Mrinal Pal/iStock Editorial via Getty Images

Tata Motors (NYSE:TTM), a leading India-based automobile manufacturer with a leading presence in commercial vehicles, as well as utility vehicles, trucks, buses, and defense vehicles, recently reported a below-par quarter on significant profitability declines in the Jaguar Land Rover (JLR) operations. Of note, weaker product mix and the inability to pass on input cost headwinds without incurring a corresponding volume decline were key points of concern, although there is light at the end of the tunnel given JLR’s growing order backlog. Plus, Tata remains on track for a cyclical rebound amid a recovery in semiconductor supply – just in time to meet the buoyant volume outlook following the launch of the new Range Rover.

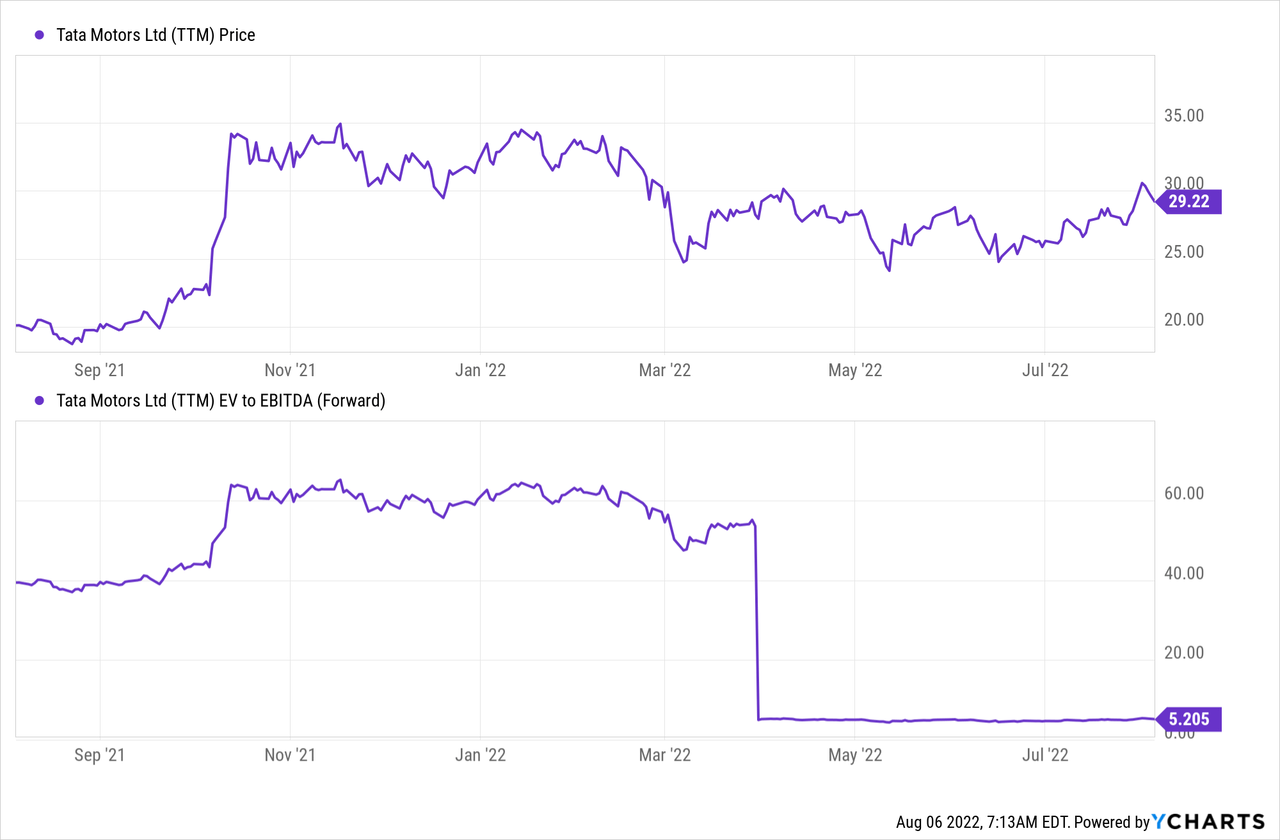

As major OEMs such as Tata Motors tend to benefit from operating leverage, any volume improvement should have a disproportionately positive impact on cash flows and, by extension, accelerate deleveraging in the coming quarters. At ~5x EV/EBITDA, the stock is cheap as well, leaving ample room for upside as the turnaround story for the domestic business and JLR takes shape.

Jaguar Land Rover was the Weak Point, but Don’t Write Them Off Just Yet

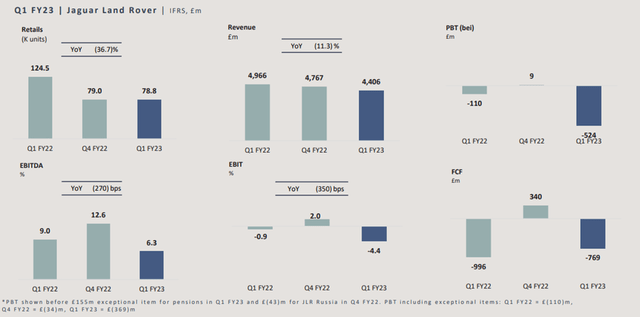

The biggest disappointment of Tata’s Q1 2023 results was JLR EBITDA numbers at ~GBP279m (-38% YoY), driven by lower volume following the latest round of price hikes, a negative product mix shift (i.e., lower volume contribution from Range Rover and Range Rover Sport), and headwinds from China (volumes down ~50% YoY), On the other hand, higher inflation-linked contribution costs (~350bps negative impact) were the key headwind, highlighting JLR’s lack of pricing power in the current environment. Of note, even with higher sticker prices, realized selling prices actually declined ~2% QoQ. When compared with EU peers such as BMW/Audi/Mercedes, JLR’s volumes also underperformed due to an outsized impact from semiconductor constraints.

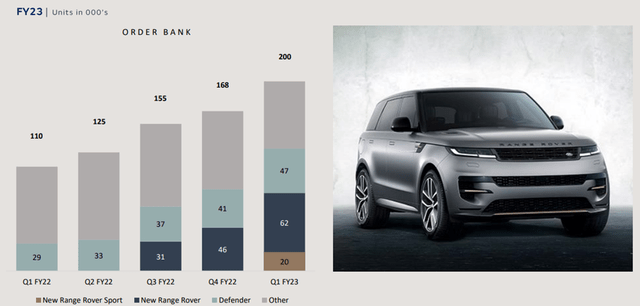

While management is sticking with its strategy of taking more price increases and implementing cost-saving actions to recover the cost inflation, a volume recovery and an easing chip shortage will likely be the key to a P&L rebound from here. Thus far, recovery signs have been positive – JLR’s order book now stands at a solid ~200k amid positive customer bookings for the new Range Rover, Range Rover Sport, and Defender models. Assuming the new models ramp up in the coming quarters alongside production, the overall product mix should also improve, presenting upside to JLR’s ~5% EBIT margin and ~GBP1bn free cash flow guidance for 2023.

Transitory Margin Pressure for Passenger Vehicles but Outlook Remains as Strong as Ever

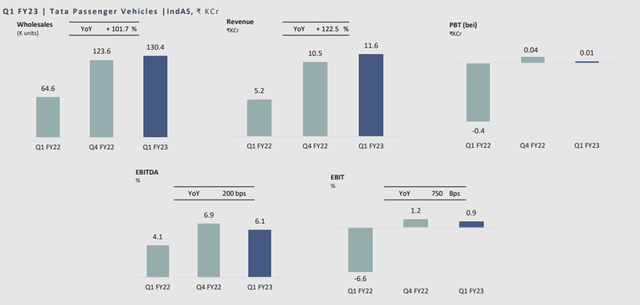

Tata’s domestic passenger vehicle business may have posted a QoQ EBITDA margin decline on higher promotional expenses this quarter, but the ~10% QoQ revenue growth due to stronger volumes and pricing was an overwhelming positive. The business also saw record wholesale and production numbers during the quarter at >130k, with robust booking pipelines and low channel inventory. More broadly, the company looks set to be a key beneficiary of a strong product cycle (including its new rickshaw variants) – a positive tailwind for its market share in the coming quarters.

The current order book already has an up to three-month backlog and, despite waiting periods extending from four weeks to three months, has seen relatively few cancellations. Assuming the chip supply improves further from Q2 (in-line with management expectations), the company should be well-positioned to meet demand via a 10-15% capacity de-bottlenecking. Looking beyond the immediate future, the refresh cycle is also due to start next year and drive volumes, while management’s commitment to also launch new products in accordance with product gaps bodes well for the mid to long-term outlook.

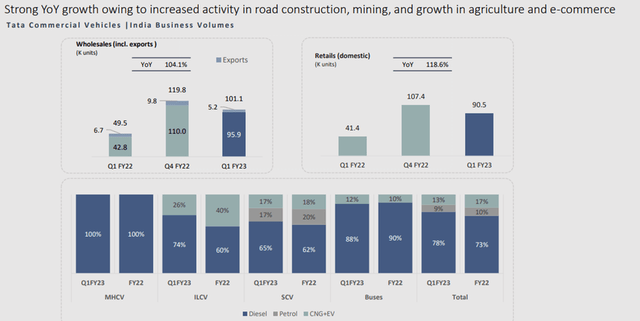

Ongoing Demand Recovery Buoys Domestic Commercial Vehicle Outlook

Tata’s commercial vehicle outlook remains as robust as ever amid strong freight demand and truck fleet utilization. While most of the post-COVID rebound had been concentrated in larger fleets, management is starting to see a demand recovery in small fleet operators as well. Of note, Tata’s trucker’s sentiment index is now at a two-year high across both medium & heavy commercial vehicles and the intermediate & light commercial vehicle categories. I would also highlight that the bullish reading comes despite demand from small fleet operators being restricted by tighter financing standards (85-90% LTV vs. 95-100% in the last cycle) as well as an uncertain operating environment.

That said, with commodity prices also starting to ease and ongoing geopolitical tensions driving an increase in freight rates, any financing headwinds should be more than accounted for – even for the smaller fleet operators. Thus, Tata should see a domestic cyclical recovery in segmental EBITDA margins from here, with the next catalyst likely to be the upcoming steel contract repricing (likely at lower rates).

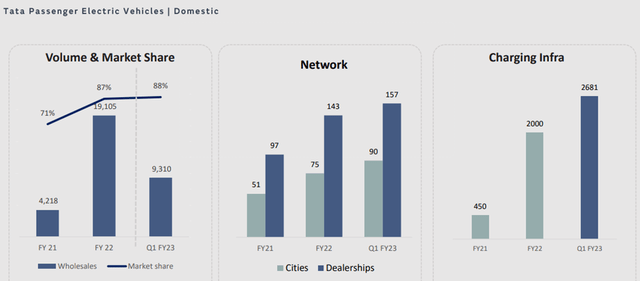

Burgeoning EV Business Presents Long-Term Optionality

Electric vehicle volumes remain a small portion of passenger vehicle volumes at ~7% this quarter – by comparison, internal combustion engine contribution stood at 64% and 18% for petrol and diesel, respectively. Still, Tata Motors’ continued market leadership within EVs is commendable, particularly given the supply-constrained backdrop. Per management, the appetite for EVs is positive – many of its models currently have a waiting period of seven months and higher (well above its ICE models). Plus, the company has a robust EV pipeline in place, having recently launched a longer-range version of the Nexon EV and retaining plans to launch more models in the years ahead.

Within India, though, EV penetration will likely remain in the low to mid-single digits % range unless EV costs become more competitive. Admittedly, this is a tough ask in the near term, with battery material costs on the rise amid ongoing supply disruptions, but over the long run, Tata’s EV business presents significant optionality. In particular, the company’s head start has allowed it to gather crucial customer and powertrain intelligence data, allowing it access to capital through the cycles – TPG’s recent ~$1bn investment, for instance, pegs the EV segment at a massive ~$9.1bn post-money valuation.

Weak Quarter but On Track for a Rebound

Tata Motors may have disappointed this time around, but the outlook is far from bleak – semiconductor supply looks set to improve from here, and with the new Range Rover already getting a positive response, the post-Q2 volume outlook could surprise to the upside. The operating leverage benefit from an improvement in volumes could lead to a disproportionately positive impact on earnings and cash flows, helping to accelerate debt reduction as well. Expectations are also low with the stock priced at the current ~5x fwd EBITDA multiple, so any positive signs of a turnaround in the domestic business as well as for JLR could catalyze a re-rating.

Be the first to comment