JHVEPhoto

Introduction & Purpose

Aritzia Inc. (TSX:ATZ:CA, OTCPK:ATZAF) reported Q2 2023 earnings that exceeded analysts’ revenue expectations and provided a spark to an underperforming apparel sector. The company’s brands continued to impress throughout the quarter, and their U.S. focus has generated strong returns, up 80% year-over-year. My recent article on ATZ:CA showcased a bull view, and these results proved that key tailwinds remain intact. While the global economy and the retail apparel sector as a whole will remain challenged as rates rise and supply chain woes drag on, ATZ:CA remains one of a select few growth stocks in apparel. I re-iterate my “Buy” rating with a $63 ($46 USD) price target over an 18-month period.

Aritzia Q2 Review

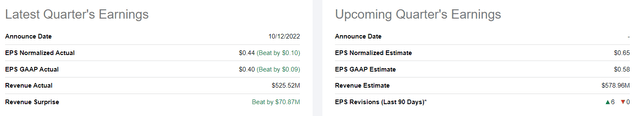

ATZ:CA recently announced impressive earnings on Oct. 12, 2022 that positively shocked investors, sending the stock up 7% between Oct. 12 – Oct. 14. Net revenue hit $525.5MM, up 50.1% year-over-year, capping off a strong summer season. The company’s profit rose to $46.3MM, sporting an 8.8% net income margin, a 600 basis point improvement from the Q1 quarter. The revenue bump was fueled by continued retail expansion, notably in the U.S., and e-commerce growth. The company saw e-commerce sales grow by 33.3% to $173.9MM from last year and it’s now 33.1% of the sales mix. ATZ:CA also saw continued momentum in the U.S., as revenue grew 80%.

Jennifer Wong, CEO of ATZ:CA, mentioned on the conference call that client demand continued to exceed expectations, and that their customer base continues to grow. Adjusted EBITDA increased by 13.3% from Q2 2022, while retail store revenue increased by 60.1% from last year to $351.6MM. Margins declined ~250 basis points in the face of a difficult supply chain environment, but overall, ATZ:CA posted a strong quarter. The company reported $0.40 of net earnings per share, outpacing last year’s mark of $0.35 earnings per share.

The company yet again raised guidance for year-end revenue expectations. ATZ:CA now anticipates $2.0Bn-$2.05Bn, which would represent a jump of 34%-37% from FY2022, up from the previous outlook of $1.875Bn to $1.9Bn. The company also expects 25%-30% revenue growth in Q3 of this year, ending November 30. ATZ:CA noted that these increases are being led by continued outperformance in the United States across both retail and e-commerce channels, and improved performance in Canada within e-commerce sell-through. The company also noted that profit margins would shrink throughout the year given the supply chain woes and high inflation, and expect gross margins to dip about 100-150 basis points compared to the prior year. ATZ:CA also re-iterated that CAPEX would be $110MM-120MM this year, highlighted by more store openings and a new distribution center in the Toronto area, which will open in 2023.

Unfortunately, the company also announced sky-high inventory of $455.1MM at the end of the first quarter, up 150% from last year. While concerning, ATZ:CA emphasized that inventory was booked earlier in order to mitigate the risk of supply chain disruptions. The company emphasized that they are comfortable with its inventory position and expect normalized markdowns to be no greater than pre-pandemic levels in Q3. While it is difficult to explain away such drastic jumps in inventory, given ATZ:CA’s consistently strong results, I’ll take management’s word until proven otherwise given such strong growth, which has led analysts on Bay St to revise estimates higher.

Seeking Alpha Quant Tool – ATZ:CA

ATZ:CA provided business updates in the quarter reflecting the culture of the company on the investor call. While the company prides its retail touchpoints, they have continued to emphasize e-commerce growth, given a shortage for labor talent. ATZ:CA commemorated Truth and Reconciliation Day for Indigenous Communities (a federal holiday in Canada) through a collaboration with Atheana Picha, artists from the Kwantlen First Nation. ATZ:CA gifted and sold orange colored apparel featuring artwork by Atheana, and donated all proceeds to the Orange Shirt society, a non-profit helping indigenous children. The company highlighted that store openings would continue at 8-10 a year, with a new opening in San Antonio imminent. The company also confirmed on the analyst call that new customers have driven growth, and that they had not seen a meaningful slowdown in consumer spending despite a high inflation environment.

Overall, aside from high inventory levels, ATZ:CA is firing on all cylinders, and have outperformed the market recently given its consistently strong results. Stay tuned for October 27, when Aritzia hosts its first Investor Day event.

Model Forecasts More Upside

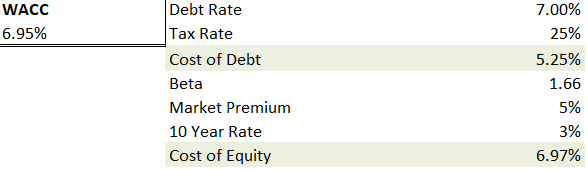

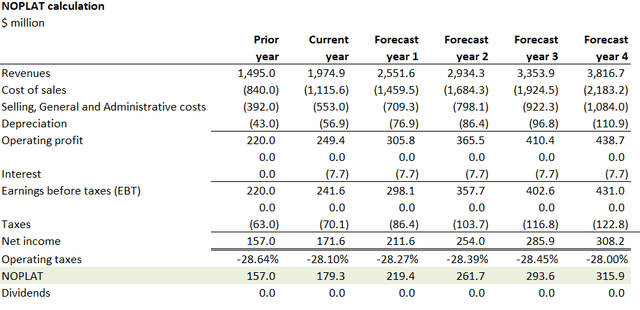

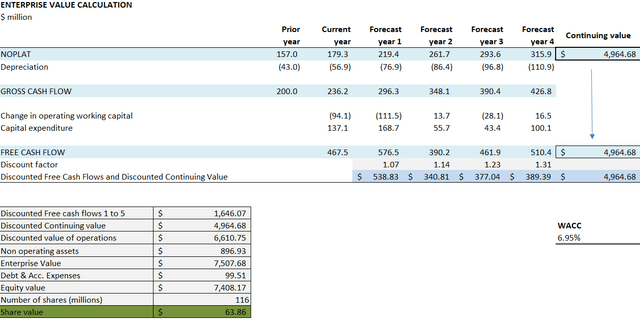

ATZ:CA continues to post mouth-watering numbers, and its stock price has followed suit, even in the rising rate environment. The stock remains well in the green over the past 6 months, and its upcoming new Investor Day proves investors are still interested in growth stories in retail. I don’t change much in the model from my prior analysis other than some small adjustments given the company’s refreshed forecast. I increased forecasted revenues this year by ~$100MM, and reduced gross margin slightly, per company discussion. This leads a terminal value of almost $5Bn and a CY2023 EV/EBITDA of 19.6.

Author WACC Author NOPLAT Forecast Author EV & Share Price Forecast

Conclusion

ATZ:CA continues to impress with outsized growth that’s unmatched with most peers. The company delivered strong revenue and profit numbers, and continued to impressively increase sales in the U.S. While high inventory is something to watch, ATZ:CA remains one of just a few high-growth stories in apparel. I re-iterate my previous Buy recommendation with a $63 ($46 USD) price target.

Be the first to comment