Media Whalestock/iStock via Getty Images

Investment thesis

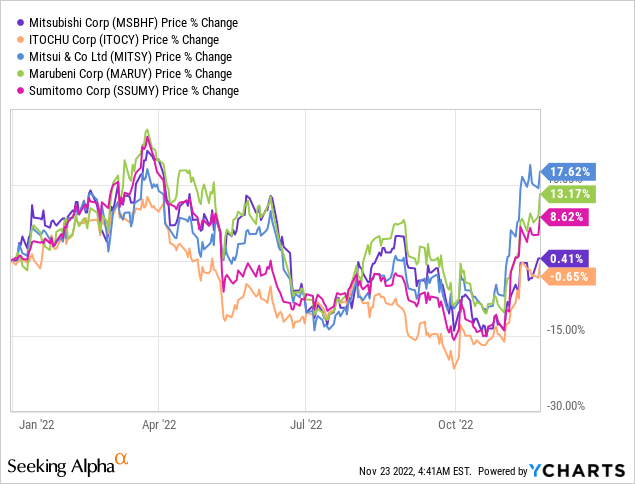

Mitsubishi Corp. (OTCPK:MSBHF) shares have underperformed its peers, and its outsized exposure to metallurgical coal will likely result in reported earnings declining for the next two years. However, given its diversified asset portfolio and management’s positive outlook on increasing shareholder returns, we maintain our buy rating.

Quick primer

Mitsubishi Corp. has origins dating back to 1873. Initially focused on shipping, the business has developed into a multinational conglomerate with 1,700 group companies ranging from convenience stores in Japan (the Lawson chain), to car exports and LNG projects in Malaysia. It has a relatively high weighting to natural resources in its portfolio with large exposure to natural gas, copper, iron ore, aluminum smelting, and metallurgical coal.

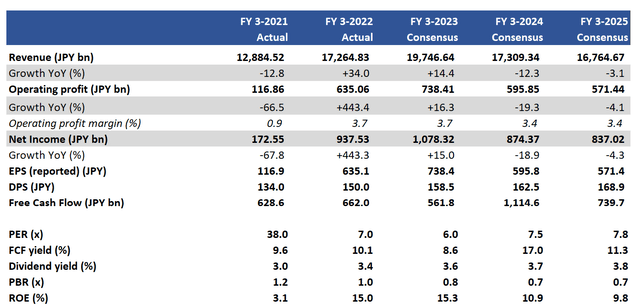

Key financials with consensus estimates

Key financials with consensus estimates (Company, Refinitiv)

Our objectives

We revisit our buy rating from August 2021, where we believed that high metals and coal exposure would drive both earnings and shareholder returns. Q1-2 FY3/2023 results saw a major boost in the Mineral Resources business with increased prices for Australian metallurgical coal, but we also had a strong showing in the non-minerals business in Urban Development with the sale of a real estate management company.

We note Mitsubishi Corp has underperformed its peers, notably Mitsui & Co (OTCPK:MITSY) with its high exposure to energy, and Marubeni (OTCPK:MARUY) with a similar story with metallurgical coal, but also agriculture.

A closer look at coal

Mitsubishi’s exposure to coal was showing signs of price rises before the Russian invasion of Ukraine, as industry production capacity remains limited on a global scale. Demand for thermal coal (burned to produce electricity) remains high as Europe switches back on coal power stations over the winter months, and with the soft Chinese economy, there is no major increase in global supply keeping prices high. Metallurgical coal (or coking coal) prices have been lifted up in tandem with thermal coal, but have settled back down around half from its recent peak to USD275, which is still at a high level historically.

Although a global recession may temper demand for steelmaking, metallurgical coal prices are expected to remain elevated as there are simply no new mines being built. That being said, revised FY3/2023 company guidance implies that Q3-4 net income generated from the Mineral Resources business will see a decline of 60% YoY, versus 125% growth YoY in Q1-2 which show that prices have significantly corrected. We believe the company is being conservative with its new targets, but the underlying message appears to be that market conditions are normalizing.

Whilst resources will continue to be the core earnings driver for Mitsubishi Corp, we believe that the company will find it challenging to grow earnings overall for the medium term – the highly elevated coal prices were temporary, and volume growth is unlikely to be significant. When we look at consensus forecasts (see Key financials table above), expectations of declining earnings look understandable given this backdrop.

A steadier outlook for dividends

Despite toning down future earnings expectations, consensus expects dividends to continue increasing. For FY3/2023, there is still potential earnings upside from a weakening Japanese yen (Q3-4 company assumption is currently in line with the market at JPY141), and the company raised FY dividend guidance from JPY150 to JPY155. The key assertion going forwards is that the payout ratio will gradually increase, given management’s relatively positive view on improving shareholder returns – the medium-term target payout range remains 30%-40% by FY3/2024. In November 2022, the company announced a small 1.5% share buyback program, underlining its commitment to improving returns.

It would appear that the market was disappointed by the revised dividend guidance for FY3/2023. Management seems to imply that the final figure is still under consideration and that volatile macro conditions are preventing the release of more concrete guidance.

The company’s strategy is to grow underlying earnings independent of market factors, whilst capturing any upside from natural resources pricing. From this context, we believe the company can still increase dividends YoY, despite seeing reported earnings declining primarily from natural resource prices falling.

Valuation

On consensus forecasts, the shares are trading on PER FY3/2024 7.5x, a prospective dividend yield of 3.7%, and PBR 0.8x. These metrics do not look overvalued on a standalone basis but do reflect a business with an asset-heavy balance sheet, operating in an environment currently with high geopolitical risk.

Risks

Upside risk comes from a continuing depreciation of the Japanese yen, as a JPY1 move versus the US dollar equates to a JPY5 billion impact on full-year earnings. Management prioritizing shareholder returns and hiking dividends to a 40% payout ratio would boost sentiment toward the shares.

Downside risk would stem from a sudden strengthening of the Japanese yen versus the US dollar. A global recession pulling down demand for resources would be potentially negative for prices, although a tight supply may keep prices relatively balanced. A major climb in interest rates will drive higher financing costs.

Conclusion

Mitsubishi is seen as one of the market leaders in the Japanese trading company space, yet the share price has underperformed its peers which are explained by its outsized exposure to metallurgical coal which is hard to offset elsewhere. Despite this, the business remains a portfolio of diversified assets generating positive returns and consequently, on current valuations, we reiterate our buy rating on the shares.

Be the first to comment