JHVEPhoto

Recently, I saw analysts write bearish articles on the Canadian banks, particularly The Toronto-Dominion Bank (NYSE:TD), due to the ‘imploding housing bubble’ in Canada. While I share some of the analysts’ concerns regarding the housing market and rising interest rates, I think the fears may be overblown.

While the headline grabbing debt-to-disposable income and home price-to disposable income ratios spin a simple narrative for a housing crash and bankruptcies for Canadian banks, astute investors should understand that most of the residential mortgages on the TD’s balance sheet have low LTV. I believe investors should monitor second order effects such as credit card delinquencies and corporate loans.

Overall, TD has already priced in some slowdown, trading at a discounted 10.6x P/E. However, I would not be comfortable buying the stock until we get more clarity on the severity of the coming economic slowdown and its impact to the bank’s earnings.

TD Bank Background

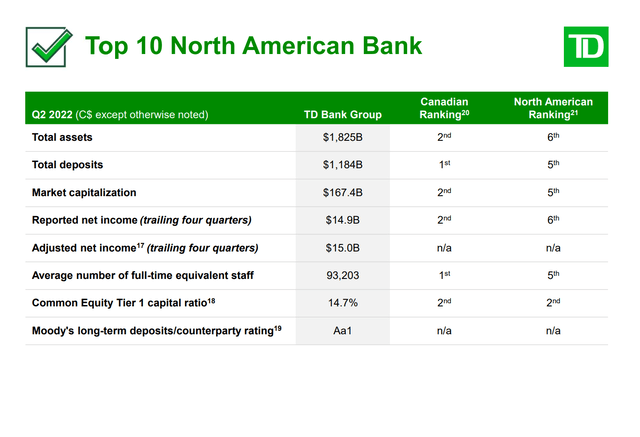

TD Bank, for those not familiar, is the 2nd largest bank in Canada by market capitalization and assets, trailing only the Royal Bank of Canada (RY). It is also the 5th largest bank in North America by market cap, having surpassed Citigroup (C) in the last few years. This is an impressive result, as a decade ago, the Canadian banks were relative minnows compared to the Big-4 American banks (Figure 1).

Figure 1 – TD is a top 10 North American bank (TD investor presentation)

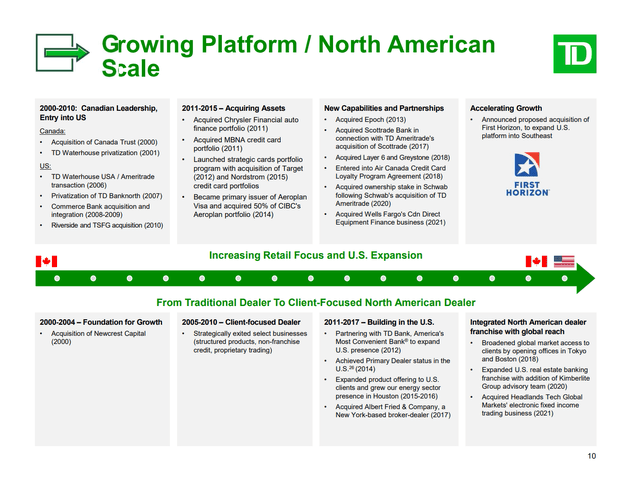

TD achieved these results by gradually building out its U.S. Retail banking franchise through strategic acquisitions and partnerships (Figure 2).

Figure 2 – TD grew U.S. platform through acquisitions (TD investor presentation)

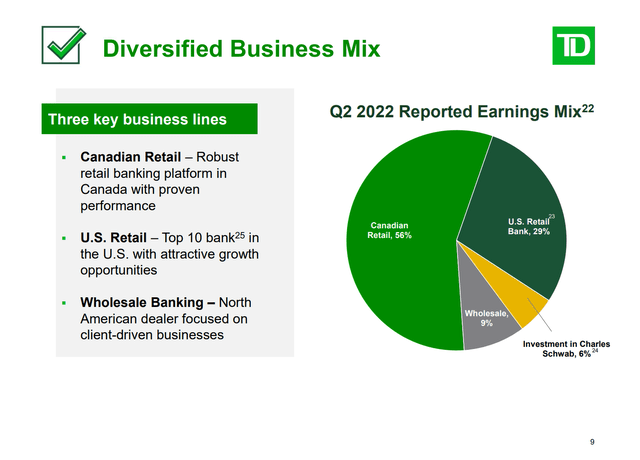

From the initial investment in BankNorth in 2004, TD has grown to become a top 10 U.S. retail bank. With the pending acquisitions of First Horizon Bank (FHN) and Cowen Inc. (COWN), TD will further expand its U.S. retail and wholesale franchises in the coming quarters (Figure 3).

Figure 3 – TD Q2/2022 business mix (TD investor presentation)

Canadian Debt Binge

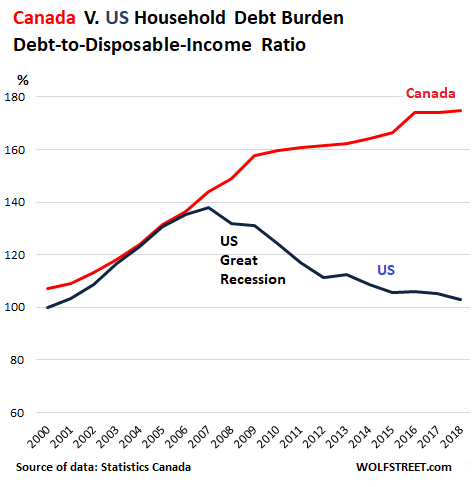

There is no doubt Canada is a heavily indebted country. Figure 4 shows the debt-to-disposable-income ratio between Canada and the U.S. It shows that while the ratio has improved significantly for the U.S. (from ~140% to 100% by 2018), the figure has continued to march higher to over 170% for Canada.

Figure 4 – US vs. Canada Debt-to-Disposable Income Ratio (Wolf Street)

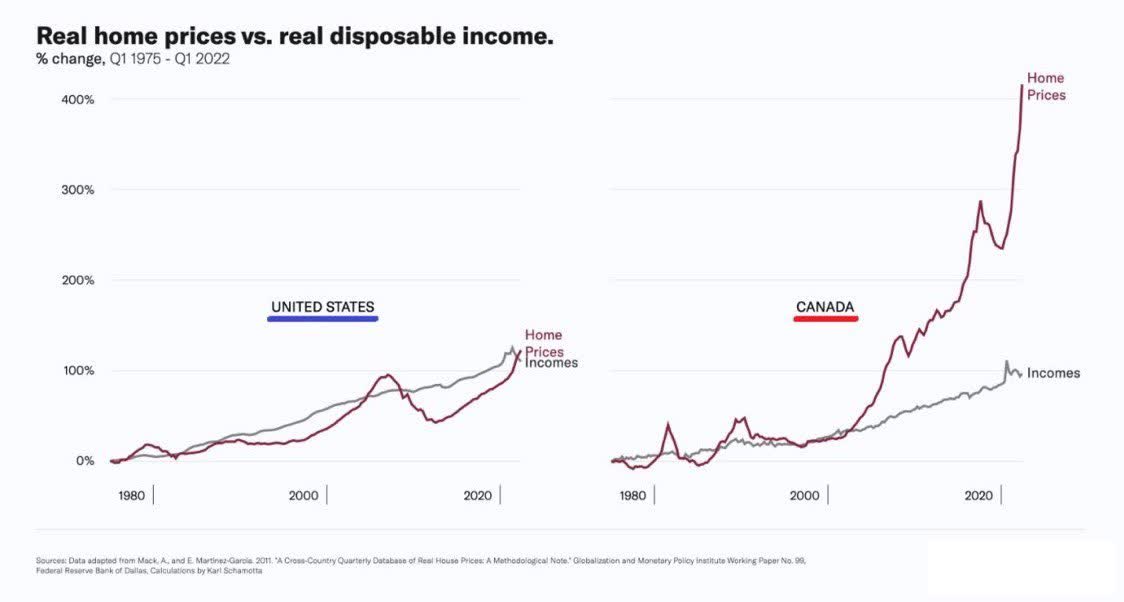

More recently, charts such as that in Figure 5 have been making the rounds on Twitter and other financial sites. Figure 5 shows that while U.S. home prices have increased at roughly the same pace as incomes, Canadian home prices have gone up exponentially relative to incomes.

Figure 5 – U.S. vs Canada Home Prices vs. Incomes (financialsamurai.com)

COVID And BoC Added Fuel To The Fire

The COVID-19 pandemic and work-from-home (“WFH”) policies added to demand for single-family-housing units (everybody needed a home office), especially in the suburbs. C$1 million became a starting point for detached homes, with many homes going for 2, 3, 4x that during the great rush to buy in 2021 to early-2022.

The Bank of Canada (“BoC”) did not help matters. Instead of preaching caution and rationality, the BoC fanned the flames of the housing bubble by telling Canadians that “interest rates are very low and they’re going to be there for a long time”. What do you do when the central bank opens the spigots? You borrow! Nationally, the average home price increased 53% between April 2000 and April 2022.

Now Comes The Hangover

Fast forward to 2022, with inflation running hot, the BoC did a 180 degree turn and began to rapidly tighten monetary conditions. Overnight interest rates were increased in rapid succession to 2.5% (including an aggressive 100 bps hike in July), with the BoC stating its willingness to increase the overnight rate above its 3.0% long-term target to quell an ‘overheating economy’. Elevated levels of household debt and high house prices were highlighted as key vulnerabilities in the BoC’s annual Financial System Review, released in June.

While we are not here to debate policy and point fingers, it is clear the BoC deserves much, if not all of the blame for the current predicament the Canadian economy is in.

The combination of statistics like Figure 5 and the BoC’s insistence on raising interest rates create an easy narrative: ‘The Canadian housing market is in an epic bubble, and banks must go bankrupt as housing prices collapse’.

First Order Housing Risk To TD Overblown

Bringing the discussion back to TD, we don’t believe in the doomsday housing crash scenario, at least not in secured residential lending.

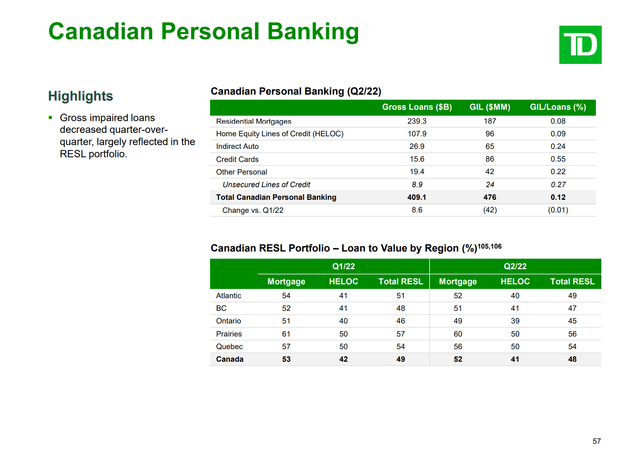

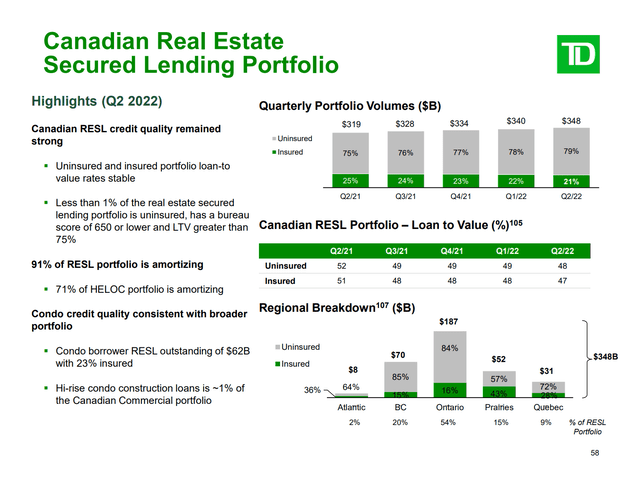

Looking through TD Bank’s Q2/2022 presentation disclosures, we see that Residential Mortgages and HELOCs make up more than 84% of Canadian Personal Banking loans (Figure 6). However, we also see that loan-to-value (“LTV”) for the residential loan portfolio is at 48%. This means house prices will have to fall on average over 50% before the loans take a loss.

Figure 6 – Canadian personal loans (TD investor presentation)

Furthermore, in Figure 7, we see that less than 1% of the real estate portfolio is uninsured, with a credit score of less than 650, and LTV greater than 75%.

Figure 7 – Canadian residential loan to value (TD investor presentation)

The low LTV is a key point that needs to be re-emphasized. In Canada, in order to purchase a home with less than 20% down payment, the homeowner must purchase ‘mortgage default insurance’ that protects the lender in case of default. Default Insurance can be purchased from either a quasi-government entity called the Canadian Mortgage and Housing Corporation (“CMHC”), Sagen (formerly Genworth Canada), or Canada Guarantee. Furthermore, properties with value over C$1 million are not eligible for default insurance.

What this means is that, unless home prices rapidly decline by 50% and homeowners default en masse, the worst effects of the bursting housing bubble will unlikely be felt by the big Canadian banks like TD.

Instead, the pain will be borne by the mortgage insurers (for loans with LTV > 80% and property price less than C$1 million), by alternative lenders (who made loans on properties >C$1 million), or by the homeowners (who have significant equity in their homes).

Investors Should Monitor 2nd And 3rd Order Risks

Instead of worrying about the first order effects on residential mortgages, investors should pay more attention to second and third order effects such as unsecured credit card lending, auto loans, and corporate loans as housing becomes a drag on the Canadian economy.

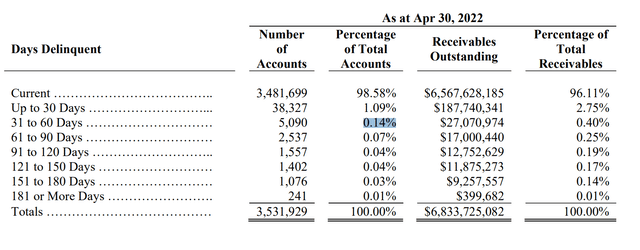

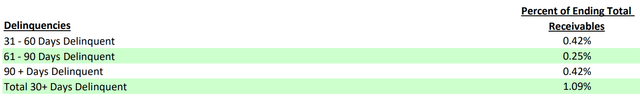

For example, for credit card performance, TD, like many Canadian banking counterparts, have timely asset securitization statistics that investors can monitor. As of April 30, the 31-90 day delinquency rate is 0.65% of total receivables or 0.23% of total accounts (Figure 8). This is broadly in line with the figure from October 31, 2021 of 0.70% and 0.25% respectively.

Figure 8 – TD Evergreen CC Trust Quarterly performance (TD investor relations)

The more timely monthly report shows 31-90 day delinquency rate of 0.67% as of July 31, 2022, roughly the same as the figure from April (Figure 9).

Figure 9 – TD Evergreen CC Trust Monthly Servicer Statement (TD investor relations)

Valuations Already Reflect Some Economic Slowdown

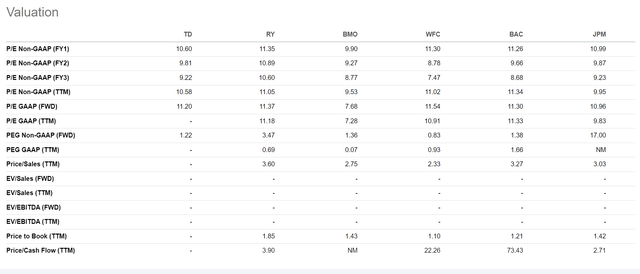

TD currently trades at a 10.6x 2022 P/E, in line with the sector’s 10.4x, but a discount to US peers like Wells Fargo (WFC), Bank of America (BAC), and JPMorgan (JPM) (Figure 10).

Figure 10 – TD valuation (Seeking Alpha)

However, this multiple is a discount to TD’s historic forward multiple, which has averaged 11.4x (Figure 11).

Figure 11 – TD historical forward P/E (tikr.com)

This implies some level of economic slowdown has already been priced into the stock.

Conclusion

While the headline grabbing debt-to-disposable income and home price-to disposable income ratios spin a simple narrative for a housing crash and bankruptcies for Canadian banks like TD, astute investors should understand that most of the residential mortgages on the TD’s balance sheet have low LTV, meaning bank mortgage credit losses are not expected to be large. Instead, investors should monitor second order effects of a housing slowdown such as credit card delinquencies and corporate loan performance. Overall, some level of slowdown has been priced into TD’s stock price, trading at 10.6 P/E. However, I would not be comfortable buying the stock until we get more clarity on the severity of the coming economic slowdown and its impact to the bank’s earnings.

Be the first to comment