Nikada

We are buy-rated on Tencent (OTCPK:TCEHY). Tencent is not yet a household name in the West, but the company has dominated China’s entertainment and technology sectors. Tencent’s had a rough year, dropping nearly 18% over the past five years as China entered a series of strict COVID-19 restrictions and regulations. Our bullish sentiment on Tencent is based on our expectation that the company is better positioned to grow now that China is easing its COVID regulations.

We expect Tencent to fuel the market rebound in China during 2023. We’re also constructive on Tencent’s expansion into overseas markets in its online gaming, cloud computing, and metaverse businesses. We believe the stock currently provides an attractive entry point into the company’s 2023 growth prospects. We recommend investors buy Tencent stock at current levels.

Juggling multiple markets

Tencent is an all-in-one company in China traded on the Hong Kong stock exchange. The company juggles multiple end-markets throughout entertainment and technology through its online gaming, Weixin and WeChat, Mobile payment, and long-form video and public cloud platforms.

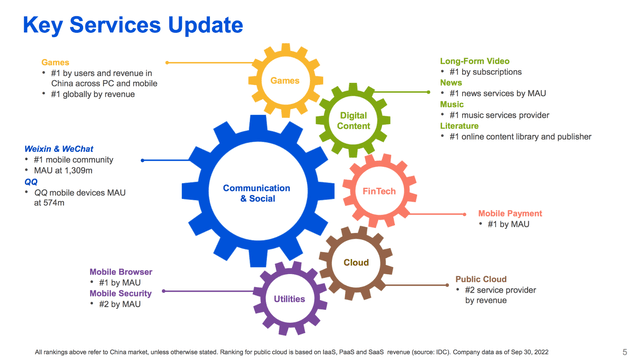

The following image from Tencent’s 3Q22 earnings presentation outlines the company’s businesses.

Tencent 3Q22 earnings presentation

Tencent is among the highest-grossing multimedia companies globally based on revenue. We like Tencent’s position within Chinese markets and believe it’s not a question of if Tencent will rebound but a question of when. Tencent has a hand in China’s gaming, fintech, social media, streaming, and cloud technological spheres. Hence, we believe the company is best-positioned to be the primary benefactor of China’s long-term upside as consumer spending and fast-growing internet reach demand increase. We believe the Tencent stock will rally as China eases its COVID restrictions. We don’t believe the opening up of China’s economy is far. China’s state council reported a new 10-point plan to ease COVID-19 restrictions, including mass testing and quarantine requirements but reducing the use of the health code system.

Shares in Asia-Pacific rose last Monday with news of China relaxing virus testing rules and making room for more restriction eases going forward. Tencent stock rose 6% after announcements of easing restrictions, while the Hang Seng Index jumped 32% from its lowest point in October. We’re bullish on Tencent stock as Beijing pivots its zero-covid policy. We believe the stock has struggled due to weaker consumer spending incited by China’s economic slowdown. We believe the worst of the pandemic-related regulations and macroeconomic headwinds are in the rearview mirror for Tencent and believe the era of Tencent missing EPS and revenue estimates is in the past.

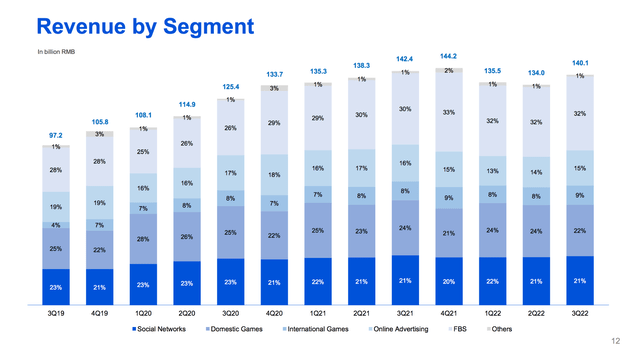

The following graph outlines Tencent’s revenue by segment and the revenue dip during 2022.

Securing a plan-B abroad

The geographic concentration of revenue is a red flag – even for a company as big as Tencent. We’re constructive on Tencent’s efforts to export a bulk of its revenue streams overseas. While Tencent is labeled as the “Facebook of China,” we believe the company is trying to make itself less vulnerable to slowdowns in the Chinese economy by putting a leg overseas. We believe Tencent is following the steps of the Chinese retail and e-commerce giant Alibaba (BABA)(OTCPK:BABAF) in expanding revenue streams. Alibaba did this by exporting its AliExpress and Lazada brands. We’re now seeing Tencent make plans to export its online gaming, metaverse, and cloud computing businesses.

Tencent announced it’ll be launching new cloud computing products, including a suite of cloud-based audio and video products, for oversea markets to serve as new avenues for growth. While we believe Tencent is behind in the cloud computing space as Microsoft’s (MSFT) Azure and Amazon’s (AMZN) AWS dominate the cloud market. Still, we believe there’s plenty of room for growth in the cloud industry, estimated to grow at a CAGR of 18.53% between 2022-2030.

Risks to our buy thesis

We believe Tencent’s biggest risk is also its greatest asset: China. Tencent trades on the Hong Kong stock exchange. While Tencent is the largest gaming company in China and dominates the social media and entertainment sectors, it’s vulnerable to geographic concentration until its oversea projects take off. Investors are often hesitant about investing in Chinese stocks, and with good reason. The U.S. and Chinese rivalry over tech is intensifying, and Tencent may be caught in the middle. The U.S. introduced unprecedented restrictions on semiconductor exports to Chinese customers this year, and we believe this may pressure China’s economy in 2023, specifically in the Artificial Intelligence [AI] market. China is also pressuring tech companies in the nation with a history of tight regulation on tech giants Alibaba and Tencent. The risk of internet and tech crackdowns from the state are real-time risks for Tencent. Still, we remain optimistic about Tencent’s position in China and, more recently, globally. We don’t expect to see internet or tech crackdowns in the near future because we believe China needs its tech giants to revive the economy.

Stock performance

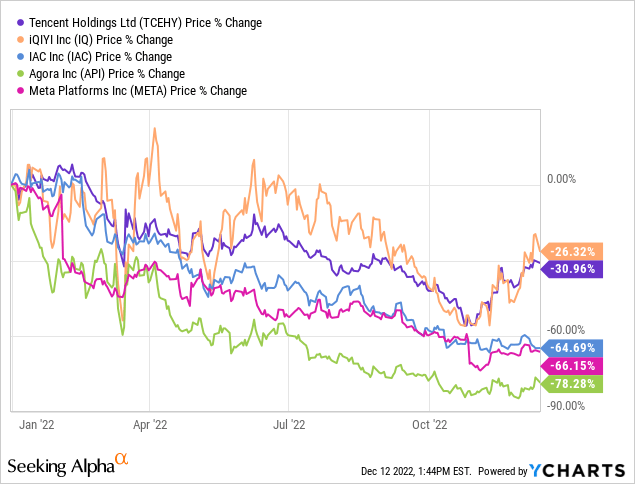

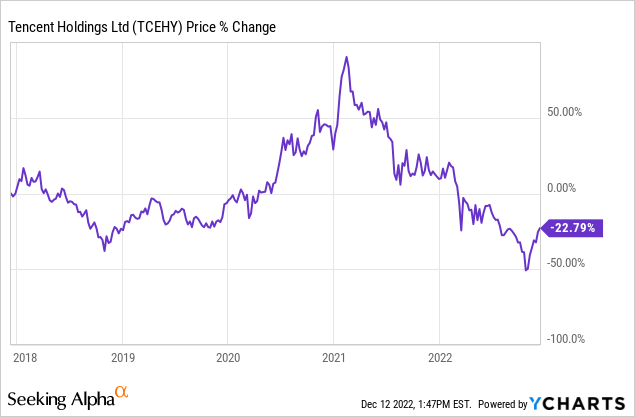

Tencent stock is down about 23% over the past five years, despite rallying during 2021 at the height of the global pandemic. YTD, the stock is down nearly 31%. We expect the YTD decline was the result of the strict zero-COVID restrictions and expect the stock to rally as China eases regulations. Tencent’s competition in the Chinese market is also in the negatives, with iQIYI, Inc. (IQ) dropping nearly 26%, IAC Inc. (IAC) around 65%, NetEase Inc about 31%, Meituan around 22%, and Agora, Inc. (API) almost 78%. On the global playing field, Meta (META) is down nearly 66%. We believe Tencent is now better positioned to grow meaningfully in 2023.

The following graphs outline Tencent’s stock performance YTD compared to the competition and over the past five years.

Tech Stock Pros Tech Stock Pros

Valuation

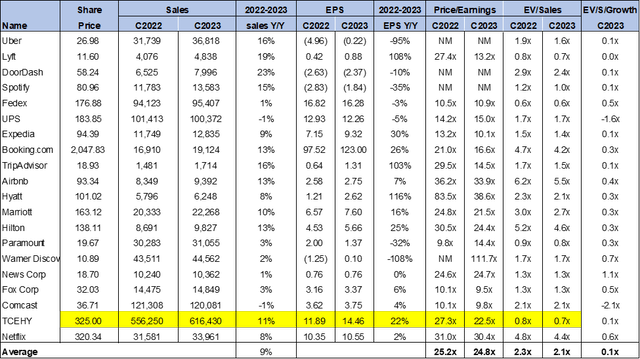

Tencent is relatively cheap after the stock sell-off earlier this year. On a P/E basis, the stock is trading at 22.5x C2023 EPS $14.46 compared to the peer group average of 24.8x. The stock is trading at 0.7x on an EV/C2023 Sales metric versus the peer group average of 2.1x. We believe Tencent’s valuation is attractive for the position the company holds in Chinese markets and recommend investors buy the stock on weakness.

The following table outlines Tencent’s valuation compared to the peer group.

Word on Wall Street

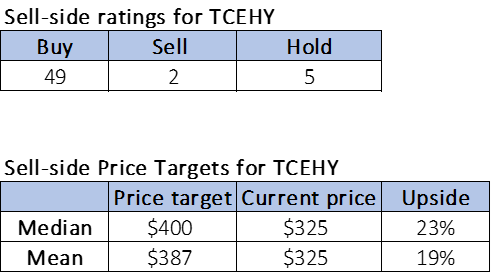

Wall Street is massively bullish on Tencent stock. Of the 56 analysts covering the stock, 49 are buy-rated, five are hold-rated, and the remaining are sell-rated. The stock is currently priced at 325 HKD. The median sell-side price targets are 400 HKD, while the mean is 387 HKD, with a possible 19-23% upside.

The following table outlines Tencent’s sell-side ratings and price targets.

Tech Stock Pros

What to do with the stock

Tencent shares fell into free fall earlier this year, and we attribute this to negative market sentiments toward the Chinese economy. We’re more constructive on the stock now as we expect Tencent is well-positioned to grow meaningfully as China eases its COVID-19 restrictions and as the company expands overseas. We believe Tencent started off the month on the right foot with statements from China’s top health officials announcing that the nation is getting closer to a return to normalcy. We recommend investors take advantage of the pullback and buy the stock at current levels.

Be the first to comment