georgeclerk/iStock Unreleased via Getty Images

Published on the Value Lab 5/4/22

Tesco (OTCQX:TSCDF) (OTCQX:TSCDY) is one of Britain’s most recognisable brands and has been one of the major beneficiaries from the pandemic. Unfortunately, we think the winds might be changing for Tesco now, with services eventually going to slowly claim back the share Tesco earned from celebration and dining at home. While the company performs well still, with inflation also being a concern, we see the headline risks mounting, and don’t think it’s worth a buy even though the price has trailed down from pre-COVID levels.

A Look At Q3

In a couple of weeks, we’ll be able to get full disclosure for the FY, but in the meantime, we think investors should look to Q3 to understand what might be expected.

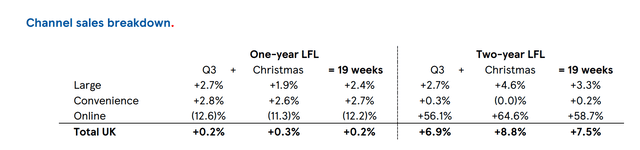

UK Channel Breakdown (Tesco Q3 Trading Update)

Tesco has been a major beneficiary of the pandemic, with Christmas performance also being particularly strong. Developing their own higher-end brands in the context of trading up, and reaping a profitable Christmas season thanks to at-home dining still being a more relevant mode of doing things as Omicron loomed over the holidays, has put Tesco ahead of even 1029 levels as shown in the two-year like for like sales performance. Tesco is generally one of the lower-cost retailers, and their commitment to value has meant that even while the online channel has contracted due to strong comps from last year, customers have converted into in-person buyers, especially as the Clubcard continues to take hold and offer buyers incentives to stay loyal Tesco shoppers. Online nonetheless lies substantially ahead of pre-COVID levels but remains a limited contributor.

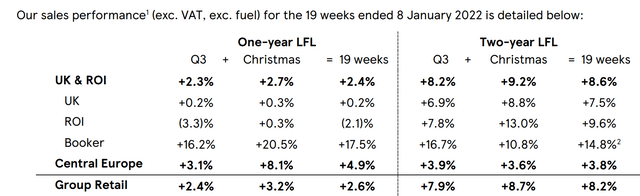

Booker, the Irish-based wholesale business, also performs surprisingly well, even in catering, despite Omicron.

Overall Revenue Split (Tesco Q3 Trading Update)

As a 15% contribution to the revenue mix, the performance of this segment impresses and will be an offset as service revenues and out-of-home activity increase at the expense of the businesses that have benefited so meaningfully from the pandemic.

Overall, the business has been performing to plan and the expectation is that operating profit guidance of around 2.5 billion GBP should be met for the current FY.

Looking Ahead

The question is what comes after? Inflation was a big focus for the Q3 trading update call, with some testy exchanges and analysts trying to understand how inflation might develop for the company. There are a couple of unfavourable forces that we believe are mounting against Tesco.

- Absences due to lower lockdowns and more Omicron spread is a cost that Tesco will have to bear.

- Tighter labor market means that a 4-5% increase in OPEX is now being expected, so quite meaningful inflation on a cost base that should be mostly fixed.

- Retreat in online sales will continue, even though Tesco has benefited from converting these customers to in-person buyers as well.

- Recovery in out-of-home channels will come at the expense of the retail business that has been so favoured by the pandemic, especially as people choose to go out rather than treat themselves to premium brands that have benefited from trading up. Residual demand could be more focused on value products, worsening the mix for Tesco.

- Food prices are rising, so while Booker can pass off these costs easily as they must due to a razor-thin margin business in wholesale, a commitment to value in retail will go up against that as Tesco pushes its brand with implicit assurances that shopping won’t become more expensive for Tesco shoppers. Tesco’s model is less in a position to bolster margins with price flexing.

Tesco management did not want to give guidance. While we are confident as they are in their market shares, the size of the supermarket pie might shrink as things do actually normalise. Tesco currently trades quite cheaply, at a 7x EV/EBITDA valuation, which is pretty good and consistent with the fact that Tesco prices have fallen below pre-COVID levels despite clear gains in operating profit and market share. To some extent, we recognise that the trading down might be a little premature, since things could cause more lockdowns as we’ve not seen the last of COVID-19 variants. However, inflation interacting with Tesco’s market positioning, as well as the fact that out-of-home should gain some inches, we worry about headline risks, and would not be excited to invest in a pretty unexciting retail business when the momentum is against them. Overall, while the valuation is cheapening, we think that nice returns are probably not likely enough given the business profile and trends. We’d stay out of Tesco, and if we were holders, we might consider trading out of Tesco in favour of other opportunities in the markets.

Be the first to comment