CHUNYIP WONG/E+ via Getty Images

Thesis

The Templeton Dragon Fund (NYSE:TDF) is a Chinese equities focused closed end fund that has capital appreciation as its main objective. The fund has over 97% of its portfolio invested in Chinese equities, with the rest being allocated to Hong Kong shares and pure cash. Unlike other CEFs which pay a high dividend, TDF does not currently pay one due to the very poor performance seen in the past year (down almost -40%). Investors need to keep in mind that the CEF structure simply transforms equity returns into dividend yields. When there are no equity capital gains the dividends stop.

The fund employs virtually no leverage, yet it charges a high annual expense ratio of 1.33%. From this angle the fund benchmarks very poorly against a pure China equities ETF such as the iShares MSCI China ETF (MCHI) which only charges 0.57% yet it has very similar 5- and 10-year total returns. A CEF structure charges high fees because presumably it will employ leverage and generate alpha. Without those two factors there is little reason to pay an almost 3x expense ratio.

The fund’s returns are driven by the performance of Chinese equities, and with many analysts speculating China is contemplating a recession, the headwinds are fairly strong for this fund, albeit most of the down move might have already been realized. If you are a holder of the fund we believe most of the drawdown already occurred, so we rate it a Hold. New money looking to enter the space would do well to consider an outright ETF such as MCHI which has proven that similar returns can be obtained with much lower fees.

Holdings

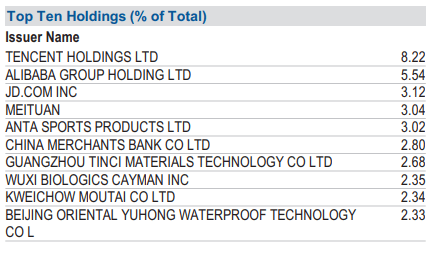

The fund holds some of the largest Chinese technology names by market capitalization:

Top Holdings (Fund Fact Sheet)

The fund holds 34 names in its portfolio but it is fairly granular with the top 10 holdings accounting for only ~35% of the portfolio.

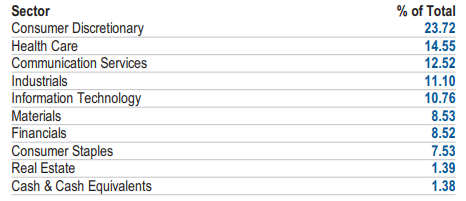

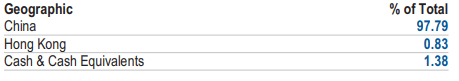

The fund has a consumer discretionary focus which is by far the largest weighting:

Sectors (Fund Fact Sheet)

All of the fund’s exposure is China and Hong Kong based:

Geography (Fund Fact Sheet)

We feel in the current geopolitical environment the parsing of the underlying holdings is less important than in a normalized macro set-up. We are referencing here the recent substantial market sell-off that saw -20% to -40% drawdowns in Chinese ADRs on the back of delisting fears. These fears were the result of political speculation around Chinese help for Russia which would have triggered U.S. sanctions. We feel that political risk was never properly priced for Chinese equities and the current economic slowdown coupled with geopolitical risk have done nothing but hammer home in investor’s mind the importance of the domicile of a specific equity. Chinese tech can have phenomenal CAGRs, but if investors do realize that there is a binary risk of potential de-listing on the back of political issues that have nothing to do with the fundamentals of the companies, then they will price said equities with a higher risk premium.

Performance

TDF is up on a 5-year basis, slightly outperforming MCHI:

5-Year Performance (Seeking Alpha)

The outperformance for the CEF is similar on a 10-year frame, but nothing to write home about:

10-Year Returns (Seeking Alpha)

We can actually see that on a 10-year basis, up to 2020, MCHI (the ETF) actually outperforms the expensive CEF. Ultimately we would expect here an alpha generating performance from a closed-end fund, in order to justify its high fees and the CEF structure to begin with.

Premium / Discount to NAV

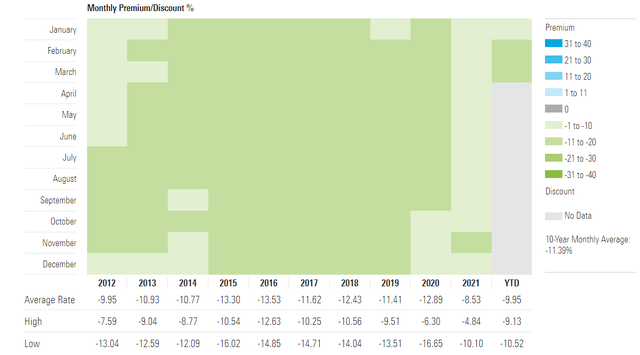

The fund has always traded at a significant discount to NAV and we feel this is justified:

Premium/Discount to NAV (Morningstar)

We can see that historically the discount to NAV has never really tightened below -8% on an annual basis and we believe the reason for this is performance. CEF structures which consistently generate alpha get an investor base willing to purchase the shares, even at a premium, in order to get said management expertise.

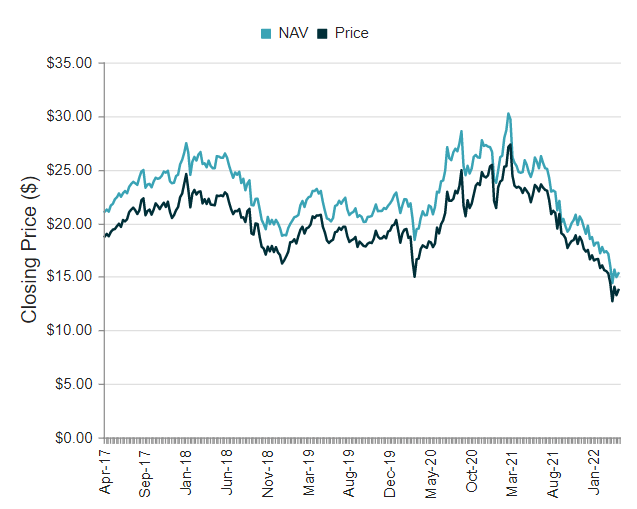

Even on a more granular basis we can see that this fund has never really traded at a premium to NAV:

NAV vs Price (CefConnect)

The fund is currently trading at a -10.61% discount to NAV, which is in the middle of the range for its historic performance, and we feel it will stay bound to these levels.

Conclusion

TDF is a Chinese equities focused closed-end fund. The vehicle charges very high management fees of 1.33% yet it fails to deliver substantial alpha when compared to the China ETF MCHI which only charges 0.57%. In our mind the set-up for a CEF structure is the result of the need to employ leverage to deliver substantial alpha versus a pure ETF vehicle. From its 5- and 10-year total returns we can see that TDF does only marginally better than MCHI. Furthermore the ETF actually outperformed the CEF up to 2020. If you are a holder of the fund we believe most of the drawdown already occurred, so we rate it a Hold. New money looking to enter the space would do well to consider an outright ETF such as MCHI which has proven that similar returns can be obtained with much lower fees.

Be the first to comment