WoodenheadWorld/E+ via Getty Images

Thesis

Guggenheim Active Allocation Fund (NYSE:GUG) is a multi-asset closed-end fund from Guggenheim. The fund IPO-ed in November 2021 and has had a rough first year. Down over -28% since inception, the CEF has switched its focus, now being overweight fixed income. The fund started off with a 50/50 equity/fixed income slicing. The vehicle reminds us of another multi-asset CEF, namely BlackRock Capital Allocation Trust (BCAT) which we explored in detail here. Both funds are multi-asset CEFs with broad mandates which IPO-ed fairly recently, and have seen their discounts to net asset value widen out to historical levels.

In our first article on GUG we talked extensively on why we believed the first year was going to be rough for the fund, given the propensity for newly IPO-ed CEFs to underperform. In addition to its issuance timing the fund also ramped-up its portfolio at the top of the market (the end of 2021). The results have not been favorable to investors. It is interesting to note though that the fund is taking advantage of its broad mandate to optimize its collateral mix, having exited most of its equity positions in 2022. The fund now has an 86% allocation to fixed income, versus 50% equity, 50% fixed income at the beginning of the year.

Both vehicles are now trading at very wide discounts to NAV, and at least in GUG’s case the discount is warranted. Having pivoted towards fixed income, the fund has failed to create a tangible, measurable risk factor track record. An investor pricing the vehicle needs to allocate a higher discount rate given its “black box” features. GUG is using now less ROC than expected (only 38% ROC as per the September distribution) given the cash flows received from the fixed income portfolio. We remain firmly entrenched in our view that new CEF vehicles should not be bought by retail investors within their first year on the market, due to historical underperformances and issues associated with establishing a well-defined and identifiable trading pattern.

Holdings

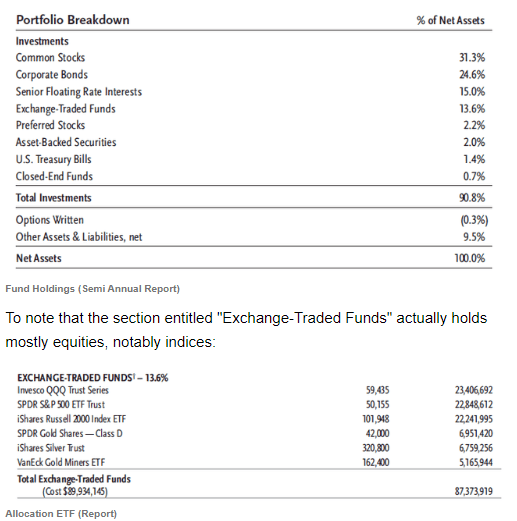

The fund started out with a balanced 50/50 equity/fixed income mix:

Holdings (Semi-Annual Report)

However the CEF pivoted toward fixed income in 2022, having exited most of its equity holdings:

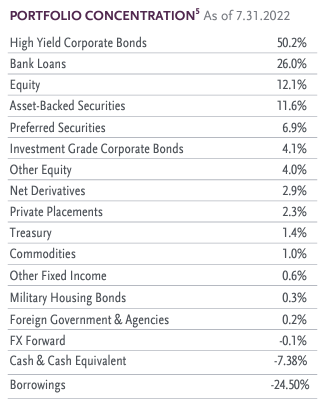

Portfolio Concentration (Fund Website)

We can see the vehicle having moved toward high yield corporate bonds and loans (traditional instruments for a classic fixed income CEF) with other small buckets geared towards ABS securities and preferred securities. Equities now account for only 12.1% of the fund.

On one hand the beauty of a broad mandate allows for this type of pivot, but at the same time investors are going to be hard pressed to allocate capital to a “black-box” type of vehicle. We are curious to see the evolution of the fund here and how the collateral mix will develop through the economic cycle. We feel the fund needs to establish some sort of identity or identifiable trading pattern for investors to be able to value it correctly.

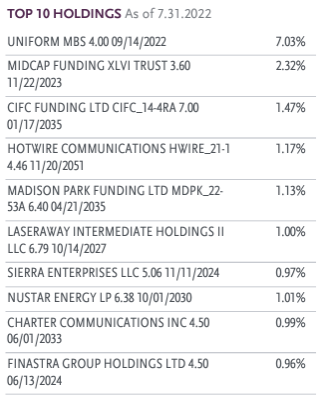

The current top holdings in the fund are:

Top Holdings (Fund Fact Sheet)

Performance

The fund is down significantly since inception:

Performance since Inception (Seeking Alpha)

We can see that since its inception in November 2021 the fund is down over -28%. During that time-frame it has a similar return profile to BCAT. A more established fixed income bond CEF from Credit Suisse, namely CIK, is down only -20% due to the better premium performance.

Year to date the return profile for the fund mimics the wider market:

YTD Total Return (Seeking Alpha)

Ultimately in the fixed income / multi-asset CEF space, when one adds leverage to a money losing position, the result will always be a more negative return.

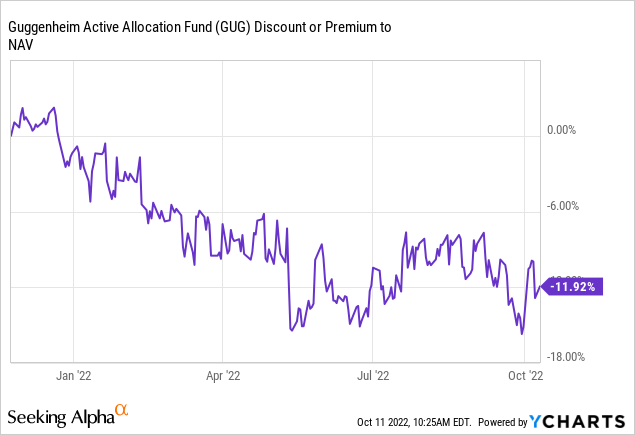

Premium / Discount to NAV

In its short tenure, the fund has moved to a discount to net asset value and has remained there:

We can see the fund having a bit of a beta to risk-on / risk-off environments, but generally being stuck in a range of -7% to -18% in terms of a discount to NAV. Is it warranted? We believe so. The fund has no track record and it has already changed its risk factors significantly by its quasi exit from equities. A prudent investor does not know what the fund will look like next so when uncertainty prevails a discount is warranted.

When the market recovers, and if the fund is able to establish a certain identity for itself, we should see that discount narrow given the robustness of the Guggenheim platform.

Distributions

So how does GUG fare in the distribution department?

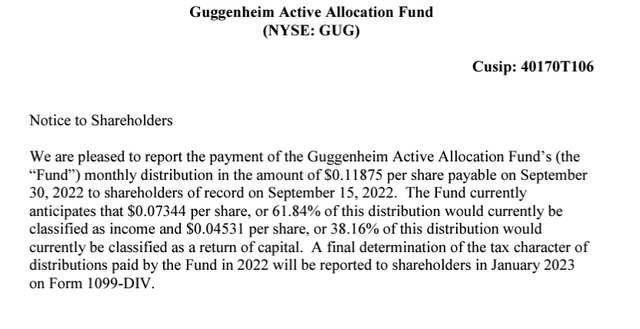

September Distribution (Section 19.a.)

Having pivoted to fixed income, the ROC usage is only 38%, much lower than we would have expected. Had the fund stayed in equities, which are having a horrific year, the vehicle would have utilized a higher amount of ROC.

Underperformance right at the start of a vehicle’s life is a bit of a vicious circle. Dividends get taken from principal via ROC and the fund basically has a steeper hill to climb upon recovery due to the principal depletion.

Conclusion

GUG is a multi-asset CEF from Guggenheim. The vehicle IPO-ed at the peak of the market in 2021 and has suffered as fixed income and equities got pummeled in 2022. Down over -28% since inception, the vehicle is still trying to find its footing and identity. The CEF pivoted to an overweight fixed income allocation (HY bonds and loans) in 2022, and has seen its discount widen to historical levels. The vehicle reminds us of BCAT, another multi-asset CEF from a large asset manager. Both funds have broad mandates, IPO-ed fairly recently, and have seen their discounts to net asset value widen out to historical levels. GUG is yet to establish an identity, and is currently using 38% in ROC for its distribution given its performance. We expect the discount to NAV to normalize in 2023 as the market recovers and the fund is able to show a track record.

Be the first to comment