TonyBaggett/iStock Editorial via Getty Images

Thesis

Tesco PLC (OTCQX:TSCDY) will be announcing its preliminary results for FY-21/22 on April 13, 2022. Based on the company’s own positive outlook, current food inflation trends in Tesco’s markets, the stock’s attractive valuation multiples, a solid plan to keep increasing dividend payouts year over year, and other factors discussed here, this looks like a good time to add to or open a position in a century-old iconic food retail and banking brand in the UK.

Positive Operating Profit Outlook

For context, Tesco’s FY-20/21 retail operating profit (from continuing operations before exceptional items and amortization of acquired intangibles) was reported at £1.99 billion for a YoY decline of nearly 15%; for FY-21/22, the company expects an adjusted retail operating profit of between £2.5 billion and £2.6 billion, which would represent an increase of approximately 26% to 31% on a year-over-year basis and about 7% to 12% up from FY-19/20 on a comparably 52-week basis.

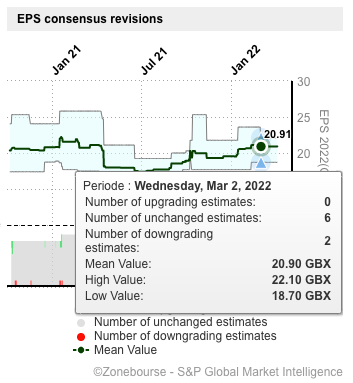

What I find to be incongruent with such an outlook is the fact that the stock rallied nearly 20% after the interim earnings came out in October 2021, but then rapidly lost the bulk of those gains by early March 2022, likely worsened by downgrades from two analysts as reported on Market Screener.

MarketScreener

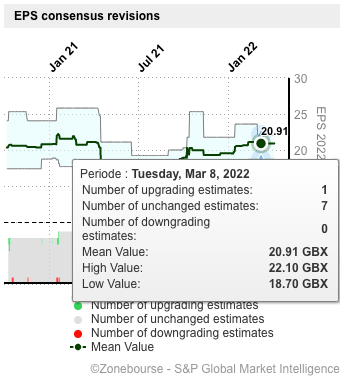

There has been minimal positive movement since then and the stock now seems to be range-bound. This current scenario suggests that the price will likely go up on the back of strong H2 and FY-21/22 results come April 13, the assumption being that the market’s wait-and-watch reaction has caused some short-term upside potential to build up over the past month or so. At least one Street analyst has revised their forward earnings outlook upward in the last 30 days.

MarketScreener

Current Food Inflation Trends in the UK

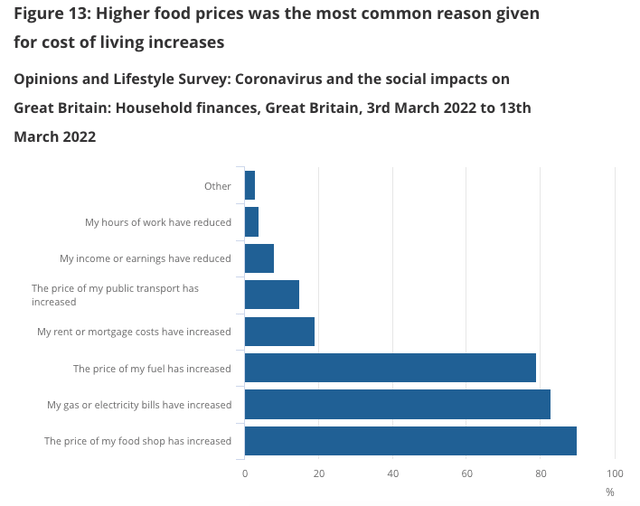

Per the Office for National Statistics’ Opinions and Lifestyle Survey:

Higher food prices was the most common reason given for cost of living increases.

Office for National Statistics

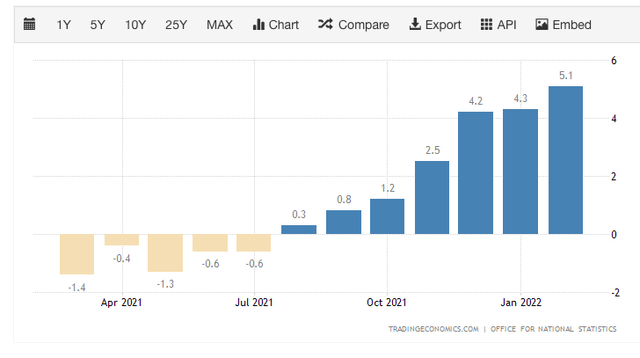

As the primary driver of inflation in the UK at the moment, food represents a significant chunk of the 6.2% annual inflation rate reported for February 2022, which tops the 5.5% rate reported in January. Data for food inflation rates for March is yet to be published, but February data doesn’t look good for consumers, with food inflation being reported at 5.1%, which Trading Economics reports is the “highest inflation rate since September of 2011.”

Against that backdrop, Tesco, the UK’s largest supermarket chain, stands to gain tremendously in H2-21/22, which could drive up the group’s retail operating profit beyond the projected figure of £1.114 billion to £1.214 billion (full-year projections less H1 adjusted retail operating profit.)

Attractive Valuation

Tesco stock is currently trading at a 40% discount to the sector median price to adjusted forward earnings multiple, but that’s not even the best part. The forward PE Growth multiple is just 0.35 against a median of 2.83 for the Consumer Staples sector. If you’re looking for value, it’s right there.

Across the board, whether you look at equity multiples or enterprise value multiples, Tesco stock is at a significant discount to the respective sector medians.

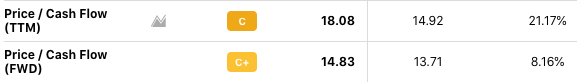

However, the price to cash flow multiples look a little high so they deserve a second look.

Seeking Alpha

Tesco’s price to TTM and forward cash flow multiples are above their respective sector medians; not excessively so for the price to forward cash flow multiple, but it does give the stock a sub-par valuation grade on those particular metrics.

Tesco’s free cash flow for FY-20/21 was down nearly 30% to £1.2 billion due to lower retail profit (15%) as well as the prior year’s sale of Gain Land, which brought in £277 million. H1-21/22 retail free cash flow, however, bounced back by 94% to £1.5 billion on a YoY basis, which also allowed the company to reduce its net debt position by £1.7 during the period. The company is now shooting for retail FCF of between £1.4 billion and £1.8 billion per year, but FY-21/22 retail FCF should come in much higher on the back of strong H2-21/22 performance on the retail operating profit front.

In summary, the retail FCF position seems to be getting stronger, which somewhat softens the effect of higher-than-sector cash flow multiples and validates the overall attractiveness of the current valuation metrics.

On the debt front, net debt is currently down to £10.2 billion, and strong free cash flow in H2-21/22 should allow the company to further deleverage and simultaneously pursue its capital allocation agenda. As of H1-21/22, the company’s net debt to EBITDA ratio stood at 2.7 against a long-term target of between 2.8 and 2.3.

Capital Allocation Outlook

On that note, in October 2021, the company announced a first-tranche share buyback authorization amount of £500 million to be used by October 2022. On March 7, 2022, the company purchased approximately 4.9 million ordinary shares as part of the total authorization cap of ~773 million ordinary shares.

We could see some further action to bolster the stock should the share price drop below the current level, which is already below the average repurchase price per share.

However, if we see the stock rally coming out of the FY-21/22 earnings announcement, the company may hold back on further repurchases in order to bolster its relatively weak liquidity position. Tesco’s current ratio at the end of H1-21/22 was 0.73 compared to 0.65 at the end of FY-20/21 and 0.74 for the year-ago period. If the guidance for FY-21/22 is accurate, we should see some improvement in the balance sheet position.

Tesco also plans to keep increasing its cash dividends every year with a targeted payout of roughly 50% of earnings, so even if a rally does happen around strong FY21/22 earnings, any potential increase in dividend payouts in the future will help keep the yield near the 3% level. For context, the current TTM yield is around 3.5% with a forward yield of 2.3%.

Other Factors

The final set of factors revolves around a greater focus on digital initiatives. Tesco is currently experimenting with on-demand grocery delivery, but the digital push after the onset of the pandemic had already resulted in a doubling of the group’s online business by the end of FY-20/21; and, as of H1-21/22, 2-year like-for-like online sales increased by 74% and already exceeded annual sales of £6 billion or $7.85 billion, which is roughly 10% of the consensus estimate revenue for FY-21/22.

That means there’s ample room to grow, and the primary drivers of this growth are Click & Collect, Clubcard (+20 million households covered), and mobile app usage (6.6 million users.) Investors should be looking closely at related metrics in the upcoming earnings call since these are long-term growth engines.

Investor’s Angle

To summarize, what we have here is a significantly undervalued company that’s showing strong sales growth performance and is armed with an investor-centric capital allocation strategy that will be supported by that performance.

Though the financials could do with some improvement, the balance sheet looks healthy enough, and a focus on staying within the targeted leverage ratio range will help keep expenses in check and funnel funds toward ongoing deleveraging and returning to shareholders.

Additionally, the current food and overall inflation scenario in Tesco’s core markets will help sales growth stay strongly in positive territory, which bodes well for profitability and free cash flows – at the very least, in the short to medium term. Meanwhile, the capital-light digital push should help bring down operating expenditure and set the tone for healthier long-term earnings growth.

The median 12-month price target for TSCDY from 13 analysts as reported by CNN Business shows a 24% upside potential. Based on the analysis here, it’s definitely a BUY. There’s certainly some amount of risk because a lot of the growth drivers are based on unpredictable external forces such as food inflation and consumer adoption of Tesco’s digital initiatives, but for now, the winds seem to be favoring Tesco, and the management is making all the right long-term, forward-looking moves while short- to medium-term tailwinds persist.

Be the first to comment