Marcus Lindstrom

Over the last couple months, I have been looking to diversify my Roth IRA with REITs in new sectors. The industrial REIT sector has been on my watchlist for a while, and on Sunday I explained why STAG Industrial (STAG) wasn’t on the short list for consideration. The REIT that became my most recent purchase was the industrial REIT, Terreno Realty (NYSE:TRNO). The selloff this year created a good entry point, and I picked up shares between $50 and $55, which is a very attractive price for this high-quality REIT. I picked up shares, but I also sold a put with a $50 strike (which expired worthless recently). For dividend growth investors looking for a long-term holding in the industrial REIT sector, Terreno is an attractive opportunity worth considering.

Investment Thesis

Terreno Realty is an industrial REIT focused on six coastal areas with favorable market fundamentals. The company recently posted Q3 results, which showcased impressive rent growth on new and renewing leases. The massive rent growth is why I think forward estimates for FFO/share are too low today. The company has a rock-solid balance sheet with an impressive debt ladder. Shares have always commanded a premium multiple, but the price/FFO is slightly below that today at 30.1x. The yield isn’t huge at 2.7%, but Terreno has consistently delivered double-digit dividend growth and that should continue for years to come. For investors considering the industrial REIT sector, Terreno is one of my favorite options out there.

Q3 Results

Terreno posted Q3 results early in November, and there is a lot to like. I wanted to focus in on the company’s debt stack and its rent growth. A quick peek at the company’s debt ladder shows a favorable setup over the next couple years. Interest rates have risen this year, but with the recent payoff of the September 2022 notes this means they don’t have any maturities until 2024. They also issued a $100M term loan in Q3 (due in 2028) with an interest rate under 4%, showing that lenders are willing to provide capital to Terreno at very attractive terms.

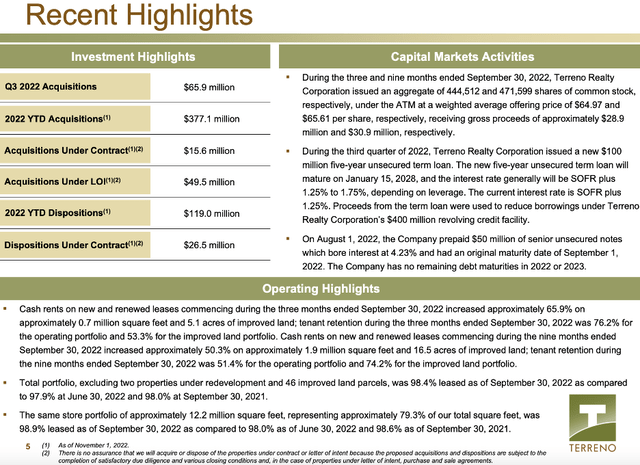

I included this slide from the recent investor presentation to show a summary of Terreno’s Q3 activity. It shows the acquisitions and dispositions as well as other events from Q3. I wanted to emphasize one of the bullets in the operating highlights from the recent investor presentation because it stood out to me as a sign of things to come for Terreno.

Cash rents on new and renewed leases commencing during the three months ended September 30, 2022 increased approximately 65.9% on approximately 0.7 million square feet and 5.1 acres of improved land; tenant retention during the three months ended September 30, 2022 was 76.2% for the operating portfolio and 53.3% for the improved land portfolio. Cash rents on new and renewed leases commencing during the nine months ended September 30, 2022 increased approximately 50.3% on approximately 1.9 million square feet and 16.5 acres of improved land; tenant retention during the nine months ended September 30, 2022 was 51.4% for the operating portfolio and 74.2% for the improved land portfolio.

Terreno currently has a portfolio of 15.4M square feet, so the new leases for 0.7M square feet in Q3 aren’t a huge portion of the portfolio. However, as the portfolio turns over, we will likely see rents increase at a significant pace. Over half of the leases are set to expire by the end of 2026 with rest expiring later. My base case is that these expirations will lead to new leases with significantly higher rent rates, creating significant value for Terreno and its shareholders. This is why I think the FFO/share estimates for future years are too low.

Valuation

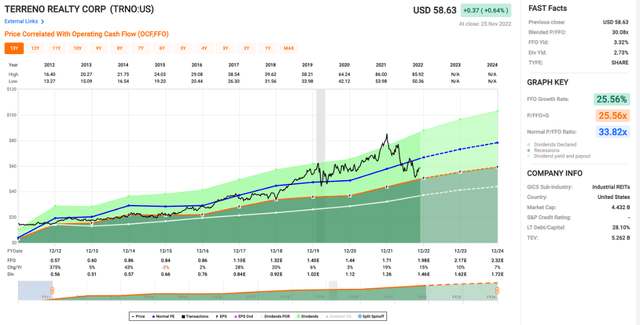

Terreno is one of the industrial REITs that has always commanded a premium valuation. Over the last decade, shares have an average price/FFO multiple of 33.8x. Today, shares are at a slight discount to that at 30.1x. The impressive dividend growth along with the consistent double-digit growth in FFO/share are the two main reasons I see for the sustained premium valuation.

As I mentioned earlier, I think the forward estimates for Terreno’s FFO/share are too low right now. The cash rents on new and renewed leases rose almost 66% in Q3, which shows where rents in these supply constrained markets are headed. It won’t happen overnight, but with approximately half of the portfolio leases set for renewal over the next four years, I think we will continue to see large rent increases for Terreno’s properties. That will likely lead to double digit growth in FFO/share as well as the dividend.

Dividend Growth

Terreno isn’t going to attract many investors looking for current income with its 2.7% yield. However, the dividend growth is very attractive and has been consistently in the double digits for many years. The fundamentals for Terreno and its portfolio are impressive and should be able to easily sustain continued dividend increases.

Conclusion

It took me a while to get comfortable with industrial REITs and their valuations, but the selloff we have seen in 2022 helped with that. Terreno is down over 30% YTD, with competitors like Rexford Industrial Realty (REXR) and Prologis (PLD) down about the same. All three have consistently carried premium valuations and shown impressive dividend growth in recent years. I chose Terreno for its focus on the US over Prologis’ international footprint and the heavily concentrated Rexford footprint in California. That’s not to say I won’t add those REITs in the future, but Terreno seemed like the logical first addition to my Roth IRA for industrial REITs.

The company has a solid balance sheet with no debt maturities for a couple years, and the rent growth on new and renewing leases leads me to believe that forward estimates are too low for Terreno. It has always commanded a premium multiple, but shares are slightly below it today at 30.1x price/FFO. I think shares are a buy below $60, and forward returns only get more attractive if they drop towards $50. For dividend growth investors looking at the industrial REIT sector, Terreno is worth a closer look.

Be the first to comment