bjdlzx

Telecom Argentina (NYSE:TEO) is an integrated telecommunications carrier with established positions in fixed, mobile, broadband and cable.

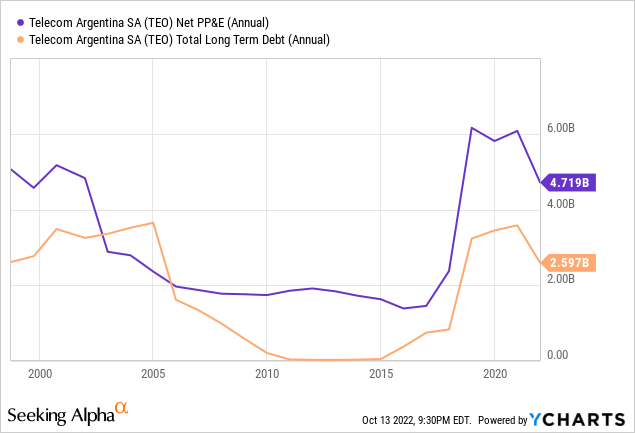

Last December I wrote an introductory article on the company with a hold rating. The main reason for the rating was the Argentinian government’s attempt to fix the prices of telecommunication services in a context of rampant inflation. Also, the company was spending more than previously on fixed investments, something I considered problematic going forward. Finally on the negatives, TEO is leveraged both financially and operationally.

On the positive side, TEO is almost profitable in a context where the price charged for telecommunication services has fallen to historic lows. Part of that fall is tied to global industry trends, but another portion is tied to Argentina’s either stagnant or contracting economy for the past ten years. Any sort of recovery on pricing power, which is inevitably tied to the recovery of the Argentinian economy, will greatly increase the company’s profitability.

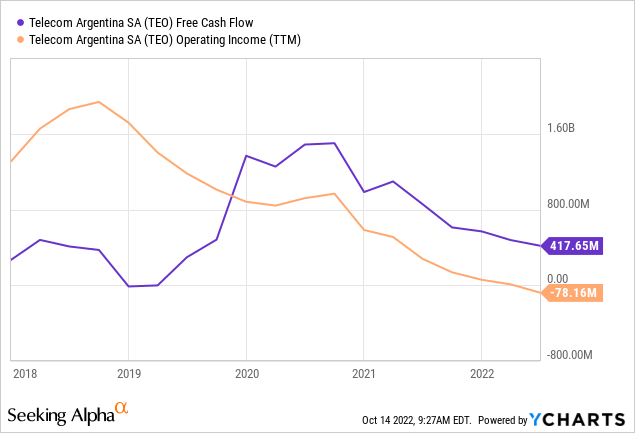

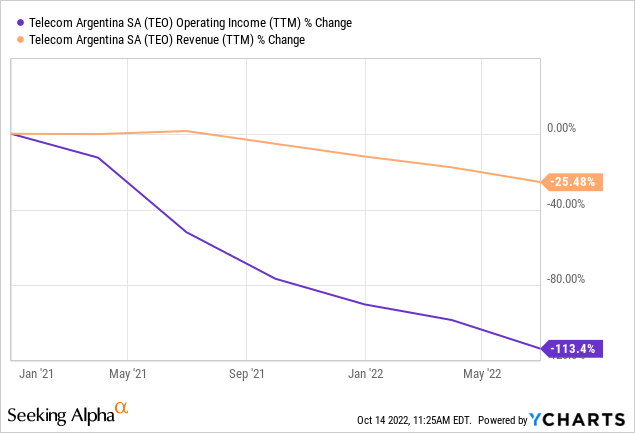

In this article, I review the situation with data from the 20-F annual report for FY21, along with quarterly reports for Q1 and Q2 of FY22. The company is presenting operational losses on an accounting basis, but it is doing much better on a cash basis, based on much lower capital expenditures than before. Although the government’s attempt to fix prices was thwarted in court, TEO has been unable to recover pricing power and revenue is falling in real terms. The company has also leveraged more by paying dividends.

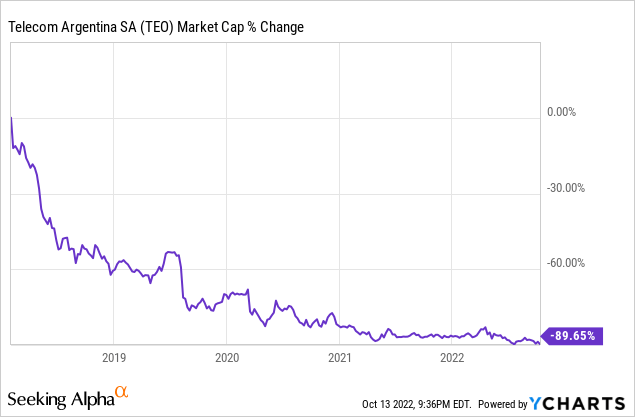

With the stock down 25% since December, TEO now presents a wider margin of safety, trading at 10 times FCF. Still, the situation is risky and future profitability depends significantly on Argentinian economic recovery and industry dynamics improving. I believe current prices can be considered a limit or ceiling, with investors purchasing below them.

Note: Unless otherwise stated, all information has been obtained from TEO’s filings with the SEC.

Previous report

This is a short summary of the initiation coverage article on TEO, for a more detailed explanation, please refer to that article.

TEO is one of the biggest, if not the biggest player, in Argentinian telecommunications. The company holds a consolidated position in fixed, mobile, broadband and cable, with market shares between 30% and 35% in all of them. That means, although the company is not dominant, it is one of the significant players. No other competitor has the same market share across all markets.

The telecommunications industry gives TEO most of its characteristics.

It is a low moat business, where competitors usually pair each other’s prices and where customers change between providers repeatedly. Churn rates for TEO are generally between 1% and 2% per month. This means revenue per customer is mostly outside of TEO’s control, and depends on exogenous factors like the income level of Argentinians. A report from S&P Global shows that revenue per customer in the telecommunications industry is heavily affected by the income level of the country.

Low moat and high rivalry is generated by enormous fixed investments that become sunk when installed, pushing competitors into fights for volume that destroy prices. In turn, high fixed investments coupled with high rivalry usually mean low returns on capital. TEO enhances its returns on equity by leveraging on debt.

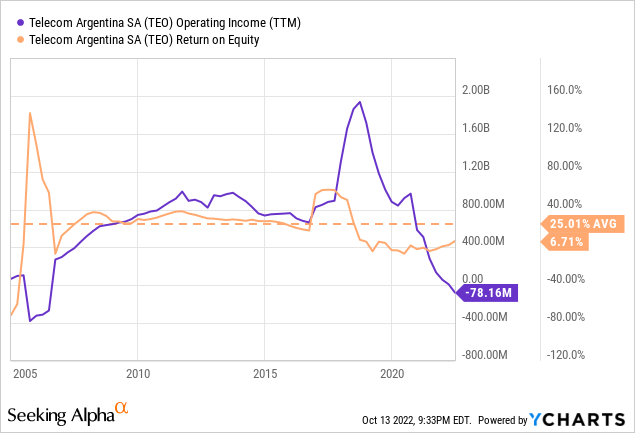

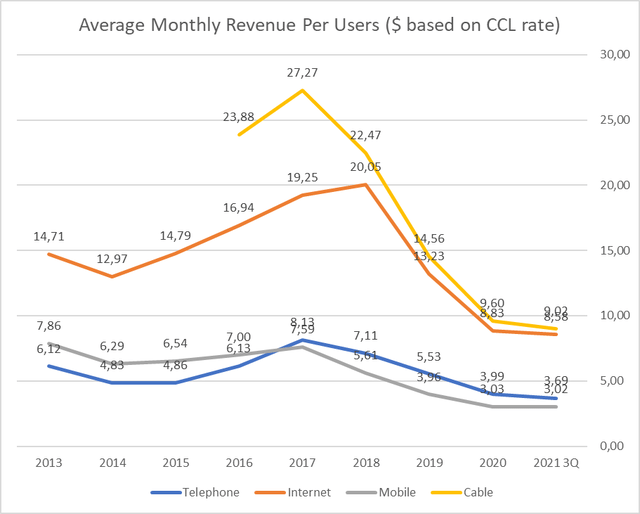

Fortunately, even in this context, TEO has been able to provide good returns on equity and remain operationally profitable consistently. Some things changed after 2017 though, because the company escalated its operations significantly, issued debt and invested in infrastructure for 4G and FTTH. When the Argentinian economy entered into a significant crisis in 2018 that lasted at least until 2021, TEO’s revenue per customer collapsed (second chart below).

TEO’s ARPU based on the CCL dollar rate (Own, based on TEO’s 20-F reports filed with the SEC)

It is true though that in general the telecommunications industry has lost ARPU globally for decades. This has been the case in the US, according to Statista, and in most regions, according to Telcoverager. The difference at the Argentinian level is the degree and the speed of the fall, and how much it differs from other countries in Latin America.

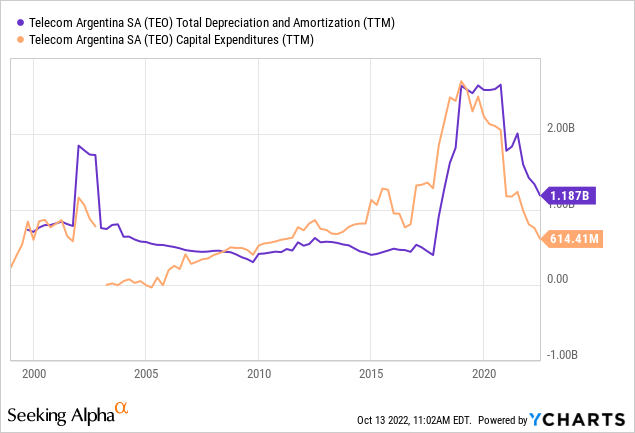

Trading at a price close to 80% below its all time-high, TEO seemed an interesting opportunity waiting for an Argentinian recovery. The main thesis was that an increase in disposable income would allow the company to recover ARPU back to regional levels. ARPU recovery would then generate a windfall given TEO’s operational leverage. Two things worried me though. First, I was not sure the new level of PP&E, CAPEX and depreciation seen after 2017 would not be permanent. If that was the case, then TEO would carry more depreciation than before, reducing future profitability. Second, the government had declared telecommunication services essential, therefore allowing an agency to set all kinds of regulations and, above all, to fix prices. When services like utilities were ‘essentialized’ in the beginning of the 2000s, contracts were breached, profitability was destroyed and the industry fell in disgrace. I was worried the same would happen with telcos.

Latest developments

Since my last article, three important reports have been published by TEO: the 20-F report for FY21, and quarterly reports for Q1 and Q2. They show a continuing trend down in terms of revenue, that translates into operating losses, albeit the accounting should be adjusted a little. The company has also continued returning capital to shareholders in the form of dividends. Most importantly, courts have put a limit on the government’s desire to excessively regulate telcos.

Courts stop the ‘essentialization’

In June 2021, TEO obtained an injunction in the Court of Appeals, suspending the articles of the new regulation that affected the company’s ability to define prices. This was an important first step, given that TEO and other telcos had not been able to increase prices since August 2020, under a context of inflation above 45%. The regulatory battle is explained in TEO’s quarterly report for 2Q22 under the headings Rates Regulation and Regulatory Issues.

The Court of Appeals ruling is not definite though, with the final decision awaiting at the Supreme Court. The final ruling may take years considering the Court’s parsimony. However, my opinion is that these regulatory risks are now lower, because the government’s attitude has changed. Even if the Court ruled that the services are essential and therefore the government gains wide regulatory rights, I believe TEO would be protected.

To begin with, October 2022 is not the same as August 2020. Income has recovered, and people are not 100% dependent on data to communicate, as was the case during the pandemic. Today, mobile internet ARPU is $2.5 per month, not a sum that would spark protests against the government if it raised a little bit.

The government is also trying to entice foreign investments, and show itself as more pro-market. Continuing or escalating a regulatory war with telcos (the canon of fixed investments with high regulatory risk) is not the way to attract other investments.

Therefore I believe the regulatory risks are now lower, albeit not completely out of the picture.

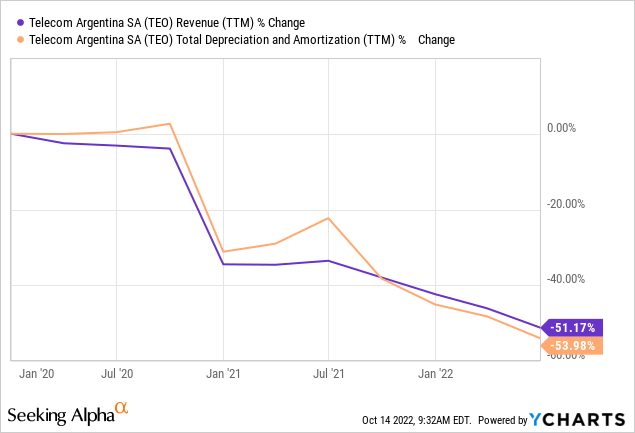

Still, revenues are down

Even though TEO and other telcos were allowed by courts to increase prices since June 2021, the company has not been able to maintain revenues on a real basis, that is, to increase prices above inflation. Revenues have fallen 13% in real terms comparing FY21 with FY19, and 11% in real terms comparing 1H22 with 1H21.

That last data point is particularly important. During 1H21, TEO was unable to increase prices, therefore it is surprising that even with price adjustments allowed, 1H22 revenues are lower in real terms. This shows that there are other barriers to higher profitability.

One such barrier might be that the Argentinian market is not ready for an increase in real prices of telecommunication services yet. However, as shown in the S&P Global report, telco service prices and income are very correlated, and Argentinian income has been growing for a year and a half now.

Another explanation is that TEO’s competitors are strained, and therefore need to squeeze prices. This is difficult to judge because neither Claro nor Movistar are public companies. Rather, they are subsidiaries of public companies, America Movil (AMX) and Telefonica (TEF) respectively.

A final explanation is that the competitive dynamics are still tied to lower and lower prices, in a sort of gridlock between the main competitors. These dynamics could change, with carriers increasing real prices together, therefore competing, but at a higher profitability level.

Depreciation is exaggerated

With both operational and financial leverage, the continued fall in real revenues implies a greater fall in operating income. TEO posted operating losses for FY21, and for both quarters of 1H22.

Albeit the loss of profitability is real, because recurrent expenses have kept in line with inflation, it is not as bad as accrual accounting shows. On a cash basis, TEO is profitable, which makes a great difference when considering the company a safe investment or not.

The reason is that depreciation does not represent neither the historic nor the current capital expenditures. In a business like TEO’s, depreciation can account for one third or more of expenses. As the chart below shows, current capital expenditures are more in line with the situation prevalent before 2017 and for most of TEO’s history. This on its own is a good signal. But depreciation lags CAPEX, leaving a huge gap, currently of $600 million, or AR$94 billion, on a TTM basis. This means that although TEO is showing operational losses, its FCF is actually higher by an important margin. TEO’s FCF is also improved by the fact that CAPEX is financed by equipment manufacturers (like Huawei or Cisco) but TEO charges its customers every month. The company has significant negative working capital.

This situation is very positive for two reasons.

First, that the business is able to generate cash is important for liquidity and solvency reasons. Even if we believe the Argentinian economy will recover, TEO has to survive in order to profit from that recovery. FCF helps with that.

Second, we can predict that depreciation will continue falling, following CAPEX. This means TEO has an accrual helper in profitability recovery. Even if revenues continue falling in real terms, if depreciation falls faster, TEO will increase its operating income. Of course, that is not real, cash based profitability, but it helps with market participants that may not study the financials and only look at accrual numbers.

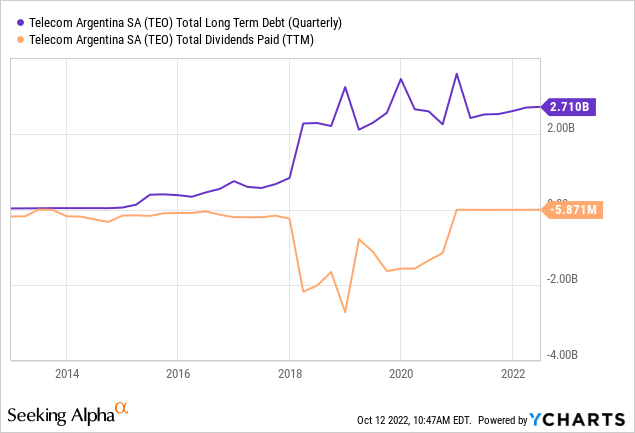

TEO continues returning capital

In 2018, TEO started a policy of leveraging by taking debt and returning equity to shareholders in the form of dividends.

In the chart below, the process can be seen up to 2020, when FX restrictions were established forbidding companies from purchasing foreign currency to pay dividends.

However, TEO has actually continued with this policy, at an aggressive level, but that does not show up in financial statements nor in platforms like YCharts above. The accounting treatment of these dividends is particular.

TEO paid dividends in 2020, 2021 and 2022. It has not used cash (unavailable because of the FX controls) but government bonds (called Global Bonds) that trade in both pesos and dollars. TEO has been purchasing and then distributing these bonds, using pesos, and shareholders can sell them for dollars.

This generates a lot of accounting shenanigans. First, the dividends do not show up in the cash flow statements, because they are paid with bonds. Second, the exchange rate used for trading these bonds is not the same as the rate used to mark them in the balance sheet. For example, if the bond costs $100, it trades at AR$30 thousand, a rate of AR$300 per dollar. However, when these bonds are held in the balance sheet, they are valued at a rate of AR$150, meaning the company absorbs fair value losses on them even if their dollar price remains constant.

Third, and most important, it is not clear exactly how much is distributed. The distributions are announced in nominal value for the bonds, but these are distressed Argentinian government bonds trading at a steep discount of as much as 80%. For example in June 2022 TEO announced a distribution of nominal value for $514 million, or $0.24 cents per share ($1.2 per ADS). However, the recorded distribution in the equity statements is AR$31 billion, which implies a rate of AR$56 per dollar, when the official rate was AR$125 and the financial rate was AR$300 in June 2022. It does not make sense either if the discounted value of the bonds is used for the equity statement. For example, in June 2022 the bonds traded at $30 per $100 of face value, meaning that a distribution of $514 million nominal corresponded to $145 million effective, which should have been translated to AR$18 billion in the balance sheet, not AR$31 billion.

Even though the actual figures are unclear, TEO is returning capital, with instruments that can be traded for dollars.

Debt is high but more manageable now

The goal of paying dividends and taking debt is to leverage the company. In my opinion this signals management’s belief in the future of the company, otherwise they would not leverage as much. Readers should consider that only 30% of TEO’s stock is publicly traded, with the rest being held by three large owners that have signed commitments not to sell the stock. They would not want to destroy their own wealth.

TEO owes about $2 billion in dollars, and about $200 million in Argentinian pesos and UVAs, an inflation adjusted unit. Most of its debt carries fixed or hedged interest rates. Only $300 million is exposed to rate variations. In terms of maturities, the company does not provide a schedule, which is strange given its size and that it is a common feature of financial statements, but I have calculated the following, in millions.

| 2023 | 2024 | 2025 | 2026 | 2027 | 2029 |

| $130 | $345 | $360 | $560 | $150 | $185 |

That is, the maturity schedule has improved significantly compared to the one in December 2021. Particularly, the first maturity heavy year is 2024, after the Argentinian elections of 2023, which allows the company to (maybe) enjoy better refinancing rates if the market likes the new government.

In terms of financing costs, I believe the best is to ignore TEO’s treatment of this subject entirely. TEO’s financial statements are occluded by the treatment of peso devaluation and inflation. In my opinion, the best is simply to consider the dollar interest amount of TEO’s debt. As of 2Q22, TEO’s debt generates $130 million in interest expenses yearly. The peso portion of interest is negligible because real interest rates in Argentina are negative.

Of course this simplification leaves out the fact that TEO’s revenues are peso denominated, therefore a sudden devaluation can make the company’s dollar reported profits fall significantly. This risk is particularly strong for a discrete jump of the exchange rate, like the ones that occured in 2018 and 2019. Since 2020, the government has followed a more predictable crawling peg policy.

Dollar to Argentinian peso exchange rate, log scale (TradingView)

Financial model

Finally, I provide a financial model to evaluate TEO’s future.

First, I assume that pesos can be converted to dollars at the official rate for imports, and debt payments. These transactions are allowed under the current regulatory regime. Earnings have to be converted at the financial rate for distribution purposes. Therefore operating and financial costs are translated at the official rate, and then after tax profits are translated at the financial rate. I also assume that the official rate will be devalued approximately following inflation, as has been the case under the crawling peg policy initiated in 2020. The financial rate is a floating market that is not intervened and therefore it fluctuates more, sometimes appreciating (like in 2021) others depreciating (like in 2022).

For operating expenses before depreciation, I assume they remain fixed at $2.8 billion. This is of course not entirely true, as part of TEO’s costs are not fixed, and because they are adjusted mostly by Argentinian inflation, becoming more variable in dollar terms.

I also assume TEO’s CAPEX and depreciation stabilize at $800 million a year, above current levels but below the extremes seen between 2017 and today. In terms of interest expenses, I incorporate the current $130 million. This figure will change as maturities are either repaid or renewed at new rates, but it works for the time being. Then I assume an effective income tax rate of 35%, which is the corporate rate since 2021 in Argentina.

TEO’s ADS currently trade around $3.9. With 2.2 billion shares outstanding, equivalent to 440 million ADS, TEO’s market cap stands at $1.7 billion. I clarify this because many sites, including TEO’s investor relations website, mention a market cap of $2.5 billion, which does not reflect the reality.

TEO’s annualized revenues currently stand at approximately AR$528 billion, considering AR$264 billion for 1H22 and the lack of seasonality of the business. With that, TEO has to pay for $3.73 billion of operating expenses, depreciation and interest charges. Using the official rate of AR$150, that translates to AR$559 billion. This means that at current revenue levels, TEO is generating a pre tax loss of AR$30 billion, or $10 million at the financial rate.

Remember that this calculation differs from the current situation because I am assuming long term CAPEX that is $200 million higher than current CAPEX. With current CAPEX at $600 million, the company would be marginally unprofitable in 2022, lossing AR$1 billion or $3 million.

What would be needed for TEO to generate a profit of $170 million to compensate for its current market cap? $170 million translates into AR$51 billion in net profits at the financial rate, which in turn means AR$78 billion in pre tax profits. Add back the AR$559 billion in operating, depreciation and interest expenses to obtain revenues of AR$638 billion.

That is, TEO should grow real revenues by 18% to justify its current market cap considering the model I built previously. Is that doable? I believe it is, because I compare the historical ARPU of its services to its current ARPU. For example, while mobile services ARPU stood at $6.5 per month in 2014, and peaked at $8 in 2017, it now stands at $2.5. If the company can marginally grow that ARPU, it can reach our profitability targets.

Conclusions

TEO is not far away from the required profitability corresponding to its current market cap. It only needs to grow revenues in real terms. In my opinion, this in turn is affected by the Argentinian economy growing and by the competitive dynamics of its industry.

The first condition has already been met. Argentina grew 10% in 2021, and is expected to grow 4% in 2022. The second condition has not been met. Even with the recovery, ARPU has been steadily falling since 2019. But that trend can be broken if telecommunication carriers initiate a different dynamic. According to Statista, Argentina has the lowest ARPU of the region, and according to Telesemana, all services across all companies are at their lowest historical ARPU.

Given TEO’s operational and financial leverage, waiting for a recovery can be risky. Particularly, the company may continue posting significant accounting losses. However, I believe that at the cash flow level, TEO can withstand more years of a depressed market. The reason is that investments for 4G have already peaked, and therefore the company can cut back on CAPEX to keep paying interests and even declaring dividends.

In my opinion, TEO is a buy for a long-term holder, albeit one with stomach to endure volatility, and able to withstand capital losses for a period that may even last a few years.

Be the first to comment