Mrinal Pal

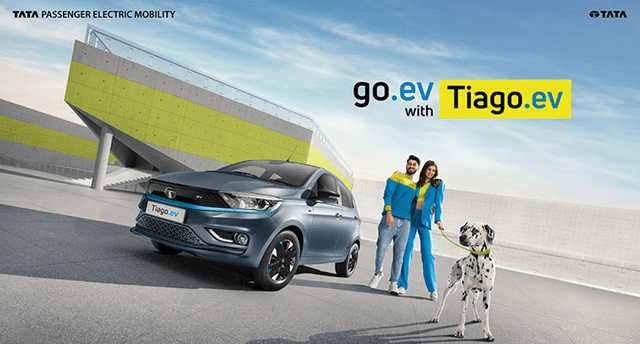

Tata Motors’ (NYSE:TTM) recent launch of an electric vehicle (EV) variant of its popular hatchback model, Tiago, has seen a surprisingly strong reception thus far, with >10k bookings since early October. In effect, the company looks to be taking the lead in the Indian mass EV market given its premium yet affordable vehicle offerings. In the near term, the Tiago launch likely won’t make much of a dent in market leader Maruti’s (OTCPK:MRZUY) overall volumes, but the first-mover advantage in EVs could make it challenging for Maruti to catch up.

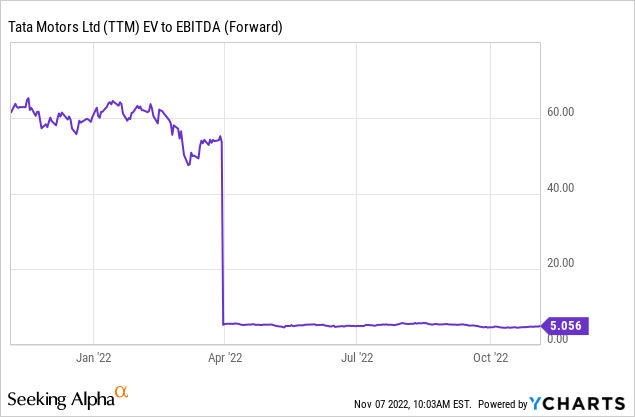

Heading into the upcoming earnings report, I like the setup for Tata Motors stock. The company has been progressing well on its balance sheet deleveraging efforts, and the Jaguar Land Rover (JLR) business is on track to halt its cash burn (even with the ongoing volume weakness). Plus, the discounted ~5x fwd EBITDA multiple already discounts a lot of the negatives, and the risk/reward appears quite favorable here.

Unveiling the Tiago EV

Tata Motors’ unveiling of the electrified variant of its popular hatchback, Tiago, lived up to expectations and then some. The vehicle launch is India’s first electric premium hatchback offering and expands the company’s EV portfolio beyond the Nexon and Tigor EV models into the hatchback segment. The Tiago EV will share the high-voltage ZipTron architecture with Tata’s Nexon and Tigor EV models, although it will also have some uncharacteristically premium features for its segment. These include standard telematics for all trims, as well as 8-speakers with Android Auto and Apple (AAPL) Car Play connectivity.

The key positive was the price – Tata has clearly leveraged its learnings from the Nexon EV and an improving supply chain backdrop into an attractive price point for the Tiago EV. As things stand, introductory pricing for the 19.2 kWh battery pack variants is in the Rs849k- Rs909k range, while the 24 kWh variants are priced in the Rs999k- Rs1,179k range. At first glance, this is still well above combustion engine hatchbacks in this segment, such as Maruti Suzuki’s Swift. Yet, compared to upper-end hatchback variants with similarly premium features, the pricing is quite competitive vs. the >Rs800K range for combustion engine models.

Going on the EV Offensive

As of October 13, the newly-launched Tiago EV has received >10k bookings (note bookings opened on October 10), despite deliveries only being targeted to commence from January 2023. This was a positive surprise, given electric passenger vehicles in India do not receive the same subsidies afforded to the two-wheelers. The FAME II subsidy (a scheme to drive “faster adoption and manufacturing of electric vehicles), for instance, is limited only to commercial vehicles. The public charging infrastructure is also at a nascent stage, limiting the day-to-day utility of an EV. Yet, the high demand levels for the Tiago EV indicate its growing appeal, even to the entry-level customer segment, as the price points become more attractive. Given the Tiago EV’s first-mover advantage in a segment that sees >40k of volumes on a monthly basis, even a conservative ~10% penetration would imply ~4k units of monthly sales volume going forward.

Going off the early traction and the price competitiveness, Tata has something special on its hands with the Tiago EV, and I wouldn’t be surprised to see the car become an EV best-seller in India sooner rather than later. As India transitions from combustion engines to EVs, this bodes well for Tata’s ability to close the gap with Maruti, currently the market leader in the hatchback segment. Selling premium electrified vehicles (based on both the Born EV platform and ICE-converted models) at affordable prices will be hard to replicate, and as the company executes its plan for ten BEVs by 2025 (implying two EV launches a year), I see Tata gaining further share at Maruti’s expense. Another key advantage is its connection to the wider Tata group companies, particularly in setting up charging infrastructure to accelerate EV adoption in India. As scale benefits accrue to margins, incremental market share gain in the EV market should add significantly to margins and, by extension, the overall market cap.

Successful Tiago Launch Paves the Way for Long-Term EV Leadership

Tata Motors has made its intentions clear with the launch of an electrified variant of its popular entry hatchback, the Tiago EV. Bookings have already outperformed thus far, supporting the company’s ambitions for ten EV launches by 2025. If successful, Tata stands to extend its valuable first-mover advantage in the nascent Indian EV market over the current market leader Maruti. It remains early days, and the Tiago launch won’t materially change the competitive landscape anytime soon, but as we’ve seen in other markets, catching up to the first mover tends to be particularly challenging in the EV market. In the meantime, the rest of Tata Motors’ business is on a recovery path as cost reduction efforts continue to offset volume declines. At a discounted ~4x fwd EBITDA valuation, the stock looks attractive heading into earnings later this week.

Be the first to comment