Alberto Masnovo/iStock via Getty Images

Annaly Preferred Shares (NYSE:NLY.PG) currently trade at $22.68 with a par value of $25.00 due to the broad market selloff and relatively low base yield. I believe that it’s likely this will trade at par value again by its call date of March 30th, 2023 and provide a 15.55% return with minimal risk.

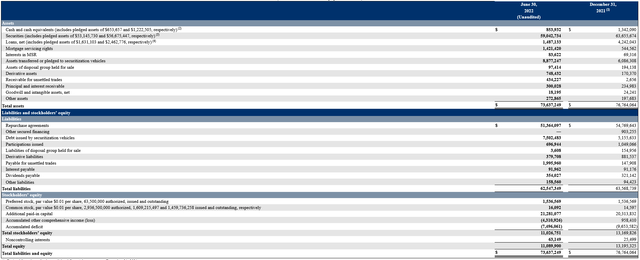

With total equity of $11.09b and preferred liquidation preference of $1.536b we can observe that the stock equity / preferred equity coverage ratio is 6.22. Additionally, the $9.6b in stock equity can be thought of as a 2390% margin of safety over NLY.PG’s “market cap” of $385.56m. NLY’s recent stock offering of $645m covers the entire liquidation value of NLY.PG and further cushions any possible damage to preferred shares. Recently announced Q2’22 net income of $839.8m is 56% of liquidation value of all preferreds – just in that quarter alone.

Given the relatively small market for FTF preferred shares overall, it’s likely there’s simply a market disconnect here based on indiscriminate selling. Despite trading above par value not even a year ago, NLY-G is now trading at a discount with positive catalysts in the near term. Either these will be called in March given rising interest rates for a 15.55% return or you can lock in an estimated long term 8.46% yield on these shares.

The Story on NLY-G

In the rising interest rate environment I’ve kept an eye on fixed-to-floating preferred shares that are callable within the next year. As these shares enter into callable territory the dividend rate reset has been typically above current yield. For example, the issue we are looking at today, NLY.PG looks something like this:

|

Current Price |

$22.68 |

|

Coupon Rate |

6.50% |

|

Current Dividend |

1.61 |

|

Dividend Yield |

7.10% |

|

Call Date |

3/31/2023 |

|

FTF Rate |

3-month libor + 4.172% |

|

Current 3-month libor |

2.80% |

|

FTF Rate |

6.97% |

|

Implied Dividend |

$1.74 |

|

Dividend Yield |

7.69% |

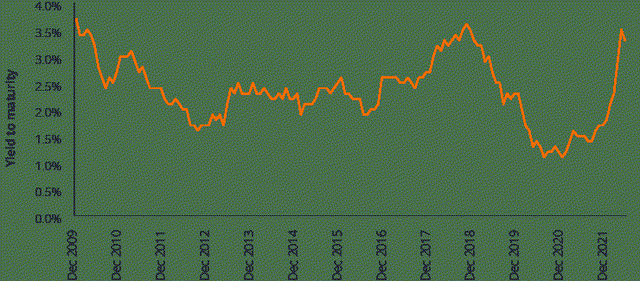

Now the key variable in this calculation is the 3-month libor component of the FTF rate. The current 3-month libor of 2.80% has not yet fully adjusted for the recent interest rate hike and with the Fed meeting again in September most are expecting a further interest rate hike to round out the year. Estimates for 3-month libor suggest they will be around 3.5% by March 2023.

|

Estimated 3-month libor |

3.50% |

|

Estimated FTF Rate |

7.67% |

|

Estimated Dividend |

$1.92 |

|

Implied Dividend Yield |

8.46% |

At current rates it’s likely that the FTF yield in March 2023 will be 19% greater than the current yield. If interest rates continue upward past September then NLY-G preferred shares would see their dividend increase proportionally.

I’ve liked this area of the market recently as the broad selloff created some dislocation in these names. As interest rates rise many have been adjusting positions and portfolios and looking at current dividend yield rates to support that decision without considering the impact of the FTF component which isn’t as easy to view via screeners. NLY-G was recently down to a low of $19.56 which in this scenario above would have implied a 9.8% yield.

Despite a 16% run-up from lows at the end of June, I believe there is still safety in this name due to its FTF nature which will likely cause the company to redeem shares around the call date. If we assume a March 2023 redemption that would bring us a reversion to par value of $25.00 plus quarterly dividends due in September, December, and March totaling $1.21. Total implied return would then be 15.55%.

|

Workout Case |

|

|

Call Date |

3/31/2023 |

|

Current Price |

$22.68 |

|

Par Value |

$25.00 |

|

3 Quarterly Dividend Payments |

$1.21 |

|

Total Return |

$26.21 |

|

Implied Return % |

15.55% |

|

Estimated days in position |

240 |

|

Implied annualized return |

23.65% |

Annaly Capital Just Raised $645m Creating Further Margin of Safety For the Preferreds

Annaly Capital announced a stock offering in May which raised $645m by issuing 100m shares. While dilutive to common shareholders, for preferred shareholders this represents an increased margin of safety. Consider that liquidation value for the NLY.PG is $425m so Annaly could theoretically use this new cash position to redeem the entire offering.

Not only does this recent stock offering support the value of the preferreds, if we look at the balance sheet we can see there is $9.5b in equity which must be lost before the preferreds would be impacted. They also have $854m in cash on hand which is about 57% of the total liquidation value of the preferreds alone.

As a business Annaly Capital is an agency focused mREIT which generates a profit primarily by holding agency MBS. These agency MBS have explicit or implicit support from the US government which mitigates credit risk. In the most recent quarter NLY made $839.8m in net income which is 56% of liquidation value of all preferreds.

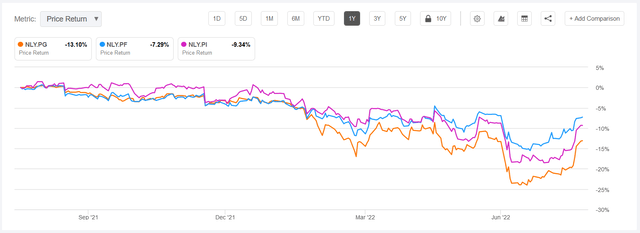

The Three NLY Preferreds

There are three preferred series shares issued by Annaly Capital: NLY.PF, NLY.PG, NLY.PI. All three of these are FTF preferred shares that are callable in the next two years. Here are some details regarding the separate issues:

|

NLY.PF |

NLY.PG |

NLY.PI |

|

|

Current Price |

$24.28 |

$22.68 |

$23.88 |

|

Shares Outstanding ((m)) |

28.80 |

17.00 |

17.70 |

|

Liquidation Value ((m)) |

$699.26 |

$385.56 |

$422.68 |

|

Call Date |

9/30/2022 |

3/31/2023 |

6/30/2024 |

|

Coupon Rate |

6.95% |

6.50% |

6.75% |

|

Current Dividend Yield |

7.16% |

7.16% |

7.07% |

|

FTF Rate (3 month libor + ) |

4.993% |

4.172% |

4.989% |

|

FTF Rate with 2.8% 3 month libor |

7.793% |

6.972% |

7.789% |

|

Coupon Rate Change |

12.13% |

7.26% |

15.39% |

A couple of things I note from the chart above. NLY.PF is callable next month and the amount raised in the stock offering is near the liquidation value of those preferred shares. NLY.PF and NLY.PI are much closer to par at this point than NLY.PG. All of the preferred shares are likely to see a significant change in coupon rate as they shift into their callable dates given the rising interest rate environment.

Just last year each Annaly Capital’s preferred shares traded above par value and in near lockstep with each other. NLY.PG’s 52 week high of $26.59 is reflective of that. If we look at a chart comparing the three over the past year we can see that there started to be some price dislocation between them with NLY.PG trailing the pack.

I believe this disconnect in pricing is simply an inefficiency in the market given the recent sell-off. Preferred shares overall were not spared the downturn even if the underlying economics of the business were not at risk. In the case of Annaly Capital, I believe that given the preferreds are shielded by $9.5b in stock equity and the company is profitable that they are likely to drift back to at least par value on their own. Redemptions are also highly likely which would immediately revert value back to $25.00.

Why Would Annaly Capital Redeem Their Preferred Shares

An assumption that I am making here is that Annaly Capital is likely to redeem their preferred shares given the rising interest rate environment. The FTF feature of these shares means that as they shift into their call date the cost of capital, in the form of the cumulative dividend, of these shares will increase. Having a floating expense tied to interest rates in a rising interest rate environment is undesirable and recent tapping of the equity markets demonstrates that Annaly Capital has methods of raising additional capital at likely lower costs. Consider that their average economic cost of interest bearing liabilities was reported at 1% for the first half of 2022.

While the preferred dividends only represented 3% of their net income in the most recent quarter, it’s a clear cut way in a complex environment to reduce costs for the company. I think we will see a test of this idea within the next month when NLY.PF becomes callable. If there is a redemption of these shares I think it further supports the thesis that NLY.PG is likely to be called in March 2023.

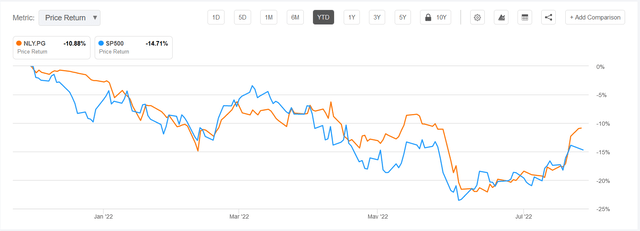

Why Does This Opportunity Exist

NLY.PG has traded downward over the year in line with the S&P 500.

Preferred shares are fixed income investments which as a group have performed poorly this year prompting articles like “Fixed income returns in 2022: Have our bonds betrayed us?”. Despite poor recent performance, fixed income vehicles are now trading at their highest yields in years which may suggest future out performance.

Janus Henderson Article Linked Above

NLY.PG has a relatively low fixed coupon of 6.50% which likely drove people out of the shares as rising interest rates made other investments seem more attractive on a fixed income basis. Part of the market dislocation has been a lack of value associated with FTF preferred shares which seem to have traded more along the lines of their pre-call date yield details.

Recent coverage from another contributor Dane Bowler reviewed the NLY preferred shares and noted that NLY.PG is “the least opportunistic of the NLY preferreds” on July 11th. He also notes that “Fixed-to-floating preferreds are not particularly common and most of the issues, with exception to those of NLY are too small to get any institutional attention. It is an opportunity in plain sight that nobody is seeing simply due to obscurity.”

All three of the preferreds have had a run up in the past month as they bounced off of June lows. NLY.PF is so close to par at this point it’s less interesting to me as a redemption play. NLY.PG is both lower priced and callable at an earlier date than NLY.PI. This is likely driven by the lower base coupon of NLY.PG given at current prices all three have a 7.1% dividend yield.

Asymmetric Risk Profile

I’ve laid out what I believe to be the upside scenario where we see NLY.PG called in March 2023 for a total implied return of 15.55%. The downside is mitigated by a host of factors including:

-

Recent capital raise alone could liquidate NLY.PG.

-

There is $9.5b in stock equity which represents a Stock / Preferred equity coverage of 6.22. Another way I think of this is that at the current “market cap” of $385.6m the stock equity provides a 2364% margin of safety.

-

From last quarter’s filings cash on hand is 57% of total preferred liquidation value. Net income was 56% of their liquidation value.

What are the risks though? As with all agency focused mREITS, leverage is high yet it would take an extreme scenario for the company to go to zero. In a previous article on NLY’s preferreds Fellow contributor, ADS Analytics, explained it well:

Does this mean that, if agency mREITs hold primarily assets without credit risk and preferreds are more insulated from the dangers of the mREIT portfolio strategy, that the preferreds are “safe”?

This is a question we looked at in an earlier article. The short of it is that a highly leveraged portfolio cannot be really called safe, for any sensible definition of the word, even if it holds securities with no credit risk. By our estimate the MBS basis has to blow out to about 3% for the equity of a typical agency mREIT to go to zero. In this scenario the preferreds are obviously worthless as well. This level in the basis is about 3x of what we saw during the GFC and the COVID shocks. It is extremely unlikely that the Fed will allow the basis to reach this level as it would be indicative of utter chaos in the fixed-income market. However, the key point here is that any agency mREIT security, whether common or preferred, relies on the backstop of the Fed to remain alive. Is it reasonable to assume the Fed will be there to backstop the market to prevent such a dislocation? In our view, it’s a reasonable assumption but it’s still an assumption.”

I tend to agree with ADS Analytics here meaning it would take extreme changes in current trends and behaviors before impact to preferred shareholders which is something we can monitor. Now that doesn’t mean that the price of the issue will reflect that so there is always market risk – but I believe that given the features driving a likely redemption of the preferred shares that market risk is mitigated as well.

Another “risk” to my thesis is that the preferred shares are not redeemed. When we play this scenario out with an underlying belief that the preferred shares are worth par value eventually, it may actually be more rewarding to receive a dividend driven by rising interest rates. If you bought at current prices you’d be locking in an 8.46% yield post call-date.

All in all, I think risks are quite minimal here. From a mental model perspective I think of this as a workout situation. The preferred shares are in a workout scenario between now and March 2023 where I gauge they will be bought at an already agreed upon price of $25. In holding this in my portfolio I’m aiming to generate returns which are non-correlated to the broader market which remains in flux. This position also serves as an inflation hedge.

A near term catalyst exists as NLY.PF is callable 9/30/2022 and within a month of that I expect we could see an announcement redeeming those shares. If the NLY.PF shares are redeemed, I suspect that we’d see NLY.PG immediately rerate back to par value at least. If NLY.PG is redeemed within a month of its call date, the total return with three dividend payments and return to par value would be a 15.55% return.

Be the first to comment