PhotoGraphyKM/E+ via Getty Images

Shares of TELA Bio (NASDAQ:TELA) have fallen by nearly 40% since its public offering was priced at $13 in November of 2019. Year to date performance is roughly equivalent at -36% loss.

This biologic mesh company popped back on my radar after reader DSJ.2018’s commentary on September 14th, where he highlighted industry leading 2-year outcomes, improved labeling, broad use and potential for accelerating sales growth.

Couple this with a still-depressed valuation and it’s clear why I wish to bring this setup to the attention of my readers and chose to prioritize it for entry in our Core Biotech portfolio.

Chart

Figure 1: TELA weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price hit a peak above $22 in summer of 2020. From there, they consolidated in mid-teens range for much of the past year and then fell to a low of $6 this summer. Currently, consolidation is taking place at the $8 level just above the 20-day moving average. My initial take is that readers would do well to accumulate shares here below $10.

Overview

Founded in 2012 with headquarters in Pennsylvania (84 employees), TELA Bio currently sports enterprise value of ~$100M and Q2 cash position of $63M providing them operational runway for around 1.5 years at current burn rate.

Keep in mind that recently the company secured up to $50M credit facility with OrbiMed Royalty Opportunities ($40M initial tranche used to fully repay prior $30M credit facility, additional $10M tranche contingent on achieving certain net revenue thresholds by the end of 2023).

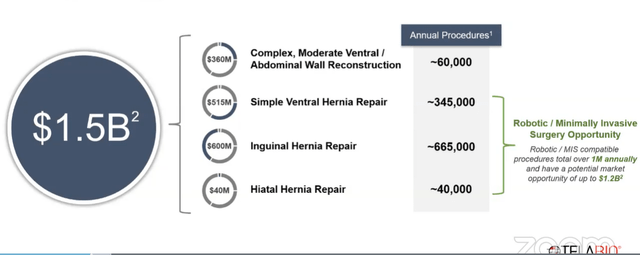

Management’s presentation at Wainwright provides an excellent overview of operations, as CEO Tony Koblish describes TELA Bio as a soft tissue and preservation company. They are centered on two major markets, one being hernia repair (includes all elements of this heterogenous procedure including simple inguinal procedures done robotically on up to the most complicated abdominal wall reconstructions). The other is plastic and reconstructive surgery (usually after cancer). These market opportunities total over $2 billion and TELA Bio has novel set of products backed by tunable technology platform with strong IP portfolio.

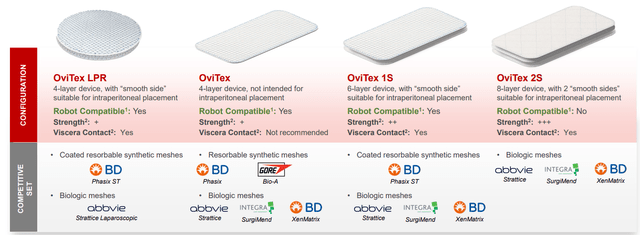

Figure 2: Pipeline (Source: corporate presentation)

Product portfolio is growing, as they sew biological materials together with reinforcement polymer sutures and fibers (both permanent and resorbable). They have a deep set of clinical data (30,000 procedures done so far and approaching 1,500 patients in various clinical studies). Data has been very consistent as compared to major competitors, offering compelling value proposition on both clinical performance and economic side (can save hospital systems significant amount of money while offering better clinical results).

They are expanding their GPO (group purchasing organization) contracting and market access potential, one contract which started in February 2022 (HealthTrust) which has generated a third of their value to date. Most recently they added Premier as new contracting partner (4400 hospitals gives them a much bigger footprint).

Figure 3: Hernia repair market opportunity (Source: corporate presentation)

Hernia repair market (above) ranges in complexity and types of procedures. Each segment is quite valuable and dependent on surgeon technique. Simple repairs are increasingly done robotically in minimally invasive manner (the majority of OviTex products are robot-compatible). The robot will gain growing share of hernia market and TELA Bio has the only regenerative biologic product reinforced with small amount of polymer fiber that is robot compatible. They are a leading natural repair product (market is moving away from polypropylene due to downstream complications featured in many of 33,000 lawsuits aggregated into class action).

Going back to the image in Figure 2, there are four major categories of products and more coming (roll out in next 12 to 24 months). LPR laparoscopic product has been specifically designed for robot compatibility (can be used both open and minimally invasively). This is one of the fastest growing products and will likely start the process of replacing all the polypropylene mesh which is in question right now. Core product OviTex is 4 layers is also robot-compatible and the 1S is mostly used in medium complexity procedures. OviTex 2S is the most advanced product and earmarked for complex procedures and not robot compatible.

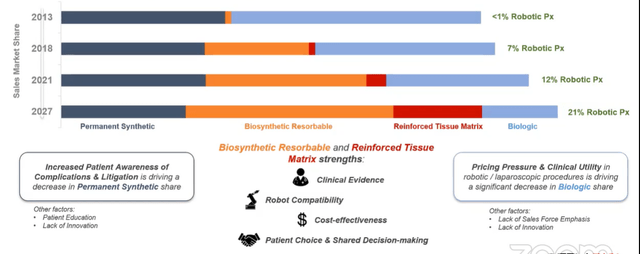

There are two major competitors, BD and AbbVie (former generally sold the polypropylene plastic and latter sold the biologic). That is changing as this natural repair segment emerges and TELA is poised to benefit from this trend. TELA started commercialization activities in hernia at the end of 2016. In 2013 the market was a duopoly (BD and AbbVie) with minimal robotic share. Percent of robotic procedures continues to rise and natural repair segment is the fastest growing segment (first place used is in replacement of Generation 1 biologics which are overpriced and have high revision/recurrence rates due to stretching too much). Natural repair offers a tremendous value proposition versus biologics and versus BD’s main offering (Phasix, a polymer mesh meant to resorb and go away).

Figure 4: Hernia market evolution (Source: corporate presentation)

Data around resorbable meshes have not been great with recurrence rates of 15% to over 30%, while Gen1 biologics have recurrence rates in that same ballpark (whereas TELA’s recurrence rates are in the low single digits and for complex procedures are less than half of competitive products). CEO states that they are poised to be one of the major players in natural repair and eat the hernia market from the inside out (middle to the left of Figure 4 above followed by middle to the right).

From survey work the company has done, 60% of surgeons feel there is a significant risk of downstream complications when using permanent synthetic mesh (proof of this being 33,000 class action lawsuits). Most patients are showing up to general surgeons requesting not to get this plastic and so TELA is in the very early stages of this opportunity driven by superior clinical data and value (where surgeons are going to be based on feedback from patients).

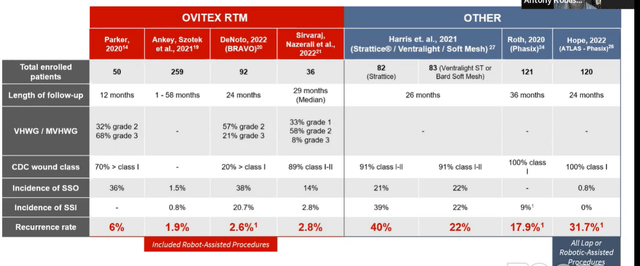

Figure 5: Recurrence Rates in Ventral Hernia (Source: corporate presentation)

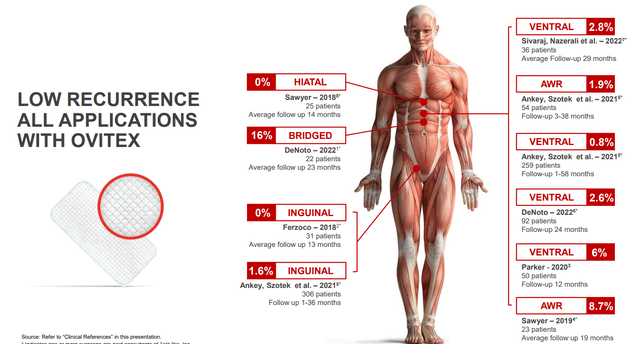

Looking above at clinical data versus competitive products, we can see very low single digit recurrence rates for OviTex (Bravo 2-year data showed 2.6% recurrence rate). Other technologies show range of 17% to 31%.

Looking below, we see the versatility of the product set doing everything in hernia. The highest number of % revision is 16% in the most complicated cases where primary closure cannot be attained and significant damage to abdominal wall (very difficult to heal and fix). Gen 1 products have revision rate as high as 40%, whereas TELA has less than half those procedures (backed up by very low single digit rates for the most simple procedures either done robotically or open).

Figure 6: Low recurrence across all applications (Source: corporate presentation)

Moving from hernia to plastic and reconstructive market, this market is centered around reconstructions that occur after cancer surgery including mastectomy ($700M opportunity). Value proposition here is similar to hernia, providing a next-generation product set with great benefit from Gen 1 (many made from cadaver skin or allograft). Gen 1 products tend to be very expensive ($10,000+ per piece), very dense (heal more slowly) and loaded with elastins (stretch a lot). TELA’s solution is OviTex PRS has open architecture, revascularizes quickly and integrates very efficiently (also designed to stretch during cosmetic application and stay put over the long term). This product is tuned specifically to offer benefits over Gen 1 including cost savings and controlled stretch.

As for generation of sales, five factors come into play (growing salesforce, increasing productivity, adding products to portfolio, increasing GPO access and generating additional clinical data). They are guiding to $42M to $45M sales this year (50% growth) and have strong cash position after just raising money and access to contracting hospitals is increasing.

Select Recent Developments

On July 20th, TELA Bio announced it had been awarded a group purchasing agreement for Synthetic Bioabsorbable Mesh Products with Premier, Inc. However, while this GPO win is encouraging, keep in mind it does not officially start until October 1st (allows Premier members to take advantage of special pricing and pre-negotiated terms for OviTex products). Premier encompasses 4,400 hospitals and 225,000 other providers. Again, the hope is to see additional GPO wins later this year and in 2023 to further fuel sales growth.

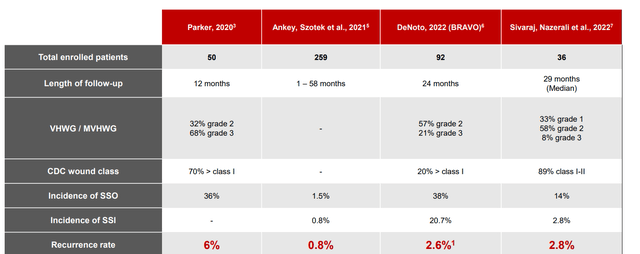

On August 4th, the company announced clinical outcomes from two studies using OviTex Reinforced Matrix (BRAVO 24-month results in ventral hernias and ReBAR 2-year outcomes in inguinal hernias). BRAVO yielded a 2.6% recurrence rate using open, laparoscopic or robotic techniques where 78% of all patients enrolled were characterized as high risk for experiencing surgical site occurrences based on at least one known risk factor (obesity, COPD, diabetes, coronary heart disease, over age 75, etc). Study included diverse clinical scenarios for ventral hernias as OviTex 1S was utilized in open and minimally invasive procedures, various planes of placement, and CDC wound classes I-III. For ReBAR, all repairs were done via standard robotic transabdominal preperitoneal approach combined with ReBAR technique (suture closure of defect followed by biologic mesh reinforcement). Only three recurrences were identified of 157 hernias repaired (rate of 1.9%).

Figure 7: Recurrence rates for OviTex in ventral hernia repairs (Source: corporate presentation)

Other Information

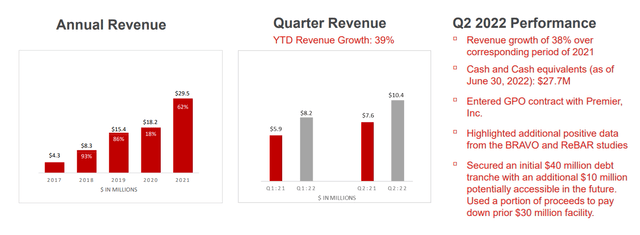

For the second quarter of 2022, the company reported cash and equivalents of $27.7M (reaches over $60M when we include proceeds from August financing of $36.8M). Net loss rose by about 50% to $12.7M, while operating expenses rose to $16.8M. Gross profit totaled $6.6M, while revenue increased 38% to $10.4M. Encouragingly, management provided full year guidance of $42M to $45M in revenues (43% to 53% growth). As a caveat, they do point out that higher than expected impact from Covid pandemic could impact this projection in a material manner. Accumulated deficit of $229M seems reasonable given the company was founded 10 years ago and sales are in the early innings of acceleration.

Figure 8: Consistent revenue growth over past few years and quarter over quarter (Source: corporate presentation)

On the conference call, management provides further color on revenue growth and market share capture as well as its drivers. The company ended 2021 with under 45 sales reps, growing to 57 reps by end of June and on track to reach 60 by the end of 2022. Quality of reps is emphasized, as many have prior experience in med-tech industry, hit the ground running in generating sales and on average cover their costs within the first 3 to 6 months of hiring (quickly contributing to top-line without negatively affecting profitability). Another potential tailwind is the up to 100,000 hernia repair procedures that have been deferred due to Covid-19 and need to be treated in coming quarters.

As for GPO wins, context was helpful as Premier (starting in October) is the second largest GPO in the US and is even larger than the prior HealthTrust win. Premier gives the company access to many west coast markets not fully penetrated to date. HealthTrust is stated to be a third of revenue ($10M to $12M on an annual basis), and consider that HealthTrust covers 1,600 hospitals versus 4,400 for Premier (2.5x the size for the latter).

As for prior financings, keep in mind August secondary offering took place at $8/share (about where our purchase for the Core Biotech portfolio took place on September 15th).

As for competition, referring back to Figure 6 recurrence rates categorized by procedure and provided by the company, I cross referenced those to rates reported in literature (just to get an idea of how numbers actually compare to competition). As we noted in Chat, companies often use inflated or deflated numbers (as suits their purposes) when referring to competition. An example of this can be observed with Cardiff Oncology (CRDF), who refers in their slides to historical response rates of 13% in 2nd line colorectal cancer when in actuality that number is from 2017 and benchmark ORR has gone up substantially since then (including with introduction of KRAS G12C inhibitors, something like 22%+ for single agent and 40%+ for cetuximab combination if I recall correctly).

Anyway (apologies for my digression), papers I looked at for hiatal hernia recurrence rate showed 5% to 15% (versus the 0% for OviTex Sawyer 25 patient study, caveat for the low N). Likewise, for bridged (16% recurrence rate for OviTex in 22 patients), literature shows 40% recurrence rate or even higher. The point being that even if company’s numbers come down a bit as they treat higher numbers of patients, they still show a substantial improvement over competitor technologies.

As for institutional investors of note, respected money manager and venture capitalist Orin Hirschmann holds a 7.9% stake in the company. EW Healthcare has been aggressively adding to its stake at 21.43% (very encouraging to see continued conviction from their lead series A investor). Likewise, Orbimed Advisors owns a 16.5% stake and Opaleye Management owns 10.6% stake (clustering is a potential green flag here). RTW Investments also owns 9.7% stake. As for insiders, CEO and President Tony Koblish owns 237,000 shares.

As for relevant leadership experience, prior to founding TELA Bio Koblish was President and CEO of Orthovita (grew valuation from $30M to $316M on exit sale to Stryker Corporation in 2011). SVP of Sales Cristopher Smith also served prior at Orthovita/Stryker leading 160 representatives and Regional Manager team.

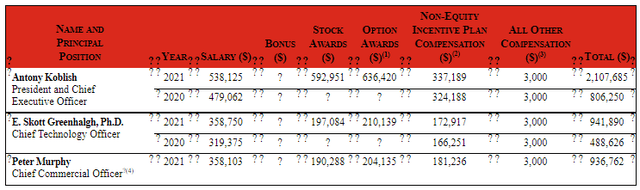

Moving on to executive compensation, salaries of top brass (cash portion) in the $319k to $538k are on the low to reasonable side for a company this size. Similarly, stock and options awards are actually on the low side and it’s nice that lavish pay packages are not a concern here (as they were with my prior article on Exelixis).

Figure 9: Executive compensation table (Source: Proxy Filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Moving onto useful nuggets from members of the ROTY community, DSJ.2018 noted the following:

TELA Bio is a biologic mesh company that is the anti-plastic/synthetic mesh play. They have industry leading 2-year outcomes with 1.9% of patients hernia recurring in under 2 years versus close to 30% for Phasix (Bard’s product).TELA originally won their first GPO contract from HealthTrust in 2019 with minimal sales force and the contract does around $15M per year. The labeling only allowed them to be used in severe cases. As revenue and data got better, they recently signed a contract 3-5X ($35-$75M annual sales) the size with Premier that put them in a new category called bioresorbable that allows TELA to be on-contract with surgeons to be reimbursed for easy, moderate and severe hernia cases. Broad-based use… this new labeling is a result of continued gravitation away from plastic/synthetic meshes given the lawsuit and safety risks that continue to arise.

For the first time, TELA can sell alongside Intuitive’s (ISRG) robotic system in hernia which is most frequently used in easy and moderate patients. They just raised $32M which will allow them to far surpass profitability. Market capitalization is $150M and should do $75M in sales next year to $110M in 2024.

Robotics/minimally invasive is the shift in the market and they are the only non-plastic (biologic) in town. Plastic hernia lawsuits are accelerating with big ruling coming late this fall. There is little binary risk and the valuation is trading at sub 2X next year sales growing 50%.

Their competitor Lifecel was bought by Allergan at 7X current year sales and BARD was bought by Becton Dickinson. Down here it could be a 5X-7x trade with minimal downside risk.

Intuitive currently does 1.6M hernia surgeries with a line of sight to 6M. As TELA continues to expand out their broad category with GPOs, they will benefit dramatically in this tailwind.

On the other hand, reader Michael.h (surgeon who used to do hernia repairs) also provided a word of caution (devil’s advocate):

I’m a surgeon and have never heard of this company or product before. Honestly spoken, I’m not doing hernia repairs anymore so I’m definitely not the top expert in this field. But during my career I heard a lot about meshes and especially biological meshes came and disappeared more than once.

I just took a brief look at the data. Is this single arm study all they have? Based on these data I would never use that mesh, and I don’t know who is. Definitely nobody that I know. They should do an RCT (randomized controlled study), then I might believe these results.

And by the way, if I read something about recurrence rates of 30% with other meshes that would appear to be totally off-base. A surgeon who has 30% recurrence rates after a mesh repair should quit his job.

All that doesn’t mean TELA can’t run, of course. But long-term I would be very careful.

As for IP, two issued US patents expire in 2029 and 2031. Twelve other US issued or allowed patents expire between 2035 to 2038 and 8 pending US patents are projected to expire between 2035 to 2042.

One final nugget, courtesy of Lake Street Securities, is that last month CR Bard (unit of Becton Dickinson) was ordered to pay $48M in a lawsuit related to its hernia mesh, Ventralex. The news would seem to be proof of that tailwind I mentioned above, namely that doctors and hernia repair patients will opt for better solutions like OviTex.

Final Thoughts

To conclude, with the usual caveats, this medical device-type story offers multiple factors to appreciate including tailwinds, sales growth and possible advantages over larger competitors. I’ve been looking for another potential winner in this space after Core Biotech holding TransMedics (TMDX) and believe we could have found it here.

The big difference is that while TMDX essentially created its own market, TELA has a much more difficult task cut out for them by taking on big name competitors with much greater financial strength and marketing muscle. Still, I think the growing body of data for OviTex speaks for itself (fewer complications as observed in lower recurrence rates), and coupled with economic benefits I would think they have a decent shot at taking some share as the market mix shifts away from permanent synthetic. I also think the recent GPO win of Premier contract has not been appreciated by the market, as the actual contract goes into effect October 1st and the acceleration it should spark will take place more in 2023 and beyond.

For readers who are interested in the story and have done their due diligence, TELA is a Buy and I suggest accumulating desired exposure at current share price levels (under $10).

As for risk rating (1=low, 5= high), I was tempted to put this at a 4 but ultimately chose a 3. It is true that the company is taking on big name competition, but multiple tailwinds in their favor coupled with recent financing to strengthen balance sheet and reasonable burn rate help me feel more comfortable here. Still, it should be noted that the medical device industry is intensely competitive and in hernia repair they are competing against Bard (Phasix and Ventralight ST) and LifeCell/AbbVie (Strattice). In plastic and reconstructive market, TELA is competing against LifeCell which produces AlloDerm. Any disappointing data on the clinical front, or conversely competitors putting up recurrence rate numbers that match or better TELA’s data, would weigh on the share price. Failure of sales to accelerate after GPO win would also add to pessimism. Float here is very low, so LIMIT ORDERS should be used and it’s clear that specialist biotech and medtech funds hold heavily concentrated positions (can be a double-edged sword, accentuating the rise on good news as well as magnifying the gap down on bad). As for dilution, I would think another secondary offering is possible mid to 2H 23. Another caveat, as Michael.h pointed out, is that the company needs to (or could stand to benefit from) running randomized head-to-head trials versus competitors with higher number of patients to definitively demonstrate superiority.

Thanks again to DJS.2018 for bringing this one back on my radar or spurring me to dig in again.

OTHER LINKS OF INTEREST

Great Management Interview from SA Contributor Fire Sale Buyer

Current Data Summary for TELA Bio

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment