cokada

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on November 23rd, 2022.

Calamos Long/Short Equity & Dynamic Income Trust Fund (CPZ) is, as its name would imply, a fund that has long and short positions. The short positions are designed to generate returns when things are falling, and the long positions should participate in the upside when things are running higher.

There are two reasons why I think this strategy is interesting; it can be for tactical purposes or when attractively valued.

2022 is an example of being used tactically, where it acts as a hedge to the downside. It has accomplished that when compared to the broader market but has still generated losses. And remember, when a bull market returns, it could also dampen upside potential. This is why I believe it should be utilized as a tactical position.

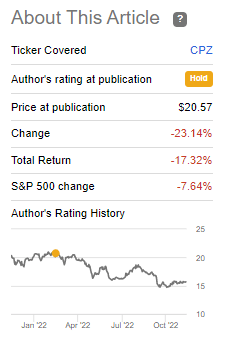

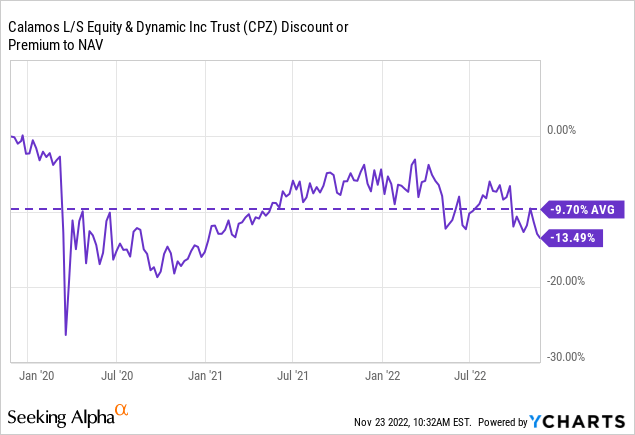

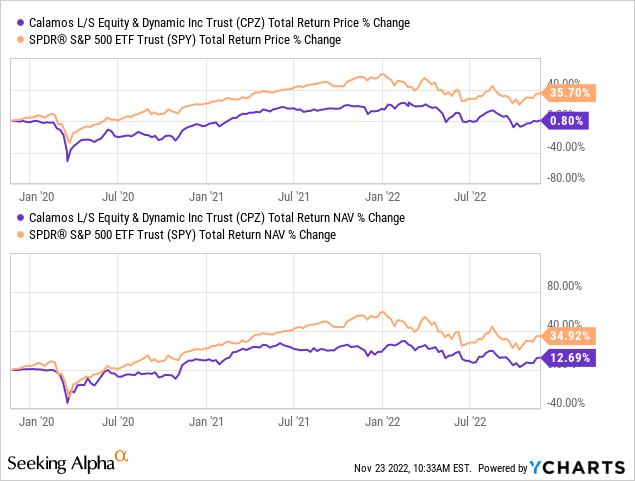

Another reason to invest in this fund could be at an abnormally large discount. That is what we have today, making it a more interesting proposition now, in my opinion. Due to the fund running to a larger discount compared to earlier this year when we looked at the fund, it actually made the fund’s performance relative to the S&P 500 much weaker.

CPZ Performance Since Last Update (Seeking Alpha)

The underlying portfolio performed better than its share price. Thus, exactly what we look for when exploiting closed-end fund discounts and premiums. We want to see a fund go to a discount when its underlying portfolio performs relatively well, but its share price doesn’t respond.

However, it isn’t risk-free. Due to the downside performance drag it can produce in a bull market, in the future, that is something to consider. You’d naturally want to avoid this fund if you expect equities to recover materially from here. Additionally, as a leveraged fund, that produces greater risks and volatility overall too.

The Basics

- 1-Year Z-score: -1.88

- Discount: 13.49%

- Distribution Yield: 10.69%

- Expense Ratio: 1.89%

- Leverage: 25.71%

- Managed Assets: $466.76 million

- Structure: Term (anticipated liquidation date November 25th, 2031)

CPZ’s investment objective is to “seek to provide current income and risk-managed capital appreciation.” They also add, it “seeks to provide hedged market exposure built around Calamos’ time-tested global long/short equity strategy.” The portfolio fit they mention, “the fund may be appropriate for risk-conscious investors who want to put capital to work in pursuit of income and capital appreciation.”

They invest in a broad array of holdings and aren’t limited to any asset in particular. That includes long/short equity positions, along with preferred and fixed-income exposure. Calamos has traditionally been geared towards convertible exposure, but this fund offers primarily high-yield corporate debt in its fixed-income component.

Unlike some of its Calamos cousin funds, CPZ runs its leverage entirely from borrowings instead of borrowings and preferreds. This, too, has its pros and cons. While rates were zero, running with a credit facility was beneficial. The leverage was cheap. With rates rising, borrowing costs are also rising in this case. They pay a rate of OBFR plus 0.80%.

One thing they could utilize as a long/short fund – and even long funds implemented in this environment – is to go short U.S. Treasuries. CPZ hasn’t done that, at least not in the last holdings available. They are only short equities, with no short positions in fixed-income through derivatives such as shorting future contracts. So at this point, they are essentially entirely exposed to the higher leverage costs with no offsetting hedges to negative some of the increased expenses.

At least not directly, they are short a sizeable position in the S&P 500 ETF (SPY). If one submits to the notion that the market is suffering this year due to higher inflation that’s causing the Fed to be hawkish and raise rates rapidly, then indirectly, it is hedged. Besides the expected recession next year due to the Fed’s aggressive interest rate hiking, I’m not sure what else would be really hitting the market this year. So I certainly find this to be a plausible theory.

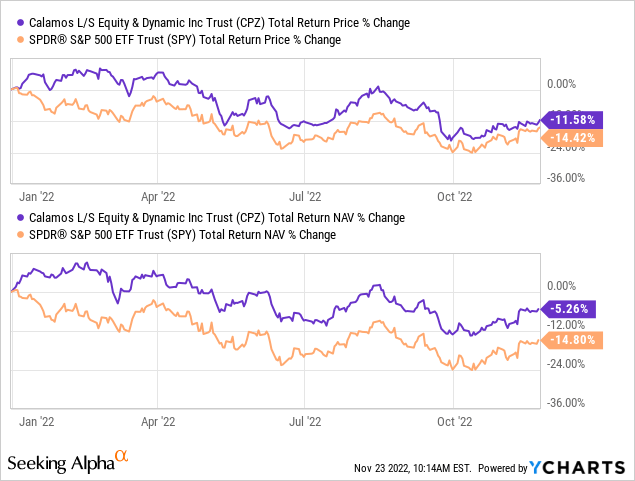

Performance – Winning, For Now

As noted at the beginning of the article, CPZ is accomplishing its goal on a YTD basis. At least on a portfolio basis, as the total NAV return has given superior results compared to SPY. This is the likely outcome when SPY is declining, and you run a short SPY position.

Ycharts

At the same time, the fund’s total share price return has been rather lackluster. Once again, outpacing the SPY on this basis, but not as materially so. This is the direct result of the fund’s discount widening out significantly. In the February update earlier this year, it was at around a 3% discount. Now, we are well over a 13% discount at the time of writing.

The fund has traded at this level before, but it was primarily through 2020. There was a little thing about COVID going on. The market was also rallying significantly after that little COVID event as the Fed, and Congress stepped up in a big way. Naturally, the strong market would hurt a fund like CPZ’s performance.

Ycharts

Unsurprisingly, in 2020 and 2021, the results in performance have been rather stark. That’s why it’s worth highlighting again; this is more of a tactical fund. You don’t necessarily buy-and-hold this type of fund.

Ycharts

However, if you believe that the next decade or even next year could see rather muted returns. If you combine the fund’s discount and that type of expectation, you would or should believe that CPZ has a strong chance of once again outperforming.

Distribution – Shorts Can Provide Potential Gains In A Bear

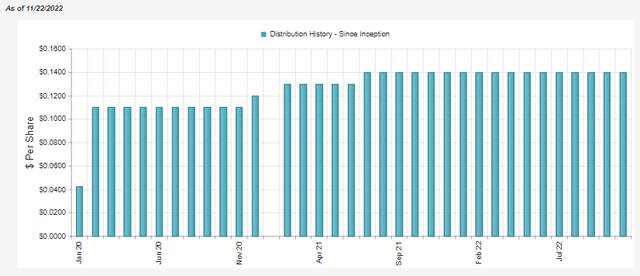

Despite not performing as well as the broader market, the fund was still able to bump up its distribution several times since it launched.

CPZ Distribution History (CEFConnect)

The latest distribution yield works out to an attractive 10.69%, and it comes to 9.25% on a NAV basis. Being that the fund can benefit from short positions to produce capital gains, it is uniquely positioned for this type of environment.

Relatively speaking, it should mean less of a chance for a distribution cut when compared to a long-only fund. Long-only funds will be under heavier pressure to produce the capital gains that it requires to meet their payout. Eaton Vance is an example of this, with most of their equity funds cutting recently.

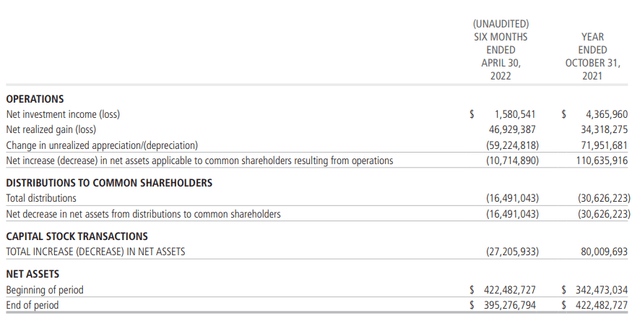

CPZ produces some net investment income; with the latest report, the NII coverage came to 9.58%.

CPZ Semi-Annual Report (Calamos)

We can also see that for the six months that ended April 30th, 2022; the fund had made up the shortfall through realized capital gains easily. However, the unrealized depreciation in the portfolio had offset any gains, which resulted in the decline of the NAV overall through the period.

We should get the next annual report with updated figures near the end of the year. That will give us a better look at what sort of income, appreciation and depreciation the fund has for their fiscal year – which has actually already ended at the end of October.

CPZ’s Portfolio

Being a long/short hybrid fund, there are a lot of components to look at for this fund. The turnover rate on this fund is also quite high, meaning that anything we look at today could become quickly outdated or already has been. All the data they share is as of the end of October. Their last semi-annual report showed a portfolio turnover rate of 93%. Last fiscal year, it came out to 213%. So the managers are certainly not sitting around; they are busy managing the fund.

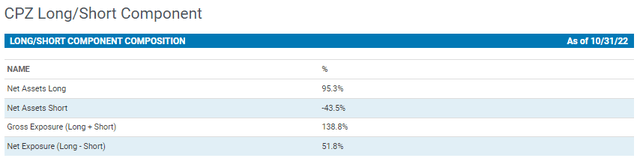

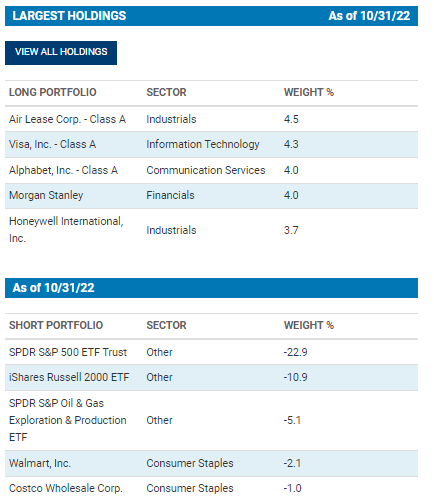

Broadly speaking, the portfolio is longer than it is short.

CPZ Long/Short Exposure (Calamos)

When looking at the positions on the short side, they tend to hone in on shorting ETFs. This can be a good and a bad thing. They are essentially picking the general direction of equities and will benefit from such a shift if they move lower. This can be compared to their long positions, where they select individual names that they feel are attractive positions to hold.

With a bias towards increases most years, this is why the strategy is set to lag the broader market returns – at least, that’s what history has shown us. The market generally climbs over longer periods. Anything is possible in the future. This also means they don’t tend to emphasize individual positions that they feel might fall.

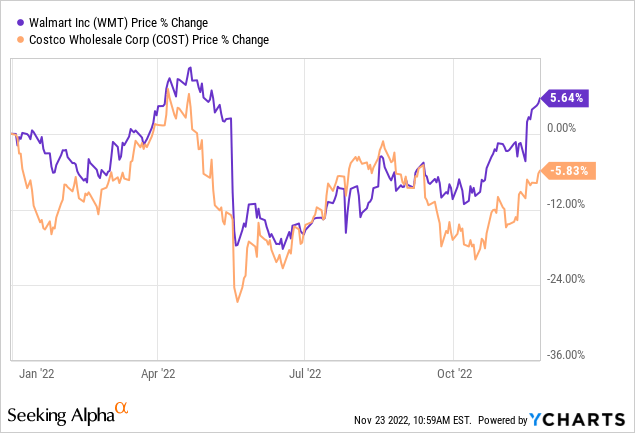

At this point, the individual positions with meaningful short weightings that show up are allocated to Walmart (WMT) and Costco (COST).

CPZ Top Long/Short Positions (Calamos)

They were short COST since earlier this year. However, WMT wasn’t a position they were short in a top-five weighting in our previous update. Given the trajectory of WMT more recently, being short wasn’t the right move. Their latest earnings were much better than expected.

Ycharts

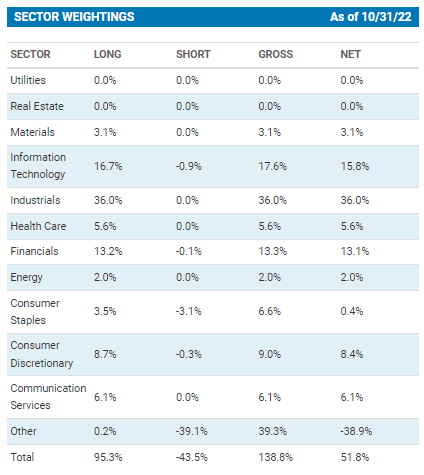

One area that they remain concentrated in is when it comes down to their sector exposure. Since earlier this year, the weighting to industrials has been significantly overweight. The only other fund I can recall this overweight in industrials is the Aberdeen Standard Global Infrastructure Income Fund (ASGI).

In that sense, if you are looking for a fairly uniquely positioned fund in the long/short space, they aren’t afraid to make concentrated bets in sectors outside what we see elsewhere. That is primarily because we see the tech in a heavy weighting in most other “diversified” funds. Tech does make up a fairly substantial 15.8% net weighting, so it’s still a significant weighting at the end of the day.

CPZ Sector Allocation (Calamos)

Following the weighting to industrials and tech, we have financials at a net weighting of 13.1%. The financial weighting was the second largest exposure previously after industrials. However, they ramped up the tech exposure more considerably in this latest report. They’ve also substantially decreased energy exposure from the net 10.5% weighting.

Morgan Stanley (MS) also shows up as a top-five holding for the fund, contributing to this financial weighting. Financials are uniquely positioned in an environment of higher interest rates to generate more net interest income.

However, the smaller regional banks and not the large financial institutions are better suited for this. In general, they generate a larger portion of their profits from loans. Banks are also susceptible as cyclical businesses when going into recession or economic downturn, which means they aren’t acting as strongly as most would imagine.

Admittedly, I thought financials would have acted better this year. The sector is still outperforming something like SPY, but it isn’t providing as much shelter as I thought it possibly could have this year.

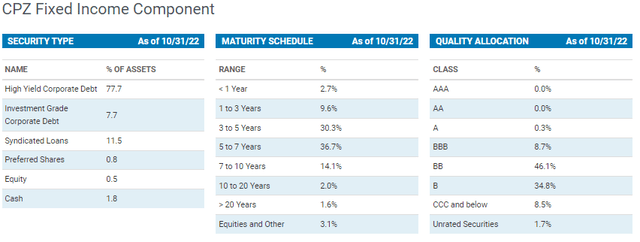

Finally, when taking a look at the fixed income exposure of CPZ, we see that it is largely invested in high-yield corporate debt.

CPZ Fixed-Income Stats (Calamos)

For the credit quality breakdown, the largest portions are invested in BB and B rated debt. There is some exposure to CCC; that’s the type of rating that gets applied to companies who need just about everything to go right for it to work out. It isn’t too unsurprising to see a weighting there. In fact, it is quite normal for most CEFs I’ve run across. We also have to remember that these weightings are within a much smaller overall allocation of fixed income within CPZ.

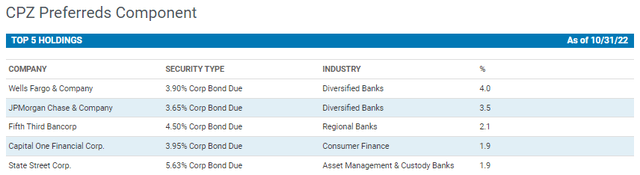

On the other hand, when looking at their preferred holdings, the heaviest weightings are in investment-grade holdings. That, too, can help balance out the riskier portions of the high-yield investments that CPZ is carrying.

CPZ Preferred Top Positions (Calamos)

At the same time, these higher-rated preferreds issued by investment–grade banks are going to be more interest-rate sensitive. These are fixed rates, meaning that they get negatively impacted when rates rise. That’s the trade-off for being less subject to credit risks.

Conclusion

CPZ is a unique closed-end fund that participates in long/short positions. The short positions are a fairly sizeable focus of the fund. However, the fund does have more long exposure than short. This type of fund can be quite helpful to provide a hedge in a down year. As we saw this year, it limited losses relative to the broader market. At the same time, it isn’t necessarily a buy-and-hold type fund because, in bull markets, the results will be less stellar. They also still didn’t produce positive results, and the fund’s discount widened, which actually chiseled away a substantial portion of the positive impacts.

If one believes that next year or the next decade is going to have more muted returns, CPZ could be great to have exposure to. At the current discount, that’s also a significant bonus at this time.

Be the first to comment