Khanchit Khirisutchalual

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on August 23rd, 2022.

Ecofin Sustainable and Social Impact Term Fund (NYSE:TEAF) provides investors with a differentiated approach to investing in real and essential assets. When considering ESG funds or investments, it’s common to only think about the renewable energy aspect of it. However, there is a whole world of investments outside of creating clean energy.

TEAF invests in a portfolio of public and private companies. They have their fair share of energy and renewable investments but also provide investments into other social infrastructure. These are “essential” infrastructure projects such as senior housing and educational facilities.

The deals have slowed down quite a bit since this fund first launched as they built out the portfolio. It is now mostly at the point of sitting back and seeing these deals play out. There were 15 deals in 2019, 8 in 2020, 6 in 2021 and just 2 deals in 2022 so far.

One of the reasons for this is because they are a “closed” ended fund. Meaning that they raised the initial capital, and that’s primarily what they are set to invest with. There are other ways of raising assets, but it isn’t like a traditional mutual fund or ETF, where new shares are created and redeemed as necessary.

While investing in these essential projects, TEAF pays a healthy distribution to investors too. This is paid monthly, which can be helpful to income investors that want to hold a bit more of an exotic and speculative investment in their portfolio. This would presumably be a smaller allocation in one’s portfolio as some of these projects are mere “ideas” at this point. Some of what they invest in hasn’t actually been built yet and aren’t in operation.

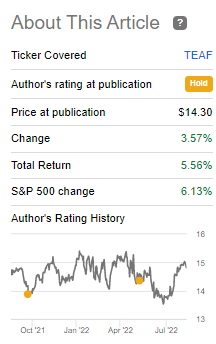

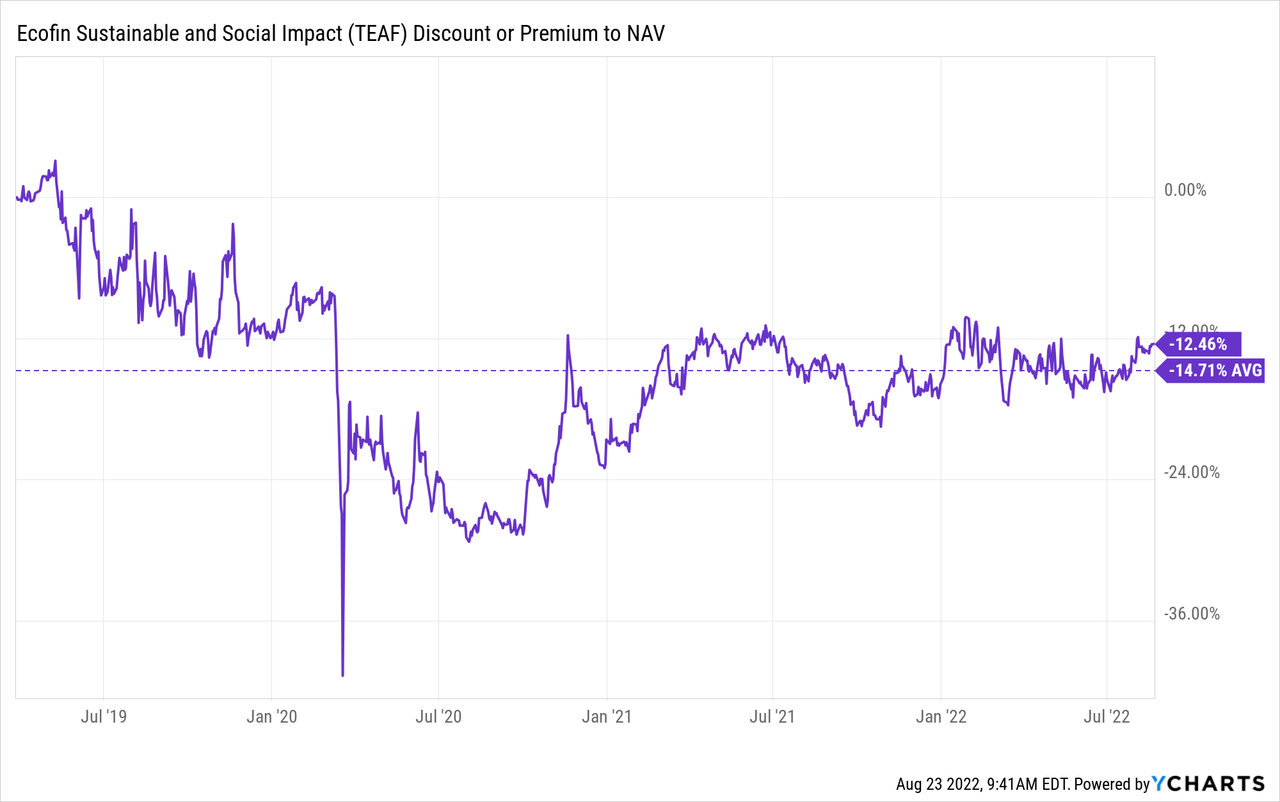

The current discount on this fund is quite attractive but slightly elevated relative to its historical range. It had also been rallying along with the broader market off of the June lows. It would have been an even better deal to buy several weeks ago. So this is one that an investor could keep on their watchlist to look for another dip to present a better opportunity.

TEAF Performance Since Last Update (Seeking Alpha)

The Basics

- 1-Year Z-score: 1.23

- Discount: 12.46%

- Distribution Yield: 7.25%

- Expense Ratio: 1.86%

- Leverage: 11.40%

- Managed Assets: $249.1 million

- Structure: Term (anticipated liquidation date around March 27th, 2031)

Tortoise launched TEAF with the goal of “attractive total return potential with emphasis on current income and uncorrelated assets.” Additionally, “access to differentiated direct investments in essential assets” and “investments intangible, long-lived assets and services.”

TEAF is also targeting a “positive social and economic impact.” Essentially, they are an ESG-focused fund with an emphasis on infrastructure. A meaningful portion of their holdings is associated with energy-related infrastructure with a background in the energy space. Though it is unique from the other Tortoise funds, it also carries a significant exposure to industries outside of the energy field.

The fund’s expense ratio is higher than usual for a closed-end fund, though it reflects the higher management fee of 1.35%. When dealing with private investments, we often see higher expenses. When including the moderate about of leverage that the fund employs, we have a total expense ratio of 1.96%.

With rising interest rates, this is a bit of a risk for the fund as interest expenses can rise as they are based on floating rates. The fund’s last interest rate reported was 1.92%. That’s on the high end for CEFs and is set to go higher as rates are bumped up. The fund seeks to have leverage of around 10% to 15%, which puts it on the low end for CEFs overall.

Performance – Discount Narrows, But Still Attractive

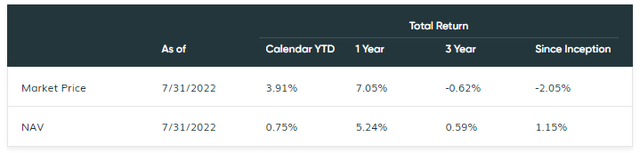

The fund’s heavier allocation to energy investments hadn’t previously helped the fund when it launched in 2019. However, it has meant that on a YTD basis, it has helped keep the fund in positive territory. Barely in positive territory, but positive on a YTD basis, nonetheless. The fund’s total market price return has outpaced the NAV.

TEAF Annualized Returns (Tortoise)

When that happens, it means a fund’s discount is narrowing, or its premium is rising. In this case, the fund has been consistently trading at a deep discount. Based on the last year, it has pushed the z-score positive to the 1.23 level. That isn’t overly elevated, but it also matches up with the longer-term average discount level, suggesting we are slightly elevated.

YCharts

The fund hasn’t performed well since it launched. I believe a primary culprit of that is when the fund launched. It was fairly heavily invested in energy infrastructure that held it back and has since been recovering. Similar to any investment, though, it matters when you buy it. Since I bought my initial slice in 2020, I’m looking at a 45% appreciation in price alone. Of course, you could throw a dart to pick any investment in 2020 and see similar or even better results.

It also matters more what the future of the fund might be and not really what the past results are. If one expects another market collapse such as COVID, especially with weakness in energy, then we could see similar results going forward.

Based on the latest discount, it could also present a risk going forward of this widening out. That’s why I’d be more optimistic about a wider discount. At the same time, the nearer we get to the termination date, the more narrow the discount should become. With a 2031 liquidation date, that shouldn’t be coming into play yet, necessarily.

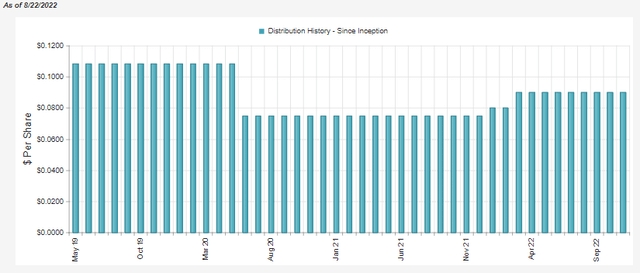

Distribution – Attractive Rate

One of the reasons I like investing in TEAF is it gives a unique exposure but also fits in as an income investment.

TEAF Distribution History (CEFConnect)

The latest distribution yield comes to 7.25%. Due to the wide discount available on this fund, the actual NAV yield comes to 6.35%. To cover this distribution, the fund will rely heavily on capital gains. That isn’t unusual for funds with significant equity investments. Common stock investments made up 51.2% of the portfolio.

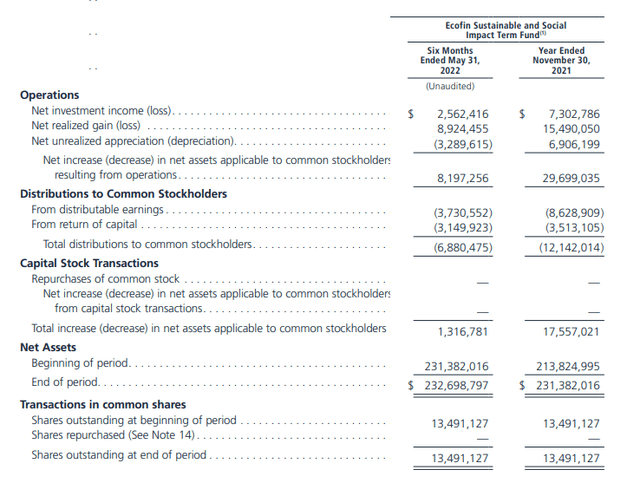

That being said, they also carry a fair bit of debt investments. That can produce some regular NII generation for the fund. However, the latest six months had a large decrease relative to the previous fiscal year. That would be if we were to extrapolate it out to that annualized period.

TEAF Semi-Annual Report (Tortoise)

Expenses were similar year-over-year, from $2.083 million to $2.126 million. The total investment income sank to around $5 million from $5.378 million. That’s only a small portion of what would have resulted in the difference, though. Portfolio positioning would be the other factor, in my opinion.

Return of capital distributions from underlying positions had also decreased from $2.434 to $1.814 million. However, that actually would have bumped NII up because the return of capital is a reduction on the TII line. When including the ROC from the underlying positions, we would see distributable cash flow at $4.376 million.

That would be against the $6.88 million in distributions paid to bring DCF 63.6%. Then we have had more than enough realized capital gains to fund the shortfall. In fact, the realized gains minus the unrealized description would have still been enough to offset the shortfall.

The fund utilizes call writing in its portfolio to generate additional premiums for distributions. That would be included in the realized gains as it produced $82.732k in options premium for the period. A small drop in the bucket, but better than a sharp stick in the eye.

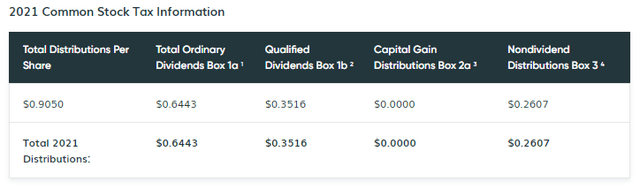

As a regulated investment company, the fund’s distribution gets passed through generally as they receive the distributions themselves. In this case, the fund has ordinary dividends, qualified dividends and non-dividend distributions (ROC distributions).

TEAF 2021 Distribution Classification (Tortoise)

This was for 2021. What might be interesting is one noting how sizeable to realized gains were in the previous year, yet no capital gains were classified in the distribution. Well, that’s where things get a bit more complicated because these funds also have significant capital loss carryforwards. Those can be utilized to offset realized gains going forward. At the end of the 2021 fiscal year, TEAF still had nearly $31.8 million in carryforwards.

TEAF’s Portfolio

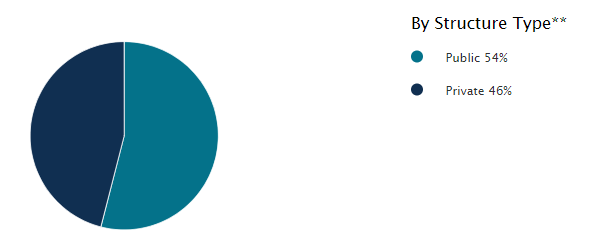

In our previous update, the portfolio was split 51/49 between public and private investments. The split was the same at the end of June 30th, 2022, according to the fund’s fact sheet. However, at the end of July 2022, they reported that the public-private split had moved to 54/46.

TEAF Private/Public (Tortoise)

This isn’t necessarily a tremendous move and would be within a rather reasonable range month over month. The fund last reported a turnover of 14.47% for the last six-month period. In the previous two years, they reported a 68.31% and 73.22% turnover. That means the fund can be quite active in its portfolio.

That being said, I believe this split difference could be happening because private investments aren’t updated as regularly in terms of their valuation. On the other hand, the publicly traded names get recalculated daily due to market price.

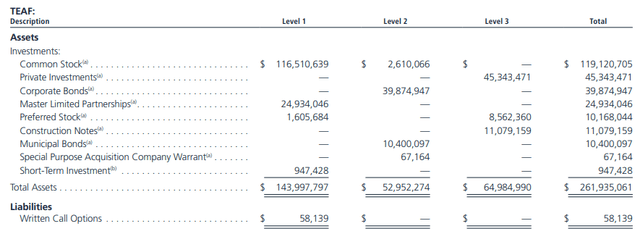

They had almost $65 million in level 3 assets at the end of May 2022. That accounted for 24.8% of the assets of the fund. That in itself can create another risk or potential downside for private investments.

Essentially, they are going to be using their best efforts to value an asset. At the end of the day, an asset is only worth what someone is willing to pay for it. If they have to unload it to terminate, for example, at that time, we would find the “true” value.

There is quite a bit more about the security valuation in the latest report. Here’s an important portion from the report:

An equity security of a publicly traded company acquired in a private placement transaction without registration under the Securities Act of 1933, as amended (the “1933 Act”), is subject to restrictions on resale that can affect the security’s liquidity and fair value. If such a security is convertible into publicly traded common shares, the security generally will be valued at the common share market price adjusted by a percentage discount due to the restrictions and categorized as Level 2 in the fair value hierarchy. To the extent that such securities are convertible or otherwise become freely tradable within a time frame that may be reasonably determined, an amortization schedule may be used to determine the discount. If the security has characteristics that are dissimilar to the class of security that trades on the open market, the security will generally be valued and categorized as Level 3 in the fair value hierarchy.

Unobservable inputs are used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity. Unobservable inputs reflect the Funds’ own beliefs about the assumptions that market participants would use in pricing the asset or liability (including assumptions about risk). Unobservable inputs are developed based on the best information available in the circumstances, which might include the Fund’s own data. The Fund’s own data are adjusted if information is reasonably available without undue cost and effort that indicates that market participants would use different assumptions. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

That brings us to the restricted securities in this fund. At 40.3% of the total assets, or nearly $94.75 million in assets, they are limited in what they may or may not be able to sell. That could create a situation where they might liquidate an investment to raise cash on a holding they otherwise wouldn’t, simply because they can’t liquidate these restricted securities.

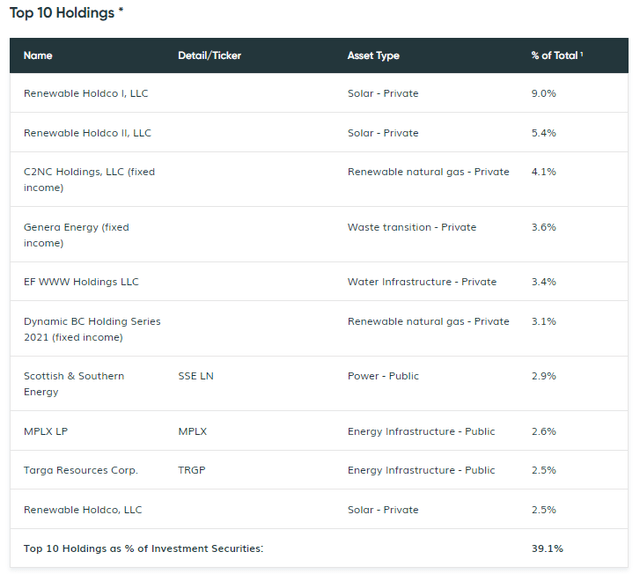

Of these restricted securities, there are also affiliated investments. We have discussed these previously. They remain relevant to the fund because they are its largest holdings. They are private solar investments and a significant part of the portfolio. These affiliated investments are the top two holdings plus the tenth largest holding in the latest reporting for the fund.

These sizeable positions help contribute to what is a fairly narrowly focused fund. CEFConnect puts the number of holdings at 63. The top ten, as we can see below, make up almost 40% of the fund.

These projects are split up into different Rewenable Holdco investments as they invest in different states. Here’s a bit more background on these and how they are affiliated:

As of May 31, 2022, TEAF has committed $63,444,315 to TEAF Solar Holdco, LLC, a wholly-owned investment of TEAF. TEAF Solar Holdco, LLC wholly owns each of Renewable Holdco, LLC and Renewable Holdco I, LLC, which owns and operates renewable energy assets. TEAF Solar Holdco, LLC owns a majority partnership interest in Renewable Holdco II, LLC. Renewable Holdco, LLC and Renewable Holdco II, LLC’s acquisition of the commercial and industrial solar portfolio is ongoing. Renewable Holdco I, LLC acquired the commercial and industrial solar portfolio in September 2019. As of May 31, 2022, TEAF has provided $3,770,670 to TEAF Solar Holdco I, LLC, a wholly-owned investment of TEAF. TEAF Solar Holdco I, LLC has committed to $6,667,100 of debt funding to Saturn Solar Bermuda 1, Ltd. through a construction note. Under the terms of the note Tortoise Solar Holdco I, LLC receives cash payments monthly at an annual rate of 9%. As of May 31, 2021, $3,510,000 of the construction note had been funded.

Affiliated investments with managers that manage several Tortoise funds could lead to a conflict of interest. That’s since most of their funds are free to invest at least a portion of their capital in private investments.

There have been two private investments in 2022 where they put some capital to work. The first was $3.89 million in subordinated notes. The cash yield on this investment was 11.75%. This is one of those investments where they haven’t built the facility yet. However, it will be a new 130-unit senior living community in New Jersey.

They also have put some capital to work very recently, near the end of July, in a charter school. This was a rather small $138k senior taxable bond investment with a cash yield of 11%. This was with the Phoenix modern charter school located in Phoenix, AZ. The deal “will allow the school to acquire its existing facility, and to further expand its capacity with a build-out and renovation of the third floor. This expansion will allow Phoneix Modern to grow from its current capacity of 135 students to 210.”

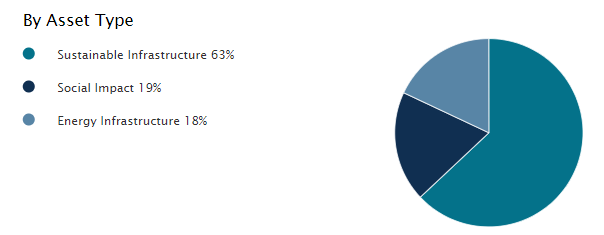

The overall breakdown of the portfolio has the majority of the fund invested in sustainable infrastructure. Social impact (such as these two new private investments) and energy infrastructure make up the rest of the portfolio’s asset allocation.

TEAF Asset Allocation (Tortoise)

A sizeable portion of the infrastructure here is related to natural gas or natural gas liquids at 7.1% of the portfolio. Another 3.4% is natural gas gathering and processing. That’s just on the public side of their C-corp investments. MLPs make up another 10.7% of the portfolio, where there too, they are focusing primarily on natural gas.

Conclusion

I know this fund isn’t for everyone; it probably isn’t even for most people. I know that’s how I concluded my previous article too, but I think it is worth repeating.

Overall, I’d wait for a wider discount or an overall further market dip before wanting to pick up more shares at this time. They haven’t shown to be too successful in this space yet. However, I’m willing to give this small investment of mine more time to play out. A significant reason for such poor performance was launching in 2019, in my opinion. It was right before the fund was set to get rocked by 2020’s negative oil prices. While the fund doesn’t invest too much in oil specifically, we’ve seen a general trend; as crude oil goes, so goes the energy complex, it would seem.

Be the first to comment