AndreyPopov

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way—in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

— Charles Dickens, A Tale of Two Cities

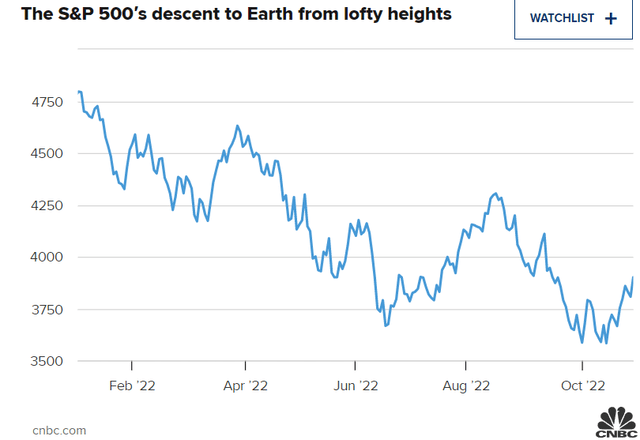

Are we heading into the worst recession since 2008, or has the tide turned and we are about to embark upon a new bull market, following one of the worst bear markets in years thus far in 2022? Investor sentiment is incredibly bearish and up until about two weeks ago, prices for just about everything from stocks to bonds to commodities were crashing hard. Experts disagree on where we are headed next.

CNBC

In the past two weeks, stocks have been rallying despite pessimistic earnings and cautious forward guidance from major tech companies like Amazon (AMZN), Meta (META), and Alphabet (GOOGL). We may have seen the bottom in early October, or we might simply be experiencing a bear market rally that will be short-lived. Most likely, the volatility will continue, and the future direction will be determined after the elections are over in another week.

History tells us that stocks tend to outperform in the 12-month period after a mid-term election regardless of the election results. In fact, according to this recent Yahoo article, the outperformance has been significant compared to “average” 12-month returns.

- Since 1942, the median equity market returns in the first three quarters of midterm election years were -1%, 2% and 5%, respectively. 4Q returns jumped to 8%. (Source: U.S. Bank)

- The average annual return of the S&P 500 in the 12 months before a midterm election is 0.3%, below the historical average of 8.1%. (Source: U.S. Bank)

- The S&P 500 has historically outperformed in the 12-month period after a midterm election, with an average return of 16.3%. (Source: U.S. Bank)

- The last time the S&P 500 Index produced negative returns during the 12 months after a midterm election was 1939 (see Great Depression World War 2). (Source: U.S. Bank)

If you are a long-term investor seeking passive income in retirement, now may be a very good time to start adding to some steady income producing investments that will generate a future monthly income stream while offering some long-term protection to downside risk of capital erosion. The experts at XA Investments advise two such funds, one in coordination with Thornburg Investment Management, and the other with Octagon Credit Investors.

XFLT – CLOs And Floating Rate Credit

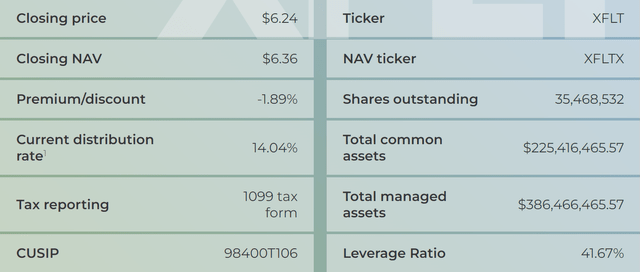

The income fund called XAI Octagon Floating Rate & Income Term Trust (NYSE:XFLT) is a trust structured as a CEF that invests in a dynamically managed portfolio of floating rate credit and other credit rate instruments within private markets. Under normal market conditions, the trust will invest in at least 80% of managed assets in senior secured loans, CLO debt and CLO equity. The fund adviser is XAI, and Octagon is the fund sub-adviser. The fund’s objective is to seek attractive total return with emphasis on income generation across multiple stages of the credit cycle.

XFLT Overview (XA Investments)

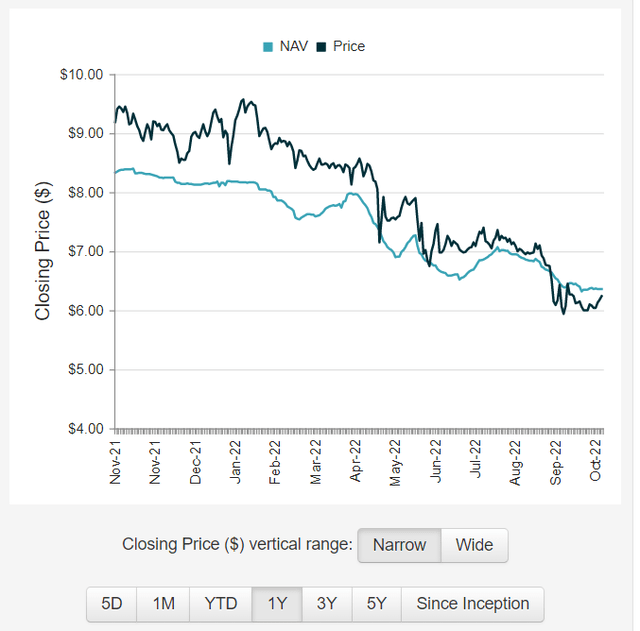

I previously reviewed XFLT back in May of this year when I suggested to hold through the turbulence. At the time I had suggested to hold due to market volatility that drove down the NAV in the first quarter of the year, however, the fund continued to pay, and still does pay the same monthly distribution.

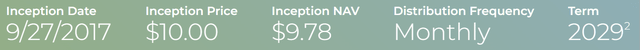

The fund was started in 2017 as a term fund, with the term expiring (unless extended or converted to perpetual) in 2029.

XA Investments

Since October 2020 and continuing through this month the distribution has been held steady at $0.073. In May when I wrote the previous article, that worked out to an 11% annual yield and the fund was trading at a 9% premium above NAV. As of 10/28/22 the yield is over 14% and the fund now trades at a slight discount to NAV of -1.89% as shown on CEFconnect.

CEFconnect

The portfolio NAV may have just bottomed along with the broader stock market, and if so, it presents an excellent buying opportunity for new investors or for those long-term holders who wish to increase their position. I rated XFLT a Buy back in May when the shares were trading for $7.60. I update my rating to a Strong Buy at the current market price of $6.24. There is no guarantee that the pain is behind us now, so the price could still go lower. But I believe that the distribution is well covered and will continue to pay the same monthly dividend through December at least.

Seeking Alpha

According to a recent article from Nick Ackerman, the NII (net investment income) increased in the latest coverage period to 88.8%, up from 87.8% in the previous quarter. Sales of additional shares also increases the expected NII, and we should learn more about how that impacted third quarter results when they issue their report in the next few days.

If you are concerned about the relative risk of CLO equity and/or CLO debt investments and other leveraged loan instruments, there are several good articles on Seeking Alpha that cover the pros and cons of investing in funds that hold CLOs, including my recent coverage of Eagle Point Credit Company (ECC). Equities (stocks, stock funds) are much riskier investments than leveraged loans and CLOs in the current market environment where many are predicting a severe recession in 2023. Another way to understand that perspective is to read a recent article from another of my favorite authors, Steven Bavaria, in which he explains why investing in credit funds like XFLT and another of my income-generating positions, Invesco Senior Income (VVR), which actually benefits from rising interest rates, enable a future income stream without “eating into your seed corn” like equity funds do.

TBLD – Income From Global Dividend Growth And Fixed Income

Switching over now to a different investment offering that XAI provides advisory support and secondary services to, I want to take a fresh look at Thornburg Income Builder Opportunities Trust (NASDAQ:TBLD), which I last wrote about in February of this year. In that article, I quoted Thomas Paine and I feel that quote is still very relevant today, nearly 9 months later.

“These are the times that try men’s souls”

— Thomas Paine

TBLD is another term fund, with the term expiring in August 2033, that has Thornburg acting as portfolio managers.

Thornburg Investment Management is a privately-owned global investment firm that offers a range of solutions for retail and institutional investors. Founded in 1982 and headquartered in Santa Fe, New Mexico, we manage approximately $44.3 billion (as of March 31, 2022) across U.S. mutual funds, separate accounts for high-net-worth investors, institutional accounts, and UCITS funds for non-U.S. investors.

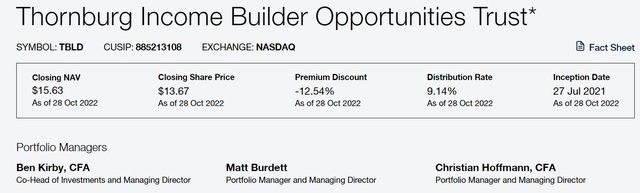

From the fund’s website, the shares are trading at a discount to NAV of -12.5% and yields over 9% annually at the current distribution rate, which has also been held steady since the fund’s inception date of July 2021.

Thornburg website

The fund’s investment approach and strategy as described in the fund’s overview:

The Trust will invest at least 80% of its Managed Assets, directly or indirectly, in a broad range of income-producing securities. The Trust will invest in both equity and debt securities of companies located in the United States and around the globe. The Trust may invest in companies of any market capitalization and may invest in both U.S. and non-U.S. countries, including up to 20% of its Managed Assets at the time of investment in equity and debt securities of emerging market companies. The Trust’s global equity allocation is expected to represent 75% of Managed Assets and may vary over time between 50% to 90% of Managed Assets. The Trust’s global debt allocation is expected to represent 25% of Managed Assets and may vary over time between 10% to 50% of Managed Assets.

The Trust’s options strategy is intended to generate current income from options premiums and to improve its risk-adjusted returns. The notional amount of the options strategy will be approximately 10% to 40% of the Trust’s Managed Assets. The Trust does not intend to use leverage and has a 12-year term.

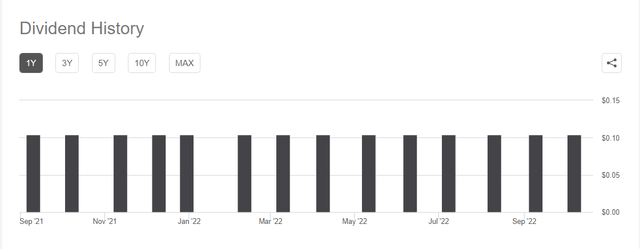

The distribution history indicates a steady monthly distribution of $0.10417 since September 2021, and none of it has included return of capital.

Seeking Alpha

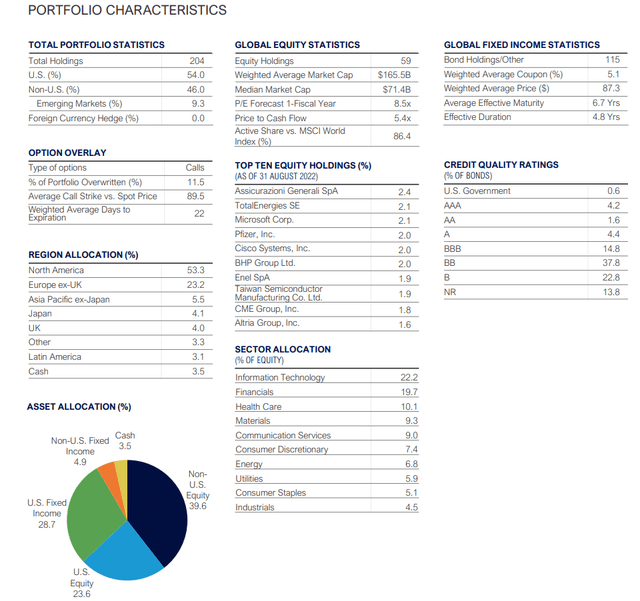

TBLD Portfolio Composition

With a combination of equity investments and fixed income, the fund’s holdings and characteristics are summarized in this view from the fund September 30 fact sheet.

TBLD fact sheet

The equity weighting has shifted to only about 63% with about 33.5% in fixed income and the rest in cash.

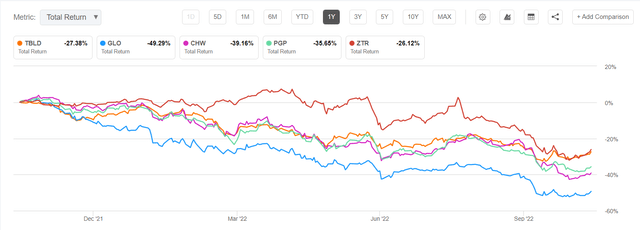

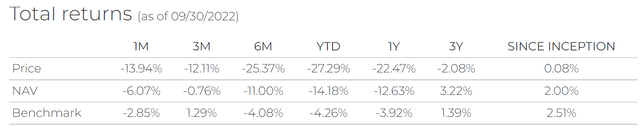

Performance since inception has unfortunately been negatively impacted by the poor timing of the public offering, which turned out to be just before the market peaked last fall. If you only looked at the past performance, it would not give you a warm, fuzzy feeling about the fund. However, given the circumstances and what the fund managers have been dealing with, the total return over the past one-year period is not terrible. In fact, compared to several other hybrid global allocation funds, TBLD has offered a total return that is second only to Virtus Total Return fund (ZTR), another fund that I own for the income generation, as shown by the charting tool on Seeking Alpha.

Seeking Alpha

From the fund’s March 2022 semiannual report, Portfolio Manager Jason Brady summed up the situation at the time by quoting his one-time colleague who was prone to Yogi Berra-like malapropisms.

These days, I recall one of his pronouncements around the time of the dot.com bubble and crash: “Just when you think you’re out of the woods, you go right back into the soup.”

He then went on to make a rather prescient prediction when he continued,

I don’t expect the volatility that we’ve seen in the last six months to abate and given somewhat elevated risk asset prices (though deflated from my last letter to you), markets remain vulnerable to shocks. High inflation has been one of those shocks, and it will take some time to resolve factors contributing to that inflation, such as supply-chain challenges, home price appreciation effects on measured shelter costs, and labor cost and availability issues. Ultimately, we expect various central banks across the globe, certainly including the Federal Reserve, to be forced to make a choice between containing inflation at the expense of employment and losing control of inflation expectations in the name of supporting a hotter economy.

With about $480M in managed assets and no leverage, the fund is nicely positioned in my view to offer a well-covered distribution while taking advantage of opportunities to acquire mis-valued equities that are being presented during this market downturn that offer future capital appreciation potential and dividend growth whenever the market does resume its recovery.

In fact, during the 3rd quarter fund update from October 20, portfolio manager Adam Sparkman had this to say about the current state of the market dynamics:

At the end of 2018, as well as in early 2020, we had a similar dynamic where the broader closed end market had dislocations across global equity and multi-assets, funds in particular, similar to what we’ve seen in 2022. And I think the encouraging thing is that those gaps for the market really closed pretty quickly, as market sentiment improved. … I do want to reiterate that while environments like today are obviously challenging for investors, as well as you as shareholders, as Christian mentioned in the beginning of the call, it does present really attractive opportunities for active managers, like ourselves.

Concluding Remarks

The year 2022 has been a challenging time for many investors, especially those who have never experienced a severe bear market where both stocks and bonds lost value and very few asset classes offered any real downside protection from inflation and rising interest rates. On the other hand, for investors with a long-term mindset and who are willing to take on a reasonable level of risk to generate future increasing passive income streams, the two funds that I highlighted in this article present compelling buying opportunities.

With XFLT there is some guaranteed income from CLOs and leveraged loans that have become undervalued due to increasing fears of worsening credit markets and rising inflation along with the Fed’s efforts to contain inflation by increasing the base lending rates. Those fears have led to a reduction in the fund’s NAV that have then resulted in a drop in market price to near 52-week lows as I write this. The total return performance of the fund in the past year has been abysmal, however, over the past 3 years the total return by NAV of the fund has beaten the benchmark by nearly 2 percentage points.

XA Investments

As it is often stated, past performance is no guarantee of future results, and with the possibility of a recovery in the credit markets looking more likely after the election is concluded, investors may have a rare opportunity to take advantage of the current low market price to establish a future income stream with a yield on cost of more than 14%.

With the potential upcoming recovery in equities based on past market history in post-election years, the opportunity for TBLD to take advantage of market mispricing offers a different and unique opportunity for investors with a long-term horizon and an income-focused perspective. The hybrid approach to the fund’s portfolio construction enables the fund managers to take advantage of a rebounding bond market along with undervalued, high-quality dividend paying global equity positions that offer future capital appreciation potential along with a recurring income stream.

With an aging global population demanding income for retirement, Thornburg offers income seeking investors a CEF that provides that income now from globally diversified sources. The opportunities that are present in the market today can be taken advantage by the portfolio managers to acquire quality assets at low prices with the potential for capital appreciation to further increase the total return of the fund over time.

For these reasons, I recommend investors acquire shares in both funds that I covered in this article, XFLT and TBLD, if you are interested in securing an income stream for retirement and your investing horizon is at least five to ten years or more. The market volatility may continue, and the prices of both funds may fall again if the bear market resumes its downward trajectory. Meanwhile, I believe that the steady income stream and the opportunity to increase the total return by reinvesting at lower prices justifies the potential downside risk for investors with a reasonable risk tolerance.

Be the first to comment