Seiya Tabuchi/iStock via Getty Images

A Quick Take On Technology & Telecommunication Acquisition

Technology & Telecommunication Acquisition Corporation (NASDAQ:TETE) has sold $100 million from an IPO at a price of $10.00 per unit (excluding underwriter options), according to the terms of its most recent S-1/A regulatory filing.

The SPAC (Special Purpose Acquisition Company) intends to pursue a merger with a company in the sectors of telecommunications and technology in Malaysia.

The Malaysian economy is influenced by China’s economy, which has been performing at a lower level in recent years and management has no previous SPAC track record.

So, my outlook on TETE is on Hold.

Tech. & Telecom Sponsor Background

Tech. & Telecom has 2 executives leading its sponsor, Technology & Telecommunication LLC.

The sponsor is headed by:

-

Tek Che Ng, Chairman and CEO, who was a Director of Bayan Development Sdn Bhd (formerly GE Properties Sdn Bhd)

-

Chow Wing Loke, Chief Financial Officer, who was previously Managing Director and CEO of A&C Technology Waste Oil Sdn Bnd, a pioneer in the waste recycling industry in Malaysia

The SPAC is the first such investment vehicle by this executive group.

Tech. & Telecom’s SPAC IPO Terms

Kuala Lumpur, Malaysia-based Tech. & Telecom sold 10 million units of units consisting of one share of Class A stock and one warrant to purchase one share. at a price of $10.00 per unit for gross proceeds of approximately $100 million, not including the sale of customary underwriter options.

The IPO also provided for one warrant per share, exercisable at $11.50 per share on the later of 12 months from the effective date of the registration statement and the date of the consummation of its initial business combination.

The SPAC has 18 months to complete a merger (initial business combination). If it fails to do so, shareholders will be able to redeem their shares/units for the remaining proceeds from the IPO held in trust.

Stock trading symbols include:

Founder shares are 20% of the total shares and consist of Class B shares.

The SPAC sponsor also purchased 2.875 million Class B shares.

Conditions to the SPAC completing an initial business combination include a requirement to purchase one or more businesses equal to 80% of the net assets of the SPAC and a majority of voting interests voting for the proposed combination.

The SPAC may issue additional stock/units to effect a contemplated merger. If it does, then the Class B shares would be increased to retain the sponsor’s 20% equity ownership position.

Commentary About Tech. & Telecom

The SPAC is interesting because management is experienced in Malaysian businesses and the SPAC aims to focus its merger search within Malaysia, a country with approximately 33 million persons.

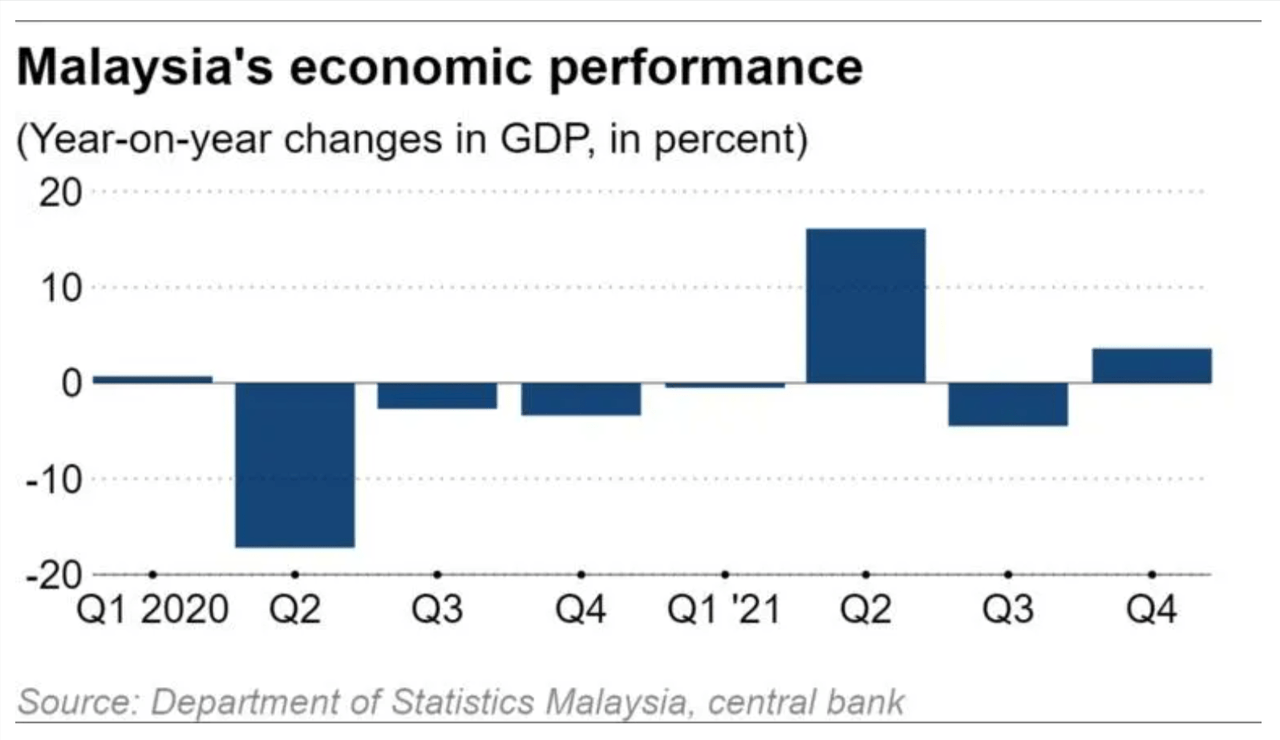

While Malaysia has been battered by the COVID-19 pandemic, the country’s economy returned to growth in Q2 2021, although that growth has been uneven, as the chart shows below:

Malaysia Economic Performance (Nikkei Asia)

The Malaysian central bank estimates that the country will grow around 6% in 2022, assuming the pandemic continues to decline in severity and normal business conditions resume.

Investing in a SPAC before a proposed business combination is announced is essentially investing in the senior executives of the SPAC, their ability to create value and their previous SPAC track record of returns to shareholders.

So, in a sense, investing in a SPAC can be likened to investing in a venture capital firm as a limited partner.

In the case of this particular management group, there is no previous SPAC track record, which is a negative.

Additionally, much of Malaysia’s economic growth prospects are influenced by its large Chinese population and connections to the economy of China, which has performed at a sub-par level in recent years due to the pandemic and its ‘zero tolerance’ policy.

Due to the management team’s lack of track record in the SPAC industry and uncertain future economic prospects for Malaysia, I’m on Hold for TETE.

Be the first to comment