primeimages

Telephone & Data Services is a legacy telecom company first founded in the mid 60s and IPOd in the early 80s.

dividendchannel

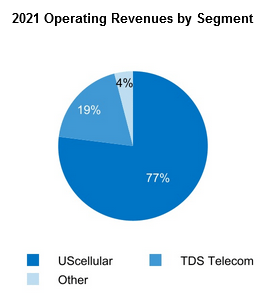

Its biggest subsidiary is 85% owned USM, which is the fifth-largest wireless provider in the US. The focus of this article is on the parent company, Telephone and Data Systems (NYSE:TDS), and isn’t meant to be a comparison of which of these two are the better buy right now.

TDS 10-Q

It was once one of the larger telecoms in the US, but those glory days are long past. Below are return on capital figures among peers.

|

Company |

10-Year Median ROE |

10-Year Median ROIC |

10-Year EPS CAGR |

10-Year FCF CAGR |

|

2.6% |

1.5% |

-5.9% |

||

|

10.8% |

5.2% |

15.4% |

5.7% |

|

|

30.1% |

9.3% |

20.1% |

-4.6% | |

|

5.5% |

2.4% |

-4.5% |

-3.2% |

Capital Allocation

The wireless market consists of the big three, followed by everyone else (with DISH working its way up to maybe be a fourth down the line). The nature of the market means that everyone else won’t have any realistic chance of becoming a major player down the road. Since telecom stocks are inherently dividend stocks, the only reason to own one of these minor players is to lock in a high yield. The qualitative aspects of the business (growth and returns on capital) don’t justify a high multiple or a low dividend yield.

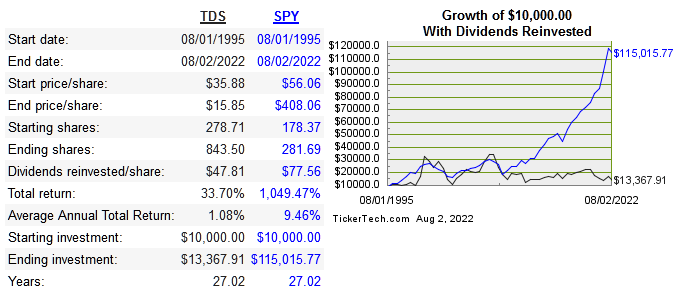

TDS has paid regular dividends and has increased CAGR 8.96% since 1989, though not every year saw an increase. The dividends are a substantial driver of returns, just like most telecoms. The problem is for yield seekers to focus on the dividend without considering the underlying business fundamentals. The current yield of 4.4% is certainly higher than the 1.5% of the S&P, but at this point you are basically getting a trust instead of a growing company that also pays a dividend. Below is the past ten years of FCF, dividends paid out, and long term debt in millions.

|

Year |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

FCF |

110 |

-389 |

-405 |

-11 |

146 |

91 |

241 |

59 |

164 |

-48 |

|

Div |

53 |

55 |

58 |

61 |

65 |

69 |

72 |

75 |

78 |

119 |

|

LT Debt |

1,722 |

1,720 |

1,994 |

2,440 |

2,433 |

2,437 |

2,418 |

2,316 |

3,424 |

3,888 |

The current 4.5% dividend yield isn’t worth a legacy company that can’t earn returns on capital above its cost of capital. Operating in a capital intensive sector means that even the best in class businesses still have to invest huge sums in order to get higher returns. Also, that LT debt figure is now higher over the TTM, currently at $4.51 billion.

Most telecoms run on perpetual debt, so I’m not in any way expecting a massive deleveraging for good. The problem is, the additional debt is not increasing the earning power at all. This is the classic case of a business that requires a lot of capital just to earn subpar returns. Most of the (small) growth potential likely comes from acquisitions. My point is not to criticize specific strategic efforts, such as the recent midband expansion deal.

Q2 Earnings

Shares ended the day down almost 3% on Q2 earnings release, although net income is 15% higher YOY. TDS has only had four unprofitable years, but had far more years where FCF wasn’t positive. A lot can be forgiven in net income variance if FCF is stable, but that’s not quite the case here with TDS.

Operating income is also up 18% YOY, which is a good sign in the short run. Operating margins did rise to the 7% level a few times within the past ten years, but I don’t think we will see much expansion over time.

My issues are more structural and longer term.

Valuation

Below is a comparison of multiples with peers:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

TDS |

0.9 |

4.1 |

35.3 |

0.3 |

|

T |

1.7 |

5.9 |

17.6 |

1 |

|

VZ |

2.4 |

6.8 |

32.5 |

2.2 |

|

TMUS |

3 |

11.8 |

143.3 |

2.6 |

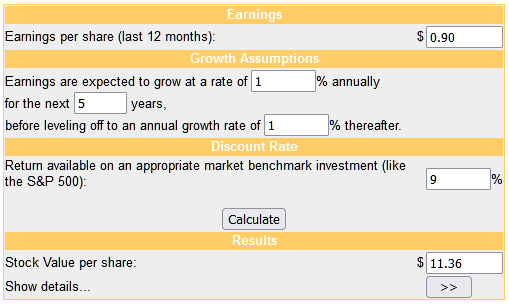

As usual I’ve given a very conservative estimate in the DCF below.

moneychimp

My ideal scenario would be to see the legacy telecom assets be sold off, followed by the sale of the wireless side, meaning USM and TDS would cease to exist. This might sound extreme in the context of an industry that inherently produces oligopoly. The main roadblock is the antitrust regulators blocking these potential sales if it were purchased by one of the big three. So, I wouldn’t count on this as always being a potential upside one day.

I don’t mean to disparage this company as a whole or the individuals running it, but my view is that there is essentially no economic reason for this company to exist in its current form if we look at it not from bottom line profitability, but from returns on capital simply being lower than the cost of capital. The assets in place obviously provide value to end users, but this has become a business that requires a lot of capital in order to generate returns below the cost of capital. The majors are able to earn higher returns on capital due to scale advantages. These assets would probably be better suited for one of majors, instead of eating away at shareholder value in the long run as an independent public company.

TDS has all the traits of a business I try to avoid: low returns on capital, low operating margins, high capital intensity, and tiny market share compared to the big, dominant companies. These traits are actually the exact opposite of a company like MA, which I consider to be highest of quality precisely because of those characteristics.

Increasing dividends alone shouldn’t warrant investment in such a tough business. If income is what you seek, there are hundreds and hundreds of better places to produce income. For the long-term investor like myself, this is an easy stock to avoid since EPS and FCF are declining, not growing.

Conclusion

If you’re fishing in the telecom pond, dividends are the key thing you’re probably focusing on. There’s nothing wrong with this, but understand exactly what you’re getting into. The dividends will be reliable, but capital appreciation will be underwhelming unless you buy a better company at a deep discount.

TDS will never become one of the majors, and the best one can hope for is to capture a high dividend yield presented by the market. The current rate of 4.5% isn’t enough to justify owning a business of this quality for the long term.

Be the first to comment