plej92

In this article, I return to building products despite the gloom and worries about construction. We examine Tecnoglass (NYSE:TGLS) to understand more about the business and whether this could be a good fit with an investment portfolio. Further, we look at the potential risks here. With a low dividend yield but attractive valuations and strong future EPS growth, an investment in Tecnoglass might provide strong capital appreciation but still relies on overall construction levels to remain strong. I outline the case about why I believe Tecnoglass is a ‘Buy’ at this level, with attractive potential returns balanced by risks of volatility.

Tecnoglass Inc designs and manufactures architectural glass and windows. The company has a strong product portfolio of tempered, laminated, insulating, and low-E glass. The company’s products are installed in hotels, residential buildings, commercial and corporate centers, airports, and hospitals as floating facades, curtain walls, windows, doors, handrails, interior partitions, and dividers. They focus on a high-margin and high-value segment of the market and predominantly focus on several key US states.

Tecnoglass: A quick overview

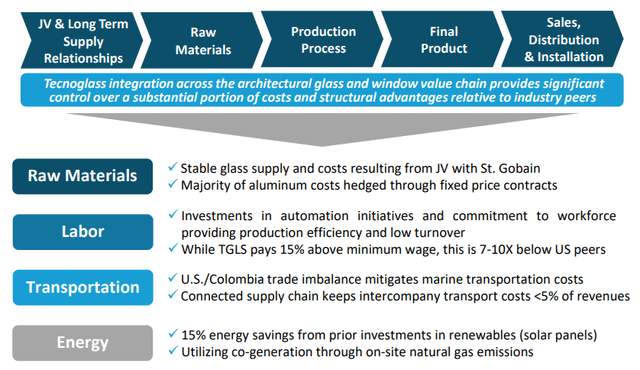

The company focuses on vertical integration and control over a range of activities that contribute to lower costs and management of the flow of materials. The positioning of non-US manufacturing and long-term joint ventures helps to manage costs (Figure 1).

Figure 1. Tecnoglass’ operational advantages and vertically integrated structure (TGLS Q2 2022 Earnings Call Presentation)

Given the ability to manage costs effectively, Tecnoglass should be able to grow earnings with future revenue growth.

Recent Tecnoglass results and operations

Tecnoglass has performed well in recent years with strong growth in their key US market and key US states. As they note in the Q2 earnings call:

Our single-family residential business, which is mainly focused on remodel and renovation based projects, was up approximately 86% year-over-year, to a record $75.9 million, or 45% of total revenues. This achievement reflects the rapid expansion of this business in key US regions.

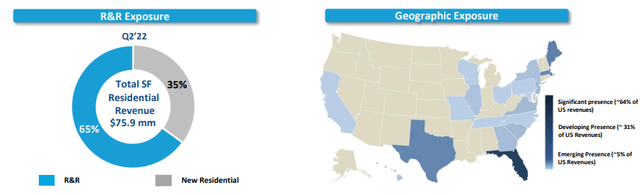

The company has strong exposure to US states with strong population growth, such as Florida and Texas (Figure 2). Their business has exposure both to new builds and ‘replace and remodel’ (R&R), suggesting even a downturn in new builds may be softened by people moving ahead with remodelling.

Figure 2. Tecnoglass diversification benefits and geographic advantages (TGLS Q2 2022 Earnings Call Presentation)

The company has performed strongly in the past year. As noted on the earnings call, certain segments have performed exceptionally strongly:

our single-family residential business, which saw an 86% year-over-year revenue increase in the second quarter. This business now represents 45% of our total revenues compared to 34% in the second quarter of 2021. Our increasing presence in the highly profitable end market has helped to create a step change in our profitability.

There are good trends here and the company has maintained good levels of profitability and margins, with, a ROIC of over 20% (Table 2).

Concerns to monitor for Tecnoglass

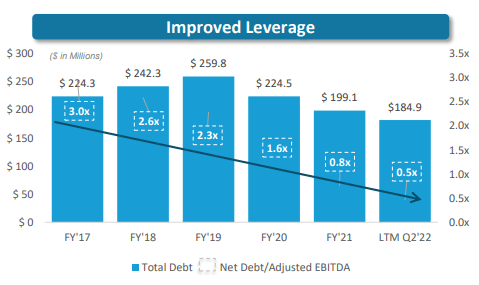

When I last looked at Tecnoglass a while back (not on Seeking Alpha), I was concerned about the burgeoning debt that the company had taken on. Over the last several years, they have wrangled the debt loads to a more manageable – and safe – level that provides more security as we move into a time of higher interest rates. Over the last five years, there has been a substantial improvement in the level of debt, making an investment in the company more secure (Figure 3). However, I remain somewhat concerned by the debt and I will continue to monitor the debt closely over the coming quarters.

Figure 3. Tecnoglass debt reductions over five years (TGLS Q2 2022 Earnings Call Presentation)

There is a relatively high proportion of shares being shorted. This type of short interest and negative sentiment has been long-standing in the company. The allegations are numerous and have been floating around for a long time. There are volatility risks associated with this type of situation, with noteworthy price drops possible in response to reports by vocal critics and short-sellers, as we saw in 2021.

Income, dividends, and capital allocation with Tecnoglass

I like dividends, cash flow, and income and I get a real sense of satisfaction and a little tickle from a sense of security when the dividends roll in. Tecnoglass provides a small dividend yield and has a spotty record of capital allocation to dividend payments with the level decreasing and increasing along with the fortunes of the company. Tecnoglass currently has a 1.48% dividend yield, with a -11.59 five-year DGR (Source: Seeking Alpha).

Income investors are unlikely to be interested in Tecnoglass with these metrics. It does not pay a reliable and steadily increasing dividend. Consequently, an investment in Tecnoglass may be more oriented to investors looking for the long-term growth of the company and capital appreciation.

Evaluating Tecnoglass relative to peers

To evaluate the valuation of Tecnoglass relative to peers and to get a sense of the opportunity here, I’ve selected other comparable peers in building products using the suggested ‘peers’ from Seeking Alpha:

- American Woodmark Corporation (AMWD)

- Apogee Enterprises, Inc. (APOG)

- JELD-WEN Holding, Inc. (JELD)

- Quanex Building Products Corporation (NX)

- PGT Innovations, Inc. (PGTI)

Table 1. Tecnoglass relative to peers in terms of valuation metrics

| Full Ticker | EV / EBITDA | Price / Book | Price / LTM Sales |

| AMWD | 9.13 | 0.97 | 0.39 |

| APOG | 7.25 | 2.87 | 0.74 |

| JELD | 8.25 | 1.19 | 0.18 |

| NX | 5.19 | 1.63 | 0.61 |

| PGTI | 9.32 | 2.24 | 0.95 |

| TGLS | 6.13 | 3.45 | 1.74 |

Source: Author, with data from Finbox.io

How does Tecnoglass look in terms of financial stability, security, and overall success? I’ve included several metrics I like in Table 2. I often use the Piotroski F-Score to get a quick assessment of how the firm is doing. The score of 7 provides some assurances, particularly coupled with the ROIC value of 20.5%, which is substantially higher than its peers. The interest coverage ratio and debt to common equity also look good relative to peers.

Table 2. Tecnoglass relative to peers in terms of financial security and ROIC

| Return on Invested Capital | Interest Coverage Ratio | Debt / Common Equity | Piotroski Score | |

| AMWD | 3.2% | 5.01 | 76.1% | 6 |

| APOG | 14.6% | 25.85 | 83.2% | 8 |

| JELD | 4.8% | 2.47 | 285.0% | 4 |

| NX | 15.1% | 46.31 | 22.9% | 8 |

| PGTI | 10.3% | 5.19 | 125.5% | 7 |

| TGLS | 20.5% | 20.60 | 64.6% | 7 |

Source: Author, with data from Finbox.io

Valuation of Tecnoglass and my thoughts on the investment opportunity

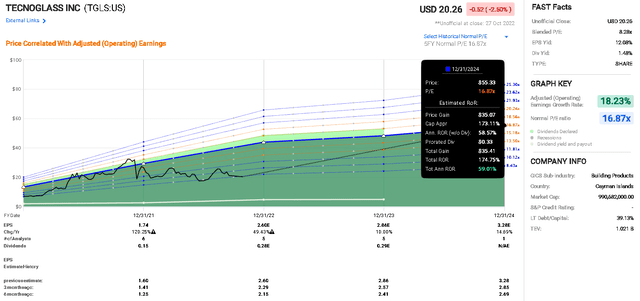

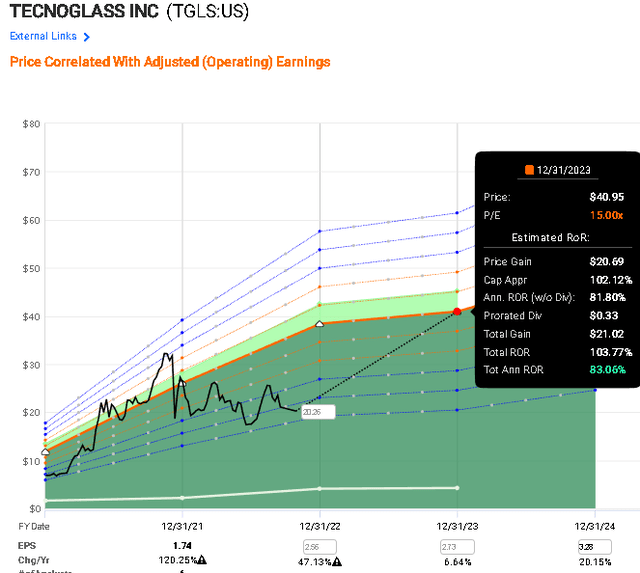

To evaluate future investment opportunities and the impact of its present valuation, I often use FAST Graphs as it supplies analysts’ looks at earnings, allowing future events of returns. We can use a target P/E multiple to assess possible returns when prices attain the required level for the multiple. The expected earnings over the coming months can then form the basis for an estimate of the rate of return. This approach has the best possible chance of success if we are both realistic in our forecasts and reasonable in terms of earnings multiples and analysts’ forecasts.

To assess the likelihood of analysts’ estimates being accurate, we can turn to the FAST Graphs’ analyst scorecard which shows that the analysts’ two-year forward estimate (with a 20% margin for error) is a 25% of the time, a beat 25% of the time, with misses half the time. The one-year forward estimate is a beat 29% of the time with 71% misses.

This level of accuracy from analysts shows the lack of stability of company operational results and the difficulty of assessing future earnings. Further, we can examine the lower panel in Figure 3 to get a sense of how the consensus estimate has changed over the prior six months. The upwards revisions provide assurance of stronger earnings estimates, coupled with the historic proportion of times that Tecnoglass has beat estimates, giving us a sense that the estimates are somewhat reliable but, perhaps, we should use the lower or more conservative set of analysts’ estimates.

If we assume the return to a normalized P/E (shown over the last five years) of 16.87x, with the average estimate for the end of 2024 (which is only one analyst providing an estimate out that far, so best to treat this with caution), we can estimate the likely rate of return. Using FAST Graphs’ forecasting calculator, we get a 174% total RoR, or 59% annualized RoR (Figure 4).

Figure 4. Analysts’ estimates and a normalized P/E used to calculate a target price and the rate of return for an investment in Tecnoglass (FAST Graphs)

There are few analysts covering Tecnoglass, but I can take the lower estimates from Finbox.io and use these with a 15x P/E to estimate a more conservative return if prices normalize in the next year (Figure 5). The calculations suggest a possible total RoR of 103%, suggesting some potential upside here if the EPS estimates can be met.

Figure 5. A more conservative estimate used to estimate likely rate of return for an investment in Tecnoglass (FAST Graphs)

Risks to monitor

Ultimately, Tecnoglass is trading at about 8.28x blended P/E (Figure 4). This valuation provides some buffer against further price declines. However, much of the future price movements appears to be based on future earnings. We can see that instability in estimates if we look at the lower panel of Figure 4 where the shifts in analysts’ estimates are shown over time. They have been revised upwards – quite a lot. This seems positive but also suggests that the EPS estimates could rapidly be reduced by meaningful proportions. As noted, earlier, analysts struggle to consistently and accurately estimate Tecnoglass earnings.

One argument for the disconnect between prices and the P/E multiple in 2022 (where prices did not rise with the noteworthy EPS rise, as shown in Figure 4), is that the prices are already reflecting an upcoming downturn in housing market activity.

The downturn is not across the board and Tecnoglass has a strong multi-family track record and this segment appears to remain strong. This may be an advantage, the COO has noted in the Q2 earnings call, Tecnoglass’ “track record of successfully delivering on high-profile multifamily projects has opened up an increasing number of opportunities across attractive US regions.”

Some of these risks may be mitigated by the strength and representation that Tecnoglass has in the South (Figure 2). Strong flows into states like Florida, where Tecnoglass has a strong market share (Figure 2) suggests there are some balances to the risks that the company faces.

A summary of my thoughts on Tecnoglass

I have included a summary section that might be useful when my thoughts were at the borderline between two recommendations.

Business: Solid business with strong EPS growth expected. Some concerns around the stability of construction in the near term and the reliability and changeability of analysts’ EPS estimates.

Valuation: Good margin of safety as it remains reasonably valued. There is a strong opportunity here for the upside moves. If P/E multiples return to more reasonable levels, this will deliver capital gains.

Financial safety: Moderately secure, but negative sentiment exists.

Dividend: A low yield is better than nothing and this is clearly not a dividend and income play.

My investment thesis for Tecnoglass

There is certainly upside potential for Tecnoglass but also volatility. The current valuation appears to have a good margin of safety at this P/E and I appreciate the presence of a small dividend to offset some risks while we wait for the upside moves to materialize.

Based on the upside and growth potential, I rate Tecnoglass as a ‘Buy.’

This is comparable to analysts’ estimates; Finbox.io reports five analysts’ targets ranging from $32 to $38. This suggests a comfortable 50% upside, but investors should watch the construction levels in states like Texas and Florida to get a sense of whether Tecnoglass revenue and growth are likely to continue.

Be the first to comment