jacoblund/iStock via Getty Images

What cannot be said above all must not be silenced but written.”― Jacques Derrida

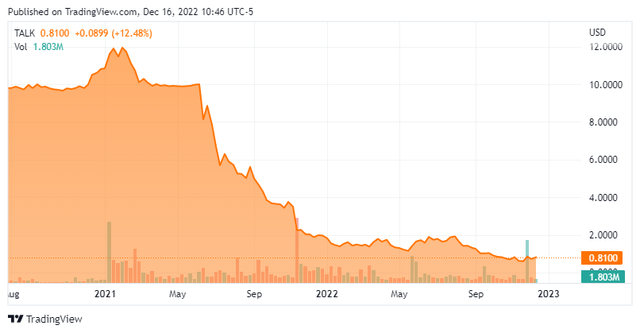

We took our first look at Talkspace, Inc. (NASDAQ:TALK) in December of 2021. The stock at that time was in free fall. We concluded that article by saying this stock was only for the most aggressive investors and then only merited a small position. The company has been in the news lately and the shares have seen a significant decline since our last piece. A potential buyout could be potentially in the works, however. We circle back on this small cap name to update the investment thesis around this equity.

Seeking Alpha

Company Overview:

This virtual behavioral health company is based in New York City. The company’s network of ~3,000 contracted and employee providers deliver counseling, psychotherapy, and psychiatric services to patients in need via messaging, video, and audio messaging. Talkspace operates on two fronts: business-to-consumer (B2C) and business-to-business (B2B). B2C is comprised of patients who subscribe directly to the Talkspace platform. B2B consists of enterprise clients and large health plans that offer their insured members access to the Talkspace platform. Currently the stock trades on the wrong side of a buck a share and sports an approximate market capitalization of $135 million.

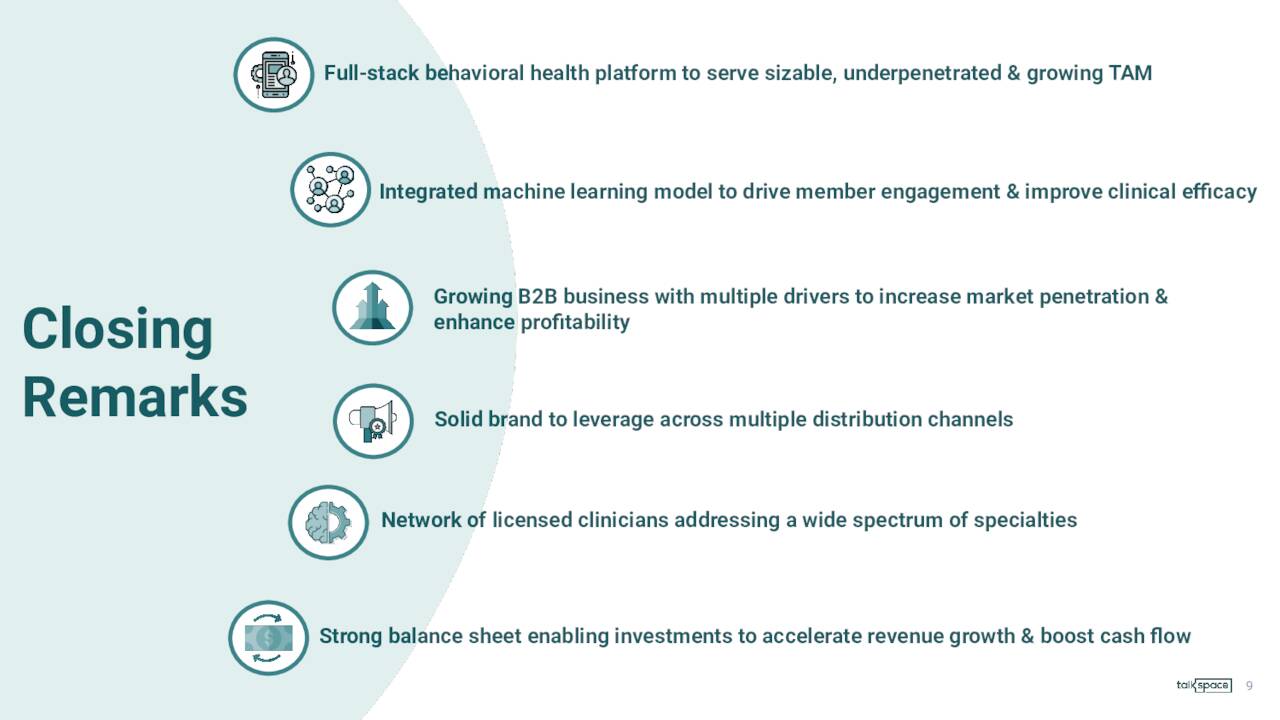

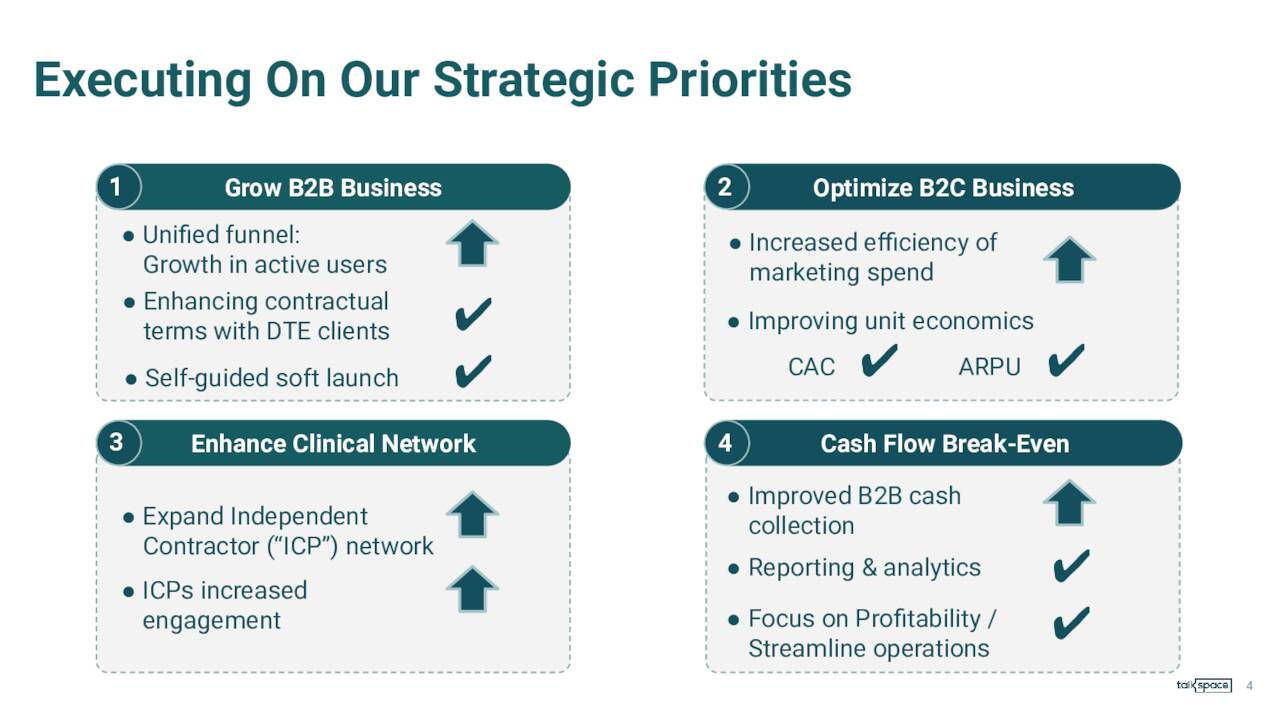

August Company Presentation

Third Quarter Results:

On November 8th, the company posted third quarter numbers. Talkspace lost 11 cents a share on a GAAP basis as revenues grew nearly 13% on a year-over-year basis to just over $29 million. This was an improvement from the 15 cent a share GAAP loss Talkspace had in the second quarter, which also had nearly a four percent sales decline from the same period a year ago to $29.8 million. Sequential sales were slightly down from the second quarter it should be noted.

Recent Developments:

The poor company performance since we last visited this name triggered a demand from an activist investor for new management. This demand came from Firstime Ventures GP, which had amassed a near-five-percent stake in the company at the time. Late in September, Talkspace announced a new CEO. The company’s co-founder and CEO Oren Frank officially stepped down in November. The new leader at Talkspace had previously served as Executive Chairman and CEO of BioReference Laboratories, one of the nation’s largest commercial laboratories. During the third quarter, the company also brought in other key new pieces of management including a new head of Human Resources and a new Chief Marketing Officer.

The activist wanted to see more details on the company’s long-term plans and its willingness to consider a buyout. The last point is important as Talkspace reportedly shot down a $2.50 to $3.00 a share buyout offer this spring from privately held Mindpath. American Well Corp. (AMWL) approached Talkspace soon thereafter but was spurned before potential takeover numbers were discussed. In retrospect, based on the current stock price, previous management did a disservice to shareholder by spurning these approaches.

In late November, more rumors surfaced that American Well was still on the hunt for Talkspace around a potential purchase in the $1.50 a share range. Cowen & Co. voiced skepticism around this possible purchase, stating that its channel checks indicate there is no sales process occurring. Truist had a more optimistic take around a potential merger as it believes Talkspace’s B2B business could be an attractive asset for AMWL and produce synergies with that company’s underlying business in this space.

Talkspace did see a significant acceleration in their B2B revenue growth in the third quarter. This was driven by higher penetration by their in-network services and new enterprise client wins. This helped to offset weakness in the company’s B2C business during the quarter. B2B revenues represented the majority of overall sales for the first time ever in the third quarter.

August Company Presentation

Specifically, B2B revenue was up 117% on a year-over-basis during the quarter to $16.8 million. B2C sales were off 33% as Talkspace is focused on downsizing their cost base and extracting operating efficiencies from that part of their product line. For the first nine months of FY2022, B2B sales have grown 72% from the same period in FY2021 while B2C revenues have fallen 24%.

Analyst Commentary & Balance Sheet:

Since third quarter results were posted, Citigroup reiterated its Hold rating and lowered its price target to $1.00 from $1.65 a share and SVB Securities reissued its Hold rating and $1.00 price target. The company had approximately $153 million of cash and marketable securities. Management believes this funding level ‘will be sufficient for the company to reach profitability while continuing to deploy resources toward initiatives that will drive revenue growth‘. Talkspace has no long term debt.

Verdict:

The current analyst firm consensus has the company losing 48 cents a share in FY2022 as revenues rise just under five percent to just under $120 million. Next year they see the company losing 41 cents a share as revenues rise to $131 million.

The company posted a net loss of $18 million in 3Q2022. The company implemented headcount reductions and organizational changes at the beginning of the fourth quarter in its quest to improve cash flow and efficiencies. These changes are expected to deliver $4 million a quarter of lower costs when fully implemented.

Obviously, there is a lot of change afoot at Talkspace currently. The stock trades at approximately one times forward revenues. Given the stock also trades just under net cash with a buyout a potential ‘wildcard’, TALK would seem to merit a very small position while waiting to see if new management can right the ship.

No speech is ever considered, but only the speaker. It’s so much easier to pass judgement on a man than on an idea.”― Ayn Rand, The Fountainhead

Be the first to comment