Group4 Studio

Thesis

InMode Ltd. (NASDAQ:INMD) is slated to report its Q3 earnings release on October 27. The company recently raised its full-year revenue guidance while expecting record revenue in Q3.

Accordingly, it led to a surge last week, but the market digested most of its gains by the end of the week. We assess that INMD has been de-rated by the market, even as it trades well below its overvalued highs in late 2021. It’s also trading below the valuations of its broad industry peers, suggesting the market is less confident of its growth prospects.

Given the discretionary nature of InMode’s customers and end market, we believe the market’s positioning is prudent. Furthermore, the Fed’s aggressive rate hikes could further impact its customers’ ability to finance their equipment purchases. Coupled with the specter of a global recession that could thwart consumer spending further, investors need to be cautious.

Moreover, Chinese President Xi Jinping has brushed aside ideas/thoughts of a premature end to China’s zero COVID strategy at the recent 20th CPC National Congress. Management had previously indicated optimism that China could loosen the COVID restrictions in October/November. Hence, INMD could be short of another growth driver to help underpin the recovery of its revenue growth through FY23.

We discuss why INMD remains cautiously configured as it heads into its Q3 release. We discuss the critical levels for investors to watch, as it could determine whether INMD could recover its medium-term bullish bias.

For now, we believe it’s appropriate to revise our rating from Buy to Hold.

InMode: Lack Of Growth Catalysts In FY23

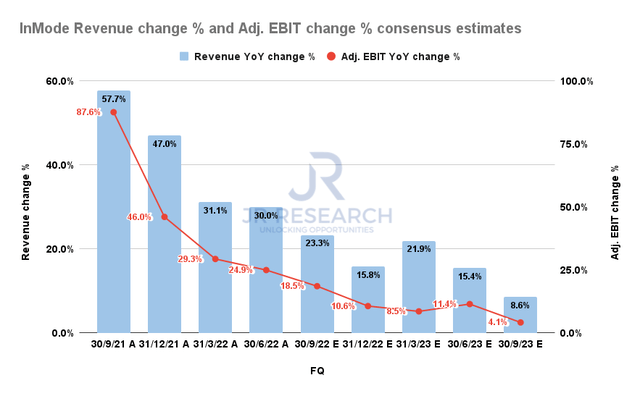

InMode Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

InMode’s Q3 preliminary guidance indicated that the company expects to post Q3 revenue of $120.7M (midpoint), up 28.2%, well above the consensus estimates (very bullish) of 23.3% growth. Furthermore, the company also lifted its FY22 revenue guidance to $447.5M (midpoint), up 25%, also coming ahead of the Street’s estimates.

As such, it led to a surge in INMD last week as the market parsed its robust guidance. However, most of its gains were lost by the end of the week as the market renewed its focus on the economy and the Fed’s rate hikes.

We believe the market continues to be concerned over InMode’s ability to lift its growth further after a phenomenal 2021. As seen above, even the very bullish Street analysts expect InMode’s growth cadence to slow further through FY23. We believe these estimates are credible, as the healthcare equipment industry analysts have revised their estimates downward through September.

As a result, analysts expect the healthcare equipment industry to post a NTM earnings growth of 2.2% (per Refinitiv data), in line with YoY earnings growth estimates of 2.7% for 2023.

Notwithstanding, InMode is projected to post adjusted EPS growth of 12.3% for FY23, despite the normalization. Therefore, the market seems concerned over the global macroeconomic headwinds and the aggressive rate hikes that could impact the company’s growth trajectory. InMode also highlighted these risks in its filings:

During uncertain economic times and in tight credit markets, many of our customers may experience financial difficulties or be unable or unwilling to borrow money to fund their operations. The market for aesthetic procedures and the market for our premium products can be particularly vulnerable to economic uncertainty, since the end-users of our products may decrease the demand for our products when they have less discretionary income or determine not to spend their discretionary income on aesthetic procedures. In addition, in many instances, the ability of our customers to purchase our products depends in part upon the availability of obtaining financing at acceptable interest rates. (InMode 20-F)

Is INMD Stock A Buy, Sell, Or Hold?

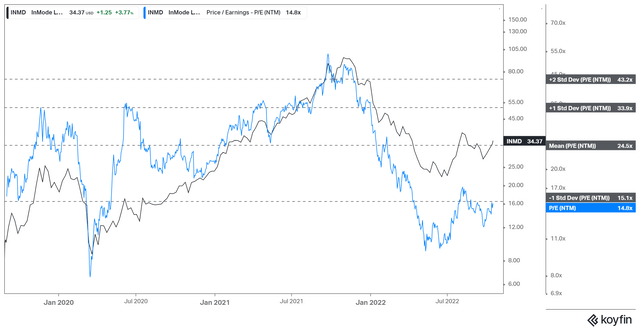

INMD NTM normalized PE valuation trend (koyfin)

INMD last traded at a NTM earnings multiple of 14.8x, well below its mean of 24.5x. However, it still traded at a premium against its peers’ median P/E of 4.7x (according to S&P Cap IQ data).

Notwithstanding, INMD’s valuation is well below the healthcare equipment industry’s NTM P/E of 22.1x. Therefore, it appears that the market has clearly de-rated INMD in anticipation of further headwinds in 2023, coupled with a lack of growth catalysts.

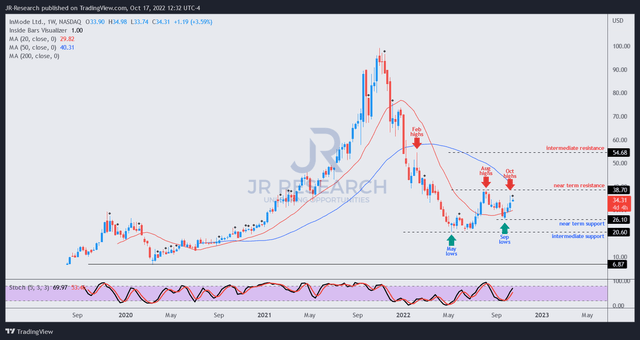

INMD price chart (weekly) (TradingView)

We gleaned that the market has rejected further buying upside above its near-term resistance. It also coincided with the steep momentum surge through its August highs.

INMD’s bulls have attempted to re-test those highs recently but further upside has failed to materialize as the buying momentum fizzled out. While INMD appears to have bottomed out decisively in May, we urge investors to wait for a potential retracement to re-test its September lows first.

Our analysis suggests that INMD’s near-term resistance could offer intense selling pressure. As such, the reward-to-risk profile is less attractive at the current levels.

As such, we revise our rating on INMD from Buy to Hold and encourage investors to watch from the sidelines for now.

Be the first to comment