tifonimages

On 15 August Taseko Mines (TSX:TKO:CA) (NYSE:TGB) finally received a draft Underground Injection Control (“UIC”) permit from the U.S. Environmental Protection Agency (“EPA”). This put an end to a series of delays and established a more clear timeline towards the execution of the Florence project. When the new facility is put into production, the total output of Taseko will increase around 87% with a much better overall cost structure. The soon-to-be improved risk profile of the company, combined with the significant discount of the current enterprise value to the two main assets’ combined NAV, makes Taseko a good buying opportunity.

Company overview

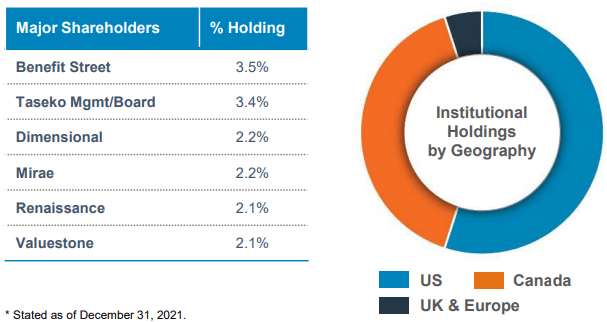

Taseko Mines is a Canadian copper producer and developer with sole focus on North America. All of the company’s assets are located in either Canada or the USA, which are both stable politically with strong property rights. Taseko has 5 main assets – one operating, one in late development phase and three in early development stage. The company has a very dispersed ownership structure, with the biggest shareholder owning just 3.5%.

Taseko’s ownership structure (Corporate presentation)

As of end-Q2’22 shares outstanding amount to 286.4M, which brings the current market cap to US$372.3M, using the latest share price of US$1.30. The company has CAD$175.7M of cash and cash equivalents and CAD$517.6M of long-term debt is senior secured 7% notes, due in 2026.

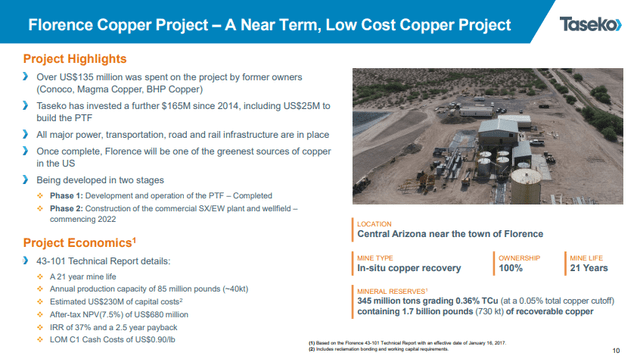

Florence Copper

The project is located in Arizona, USA. It has a projected mine life of 21 years and an after-tax NPV of US$680M, using a long-term copper price of just US$3.00 and a discount rate of 7.5%.

Florence copper overview (Corporate presentation)

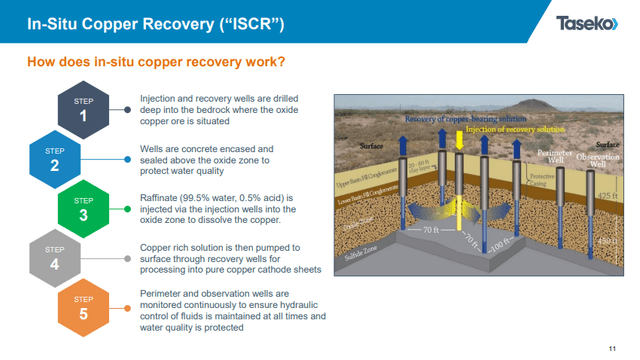

Taseko intends to use the In-situ recovery mining method, which the uranium giant Kazatomprom (KAP:LSE) has been notorious for using in its production process. While this approach is new to copper mining, Taseko has proven the concept, using a test facility on the Florence site in 2018-19. Furthermore, this method would allow for a very lean cost structure with expected cash costs of around US$1.10 per pound of copper. For comparison, the existing Gibraltar mine has estimated cash costs of around US$1.90 per pound. In addition, there are ESG advantages, as much lower energy and water will be used.

In-situ recovery (Corporate presentation)

Following eight years of regulatory hurdles, on 15 August the EPA finally issued a draft UIC permit for Florence, which triggered a 45-day public comment period. On 15 September a public hearing was held, where Taseko received unanimous support by the local community. As part of the procedure, after the public comment period is over, the EPA must address any concerns, if such arise, before issuing the final permit. Given the support by the locals, I think that additional delays are highly unlikely and the procedure should be over before the end of 2022. For reference, in 2020 the Florence Copper project received a final permit by the Arizona Department of Environmental Quality in December 2020, after the draft was issued at the beginning of August 2020 and similar public hearing process followed.

Project financing

The initial cost of the project were initially US$204M in the Technical report of 2017 but were subsequently raised to US$227 in the Competent Persons Report in June 2019. Taseko has not provided subsequent updates on the initial CAPEX, but given inflation during the period it likely has risen significantly. Assuming 15% further increase the project totals around US$260M. The company has available cash of US$135M, assuming CAD/USD exchange rate of 1.30 and undrawn US$50 million revolving credit facility. However, according to the Q2’22 report, Taseko already incurred CAD$52.2M, or around US$40M worth of expenses for the project. This leaves a gap of around US$35M, if the credit facility is fully utilized.

|

CAPEX |

US$260M |

|

(-) Incurred costs |

US$40M |

|

(-) Cash and equivalents |

US$135M |

|

Shortfall |

US$85M |

|

(-) Revolving facility |

US$50M |

|

Shortfall |

US$35M |

*based on author’s own assumptions

This shortfall could be filled through cash flows from the operating Gibraltar mine, given favourable economic conditions. However, the company has an alternative option, as the 2026 Notes’ covenants allow for the issuance of up to US$145M of first lien secured debt.

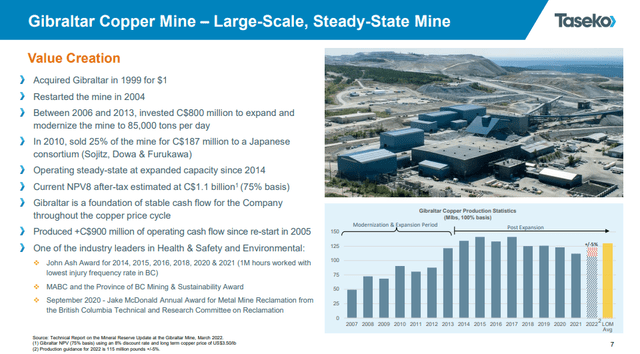

Gibraltar

The project, which is 75% owned by Taseko, is located in British Colombia, Canada. It has a projected mine life of 23 years and an after-tax NPV of CAD$1.1B (roughly US$850M), using a long-term copper price of US$3.50 and a discount rate of 8.0%.

Gibraltar overview (Corporate presentation)

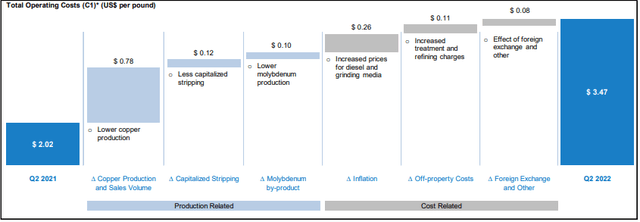

Unfortunately, Gibraltar suffers from the low-grade curse. The project has an average grade of just 0.25%, which is a lot less than average. Taseko has done an exceptional job, structuring the project with very lean cost structure, allowing it to be economically feasible even at those grades. However, such small copper content could lead to significant volatility in the results, since small nominal change in the ore grade constitutes big relative change. This problem was especially prominent during Q2’22, when the head grade fell to 0.17%. This put significant upward pressure to the operating costs per pound, which ended up at US$3.47, more or less equal to the current copper price. Out of those, around US$1.00/lbs is related to the lower production and should be temporary.

Gibraltar’s Q2’22 operating cost structure (Taseko Mines)

The company stated that operations will be moving deeper into the mine, where higher ore grades are expected. The performance of Gibraltar would have an important role in providing the necessary cash flows for the construction of Florence. Given a construction schedule of 18 months, as indicated by management and assuming final permit by the EPA in 2022 year-end, final outflows for the construction may happen in H1’24. For that reason, I’ll try to calculate the free cash flow from Gibraltar from H2’22 to H1’24 (8 quarters), based on the following assumptions:

|

Copper production (Mlbs, 75% basis) |

180 |

|

Copper price (US$/lbs) |

3.5 |

|

OPEX (US$/lbs) |

2.47 |

|

CAD/USD |

1.30 |

|

Revenue (US$M) |

630 |

|

(-) OPEX (US$M) |

444.6 |

|

(+) Hedges (US$M) |

27.6 |

|

(-) G&A expenses (US$M) |

16 |

|

(-) Interest expenses (US$M) |

56 |

|

(-) Other outflows (US$M) |

27 |

|

FCF (US$M) |

114 |

*based on author’s own assumptions

In such a scenario, Taseko would likely have more than enough capital to fund the Florence project, without utilization of the US$50M credit facility.

Other projects

Yelowhead Copper Project – located in British Colombia, this property has one of the most significant copper reserves in North America. Taseko has estimated a pre-tax NPV of CAD$1.3B at a long-term copper price of US$3.10. The problem is that the initial investment also is expected to be at least CAD$1.3B, which makes it almost impossible for Taseko to execute the project on its own in the foreseeable future. In my opinion, the most probable outcome will be for Taseko to either sell the project or look for JV partners.

New Prosperity Gold-Copper Project – located in British Colombia, this property, based on a Technical report from 2009, has indicated resources of 5.3B lbs of copper and 13.3Moz of gold. Unfortunately, its development is put on halt, due to opposition from the locals of Tsilhqot’in Nation. Although Taseko claims that there’s a constructive dialogue between the parties, I don’t believe this project would see the light of day.

Aley Niobium Project – located in British Colombia, this property provides diversification into the rare earth metal – niobium. Taseko claims that this asset constitutes the largest deposit outside Brazil and has pre-tax NPV of CAD$860M at an 8% discount rate and mine life of 24 years. Those calculations are based upon reserve estimation from 2014. It looks like that Taseko is not putting much focus towards Aley at the moment, but at a later date, I think it may try to unlock its value through either developing it as part of JV or selling it.

Share price and valuation

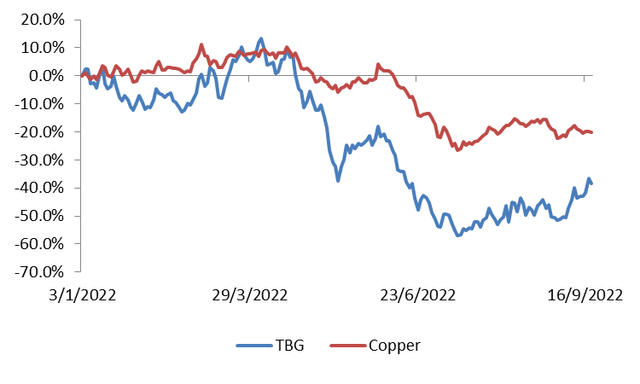

Compared to the beginning of the year, Taseko’s shares have lost 38.4%, while copper is down 20.0% YTD.

Taseko Mines vs. Copper prices (Investing.com)

Looking at Taseko’s enterprise value, compared to the NAV of its assets I’ll try to get a sense of the valuation. Currently, Taseko has an EV of about US$637.5M, while the estimated NPV (on 75% basis) of the operating Gibraltar mine is US$850M. If I add to that Florence, which construction looks almost certain, with an NPV of US$680M, I end up with a combined NPV of over US$1530M. Subtracting the net debt of around US$265M, equity value comes at US$1265M or more than x3 the current market value. Note, that I don’t include in the calculation the other three projects, even though some value may be unlocked in the future from at least one of them.

So now what appears to be a significant valuation gap may be closed. An obvious upside trigger will be an increase of copper prices. However, I think that even at current prices, the advancement of the Florence construction and the starting of production there should move the shares of Taseko up. Another catalyst could be a takeover from another company. Mining majors are looking for deals, even as copper prices are trending lower. A recent example of this is Rio Tinto’s (RIO) attempt to take over Turquoise Hill Resources (TRQ) for USD$3.3B which will give the Anglo-Australian mining major a direct ownership of the giant Oyu Tolgoi copper-gold mine in Mongolia. Although Taseko’s projects can’t individually compare with the world’s largest deposits, the political stability of Canada and the USA gives them an advantage. In addition, the lack of a major shareholder, demonstrated by the dispersed ownership of TGB, is another characteristic of a potential takeover target.

Risks

Single operating assets risk – Right now, the relatively low-grade Gibraltar mine is the only producing asset of Taseko. If for any reason it has to stop production, revenue generation goes to zero. For example, in 2017, operations were halted for a couple of days, due to fires in the area around the mine. The addition of Florence will help to mitigate the risk as it will add a second revenue source, which is not located in a close proximity to the existing one. The projected production of Florence of around 85Mlbs is very close to the 75% cut of Gibraltar’s 130Mlbs expected output.

Lower copper prices risk – This is an obvious risk for Taseko, especially given the relatively high operating costs of Gibraltar. The company has a hedging policy in place and has hedged a part of its production to H1’23. Here the inclusion of production from Florence would also help significantly, as operating costs are projected to be around half of those in Gibraltar. Existing sources of liquidity theoretically can be sufficient for the construction of Florence, even if the existing mine doesn’t contribute with positive cash flow in the meantime.

OPEX pressure risk – Taseko has already suffered from OPEX pressure as evident from operating cost breakdown. Here Florence would also be of great help, as the in-situ recovery mining method is much less energy and water intensive, leading to leaner cost structure.

Construction delay risk – In the current environment of supply chain problems around the world, construction delays are also an obvious risk. In order to mitigate it, the company has taken steps to pre-order some of the equipment.

Political risk – In the case of Taseko, this risk is relevant mainly in the stages before an asset is put into operation. Red tape and higher ESG standards could lead to delays as evident from the Florence project. However, once construction is finished and operations begin, Canada and the USA are one of the best jurisdictions.

Interest rate risk – The current long-term debt of the company is with a fixed coupon, therefore such risk is not very relevant at least to 2026, when principal will come due and would have to be at least partially refinanced. In the meantime, if cash flows from Gibraltar and current cash and equivalents are not sufficient for the construction of Florence, another loan should be taken, exposing the company to current rising interest rates environment.

Conclusion

After finally receiving the draft UIC permit by the EPA, Taseko has a highly-probable construction timeline of the Florence Copper project. Even at current copper prices, it looks that the company will be able to build it with existing sources of liquidity. The addition of Florence to the production and cost profile of the company will greatly improve both. Given the significant discount to the two asset’s estimated NAV, Taseko looks like a good buying opportunity.

Be the first to comment