Justin Sullivan

By Levi at StockWaves, Produced with Avi Gilburt

If you have not had the opportunity to experience the latest rollout of Full Self Driving mode on a Tesla, I highly encourage you to at least talk to someone that has or, better yet, find a friend with a Tesla and see for yourself what all the hype is about. No, I’m not joining the cult nor drinking the Kool-Aid. Rather, let’s look at what’s being accomplished here and how we may be able to benefit from this sentiment-driven stock.

The Fundamental Viewpoint

First, however, let’s back up just a bit and view this from the standpoint of one of the premier fundamental analysts around today. A few days ago, we queried Lyn Alden, lead fundamental analyst at StockWaves, regarding how to properly value (NASDAQ:TSLA) stock. Her answer and explanation follow below:

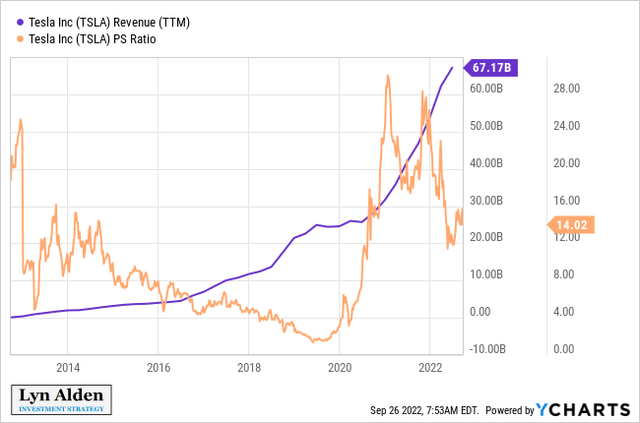

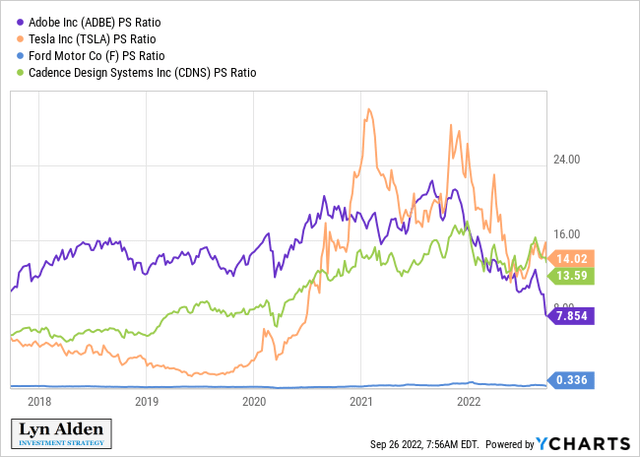

“Tesla is one of the hardest stocks to analyze fundamentally because it trades a lot more-so on sentiment than even other stocks of its size. This is a stock that has ranged from a 1.5x price/sales multiple to a 30x price/sales multiple over the past few years. Although it is cut in half from its 2021 highs in terms of its price/sales multiple, I continue to be concerned about Tesla’s valuation as primarily a hardware company.”

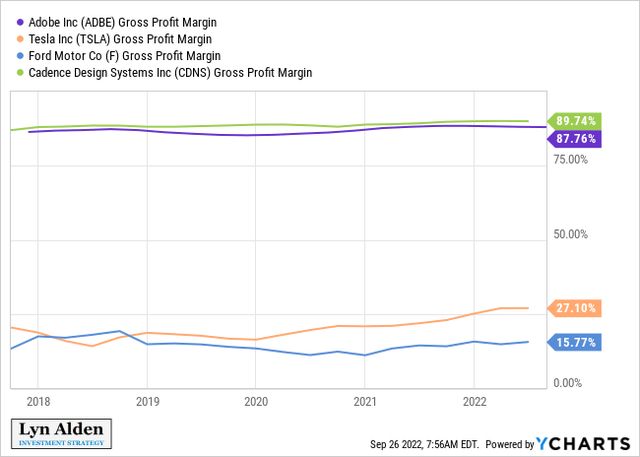

“One of the bull cases for Tesla historically is to argue that it’s more of a software company than a hardware company. However, in terms of the various operational risks and profit margin profiles they have, they clearly fit more in the hardware category. For example, this is the gross margin of two example software companies vs two examples hardware/’car’ companies.”

“And yet, Tesla has been valued as a software company in recent years.”

“Given the current geopolitical backdrop, I also have concerns about Tesla’s exposure to China and overall increased competition in the global EV market.”

Now, please note Lyn’s conclusion and one of the main benefits of our synergistic methodology in StockWaves:

“So, I generally leave Tesla purely for the technical analysts to work with, because it’s a stock that has such wild valuation fluctuations, that fundamentals are a distant second in terms of analysis compared to sentiment and narratives.”

So, Where Does That Leave Us?

Obviously, this is simply an informed opinion, but there’s no other technology company currently displaying the clear advantages over its peers that Tesla has at the moment. Some would even say that Tesla is without a comparable peer in this space. Will that change? That’s certainly possible. But at this time it’s a “Catch Me If You Can” situation.

Yes, there are other companies out there with impressive tech. I would however invite you to take the time to go ride in or drive a Tesla with the new full self-driving update that was just rolled out a few weeks ago. Reserve your opinions until you do. I know that the experience has certainly augmented my viewpoint of what’s possible and what’s actually happening in that world.

And, yes, there are questions about selling of TSLA stock to resolve or realize the Twitter (TWTR) situation. There are geopolitical concerns. Investors have their doubts about the possibilities and/or probabilities that Tesla will continue to fulfill its lofty goals. And the list goes on…

However, if this is truly leading technology that will continue to be ahead of the pack, then we need a way to overlay analysis on the structure of the stock price to identify high-probability setups for our members and the readership here.

Enter Elliott Wave And Fibonacci Pinball

When one of the leading fundamental analysts (Lyn Alden) concludes that, “Tesla is one of the hardest stocks to analyze fundamentally because it trades a lot more-so on sentiment than even other stocks of its size”, then we must find a way to track sentiment. Sentiment is simply fear vs greed.

From the Education section on our website, please note this brief explanation of Elliott Wave Theory:

“Elliott Wave theory understands that public sentiment and mass psychology move in 5 waves within a primary trend, and 3 waves in a counter-trend. Once a 5 wave move in public sentiment is completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply a natural cause of events in the human psyche, and not the operative effect from some form of ‘news.'”

“In fact, the former Chairman of the Federal Reserve, Alan Greenspan, understood this fact well. During his tenure, in several hearings in front of the Joint Economic Committee, Mr. Greenspan noted that the idea that the Fed can prevent recessions is a “puzzling notion”… Rather, the stock market is “driven by human psychology” and “waves of optimism and pessimism.””

“This concept is inherent in the aggregate actions of individuals. Based upon these concepts, it is clear that man’s progress and regression do not take the form of a straight line, nor does it occur randomly in nature. Rather, it progresses in 3 steps forward, with two steps back within the primary trend.”

“This is the basis of the Elliott Wave theory. This mass form of progress and regression seems to be hard-wired deep within the psyche of all living creatures, and that is what we have come to know today as the “herding principle,” which is what gives the Elliott Wave theory its ultimate power.”

(For a more detailed understanding of this concept and application, I highly suggest reading Elliott Wave Principle, by Frost & Prechter.)

You can read much more about the proper application of this methodology on Seeking Alpha here.

The Technical Setup

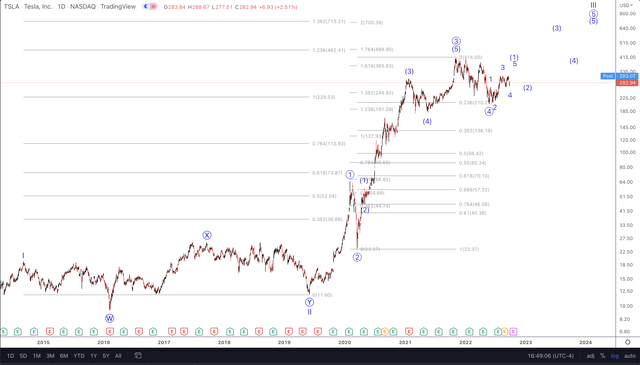

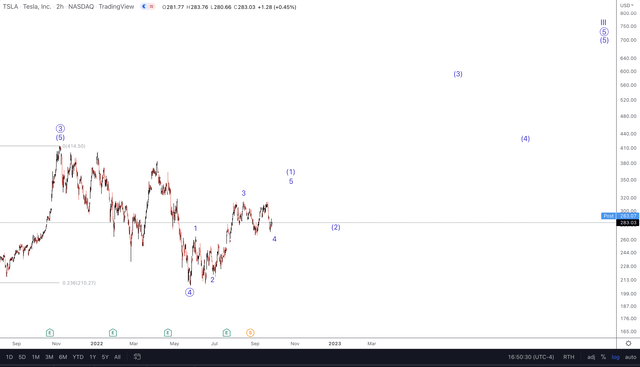

This is how we’re currently viewing Tesla sentiment. First, a word picture. The most probable path we see at the moment is that TSLA is in a larger third wave higher, marked on the chart below as wave ‘III’. You will also note that there is a circle ‘5’ (Primary Wave) and then a parenthesis ‘5’ below that (Intermediate Wave). This nomenclature helps us identify the importance of the next anticipated high in price.

Inside that wave pattern is another 5 wave structure that’s underway. Remember that the market is fractal in nature, and there’s self-similarity apparent at all degrees of this pattern. Simply stated, a larger 5-wave structure will have each of the advancing waves as 5 smaller waves as well.

We see TSLA as needing a higher high in the near term, perhaps near the $340 level. In the bullish case, that would complete wave 5 of the parenthesis wave ‘1’ up. Thereafter, a pullback in parentheses wave ‘2’ would be underway and would typically retrace 38% to 62% of the larger wave ‘1’.

The highest probability entry point would be once that larger wave ‘2’ finds its low and starts back up in what would be a third wave to new highs.

Where Might This Scenario Be Wrong?

Breaking back below $210 would have us reassess this near-term bullish outlook. However, should the stock strike a new high above the most recent swing high near $315, then that would have the appearance of 5 waves up from the low struck at the end of May of this year and would suggest a new uptrend is underway.

Conclusion

Given the technological advantage over its peers and the mass sentiment that continues to impel the stock price, we’re viewing TSLA ripe for another rally phase.

I would like to take this opportunity to remind you that we provide our perspective by ranking probabilistic market movements based upon the structure of the market price action. And if we maintain a certain primary perspective as to how the market will move next, and the market breaks that pattern, it clearly tells us that we were wrong in our initial assessment. But here’s the most important part of the analysis: We also provide you with an alternative perspective at the same time we provide you with our primary expectation, and let you know when to adopt that alternative perspective before it happens.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

Be the first to comment