kemirada/iStock via Getty Images

The past few months have been particularly difficult for investors. With concerns over the economy mounting, share prices have mostly declined. So it is rare to find an enterprise that, over the past few months, has performed exceptionally well by comparison. One such firm is Terex Corporation (NYSE:TEX), a business that focuses on the production and sale of aerial work platforms and materials processing and specialty equipment like crushers, washing systems, cranes, and more. Driven by continued growth on the top line, and an upward revision when it comes to profitability for the 2022 fiscal year, shares of the business have outperformed the market handily. While investors would not be wrong to take their profits and look elsewhere for opportunities, I do still believe that the company offers enough upside potential to warrant a ‘buy’ prospect at this time.

Strong expectations drive shares higher

Back in July of this year, I found myself drawn to Terex as an investment opportunity. Although I never ended up buying shares of the firm, I did look upon it in a favorable light, impressed by management’s guidance for the 2022 fiscal year. Another contributor to my enthusiasm regarding the stock was how cheap shares looked. And as a value investor, that means a lot. Due to these factors, I ended up having a ‘buy’ rating on the company, reflecting my belief that it would likely outperform the broader market for the foreseeable future. Since then, that call has played out nicely. While the S&P 500 is down by 6.3%, shares of the company have generated upside for investors of 8.6%. Though in all fairness, the stock is down still more than what the broader market has been since I first wrote about it in October of 2021.

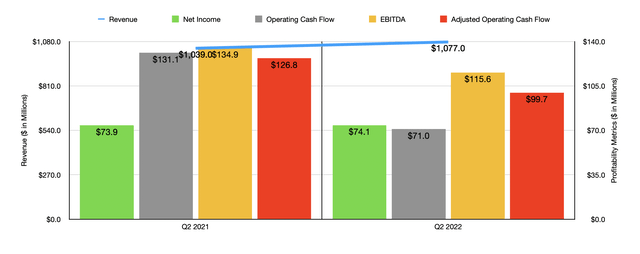

In my prior article, I had data covering through the first quarter of the company’s 2022 fiscal year. Fast forward to today, and that data now extends through the second quarter of the year. What we saw during the second quarter was somewhat mixed to be fair. On the positive side, we saw revenue hit $1.08 billion. This is 3.7% higher than the $1.04 billion reported for the second quarter of the firm’s 2021 fiscal year. Management attributed this increase to a combination of higher pricing and strong demand for its offerings. Having said that, sales actually would have been higher had it not been for foreign currency fluctuations. In that quarter alone, revenue was impacted negatively to the tune of $52 million by foreign currency changes.

This rise in revenue brought with it a modest improvement in profits. Net income for the company grew from $73.9 million in the second quarter of 2021 to $74.1 million the second quarter of this year. Even though the company saw decreased costs across some areas, the gross profit margin of the firm shrank from 22.3% to 19.8%. This decrease, management said, was mostly due to material, labor, manufacturing inefficiency and freight costs, all related to the global supply chain disruptions that we are experiencing, as well as to significant inflationary pressures. The negative impact associated with foreign currency exchange rates also hit the company.

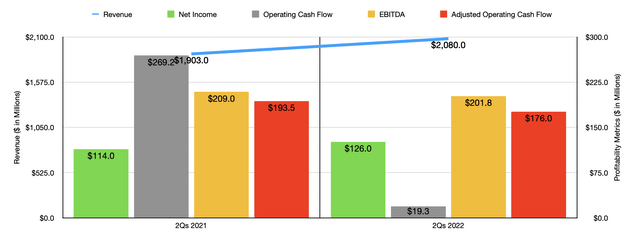

While it’s great to see net income rise, not every profitability metric for the company improved year over year. For instance, operating cash flow actually fell, dropping from $131.1 million to $71 million. If we adjust for changes in working capital, it still would have fallen, declining from $126.8 million to $99.7 million. Even EBITDA experienced some pain, dropping from $134.9 million in the second quarter of 2021 to $115.6 million in the second quarter of this year. If we were to look at results covering the entirety of the first half of the 2022 fiscal year, we would see that the picture is fairly similar. Revenue is up, as is net income. But the other profitability metrics happened to be down.

Even though the company is experiencing some pain, management seems to be hopeful about the future. Revenue for the 2022 fiscal year is now forecasted to be between $4.10 billion and $4.30 billion. At the midpoint, that would translate to a year-over-year increase of 8.1%. It’s also worth noting that management has become even more bullish about the company’s bottom line. Earnings per share are now forecasted at between $3.80 and $4.20. Previously, the forecast called for this to be between $3.55 and $4.05. At the midpoint, this all should translate to net income of $280 million. That would represent an increase of 28.7% over the $217.5 million reported for the 2021 fiscal year. No guidance was given when it came to other profitability metrics. But if we were to annualize results seen so far for the first half of the year, that would give us adjusted operating cash flow of $313.8 million and EBITDA of $366.1 million. Both of these would imply declines compared to what the company saw last year.

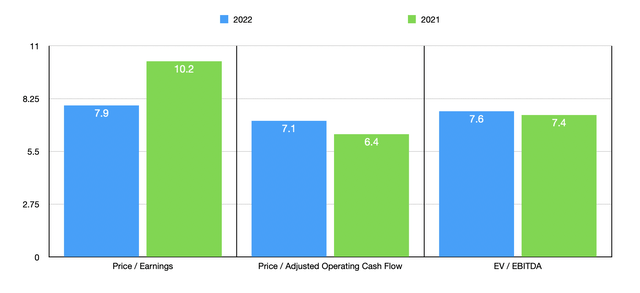

Using these figures, I calculated that the company is trading at a forward price-to-earnings multiple of 7.9. The forward price to adjusted operating cash flow multiple is 7.1, and the forward EV to EBITDA multiple should be 7.6. If, instead, we were to use data from the 2021 fiscal year, these results would be 10.2, 6.4, and 7.4, respectively. In valuing the company, I also decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 8.8 to a high of 29.2. Using the price to operating cash flow approach, the range was between 5.1 and 35.3. In both scenarios, two of the five companies were cheaper than Terex. Meanwhile, using the EV to EBITDA approach, the range was between 7.1 and 18, with only one of the companies being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Terex Corporation | 10.2 | 6.4 | 7.4 |

| Trinity Industries (TRN) | 16.3 | 5.1 | 15.8 |

| Federal Signal Corp. (FSS) | 26.6 | 26.3 | 16.7 |

| Allison Transmissions (ALSN) | 8.8 | 6.1 | 7.1 |

| Alamo Group (ALG) | 21.8 | 35.3 | 12.0 |

| The Greenbriar Companies (GBX) | 29.2 | 24.8 | 18.0 |

Takeaway

What data we have right now suggests to me that Terex is doing fine. Of course, the company would be doing much better if it weren’t for foreign currency fluctuations. But there’s not much that can be done on that front. While I wholly suspect that the company could experience some pain should the economy experience a material worsening, I do think it’s also worth noting that the firm has backlog of $3.5 billion supporting it. This is actually up 51% compared to the same time last year and is flat compared to the first quarter of the year. Management is also confident enough to have engaged in $61 million worth of share buybacks over the past quarter. Add on top of this how cheap shares are, both on an absolute basis and relative to similar firms, and I cannot help but to think that further upside is on the table.

Be the first to comment