LunaKate

The JPMorgan Equity Premium Income Fund ETF (NYSEARCA:JEPI) and associated mutual fund is aimed at high current income with damped volatility. It is actively managed. Its strategy is to write calls on some of the assets in its portfolio and to manage the remainder of the portfolio for lower-than-market volatility. The calls are not clearinghouse cleared, but private label contracts with banks. As of the latest report, none of these contracts are with JPMorgan’s (JPM) trading desk. It’s important to note that these contracts are cash settled, unlike listed options. Also, all the current options are on the S&P index rather than individual stocks.

JEPI started in May 2020 and has attracted over $12.8 billion in assets. This makes it one of the most successful launches in the last five years. The various classes of mutual funds are smaller, but still in the billions.

JEPI’s current portfolio includes a preponderance of low vol sectors like health care and consumer staples. It is underweighted higher vol sectors like energy, materials, and tech.

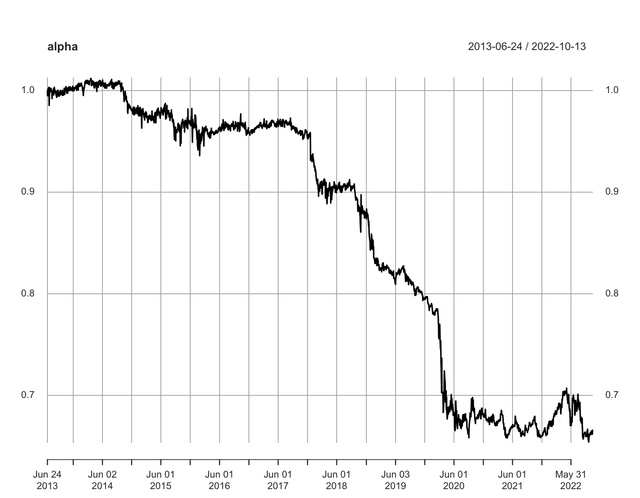

Covered call writing is a somewhat controversial topic. It sounds like it should be an alpha generator since the option writer is essentially providing a service to people who are buying options. However, during the secular bull market that accompanied the decline in interest rates from 1980 till 2022, call writing has not done well. For example, the Global X S&P 500 Covered Call ETF (XYLD), has had significant negative alpha versus the S&P. Since starting in 2013, its total return is much less than the overall market. Here’s a graph of its market-risk-adjusted performance (alpha):

Cumulative Alpha of XYLD (Yahoo Data)

Let me explain this type of graph since many of you may not have seen it. I have used this type of analysis for my personal trading for many years since I find charts more consistently than pure price. It is an attempt to get the non-overall-market gain of an asset. The way it works is that a statistical model of the asset’s price is made:

Price(Asset) = alpha + beta x Price(Overall Market)

By the way, that’s how you get the “Alpha” in Seeking Alpha!

So the alpha is the return of the stock that is not due to a change in the overall market. The above graph cumulates this over time. In other words, XYLD has had negative alpha of about 35% since its start. Not good.

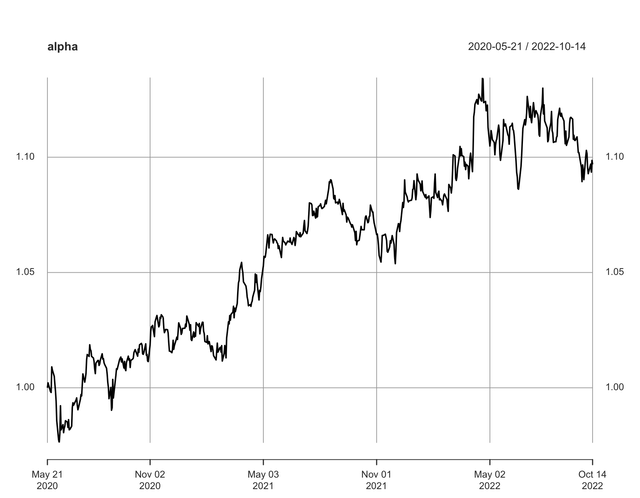

There are some other indices of covered call writing that have done better or worse, but the long-term overall record is mediocre at best. JEPI, on the other hand, has done quite well. Here’s the same graph for them:

Cumulative Alpha of JEPI (Yahoo Data)

What accounts for the disparity in alpha between a generic covered call strategy and JEPI. I can think of three things, two of which I expect to continue.

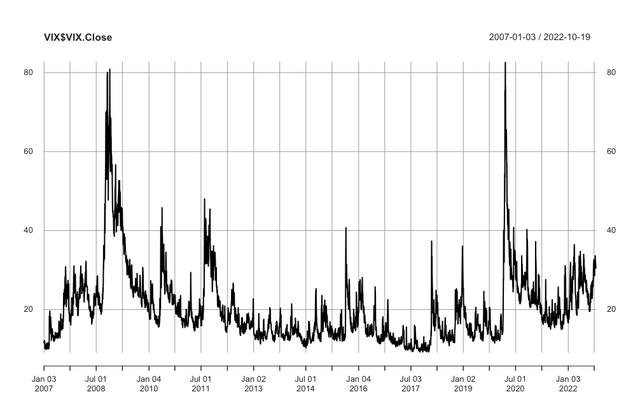

– Timing. JEPI was started in early 2020. This not only marked the rise of covid, but the rise in market volatility. During the secular bull market of the current century, stock market volatility was depressed. There were a lot of reasons for this, the biggest being the so-called “Fed put.” This was the expectation that the Federal Reserve would adjust policy to make sure market values didn’t fall too far. This in turn led to investors front-running the Fed by buying dips. This buying kept volatility low. Here’s a chart of the VIX:

From the end of the GFC until covid, the VIX was mostly in the 10% to 20% range. Since covid, it’s been in the 20% to 33% range. I believe that the higher volatility regime will continue. The long bull market in bonds (interest rates going down) from 1980 to 2021 is over, in my view. This rise in volatility is great for call writers since it directly feeds into the value they get for the calls they sell.

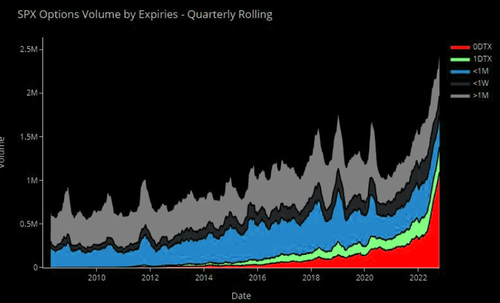

– Change in market structure. For whatever reason, retail investors have drastically increased their trading of options vs. actual stocks. This new demand has also increased the price for calls. I have no idea if this will continue.

Options Volume (Nomura)

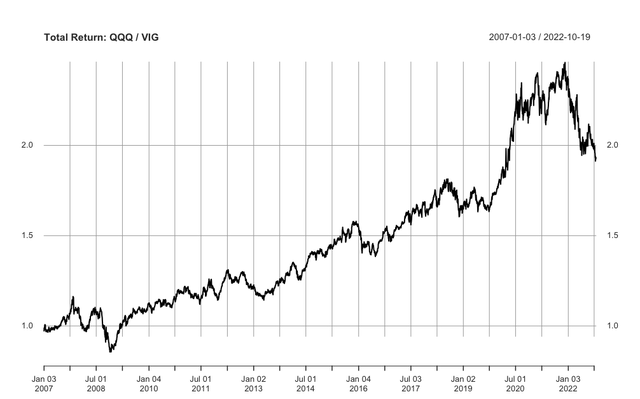

– The outperformance of defensives vs. growth. As mentioned above, JEPI favors defensives such as consumer staples over tech. With the long decline in interest rates having reversed, defensives have gained. Here’s a graph of the total return of the tech-heavy QQQ vs. a large defensive ETF, the Vanguard VIG.

It’s plain that the years of the Fed put were great for QQQ. Since the change in interest rate trends, defensives have recouped some of their underperformance. I expect this will continue, although there may be sharp short-term reversals as news comes in. This is a little tough for me since I’m mostly a materials/energy guy. Also, I’m not as certain on this as I am on the increase in volatility. At some point, the market will finish reacting to the new interest rate regime and growth will come back.

So, I like defensives and I especially like option writing. Besides JEPI, how else could you play this?

The traditional way is to simply sell calls against your existing positions. This makes sense, but you have to be careful. Selling all the calls at once leaves you open to correlated risk. If the market takes off the next day, say on some Fed news, you are immediately behind on all your options. I like to sell some every week on a cycle of two months. That way, if we get that news, at least, I have a lot of time decay in the existing options. It also reduces the amount of very short-dated options you will have around expiration. Selling very short-dated options is almost impossible to manage (gamma flips).

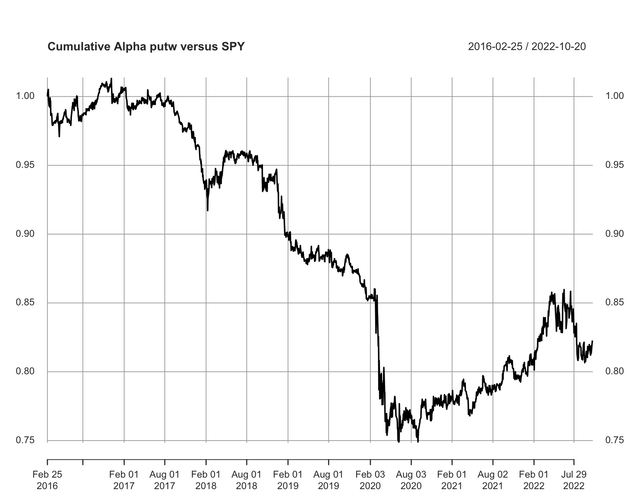

Another ETF that looks OK (I don’t own it) is PUTW. This has also produced alpha since the change in macro regime this year. Here’s the alpha graph for it:

PUTW Cumulative Alpha (Yahoo Data)

Not great, but it has come back since the change in vol regime, as expected.

I do have one concern about JEPI. The fund has gotten so big that it really can’t do options on a lot of stocks. As I said, the current options all seem to be generic S&P calls. That’s OK for now because the correlation of stocks is quite high. As time passes, these correlations will decline, and single stock calls will become effective again.

Be the first to comment