MikeMareen/iStock via Getty Images

Investment Thesis

Tellurian (NYSE:TELL) reported results that positively surprised investors. The highly shorted and contentious Tellurian was able to positively impress investors despite making no mention of any significant progress on its highly anticipated Final Investment Decision (“FID”).

As I’ve maintained for a while, the stock is extremely cheaply valued, if investors believe, as does Tellurian, that the demand for natural gas in Europe and in Asia is going to remain high for several years to come relative to the US.

Looking ahead, the big question is, what proportion of the $12 billion capital to be raised to build Driftwood will come from shareholders?

I maintain that even if the founder-led Tellurian were to raise the capital with 80% in the form of equity, the stock is still priced at 3x its 2026 cash flows.

This stock is a buy.

Q2 2022 Download

The most significant news from Tellurian’s Q2 2022 earnings report was that total production was 9.0 bcf, up 329% y/y from 2.1 bcf in the same period a year ago.

Shortly after the earnings report was out, Tellurian’s CEO took to YouTube to comment on the results. The video was significantly shorter than other videos that CEO Charif Souki has recently made.

In the YT video, Souki remarks that not only more wells are now going to become available to Tellurian, but that an acquisition that Tellurian is set to complete later this month will also augment its production capacity.

All that being said, investors clearly welcomed the fact that in Q2 alone, Tellurian’s EBITDA jumped from around $2 million of negative EBITDA this time last year to a positive $53 million this time around.

Indeed, I believe that given that Tellurian’s Q2 2022 was essentially breakeven on a cash flow basis when taken together with its more than $820 million of cash on its balance sheet, this altogether solidifies the bull case. It’s now all about what percentage of its FID will come from shareholders.

TELL Stock Valuation – The Small and Big Carrot

The small carrot is that Tellurian guides that it expects $400 million in EBITDA in 2023.

However, serious investors considering this stock are not paying a lot of attention to this small carrot. What everyone is trying to figure out is exactly how much will shareholders get diluted to build the Driftwood LNG facility.

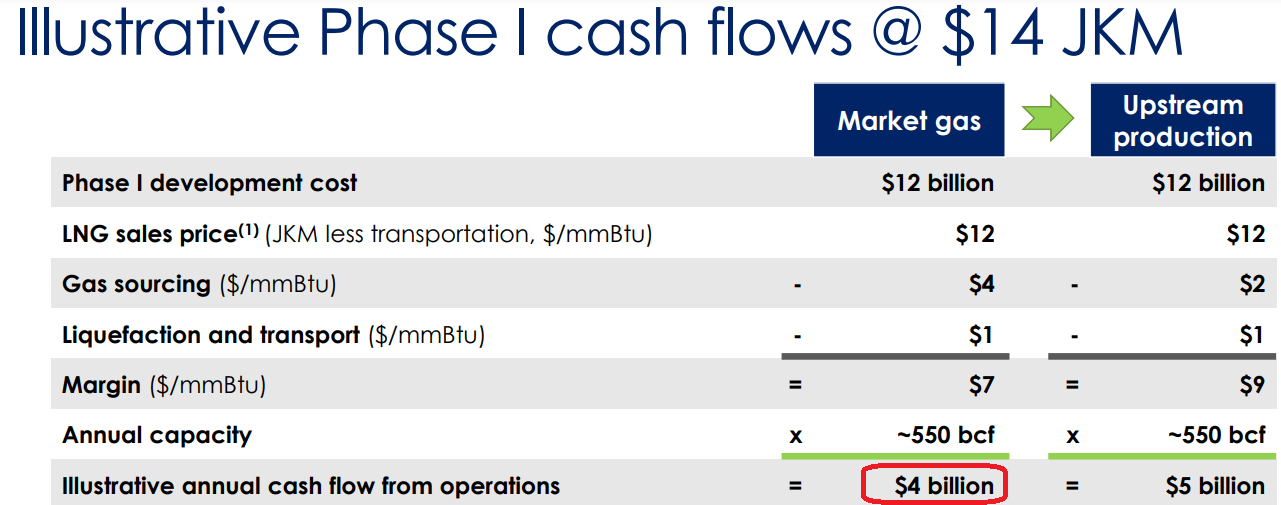

Tellurian’s hope is to build the $12 billion facility with two-thirds debt to one-third equity. Yet, I have consistently maintained that if FID is forced in a manner that shareholders will have to stomach as much as 80% of the capital raise, that would still only see current equity holders being diluted 6x to approximately $12 billion market cap.

Tellurian investor presentation

This would imply that the stock today is priced at 3x its 2026 cash flows. Nevertheless, needless to remark that a lot can happen by 2026.

There are likely to be inevitable delays in getting the multi-billion dollar facility up and running. Also, obviously, it’s far from guaranteed that there would still be a significant spread between natural gas prices in the US and Europe, and Asia.

However, realistically, I believe that most rational investors would declare that this second risk is relatively immaterial. The biggest risk here is whether or not Tellurian can get its FID in place or not.

In fact, just yesterday, one analyst downgraded the stock on precisely this argument: is FID coming or not?

The Bottom Line

Tellurian is a highly shorted stock for good reason. For now, investors are having to buy equity today for something that may or may not happen over the next 3 years.

That being said, I would counter this by charging that as soon as Tellurian’s FID agreement is announced, this would fundamentally destroy the bear case on the stock. And with 20% of the stock sold short, I’m inclined to believe that if/when the FID announcement is made, the stock will rally strongly and quickly.

In sum, I rate this stock a buy, despite highlighting all the potential risk factors.

Be the first to comment