FG Trade/E+ via Getty Images

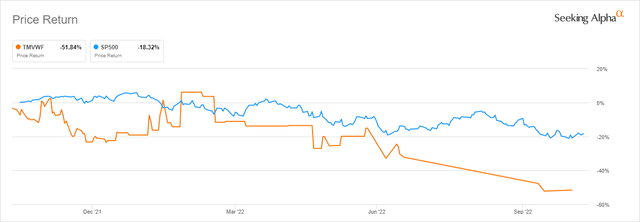

TeamViewer AG (OTCPK:TMVWF) (OTCPK:TMVWY) is a German-based software technology company best known as a pioneer in developing remote connection and control solutions that over the years evolved to the point of becoming a household name in the industry. It was initially founded in 2005 under the name “Regit Beteiligungs-GmbH”, but has recently decided to change its name in order to be better associated with its famous remote solutions product. The company has had a very difficult year in the markets, as it managed to significantly underperform the S&P 500 (SPY) by generating a negative year-to-date return of 25.9% and a negative one-year return of 36.5%. The performance of the dollar-denominated securities sold over the counter on U.S. exchanges has been much worse, seeing declines of as much as 51.3%.

The stark difference between the OTC traded securities and those sold on German exchanges mostly comes down to the issue of the surging dollar and the way it affected the Dollar/Euro exchange rates. Either way, there is no doubt that shares of TMV can be purchased for a significant discount both when compared to the IPO prices, and also when compared to the all-time highs of last year when we saw shares of the tech company getting sold for as much as €53.62. At the time of writing this article, shares of TeamViewer can be bought for only €8.75, which prompted us to take a deeper look in hopes of finding out whether we are dealing with a falling knife we might try to catch or a potentially truly lucrative investment opportunity.

TeamViewer vs S&P500 One-Year Returns (Seeking Alpha)

The business model

TeamViewer began its life as a rather simplistic remote access and remote control solution, allowing for the maintenance of computers and other devices. The software solution was first released in 2005, but the company kept working on the tool, and its functionality expanded step by step. Throughout the years, TMV has grown and become almost a household brand in the industry, as one would have a hard time finding an IT professional that didn’t interact at least once with the services of the German-based company during their career.

However, TeamViewer’s offered products and solutions have evolved to something much more than rather “simplistic” remote connection and control features. Fully understanding the business model is rather difficult, as the company seeks to achieve so much in various fields, almost making it problematic to keep track of all of its business endeavors.

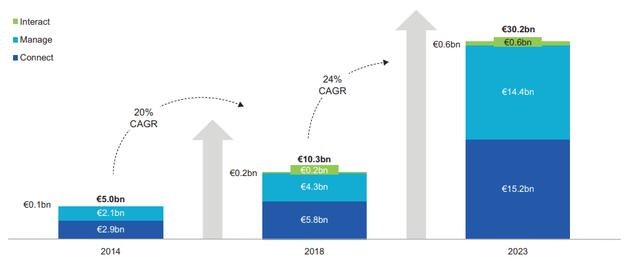

It currently pursues three major market segments that it defines as:

Connect – is the largest category that includes use cases where TMV’s platform provides full remote access and control functionalities for connected devices. Customer use cases addressed by the “connect” category include unified support; small office/home office access; enterprise access; and device connectivity use cases.

Manage – includes use cases for centrally managing and controlling connected devices. Customer use cases addressed by the “manage” category include IT management; remote monitoring; remote control; and incident management.

Interact – includes use cases for the live interaction of users connected to the same device by enabling them to share multiple screens, share files, have VoIP conference calls, and hand over endpoint control rights in real-time. Customer use cases addressed by the “interact” category include expert interaction and AR field support.

TeamViewer TAM (IPO Prospectus – McKinsey Research)

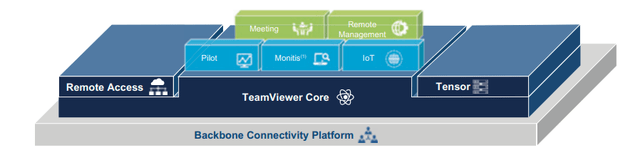

Those business models and philosophies evolved into several products the company currently has to offer to the market:

TeamViewer Core – enables end-to-end secure connectivity including full remote device access and control and multi-user sessions with strong cross-device capabilities covering all major operating systems. TMV Core represents the household brand and accounts for the majority of the sale key customer gateway and accounts for a large majority of the company’s sales. It is sold in the markets through three editions – business, premium, and corporate.

TeamViewer Tensor – enhances TeamViewer’s core connectivity platform with features required for IT systems of large enterprises, such as efficient mass deployment, support of single sign-on, logging and auditing, conditional access, and an improved user interface for enterprise environments.

TeamViewer Engage – is a next-gen digital customer engagement platform intended to assist with online sales, digital customer service, and video consultations, thereby elevating the customer support experience.

TeamViewer Remote Management- is mainly intended for IT administrators and managed service providers as it automates backend IT processes related to end-user computing assets.

TeamViewer Assist AR – formerly known as Pilot, Assist AR is an augmented reality product designed to enable in-field professionals to receive live guidance from subject experts. The remote support solution provides easy, fast, and secure augmented reality-powered visual assistance to identify and solve problems from anywhere in the world. The augmented reality offering also includes TeamViewer Frontline and TeamViewer LifeAR.

TeamViewer Internet of Things – TeamViewer IoT is designed to enable advanced IoT device connectivity with features to remotely operate, maintain and manage IoT devices. This product includes additional features such as application control, cloud-stored sensor data, data visualization, and enterprise-grade security and encryption.

Other than the products listed, TeamViewer also offers an advanced ticketing system called “Bootcamp“, a Virtual Classrooms solution aimed at educational institutions, and “TeamViewer Meeting“, which is their take on a video conferencing solution. The main takeaway here is that the company elevated itself and represents a true leader in the field, and has created a complete and compelling offering attractive to small and medium businesses as well as large enterprise customers alike, on top of their traditional retail-oriented clients.

TMV Backbone Connectivity Platform (IPO Prospectus)

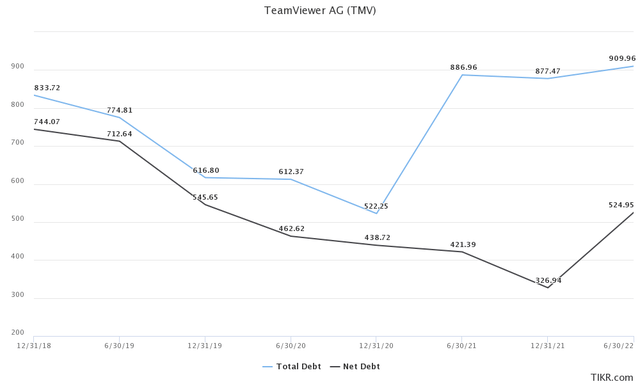

The balance sheet

When we take a look at the company’s balance sheet, it becomes immediately clear that we are still dealing with an asset-light technology company. As per the latest report, we can see that the company has €909.96 million in total debt and €524.95 million in net debt. On top of that, non-current liabilities amounted to €471.8 million, while TeamViewer’s current liabilities are set at €807.3 million.

The company reported its net leverage ratio at 2.1x. In order to service its debt obligation, TMV has only spent €15.6 million in the first part of the year, which represents a year-over-year decrease of €6.0 million. The current EBITDA/Interest Expense coverage sits at 3.67x.

Total Debt and Net Debt (TIKR Terminal – IQ Capital Data)

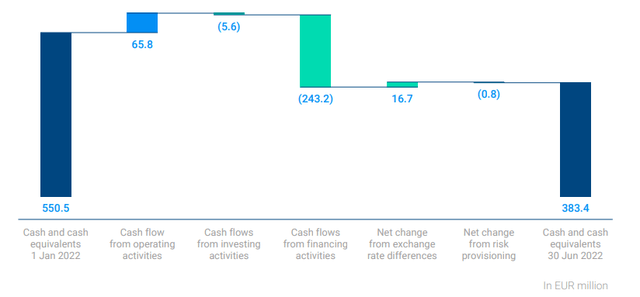

TeamViewer also has a very good position in terms of liquidity. According to the latest half-year report, cash and cash equivalents amounted to €383.4 million, which represents a decrease of roughly 18% as compared to the same period last year. The company had €465.6 million on the books back then. In other words, the company is sitting on a lot of cash.

Liquidity Position (Half-Year Financial Report)

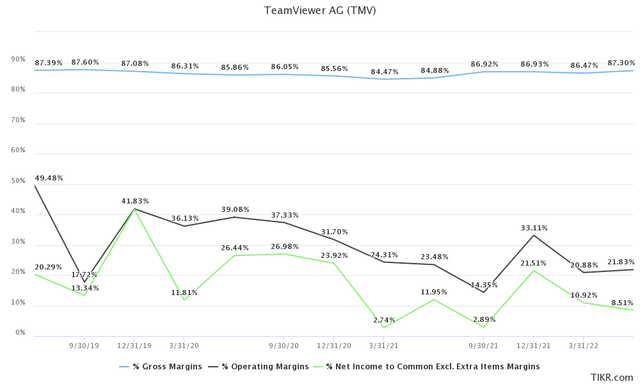

One of the major benefits of operating in the tech industry is the high margins TMV consistently manages to produce. As we can see, the company has a long history of delivering industry-leading margins, with TeamViewer’s gross margins consistently staying above 85%.

Gross, Operating, and Net Margins (TIKR Terminal – IQ Capital Data)

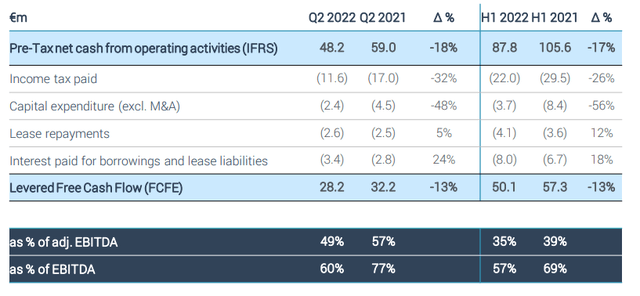

The company can also pride itself on the historically high EBITDA to free-cash-flow to equity conversion rates, which did come in slightly lower than during the same period last year but were nonetheless extraordinary. TeamViewer managed to convert 57% of its EBITDA to FCF, compared to 69% in H1 of 2021.

EBITDA to FCF rate (H1 Investor Presentation)

Looking at the valuation

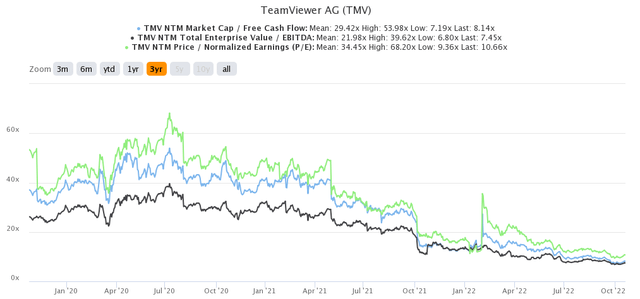

This leads us directly to the question of valuation, which seems to have become a very enticing aspect of TeamViewer after the huge pullback in the share price we have witnessed over the past two years. The company is currently being sold for a NTM EV/EBITDA of 7.51x, NTM P/E of 10.77x, and NTM P/FCF of 8.23x.

Again, these multiples only came to be as the stock got hammered in the markets and lost more than 85% of its value since the IPO high, which prompts the question of to what extent and for how long has the company been overvalued.

If we take a look back to July 2020, we realize that investors were at the time willing to buy TMV at a NTM EV/EBITDA of 39.62x, NTM P/E 68.20, and NTM P/FCF 53.98x, which we find simply astonishing. Compared to the valuation back then, the company looks like a steal at this point. Yet, we would argue that TeamViewer is only getting interesting after the pullback.

TeamViewer Valuation History (TIKR Terminal – IQ Capital Data)

If we consider that we are dealing with an asset-light high-margin software company that is still expected to grow in double-digit figures, the current valuation does seem to be very convincing.

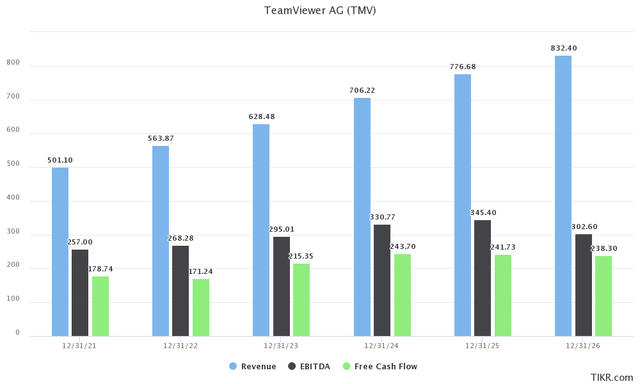

TeamViewer Estimated Growth (TIKR – IQ Capital Data)

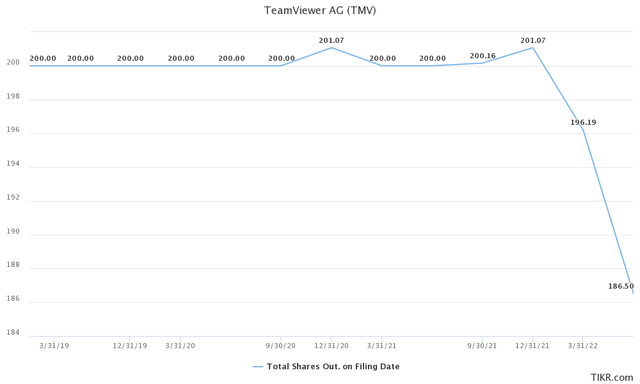

Management on the other end capitalized on this pullback and executed its first buy-back initiative in the company’s history, making its position on the matter rather clear. The buy-back was very effective and drained €231.2 million, or almost half of its cash position as of the 1st of January 2022.

Shares Outstanding (TIKR Terminal – IQ Capital Data)

We would define this as a huge vote of confidence by management. The program was completed late last month, with TeamViewer successfully buying back 24,093,675 shares which represented roughly approximately 12.9% of the registered share capital of the company.

Final thoughts and conclusions

While it remains immensely difficult to argue with the value proposition presented by a potential investment in TeamViewer, as we believe the company is currently selling at least at a fair valuation, it ultimately comes down to where we see the future of the company and how deep we estimate its MOAT to be. Unfortunately, this is where TeamViewer ends up falling short of our expectations, as the company operates a useful utility that has a good user base, but one that seems easily replicable. Companies such as Zoom Communications (ZM), Microsoft (MSFT), and Cisco (CSCO), all want their piece of the pie in one way or another, and it is questionable for how long can TMV keep up as an industry leader. With much fewer resources at its disposal, we do see a realistic possibility of the company slowly falling behind the larger players in the field.

We don’t see a future where TeamViewer would necessarily command the same market share or be able to impose premium prices for its rendered services. It would also be interesting to consider TeamViewer as a potential acquisition target, given that the €1.65 billion euro small-cap would in theory make an “easy” target for the aforementioned companies. Still, since TeamViewer already displayed it is both capable of generating strong enough cash flows and willing to use them to reward shareholders, we believe it is worth keeping an eye on TeamViewer, unrelated to what the broader market thinks. The game changer here could be its newly focused business model, which if successful could launch the company to different heights, but given where we stand today, it does still seem to be a far stretch and not solid enough to warrant an investment in the company.

Be the first to comment