Derick Hudson

Introduction

Mark Zuckerberg of Meta Platforms (NASDAQ:META) has been betting aggressively on the metaverse in the hope of creating an entirely new AR/VR ecosystem for users to enjoy themselves in a virtual world.

Between 4Q20 and 2Q22, Meta has incurred a total operating loss of $18 billion for the Reality Labs segment on revenue of just over $4 billion. While the early losses are understandable as Zuckerberg has indicated Reality Labs will not be a real business story until the end of the decade, investors are beginning to question whether Facebook’s transition into the metaverse will truly be a sustainable growth driver for the social media company.

In this article, I will discuss why the metaverse will probably fail and explain why investors shouldn’t bet on Reality Labs becoming the next successful value driver for Meta’s stock.

Users are not really interested

A recent WSJ article published on 10/15 indicates that Meta’s Horizon World (the core metaverse product) is gaining little consumer interest according to internal documents. The initial goal was to reach half a million MAUs (monthly active users) by the end of 2022, but Horizon World has only attracted less than 200k users so far. Since this spring, Horizon World’s user base has been on a steady decline and most users don’t come back to the virtual world after the first month.

These internal documents also revealed the following:

- Only 9% of worlds made by creators of the app are visited by over 50 people, while most worlds have 0 visitors.

- The Oculus Quest (Meta’s VR headset) has seen declining retention rates in the past 3 years. More than 50% of Quest headsets are no longer being used after 6 months since purchase.

- Less than 1% of users are building their own worlds.

- In a survey of 514 Horizon users, people said they couldn’t find the worlds they liked and couldn’t find too many people to interact with. Avatars also look fake and “don’t have legs”.

Meta

Another article by The Verge on 10/7 shows that per Meta’s internal memos, Horizon Worlds is having too many quality issues and even company employees aren’t using it very much.

Vishal Shah, the VP of metaverse, has put Horizon Worlds in a “quality lockdown” for the rest of 2022. While Shah acknowledged the potential of the metaverse, the following words in his memo to the team indicate there’s much to be done.

But currently feedback from our creators, users, playtesters, and many of us on the team is that the aggregate weight of papercuts, stability issues, and bugs is making it too hard for our community to experience the magic of Horizon. Simply put, for an experience to become delightful and retentive, it must first be usable and well crafted. – The Verge

Evidently, Meta is having issues convincing its more than 3.6 billion global monthly users across Facebook, Instagram, Whatsapp and Messenger to join the metaverse. In February, Meta said Horizon Worlds had ~300k MAUs, but has not provided an update since.

Thus far, the primary purchase of the Meta Quest is gaming, but the issue surrounding motion sickness and disorientation will likely prevent many gamers from using the headset for long. Fitness is another popular application, but the FTC voted 3-2 in July to block Meta’s acquisition of VR fitness app maker Within based on antitrust grounds. Meta is of course trying to dismiss the FTC’s complaint.

The newly announced Quest Pro (available on 10/25 for $1,499) will have VR applications like Teams and Office thanks to a partnership with Microsoft (MSFT), but whether users will want to purchase such an expensive headset for work remains a major question.

Competition is heating up

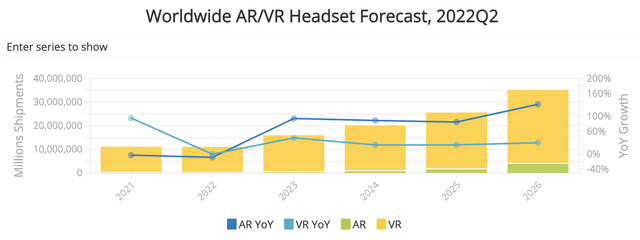

Per IDC, global VR headsets grew 32% YoY in 2Q22 and Meta continued to be the market leader with an 86% share, while China’s Pico (acquired by Tik Tok parent ByteDance in 2021) had 8% of the market. While global volumes are expected to remain flat in 2022 given the current macro backdrop, IDC forecasts total shipments of 31 million units by 2026 from 10.8 million in 2022.

IDC

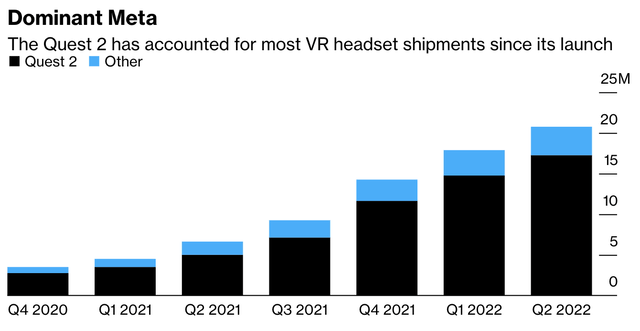

At the end of 2Q22, the Meta Quest 2 accounted for the majority of cumulative VR headset shipments at 17.2 million vs. 20.7 million total. Evidently, Meta is a dominant force in the VR market, for now.

IDC, Bloomberg

With success comes competition. Per MacRumors, Apple (AAPL) is looking to launch its AR/VR headset, which may cost up to $2,000, in 2023. In recent years, Apple has been hiring AR/VR talents and has acquired a number of companies in the space. The headset is rumored to have two M2 processors, 4K micro-OLED displays, iris scanning, facial expression tracking, and many more functions.

On the other hand, Sony (SONY) is launching its PSVR2 in early 2023 that will likely cost as much as the PS5 console. There are more than 20 games currently in development from 1P and 3P game developers. Although the preceding PSVR took 8 months to reach 1 million unit sales vs. 2.8 million Meta Quest 2 units in the first quarter, Sony’s new take on its VR headset still poses threats to Quest with improved functionalities such as eye tracking, vibrations and moving lenses.

The economics may not make sense

From a business perspective, the ultimate goal of building a metaverse is to control a VR platform with a massive user base and tax every purchase within this ecosystem. The idea is quite similar to the iOS app store and Android’s Google Play (GOOG).

Apple takes a 30% cut from developers making over $1 million in annual sales and 15% for those below this number. Google Play has reduced its platform fee from 30% to 15%. Roblox (RBLX) takes 30% from developers on every Robux sale within the developer’s experience on the platform. Lastly, popular NFT platform OpenSea takes just 2.5%.

While Zuckerberg has previously criticized Apple for charging a massive 30% fee on app store sales which he believed would hurt innovation, Meta announced in April that it would charge developers as much as 47.5% per sale within the metaverse (30% Meta Quest Store fee + 17.5% Horizon Worlds fee). This is clearly the antithesis of a platform that stimulates innovation.

By taking an almost 50% cut from developers selling digital products in the metaverse, Meta is giving creators an incentive not to invest too much time and effort on its platform unless the user base is too big to pass. This then becomes a chicken-and-egg situation where developers will not put up with the extraordinarily high fee if there aren’t billions of users in the metaverse, and users will not want to spend time in the metaverse if there aren’t that many developers willing to create new and exciting content all the time.

Conclusion

In my view, Zuckerberg’s massive bet on Reality Labs is doing the social media company more harm than good given the metaverse is seeing muted user engagement, increasing competition and unattractive economics for developers. This is a major reason why I’ve long argued that shares of Meta remain a value trap (analysis here) despite the seemingly cheap valuation at 12x 2023 earnings.

Though Meta is looking to cut costs by at least 10% in the next few months, the metaverse (or Reality Labs) is still expected to generate $13 billion in total operating loss in 2022, which is a major margin drag considering the core advertising business is already experiencing growth headwinds. As much as investors may view Meta as a value stock that comes with a call option on the metaverse, I continue to see more risks than rewards.

Be the first to comment