ipopba

A Quick Take On TaskUs

TaskUs (NASDAQ:TASK) went public in June 2021, raising approximately $127 million in gross proceeds from an IPO that was priced at $23.00 per share.

The firm provides enterprises with a variety of outsourced digital services for customer care and content security applications.

While TASK is generating impressive growth and profits, a global slowdown may exert unpredictable effects on its near-term results, and we don’t know whether a slowdown will help or hurt the company’s net operational results.

For that, I suggest that interested investors put TASK on a watchlist for close consideration in the period ahead.

Until we learn more about its trajectory in a slowing growth environment, I’m on Hold for TaskUs.

TaskUs Overview

New Braunfels, Texas-based TaskUs was founded to provide labor outsourcing services to enterprises seeking to accommodate increased demand.

Management is headed by co-founder and CEO Bryce Maddock, who received a B.A. in International Business from New York University.

The company’s primary offerings include:

-

Digital Customer Experience

-

Content Security

-

AI Operations

The company provides services to firms in industries including general technology, streaming media, food delivery and ride sharing, financial technology and health technology.

TASK pursues client relationships in high-priority industry verticals such as various technology verticals and food delivery and ride sharing.

TaskUs’ Market & Competition

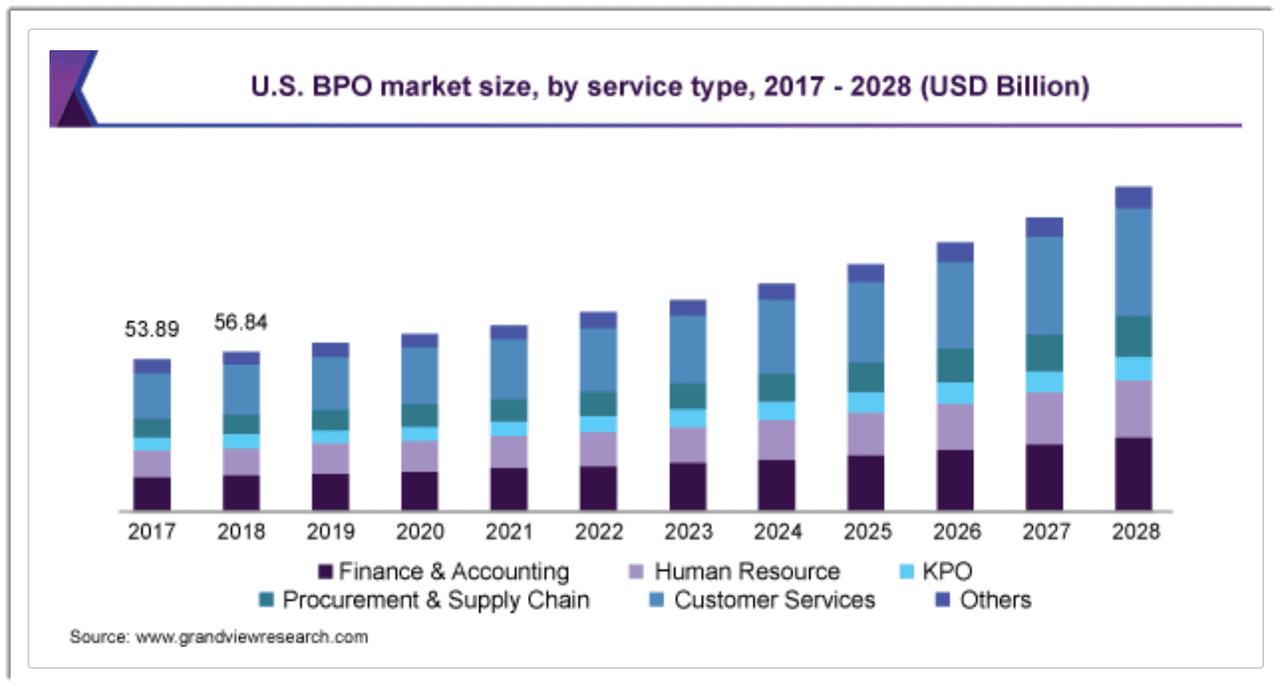

According to a 2021 market research report by Grand View Research, the global market for business process outsourcing was an estimated $232 billion in 2020 and is expected to reach $446 billion by 2028.

This represents a forecast of 8.5% from 2021 to 2028.

The main drivers for this expected growth are an increasing usage of digital tools and delocalized talent to maximize business efficiencies.

Also, the versatility of outsourcing services is increasing as other types of service process automation and intelligence adds to return on investment for enterprises.

Below is a chart showing the historical and expected future growth trajectory of process outsourcing services in the U.S.:

U.S. BPO Market (Grand View Research)

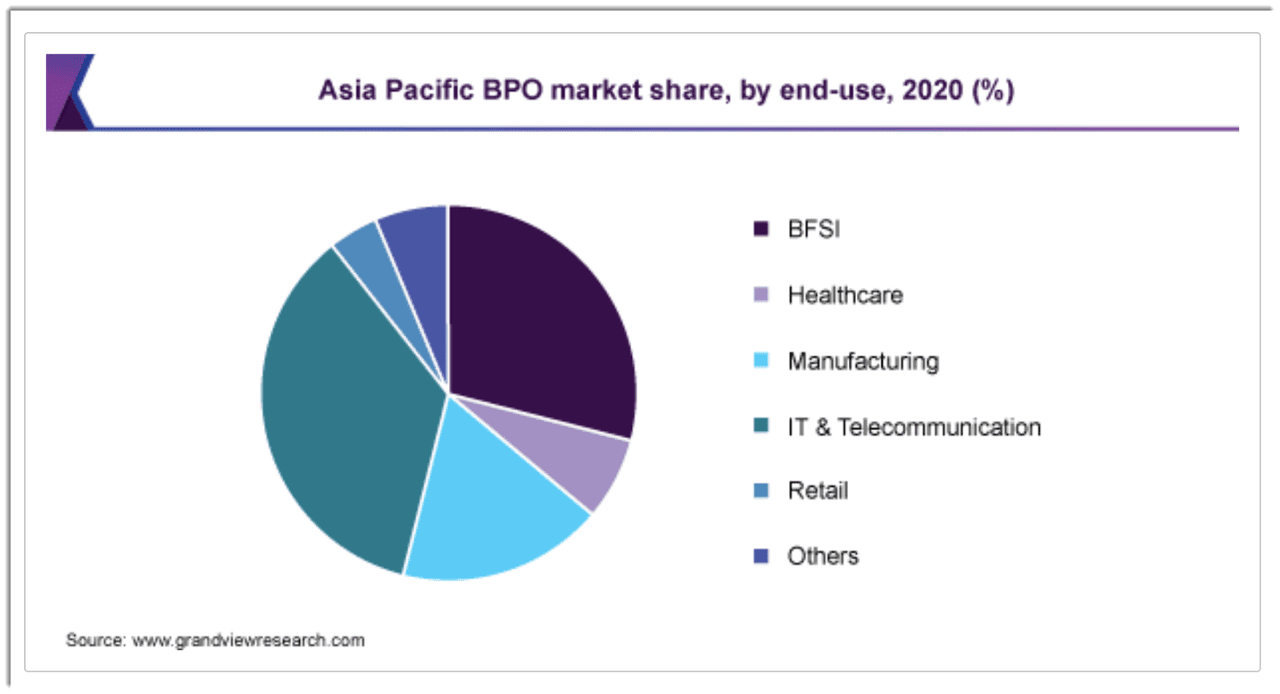

The Asia Pacific market is forecast to see the highest CAGR from 2021 to 2028, and the chart below indicates the breakdown of that market by end-use industry in 2020:

Asia Pacific BPO Market (Grand View Research)

Major competitive or other industry participants include:

-

24/7 Intouch

-

Appen

-

TDCX

-

Accenture

-

Genpact

-

Tata Consultancy

-

Cognizant

-

Teleperformance

-

Telus International

-

TTEC

-

VXI

-

Sutherland

TaskUs’ Recent Financial Performance

-

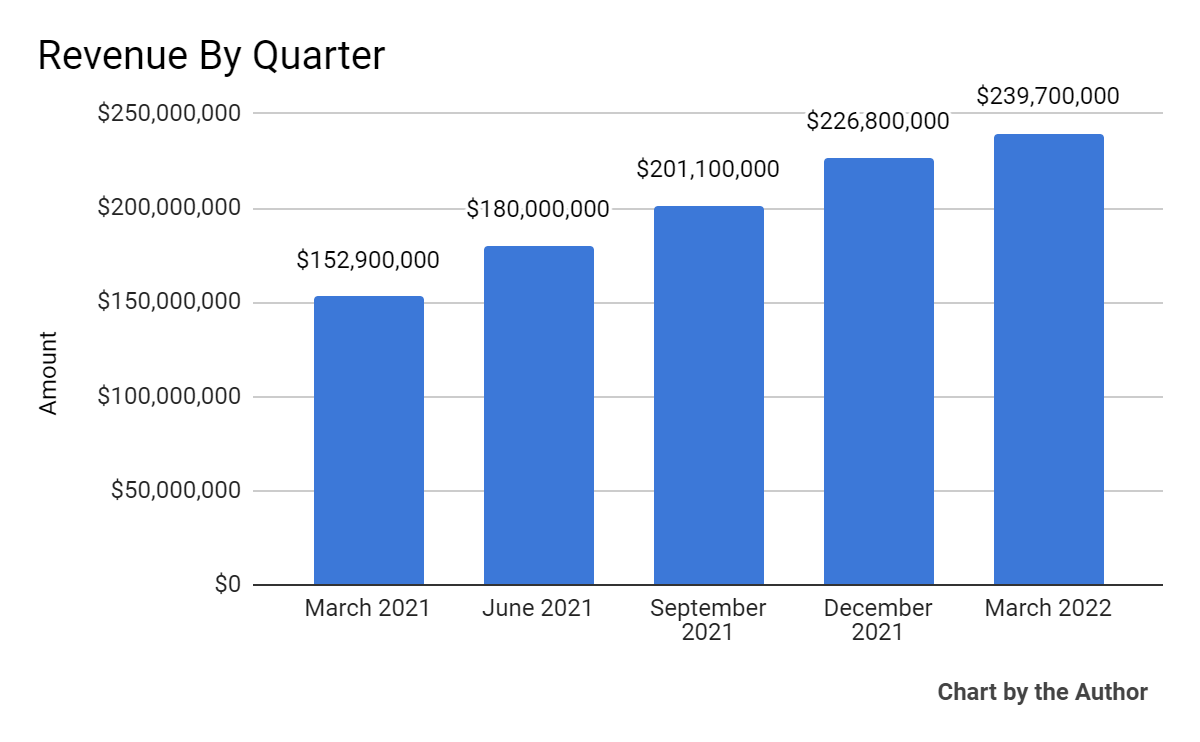

Total revenue by quarter has grown impressively over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

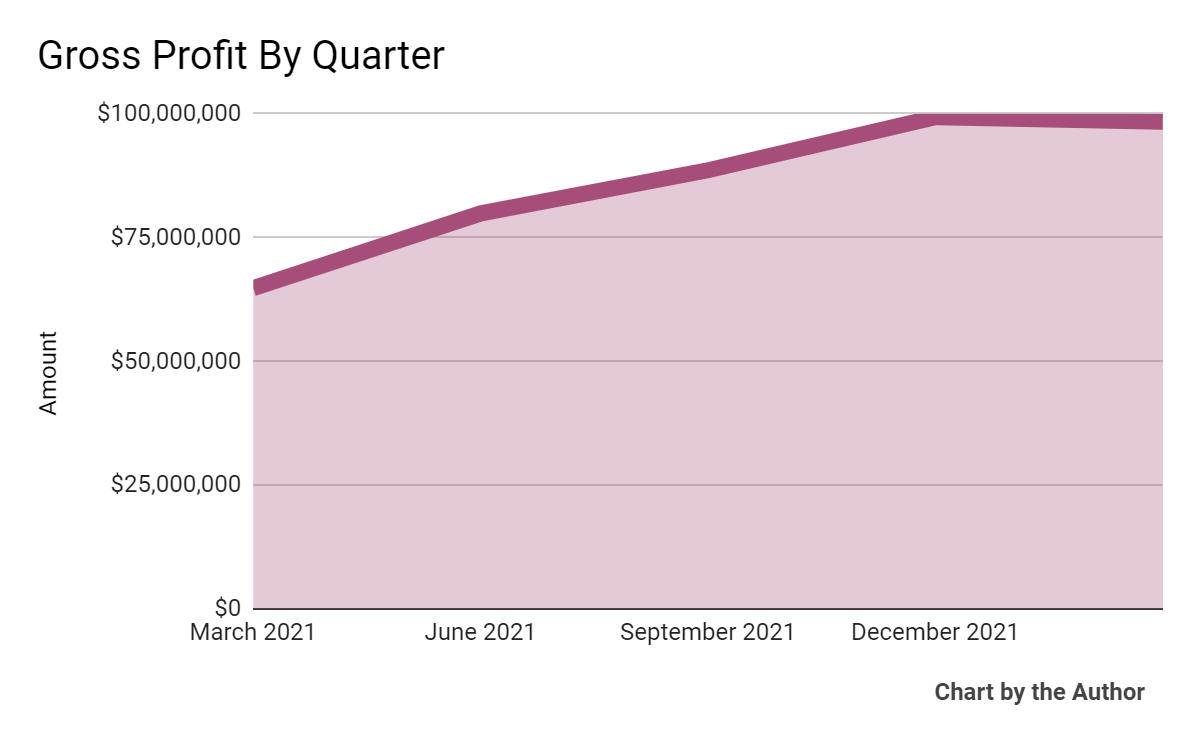

Gross profit by quarter has grown but recently plateaued in Q1 2022:

5 Quarter Gross Profit (Seeking Alpha)

-

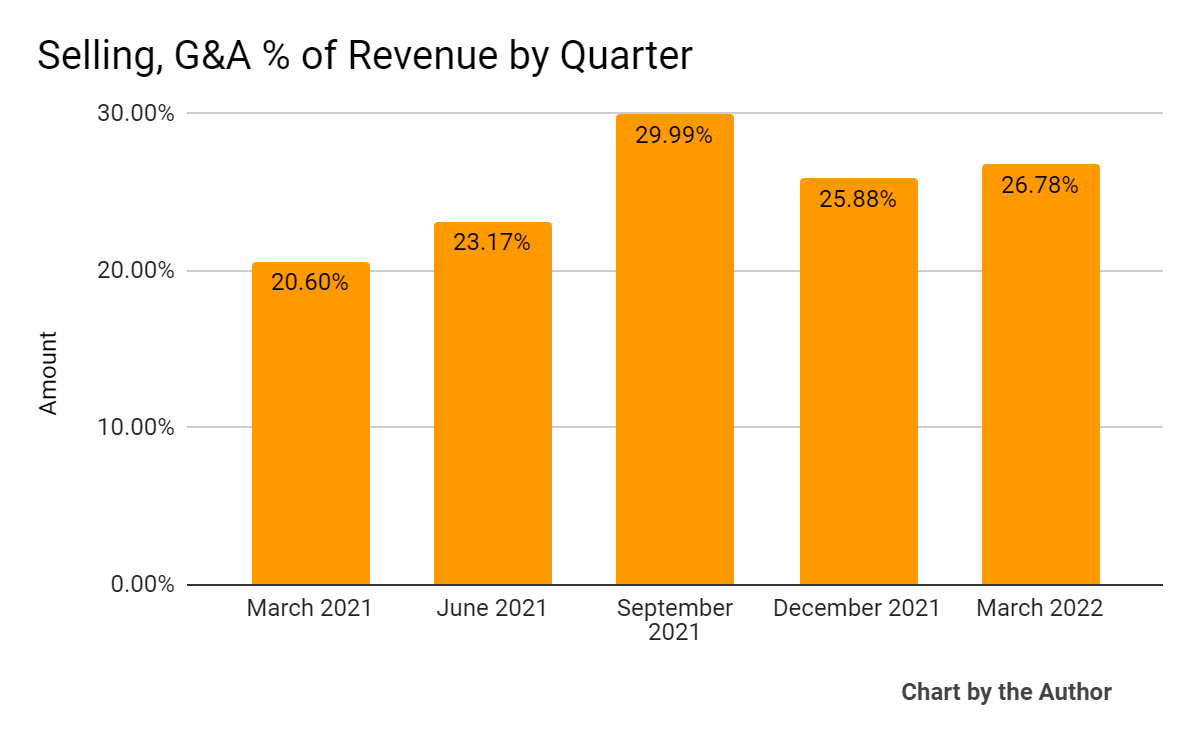

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher over the past 5 quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

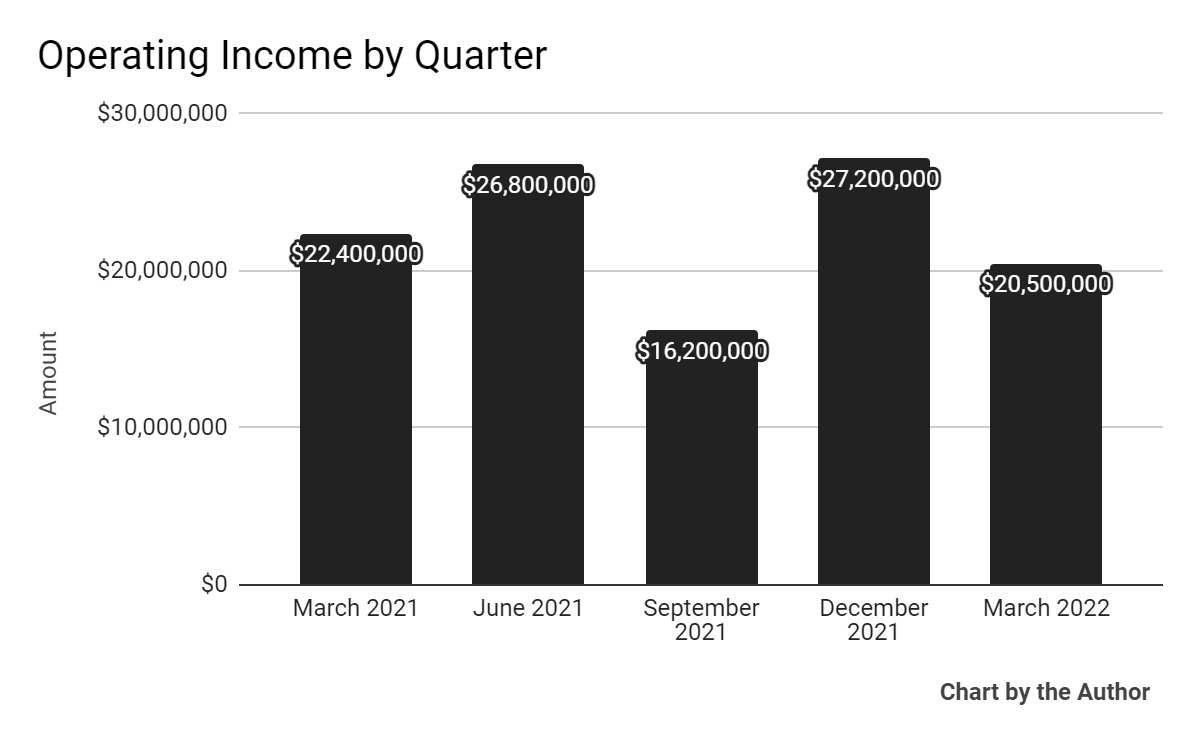

Operating income by quarter has fluctuated but remained positive, as the chart shows below:

5 Quarter Operating Income (Seeking Alpha)

-

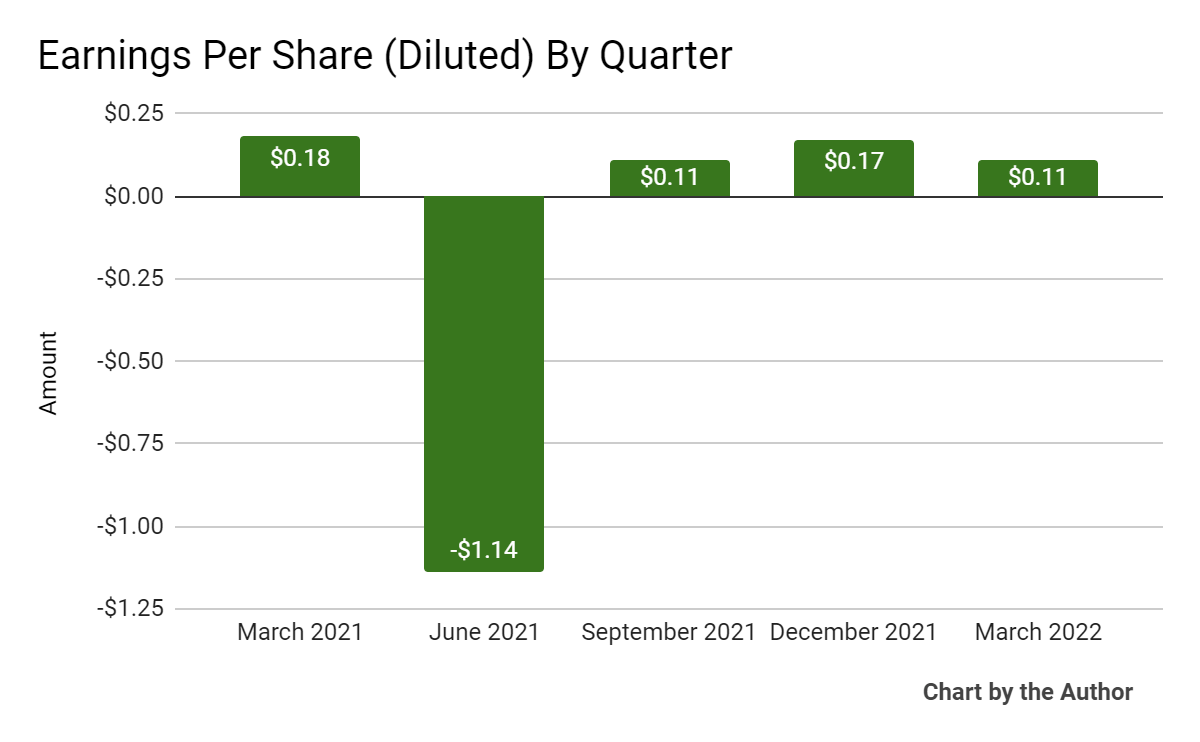

Earnings per share (Diluted) have been positive in 4 of the last 5 quarters, with Q2 2021 being negative due to stock-based compensation expense related to the firm’s IPO:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

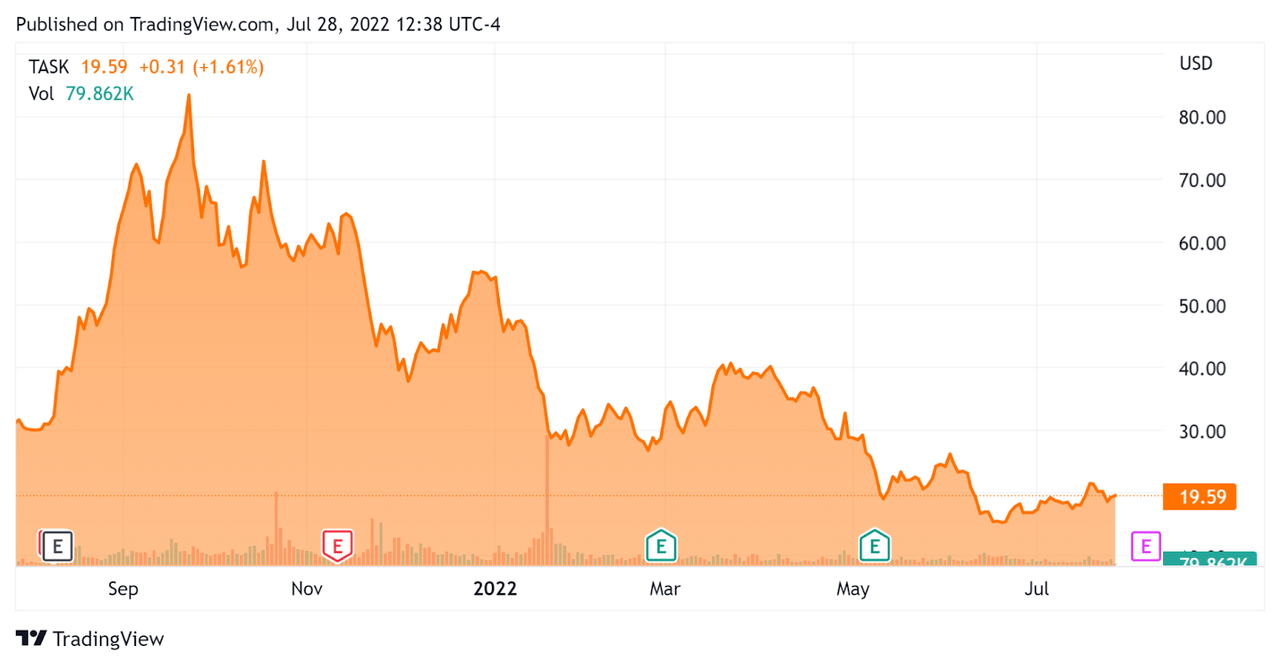

In the past 12 months, TASK’s stock price has dropped 36.8% vs. the U.S. S&P 500 Index’s drop of around 7.9%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For TaskUs

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$2,040,000,000 |

|

Market Capitalization |

$1,880,000,000 |

|

Enterprise Value/Sales (TTM) |

2.41 |

|

Price/Sales (TTM) |

2.19 |

|

Revenue Growth Rate (TTM) |

60.37% |

|

Operating Cash Flow (TTM) |

-$35,710,000 |

|

CapEx Ratio (Op C.F./CapEx) |

-0.53 |

|

Earnings Per Share (Fully Diluted) |

-$0.75 |

(Source – Seeking Alpha)

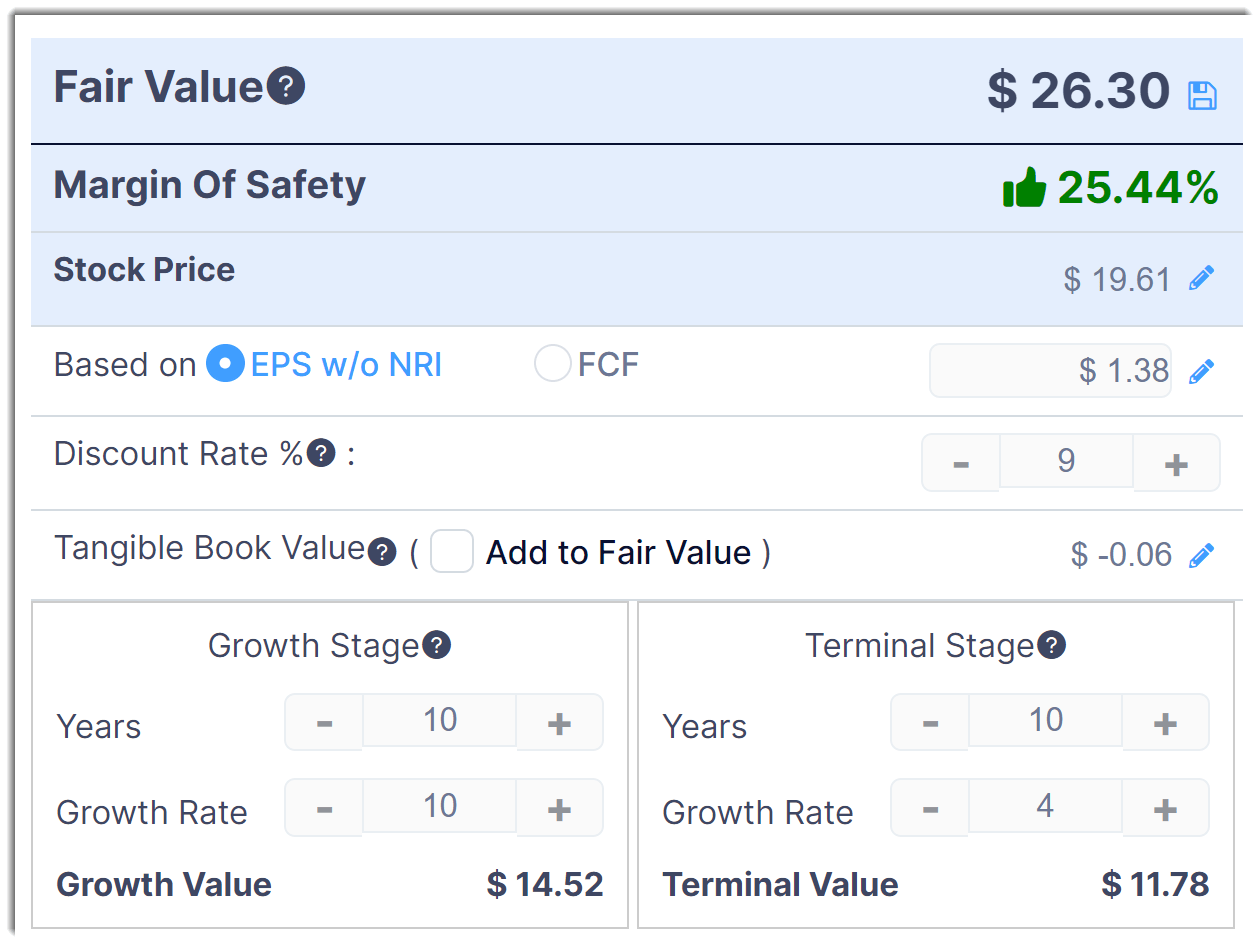

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Estimated DCF Calculation (GuruFocus)

Assuming conservative DCF parameters, the firm’s shares would be valued at approximately $26.30 versus the current price of $19.61, indicating they are potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

TASK’s most recent GAAP Rule of 40 calculation was 77% as of Q1 2022, so the firm is performing quite well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

60% |

|

GAAP EBITDA % |

17% |

|

Total |

77% |

(Source – Seeking Alpha)

Commentary On TaskUs

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its content security segment, which has seen volume growth with its existing client base and for which the firm expects to return to growth in 2023.

AI services revenue doubled year-over-year as a result of expansions of existing and new clients in the sectors of travel, social media and autonomous vehicle industries.

The company also recently launched new specialized services within its Risk and Response segment as well and is seeing customer uptake for applications such as payment risk operations, anti-money laundering (AML) and know your customer (KYC).

Notably, the firm has increased its focus on M&A as a strategic driver of growth. To that end, it recently acquired heloo, to spearhead its delivery of outsourced specialized services in the European market region.

As to its financial results, revenue grew 56.8% year-over-year and adjusted EBITDA rose 36.9%, above the top end of its previous guidance.

Its cost of service rose slightly due in part to increased absenteeism from COVID-19 conditions.

SG&A expenses rose to 26.8% of revenue from 20.6% in Q1 2021, primarily due to stock-based compensation.

For the balance sheet, the company finished the quarter with cash and equivalents of $77.1 million while free cash flow was a reasonably strong $19.1 million.

Looking ahead, management maintained its expectation for 30% topline revenue growth. The firm is laying off some U.S. employees as it shifts to a higher number of offshore located employees to better serve its global client base.

The company expects to achieve up to $1 billion in revenue for 2022 as it continues to increase revenue diversification between the three pillars of Digital Customer Experience, Content Security and AI Services.

Regarding valuation, a discounted cash flow analysis above using conservative projections indicates that the stock may be undervalued at its current price of around $19.60.

The primary risk to the company’s outlook is a global economic slowdown, which may slow sales cycles and reduce revenue growth results.

A potential upside catalyst to the stock could include a relatively shallow economic drop as well as an increase in valuations as a result of tapering interest rate rise expectations.

Recently, a few major analysts have reduced their price targets to $20 or $28, depending on the analyst, while Citi analyst Ryan Potter initiated coverage at a Buy and said the company was his top prospect in the digital customer experience space.

So, analyst opinion and SA’s Quant Rating are at a serious divergence with respect to TaskUs.

My opinion is more positive, although cautious. While the firm is generating growth and profits, a global slowdown may exert unpredictable effects on its near-term results, and we don’t know whether a slowdown will help or hurt the company’s operational results.

For that, I suggest that interested investors put TASK on a watchlist for close consideration in the period ahead.

Until we learn more about its trajectory in a slowing growth environment, I’m on Hold for TaskUs.

Be the first to comment