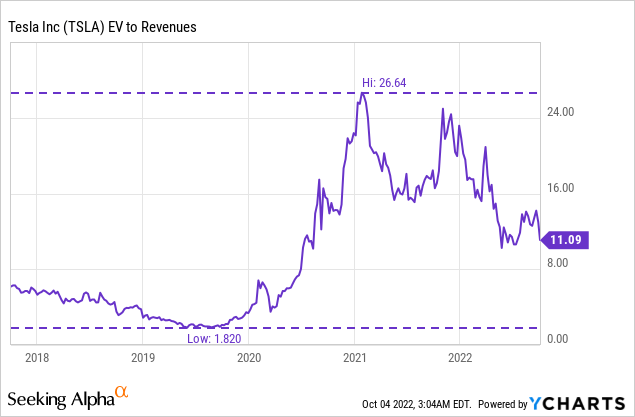

Last but not least, there’s also the wealth effect problem considering prices of stocks, bonds and cryptos have made people rethink their retirement timeframes and spending habits. In 2020 and 2021, any Redditor can buy a company near bankruptcy and triple his/money in a couple of weeks and any mom-and-pop trader can start a successful YouTube channel teaching others about the path to financial freedom. Tesla (or Elon Musk), of course, was one name that investors couldn’t miss during the irrational exuberance. Just look at how ridiculous the valuation was at the height of the Covid bubble.

Now the valuation

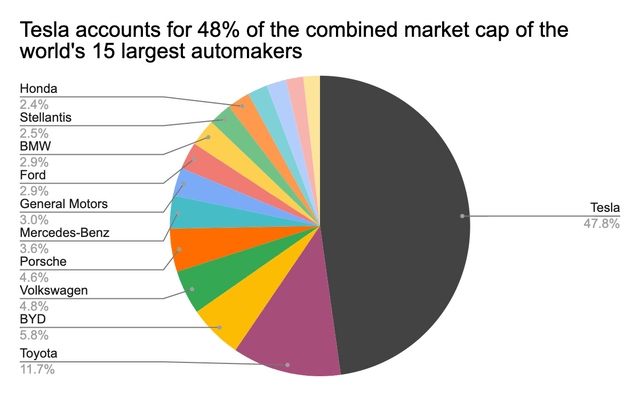

Despite the 2022 market rout, Tesla shares are down just 32% YTD and many investors continue to treat any dip as a buying opportunity irrespective of whether the valuation makes sense. With a market cap of $754 billion, Tesla still accounts for roughly 48% of the combined market cap (~$1.58 trillion) of the world’s largest 15 automakers (incl. Tesla) from Toyota (TM) to Volkswagen (OTCPK:VWAGY).

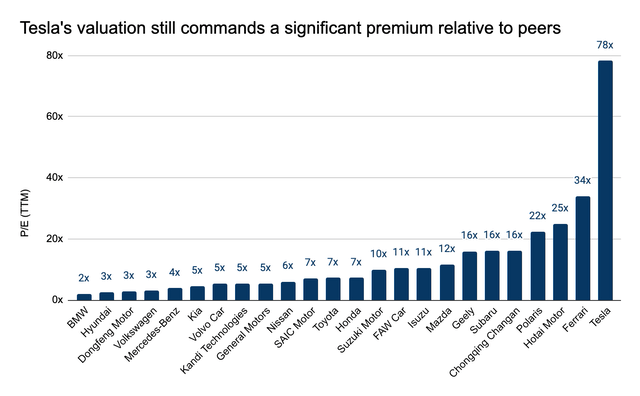

companiesmarketcap.com, Albert Lin

Taking a quick look at the relative valuation again tells us that Tesla’s shares trade at a massive premium vs. industry peers. I get that Tesla cars are great and fun to drive and the Optimus robots are coming, but it’s difficult to argue that shares are not priced for perfection even at 56x forward earnings vs. 78x TTM earnings. Further, keep in mind that the Street currently projects revenue of $85.3 billion in 2022 (+58% YoY) and $120.3 billion in 2023 (+41% YoY). At 56x forward P/E and 8.9x forward P/S, future results MUST exceed expectations just to keep the stock price from falling.

companiesmarketcap.com, Albert Lin

You don’t get it, EV is the future!

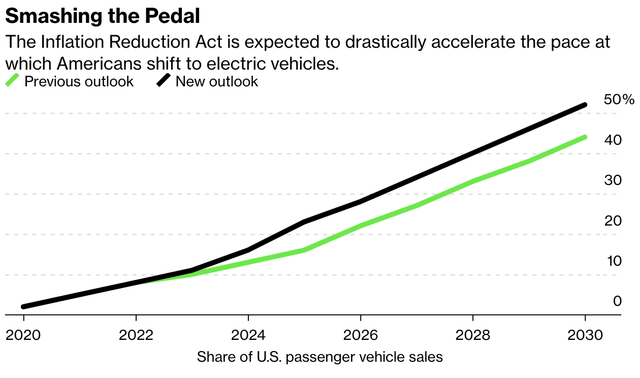

No disagreement here as EV is indeed the future so I get it. President Joe Biden wants 50% of all cars sold in the US to be EVs by 2030 and has passed a $370 billion-dollar bill to tackle climate change with incentives that include tax credits of up to $7,500 when someone buys a new electric vehicle. The US is quite behind in the EV adoption race considering EVs only made up 5% of total car sales in 2021 vs. 24% in China. In Europe, Norway already became the first country in the world to see higher sales of EVs than ICE vehicles last year.

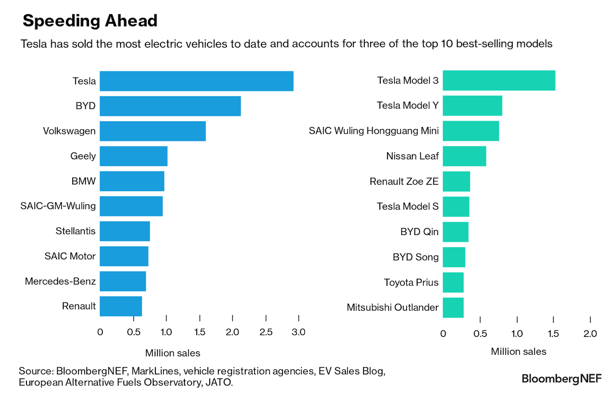

Evidently, the future of EV cannot be brighter as my kid will likely grow up asking me what an ICE vehicle is just like how today’s Gen Zs may ask what a Nokia phone is. This brings me to my biggest problem with Tesla’s valuation: increasing competition. In the US, Tesla is the undisputed leader with a 50% market share and total sales 3x those of GM (GM) and Ford (F) combined. According to Bloomberg, Tesla Model 3 and Y are the most popular EVs in the world.

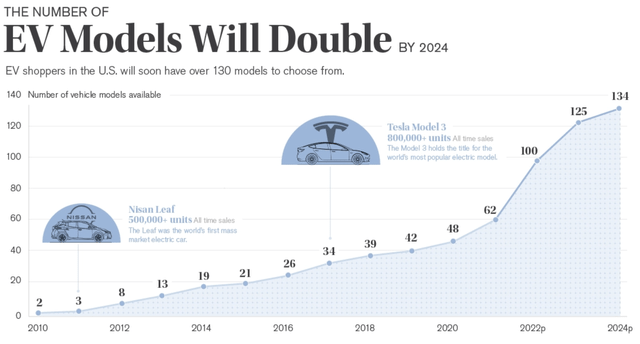

BloombergNEF

Just like any fast-growing company in any fast-growing industry, Tesla’s success has quickly attracted the attention of major industry players that also want a piece of the action. For example, here’s how much some of the biggest carmakers intend to pour into the EV opportunity going forward.

- Ford: $5 billion in 2022 and $50 billion through 2026.

- GM: $35 billion through 2025.

- Toyota: $70 billion through 2030, including $35 billion in battery tech.

- Volkswagen: $73 billion from 2021 to 2025.

- Mercedes-Benz: $40 billion through 2030.

- BMW: $30 billion through 2025.

Considering how much money is being invested in the EV supercycle, consumers will be sure to benefit from diverse selections and competitive prices thanks to rising competition. By 2024, the number of EV models available in the US will likely exceed 130. With high gas prices and tax credits being key drivers for EV adoption, car buyers will only be showered with more choices going forward.

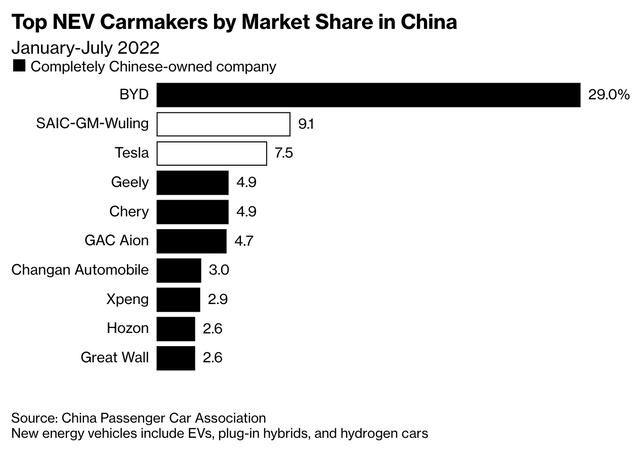

Outside the US, China remains a massive EV market ($124 billion in 2021) where 1 out of 4 new cars sold is powered by electricity. There, Tesla currently has the third largest market share behind domestic carmaker BYD (OTCPK:BYDDF) and SAIC-GM-Wuling, a joint venture between SAIC Motor, GM and Liuzhou Wuling Motors. The best-selling EV in the country is the Wuling Hongguang Mini that seats 4 passengers, with prices starting at just $4,600. Then there’s the BYD Qin that starts at $16,500, significantly below Tesla’s Model 3 at $43,000. As much as Tesla has a strong US appeal and the aura of Elon Musk, China is by no means an easy market to penetrate.

All told, EV is the future and I completely believe that everyone will be shopping for a new electric vehicle in the many years to come (if not already). Tesla has a great brand and the idea of owning something created by the one-and-only Elon Musk is a psychological moat with few substitutes. With increasing competition, however, consumers will have plenty of options to consider which could potentially dilute Tesla’s mindshare in the purchasing journey. At 56x forward earnings, Tesla’s shares face significant risk of a valuation compression as competition heats up from here.

What about robots?

On Tesla’s AI Day, Elon Musk unveiled two prototypes of the Optimus robot, which can walk and perform basic gestures such as waving. Per Musk’s remarks on Tesla’s 1Q22 earnings call, Optimus will ultimately be worth more than the core EV business as humanoid robots will have two times the economic output of humans. Consumers can expect to buy one for $20,000 in 3 to 5 years.

All talks aside, the initial versions the Optimus didn’t really surprise the technology world to the upside. The movements are slow, basic, and frankly not very impressive. While Must would like to show the audience more, he didn’t want it to “fall on its face.” As quickly as Tesla was able to put these prototypes together, the Optimus robot looks similar to Honda’s ASIMO released years ago and comes nowhere close to those made by Boston Dynamics.

If one is to ask a financial analyst to perform a full valuation analysis on Optimus, the only thing supporting those numbers on the spreadsheets is imagination. As early as the new venture is, however, I would not be surprised to one day be inundated with analyst reports touting Optimus as the next major growth driver for Tesla. The story almost always starts with a massive TAM (total addressable market) coupled with a penetration rate that beautifully increases by x% every year until 2050. In short, trying to price in Optimus is like trying to price in the metaverse for Meta (META), except you’d have to do it with a lot more optimism.

Conclusion

This is a lengthy article so I will summarize my thoughts in the following bullet points:

- At 56x forward earnings, Tesla shares are priced for perfection and future results will have to beat lofty expectations just to keep the stock from falling.

- Worsening macroeconomic conditions are likely to reduce consumer affordability in the form of higher interest rates.

- While pro-EV policies will accelerate adoption, intensifying competition will likely increase sales cycles as consumers explore more options, potentially diluting Tesla’s mindshare in the car buying journey.

- Incorporating the Optimus robot into the valuation framework is equivalent to building a castle in the air.

While I see Tesla as overvalued, I must recognize the fact that shorting the stock could put one in a highly uncomfortable position given overvaluation can always lead to more overvaluation in a market that’s not always rational. In my view, the risks include not only the company beating estimates but also other factors from a Fed pivot to whatever Elon Musk may tweet that gets the investment community excited. There have also been numerous failed attempts amongst some of the best investors including Michael Burry, David Einhorn and Jim Chanos. If there’s one thing we can learn from them, sometimes better results can be achieved by avoiding rather than shorting a stock like Tesla.

If I could avoid a single stock, it would be the hottest stock in the hottest industry. – Peter Lynch

Be the first to comment