HAYKIRDI/iStock via Getty Images

Investment Thesis

Tellurian (NYSE:TELL) is well-positioned to benefit from a change in demand for U.S. liquefied natural gas (”LNG”).

Tellurian is an old company that is still meaningfully unprofitable. To illustrate, for it to grow its revenues by $73 million in 2021, it incurred more than 100% in losses.

However, I’m inclined to believe that Tellurian’s Driftwood terminal will give it a meaningful headstart on the competition. Even if LNG exports from this terminal won’t start until 2026, investors are starting to price in the odds of success now.

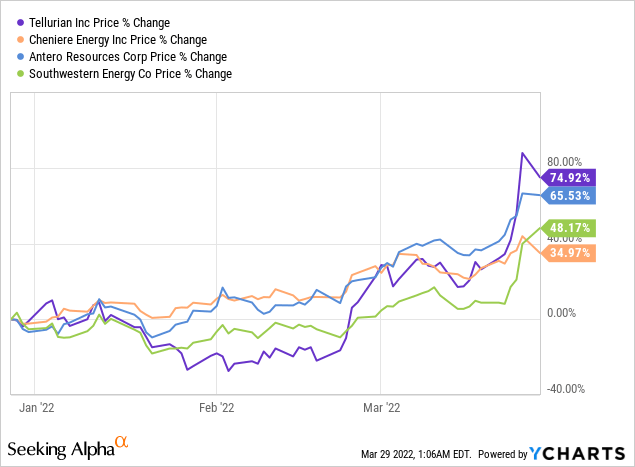

Investor Sentiment Rapidly Moves For TELL Stock, But Will It Continue?

There’s no question that demand for liquefied natural gas (”LNG”) stocks has soared of late. The question here is whether or not this upward revision in these share prices is going to continue going higher, or whether they’ll revert back down, as investors cool off on the idea here.

I’m very much inclined to believe that these shares will continue to re-rate higher. That being said, we are talking about something that is intangible and unquantifiable, at least at this stage.

Consequently, readers should brace themselves for a lot of volatility in these shares, as investors go through bouts of fear, uncertainty, and doubt, as to how realistic the upside potential is here.

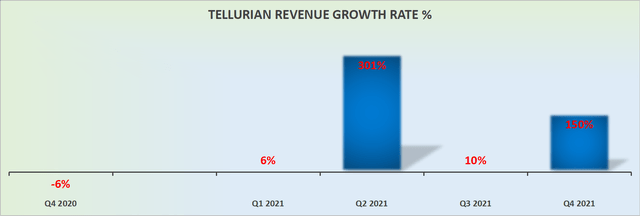

Tellurian’s Revenue Growth Rates, Prone to Wild Swings

Tellurian revenue growth rates

There’s no getting around calling this what it is, a highly speculative investment. The bull thesis isn’t focused so much on the near-term revenue growth rates of Tellurian.

The bull thesis here is more based on the market changing its perception as to the sustainability of the spread between natural gas prices in Europe and the U.S.

And absolutely nobody can predict how this will unfold. Not analysts closely following the company, not me, and not you.

What we can say is that the near-term revenues here will be less meaningful to the bull case, when compared to the long-term bull case.

Why Tellurian? Why Now?

Tellurian is a global natural gas business that delivers natural gas to customers worldwide.

As you know, President Biden has announced his plan to reduce Europe’s dependency on gas from Russia. The headline announces that the US will aim to get around 15 billion cubic meters (”bcm”) to Europe, amounting to around 10% of what Europe presently gets from Russia.

The problem though is that aside from the headline, we are talking about years of needed capital investment to make the physical infrastructure needed to be able to transport LNG to Europe. Transporting LNG is a multitude more difficult than transporting oil. These two have very different infrastructure requirements.

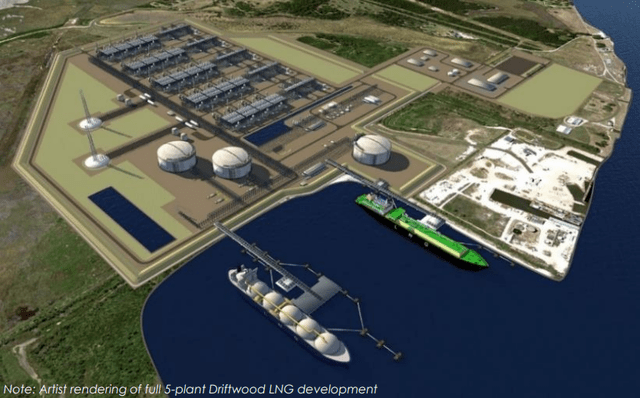

Hence, enters the wildcard for Tellurian. Tellurian announced yesterday that it will begin construction of phase one of the Driftwood LNG terminal.

Tellurian investor presentation

Tellurian’s Driftwood will cost around $12 billion for phase 1. And as the press statement alludes to, Tellurian hasn’t completed the full financing of this project.

But this actually makes a ton of sense to press ahead, even with incomplete funding in place. Right now, nobody wants to back this sort of expensive project as investors are skeptical as to whether or not this business will in actuality become cash-flow positive any time soon.

Thus, getting investment for this project is only achieved on onerous terms. It makes sense to build this out in stages, as more and more entities come to understand that the green agenda is still some time away and that LNG is a ”reasonable” stepping stone away from the dependency on fossil fuels.

Sustained Profitability Remains a Long Way Off

Even though Tellurian has been around as a public entity for more than 40 years, it’s still unprofitable. Indeed, for 2021 as a whole, for it to grow its topline by $71 million it had to incur $113 million in GAAP operating losses.

Said another way, this is a highly speculative company, where its P&L statement is ”upside down”.

TELL Stock Valuation – A Speculative Play

Objectively, it’s impossible to make any sort of realistic assessment as to whether the business is undervalued or not. There are a lot of different factors at play.

Yet, it’s not binomial either. And a lot of investors lazily consider this investment as 50/50 chances of working out. Investments are rarely 50/50.

Here’s what I’m thinking about. For the majority of the past 5 years, the stock had largely found its ”floor”. At the time, there were no positive dynamics to support a higher valuation, but the share prices didn’t go much below $0.70.

But that was during Covid, and the demand for U.S. natural gas had meaningfully fallen at the time.

However, right now, it’s very much the opposite dynamics. There’s a lot of demand, and there’s not enough supply. This implies a very favorable setup for shareholders.

The Bottom Line

If we make the case that Tellurian has a 65% chance of ending up higher in 2022 than it trades for now, that means that there’s a 35% chance that it ends up lower.

So, it could still end up lower, the chance is clearly there. How much lower? Depending on the execution of the team, of course, perhaps it falls back to $2.20, as it was before the Russian sanction put the spotlight on this sector a few months ago? That’s a 60% fall from the current price.

But if it does end up higher, it can end up higher by 30%, 50%, or 100%+. Consequently, I’m positively inclined to believe that there’s a favorable risk-reward being offered here.

All this being said, I’m not buying shares here. But I am very much interested in investing in this space. Whatever you decide, good luck and happy investing.

Be the first to comment