ewg3D

Investment Thesis

Tellurian Inc. (NYSE:TELL) has an amazing story: how it’s going to be able to arbitrage the price difference between U.S. natural gas and that of Europe and Asia.

Recall, back in the summer, we were expecting to hear about Tellurian’s Final Investment Decision (”FID”). And the summer came. And the summer went. Alas, there was no meaningful update.

Or, perhaps better said, there was an update, but diametrically the opposite of what shareholders wanted to hear, namely, that Tellurian lost two substantial contracts.

So, even though Driftwood is looking to be increasingly further away from becoming a reality, there is still the underlying core business.

And that continues to deliver positive results. Although, realistically, I don’t believe it will be a needle-mover for either bears or bulls.

What’s The Story, Now?

The natural gas space is now extremely fluid. Here’s what we know to be facts. We know that warm weather in Europe has implied that Europe this winter does not face an energy crisis.

What we don’t know is how, exactly, next winter’s heating/energy crisis in Europe is going to get solved.

Meanwhile, we know that more and more governments around the world have come to view energy prices as anything but cheap. There’s now a clamor for cheap energy as an energy security issue.

Hence, for now, the solution has been to turn toward the dirtiest of all fossil fuels, coal.

Consequently, governments in Europe and Asia are desperate to get hold of cheap liquefied natural gas (”LNG”) from the U.S. As you know, the U.S. has access to some of the cheapest natural gas in the world.

Indeed, I firmly believe that over the coming years there’s a natural gas secular growth story going to take hold where more and more countries come to look at natural gas as solving a lot of their energy problems.

And this is the appeal for investors in Tellurian. Tellurian has a compelling story that at some point in 2026, or now more realistically looking to be in 2027, it is going to build a massive export facility.

The problem here is that, aside from a compelling story and the facility being built, there’s a $12 billion shortfall. And we have no idea how that shortfall is going to get resolved. Or even if it does get resolved. Ever.

Q3 Earnings, What to Think About?

As I touched on already, a lot of investors forget that beyond Driftwood, there’s still the core business, Tellurian’s Upstream segment.

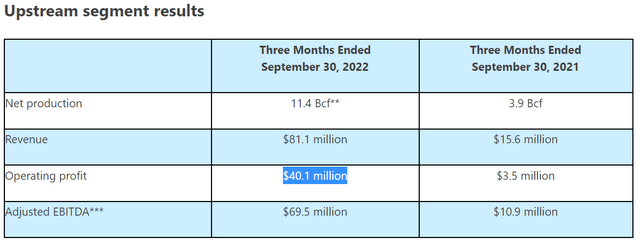

And what we saw in Q3 was that Tellurian’s Upstream segment actually delivered an operating profit of $40 million compared with $4 million for the same period a year ago.

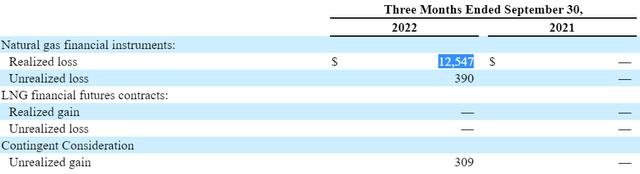

That being said, for Tellurian to book that $40 million profit in its Upstream segment, there was an associated $13 million hedging loss with its Marketing & Trading segment, see below.

Clearly, that hedging loss once again nullifies a lot of enthusiasm for Tellurian. You’ll have to search in Tellurian’s SEC filing to find this little nugget of detail.

Meanwhile, keep in mind that although Tellurian’s balance sheet does hold approximately $600 million of cash and equivalents, the bulk of that cash is equally offset by more than $560 million of debt.

Hence, we once again circle back to the reality that Tellurian simply doesn’t have a lot of room to maneuver on its balance sheet.

How to Value Tellurian?

One part of me looks to TELL as a really long-dated option, where investors will only lose what they put in.

Along this thought process, an investor can position size their TELL investment in their portfolio for this reality: Tellurian may never end up finding anywhere near enough capital investment to get Driftwood built.

Then, there’s the optimistic in me that thinks that despite reality check after reality check, somehow Tellurian gets its FID.

The Bottom Line

As I reminded readers in my previous article at the start of October, Tellurian states that in 2023 it could see approximately $400 million of EBITDA from its natural gas production activities.

That being said, Tellurian has frequently been seen as overpromising and underdelivering. Something that any investor should keep in mind.

Be the first to comment