morfous

Telephone and Data Systems, Inc. (NYSE:TDS) continues to face enormous challenges as the small telecom struggles to get any significant return on its investments, while also have increasing churn eat away at its customer base.

Among the negative catalysts for churn were an increasing number of non-paid customers and competition ramping up deals. In a number of situations TDS had to respond to further avoid losing more customers to its much larger competitors by cutting prices, putting downward pressure on its bottom line.

Considering the macro-economic environment it’s competing in, where its competitors are fighting to maintain or grow market share from changing consumer spending behaviors, it’s difficult to see how TDS can effectively combat that over the long term, considering in the third quarter its operating expenses exceeded its operating revenues.

In this article we’ll look at some of its recent earnings numbers, the impact of the macro-economic conditions it’s operating in, and why I don’t see the company going anywhere on the growth side, although it’s likely to be able to pay out a consistent dividend if the economy doesn’t go into a prolonged and deep recession.

Latest numbers

Revenue in the third quarter was $1.39 billion, up from the $1.32 million in the third quarter of 2021.

Net income came in at a loss of $25 million, or ($0.22) per share, compared to net income of $28 million, or $0.24 per share year-over-year. While the company suggested the drop in net income came from investing in growth initiatives, that would include steps it was taking to ward off competitors.

Adjusted EBITDA in the quarter was $271 million, down from the $341 million in adjusted EBITDA in the same quarter of 2021.

Company Presentation

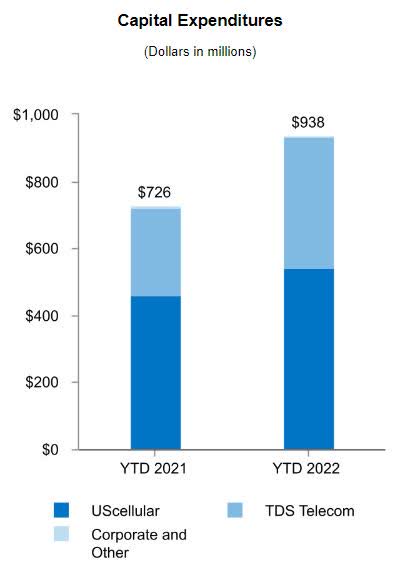

CapEx in the reporting period jumped from $279 million last year in Q3 to $305 million in the Q3 of 2022. Total CapEx in the first nine months of 2022 was $938 million, up $212 million from CapEx in the first nine months of 2021.

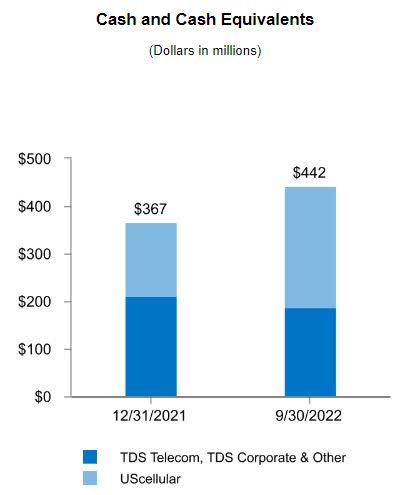

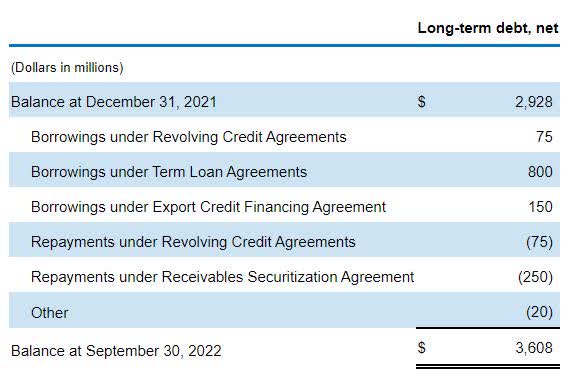

Cash and cash equivalents at the end of the third quarter were $442 million, with long-term debt at the end of the quarter of $3.6 billion.

Company Presentation

Since telecoms run on high debt and huge expenditures, that’s not unusual for TDS, but getting little in return in regard to its earnings performance.

Non-GAAP free cash flow in the third quarter was $107 million, down $30 million from the $137 million in free cash flow year-over-year. Management said, “U.S. Cellular and TDS Telecom are in key investment cycles that are pressuring free cash flow near term.”

Depending on what management means by “near term” in this case, I tend to think with rising competition and the macro-economic effects on consumer behavior, pressure could remain on free cash flow longer than is expected.

Company Presentation

Churn issues

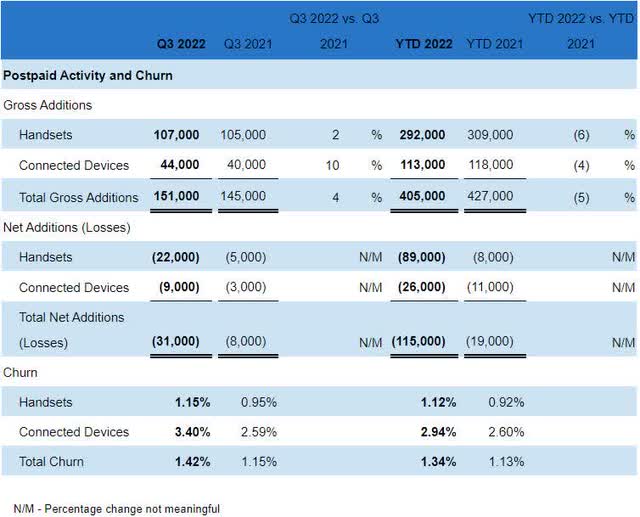

Churn in the third quarter fell again, with both handsets and connected devices down from 2021 levels.

Handset churn was 1.15 percent in the reporting period, up from the 0.95 percent in the same reporting period last year. For the first nine months handset churn stood at 1.12 percent, up from the 0.92 percent in handset churn in the first nine months of 2021.

For connected devices churn jumped from 2.59 percent in Q3 of 2021 to 3.4 percent in Q3 of 2022. For the first nine months of 2022 connected devices churn was 2.94 percent, compared to the 2.6 percent in the first nine months of 2021.

Company Presentation

Total churn for quarter three was 1.42 percent, measured against the 1.15 percent total churn of the third quarter last year. Total churn for the first nine months of 2022 was 1.34 percent, compared to the 1.13 percent churn in the first nine months of 2021.

When thinking of churn there is the voluntary and involuntary side of it. Voluntary refers to customers leaving for competitors, while involuntary churn refers to non-payment customers.

An important thing to take into account here is postpaid churn in part, was the result of the disconnecting of devices of government and business customers that received government funding during the pandemic. With that funding ended, those customers are likely to be permanently gone.

One other area of concern in churn associated with increasing competition is that some competitors are now expanding into some rural parts of America where TDS has a footprint, that ensures, to some degree, that it will lose some market share, or at best, slow down its growth. I expect it to be the latter, which means TDS is going to probably lose more customers to churn in the quarters and years ahead.

To combat that it’ll have to either compete on price and/or bundled services to offset the loss in customers. Either way, that will put pressure on margin and earnings.

Last, churn is likely to get worse because consumers that received stimulus checks when locked down had better payment records than before the pandemic. With churn returning to pre-pandemic levels, and the economy having a significant effect on consumer behavior, this will be another headwind connected to churn that will get worse before it gets better.

Conclusion

With higher expenses, growing churn, macro-economic impacts, and an increasingly competitive environment, the road ahead for TDS is getting harder, and I don’t see anything in the near term that will change that.

While the company has enjoyed some protection from its rural strategy, it appears that competitive advantage will be under pressure as competitors start to look to expand in markets where TDS has a footprint.

Not everything for the company was bad news, as it did manage to increase ARPU in the quarter, and some of its spending initiatives in certain parts of the company were effective, but as a whole, there are just too many macro-headwinds the company faces to overcome in the near term, and if things get really bad in 2023 economically speaking, it could get much worse in the long term as well.

Even though the company currently pays out a decent dividend and yield, I don’t see that offsetting the challenges ahead for the company in regard to growth. I don’t believe it’ll be able to stop its share price from falling further, and it’s not probable that the dividend yield will come close to making up for the loss in value.

Taking everything into account, there are a lot better companies to invest in if considering income, companies that should be able to continue to raise dividends in the quarters and years ahead, while growing incrementally on a steady basis.

Be the first to comment