Kiwis/iStock via Getty Images

Teladoc (NYSE:TDOC) stock has been absolutely crushed for about a year straight. The pain has been real. While markets are trying to find their bottom, we think after all of the downgrades, the miscues from management, the general train wreck that has been innovation stocks, and the malaise of the markets as the Fed is combating high inflation, TDOC stock appears to have put in a near-term bottom. There has been a bit of a sentiment shift in recent weeks. We have never seen anything like this collapse, and so there is potential for some gains here on a sentiment reversal in the near- and medium-term. We took a contrarian view against the panic and fear crowd and did some buying in September and that paid off, but we think the stock is setting up for another trade. We could be in store for a large move higher if the market cooperates. Here is how we think new money can consider playing it.

The play

Target entry 1: $28.50-$29.00 (40% of position)

Target entry 2: $26.00-$26.25 (60% of position)

Stop loss: $23

Target exit: $33-$35

We like selling $30 puts 2-3 months out is a valid options entry strategy here.

Recent performance suggests bottom, for now

Make no mistake this is still speculative, but we see the stock bottoming here. It is true – the rapid growth has stalled. The landscape is challenging, and competitors are emerging always. Still, there is a strong foundation even if there is ongoing uncertainty in the macroeconomic backdrop. All of these high revenue growth, little to no earnings type companies saw their stocks get crushed. But sentiment appears to have shifted here after Teladoc recently reported a quarter that really impressed the Street. While we believe telemedicine is here to stay, the Street had left this stock for dead. But the company really delivered an impressive set of results and it has us bullish.

In the actual results, the company beat consensus estimates on both the top and bottom lines. The company is still showing growth, but the rapid growth has slowed. Revenue beat by $2.4 million. That is not terrible in the grand scheme of things, but was not all that strong either but was still nice to see. On the earnings front, the company really surprised, losing $0.45 per share, which was $0.12 better than expected.

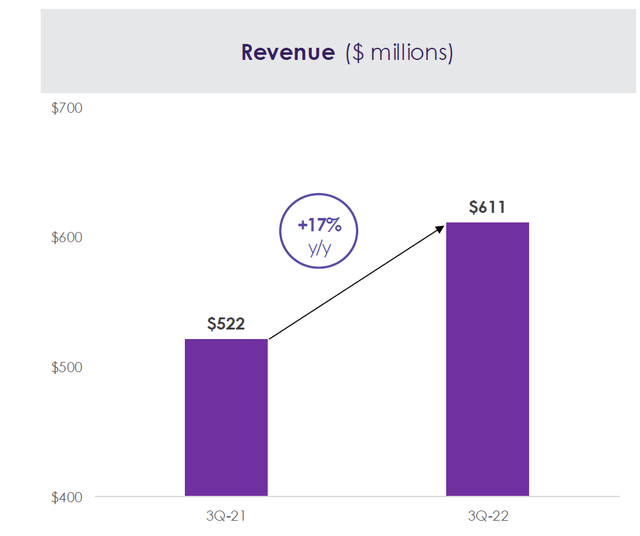

While revenues grew, the rate of growth has continued to slow. That is a problem. Revenue increased just 17% to $611.4 million, from $521.7 million a year ago.

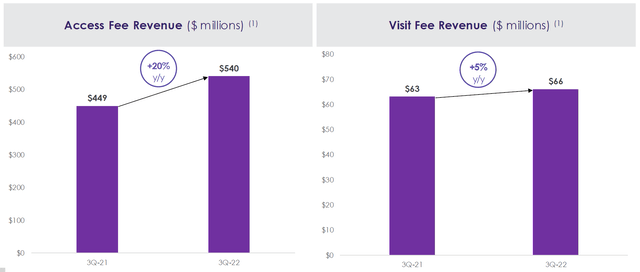

This is definitely nice growth in terms of the actual numbers. But folks, we do have to say there is justification to SOME of the major repricing of the stock lower in the last few months because 17% growth is absolutely nowhere near where it was in the past. Most of this growth came from access fee revenue growing 20% to $540.1 million and visit fee revenue growth of just 5% to $65.6 million.

So this is positive and the two combined drove the modest revenue growth. Again, yes, it is nowhere near where it used to be. But friends, we are traders. It matters not where the company was, or where the stock was (down about 90% for those keeping score). What matters is where the stock is going and we think that it will move with the market of course, but shares are seeing a sentiment shift to a more positive outlook and we think this trade will play out nicely.

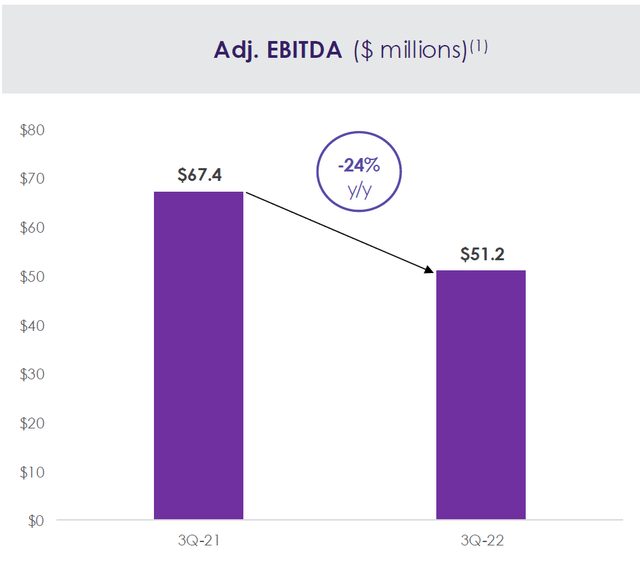

That all said, one of the biggest issues the Street had with the stock was that the company was continuing to see weakening EBITDA. But here in Q3, the company really surprised. Now look, it did fall 24% from last year but losses were expected. Adjusted EBITDA was $51.2 million. Despite it being down (expected) it came in at the highest end of the range management was anticipating.

This comes as a result of some strong work to reduce expenditures and preserve margins. Gross margin was a strong 68.3% compared to 67.1% for margins a year ago. Adjusted gross margin was 69.6%, rising 230 basis points compared to 67.6% last year. This is a very strong result.

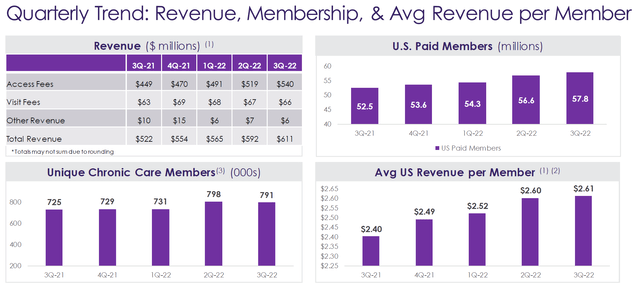

All of this combines with a growing membership, as well as increased revenues per member.

Guidance looking better and that shifted sentiment

Look, several times this year there has been revised guidance from management and that really left investors with doubts about how the company was being run. But the guidance update after Q3 was solid. We like the outlook for Q4.

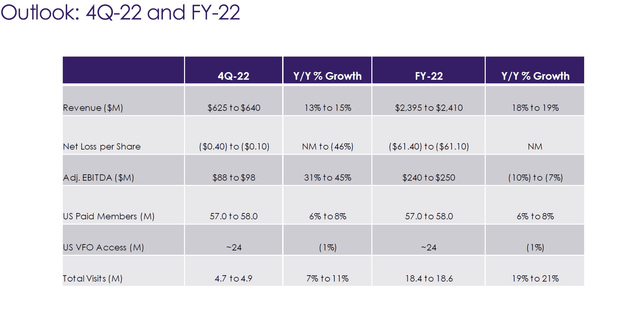

We have to tell you that the Q4 outlook suggests year-over-year improvement is back in the cards. Management expected revenue to range between $625 and $640 million compared to the consensus expectation of $636 million. Decent overall. Net loss could be even with a year ago or down up to 46% per share as there was a wide net cast for EPS. But we were really bullish on EBITDA as it is likely to grow 31%-45% from last year. That is a key result.

Sentiment improving

Look this stock had been liquidated the last year and a half. Down some 90%. That is craziness. Clearly a lot of bad news is priced in here. Revenue growth is stalling, but growing still. We cannot look at the performance like we did when shares were over $200. Or even $100. Or even $50. This is a stock in the high $20s with no earnings but an improving path. Average revenue per U.S. paid member increased to $2.61 in the quarter, and continues to rise along with member count. The company is starting to get serious about expenditures too. The company is expecting total visits in 2022 to be between 18.4 million and 18.6 million visits, while focusing its spending on reaching more of the total addressable market is growing as well. Finally, it appears that EBITDA margins will increase as we move into 2023. While a ton of negativity is indeed priced in, competition is a major risk

Risk

The major concern is that telemedicine is not something that other companies cannot replicate. There are other players out there. This leads to concern over the company having any kind of moat. There are many private competitors pursuing customer acquisition strategies to establish market share. There are continuing to see some of the competitive dynamics in the chronic care space. We also just learned that Amazon (AMZN) will have its own digital clinic. With a huge brand like Amazon in the mix as it is now entering the consumer telemedicine business, Teladoc is facing real pressure. Amazon Clinic will provide care for more than 20 common ailments. By operating in the same space, it just takes a piece of market share away from Teladoc.

There also continues to be dilution and costs associated with stock-based compensation. This seems to be a common problem for many of these high revenue growth tech companies to keep talent. But keep an eye on it because it can lead to wider EPS losses.

Final thoughts

The company and the stock were left for dead. But the quarter was strong and the outlook was positive, all things considered. There is risk here as there is little to no moat, and competition is strong. We like that EBITDA is looking set to expand, and revenue growth persists, albeit at a slower pace than in the past. But 90% later, this is a whole different stock now. We think you can trade this for a bounce.

Be the first to comment