georgeclerk/iStock Unreleased via Getty Images

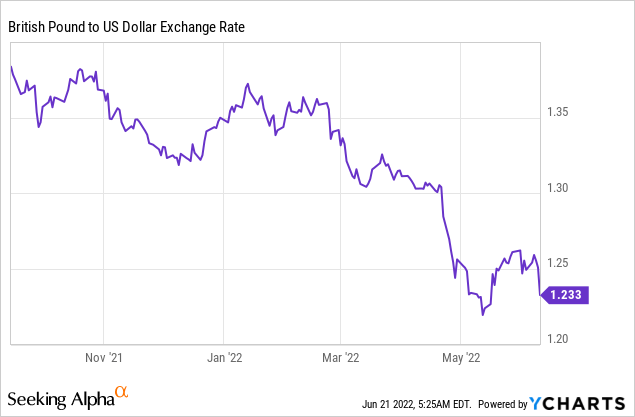

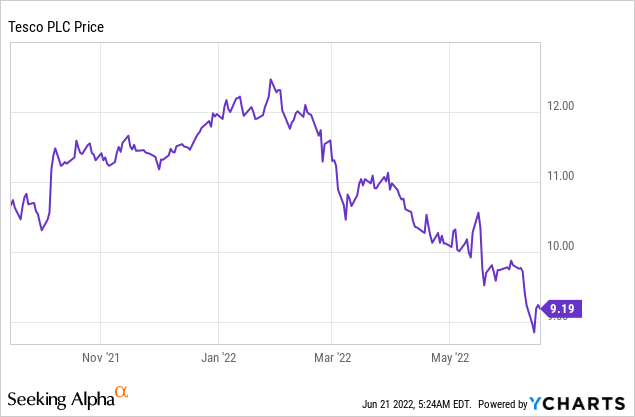

Tesco (OTCQX:TSCDF) (OTCQX:TSCDY) shares have been pretty flat in GBP terms since I first covered the supermarket giant last year, with a slight decline in the share price offset by returns from the dividend. The ADRs have performed quite a bit worse – falling by double-digits on account of sterling’s slide versus the US dollar.

In terms of the business, Tesco has by-and-large put in a solid operating performance in that time, with aggregate sales continuing to hold up well following elevated demand and profits recovering as expected post COVID.

Looking ahead, inflation and the cost of living are dominating the news these days, and Tesco is obviously on the front line given both its relationship with the UK consumer and the nature of its cost base. That will certainly pose a bit of a challenge in the near-term, though management have tentatively left profit guidance in place while cash returns to shareholders have been upped significantly in the meantime.

With that, I’m largely sticking with my view from last time. Tesco isn’t a great business by any stretch of the imagination, but the current share price isn’t so demanding that it can’t support high-single-digit annualized returns in GBP terms on modest growth assumptions. US-based investors might also wish to take another look on account of the cheap British pound.

Trading Still Robust

Tesco had been juggling some contrasting COVID effects when I covered it in the autumn, with sales booming on account of lockdowns but profits dented by various pandemic-related costs as well as elevated bad debt charges at the bank.

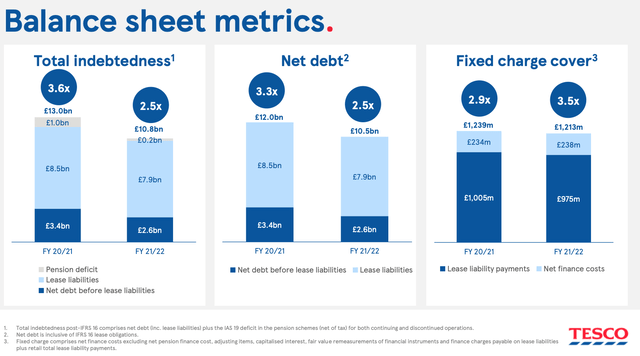

The latter recovered as expected in its fiscal 2021/22, with direct COVID-related costs declining by around £600m or so (from over £800m the year before) and Tesco Bank recording positive provisioning versus a significant expense in 2021. Sales likewise held up well last year, increasing 3% (ex. VAT, ex. fuel) to £54.8B, with the group putting in impressive market-share performance at home. All told, that helped deliver adjusted group operating profit of £2.8B, up almost 60% on the year before. Free cash flow rose markedly, up 70% year-on-year to almost £2.3B, and the balance sheet strengthened, with net debt falling by around £1.5B.

Source: Tesco FY2021/22 Results Presentation

Tesco doesn’t release earnings and cashflow data in its quarterly updates, but sales for the first quarter suggest that trading remains robust. Group retail sales (again ex. VAT, ex. fuel) for the 13 weeks ended 28 May clocked in at just over £13.5B, up 2% year-on-year and almost 10% versus pre-COVID levels. UK and Ireland retail sales were softer, falling by 1.5% and 2.4% respectively as behavior continues to normalize post-COVID, though the company gained share in both markets (+37bps and +11bps in the UK and Ireland respectively). This was offset by near 20% growth at wholesaling arm Booker (benefitting from a soft comp with lockdowns in the prior period) and 10% growth in its Central Europe segment, where the company also gained market share.

Focus Turns To Inflation

With customer behavior normalizing post COVID, focus is now rapidly turning toward inflation and the real-terms squeeze in household income. For Tesco, that obviously has potential implications on the customer side of the equation, with management already noting that consumers are trading down:

What we have seen is reasonably early signs that where there is heightened levels of inflation in staples, such as bread and pasta, we are seeing the customer choose the own brand or the entry level brand variety, and to help them manage their overall basket cost.

Ken Murphy, CEO

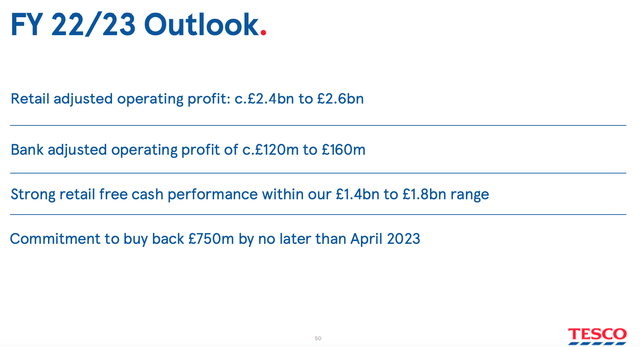

On top of that, inflation will also feed through to the firm’s cost base, with obvious upward pressure in energy and labor costs for example, and that has contributed to profit guidance that is slightly below last year’s level.

The firm does have some levers to pull – its £1B, three-year cost savings program will help offset inflation a little – and FY2022/23 profit and cash flow guidance so far remains unchanged from the start of the fiscal year, but it is definitely something to keep an eye on as the year progresses.

Shares Still At An Undemanding Valuation

While inflation is clearly posing a challenge, it’s not all bad news here. Capital returns have been upped significantly for one, with management announcing an initial £500m share buyback program alongside interim FY2021/22 results in September. Management confirmed that £300m of that had been used to purchase the company’s shares as of April 2022, before committing to an additional £750m (~5% of shares in issue) before April 2023. All in, that £1.05B would be good for around 7% of the pre-buyback share count. Management also upped the dividend, with the 10.9 pence per share full-year payout representing circa 20% growth year-on-year. The yield is currently 4.3%.

Source: Tesco FY2021/22 Results Presentation

More importantly, these shares remain at a fairly undemanding valuation, currently trading at just under 12x FY2022/23 EPS estimates. Margins are fragile, competition with the discounters is fierce and inflation hasn’t peaked in the UK yet, but retail and bank operating profit guidance remains in place at ~£2.5B and ~£140m respectively, as does retail free cash flow in the £1.4B to £1.8B range. Discounting low single-digit annualized growth on top of that gets me to a fair value in the £2.70 per share area, around 7% higher than the current price in London trading. With implied high single-digit annualized returns in GBP terms, these shares continue to look undemanding for value investors, while the GBP’s slide versus the USD means that US-based investors can currently get British assets on the cheap. Buy.

Be the first to comment