blackdovfx

Tencent’s (OTCPK:TCEHY) major shareholder Prosus (OTCPK:PROSY) (which is ultimately owned by Naspers (OTCPK:NPSNY)) was one of the earliest investors in Tencent and achieved legendary returns of like 3,000 times the initial invested capital (the initial investment of $32 million garnered a c.30% stake in a company that is still worth $373bn, i.e. a $32 million investment generating a $100bn+ return). Naspers was also famed for not selling its stake for over a decade until its first sale in 2018.

Each of its sales has proven quite prescient as shown in the green circle below:

Prosus sell points on Tencent (stockcharts.com)

In March 2018, it sold 2% equity interest in Tencent, which turned out to be a peak not surpassed until COVID.

In April 2021, it sold another 2% equity interest in Tencent, which corresponded to another peak which may perhaps be the all-time peak for a long period.

On June 27, 2022, Tencent announced that Prosus would sell an indefinite number of shares ostensibly to fund Prosus’s buyback program. This occurred even after the stock price fell 50% from peak, their stated intention to sell shares just because they are raising cash for buybacks sounds, well, just like a cover story to me (but this would just be my own opinion) given that they have stuck with Tencent through thick and thin for about 20 years. It is quite possible that they have grown negative over the long term growth prospects and just want to take chips off the table – something they have done really well in the past few years.

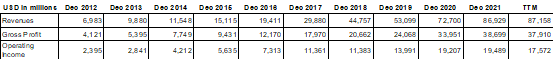

After two decades of sizzling growth, Tencent’s growth has slowed to the point where it is barely growing on a TTM basis in terms of revenue and operating income is actually declining (this is TTM latest to quarter ended March 2022). Growth was probably boosted by COVID as users spent more time at home and Tencent might face a lengthy period of lethargy until revenues revert to the new normal.

Tencent revenues and operating income in past ten years

Tencent summary financials (Seeking Alpha)

Tencent is probably facing a story similar to many other internet giants that received a major boost from COVID and had these growth rates in revenues and profits extrapolated into frothy valuations. At its peak, Tencent was worth roughly $900bn based off $20bn in operating income – operating income is used rather than net income that includes investment gains. This was essentially a 45 P/E for a company whose revenue growth is somewhere near 2% in first quarter of FY22 (and unlikely to pick up more). According to its Q1 FY-22 report, monthly active users grew at 1.6% over the past quarter, which is growth rates we associate with stalwarts not with high flying internet companies.

I’m not saying Tencent is a bad business or company, but given that Prosus/Naspers has an uncanny ability to be right with the timing of their sales, now that they are so eager to sell an indefinite amount rather than just the 2% they used to sell, I would be very cautious about picking bottoms even if Nasdaq starts going up and tech stocks see a glimmer of light.

Be the first to comment