JHVEPhoto

Over recent months, economic demand has waned in the US and worldwide. As the cost of living grows, and wages fail to keep up with inflation, many people are slowly reducing discretionary spending. At the same time, many companies are facing increasing input costs as energy (transportation) and other commodities become more expensive. These trends are further exacerbated by rising interest rates, which lower businesses and households borrowing capacities and increase interest expenses.

Indeed, as long as the global production of essential commodities (energy, food, etc.) and manufacturing remain low, the only way for inflation to slow is for economic demand to decline. In 2021, when economic demand was far above supply, many items fell into significant shortages, causing prices to rise. In 2022, we’ve seen a general decline in the severity of shortages as higher prices force demand lower.

This trend impacts specific segments of the economy more dramatically than others. In my view, department stores carry particularly high-risk exposure due to these economic trends, combined with weakening competitive moats compared to online retailers like Amazon (AMZN). As detailed in “Kohl’s: The End Of The Department Store Era Draws Close,” I believe some firms like Kohl’s (KSS) may face bankruptcy over the coming year as these factors override its already weak balance sheet.

With this in mind, investors may wonder about the prospects of higher-quality department stores such as Target (NYSE:TGT). Target faces similar risk factors, with particular strain signaled by rising inventory and weak working capital, as well as sharp declines in net income. Initially, Target, like its peers, was able to pass rising input costs onto consumers and maintain profit margins. However, with consumer confidence stuck at extreme lows, Target is now experiencing margin strain as it struggles to keep prices up with input costs while maintaining sales. TGT has lost nearly 40% of its value this year but trades at a relatively high forward “P/E” ratio of 19X. Accordingly, I believe it is an opportune time to take a closer look at the company to judge better its “fire sale” or “falling knife” potential.

Flying Too Close To The Sun

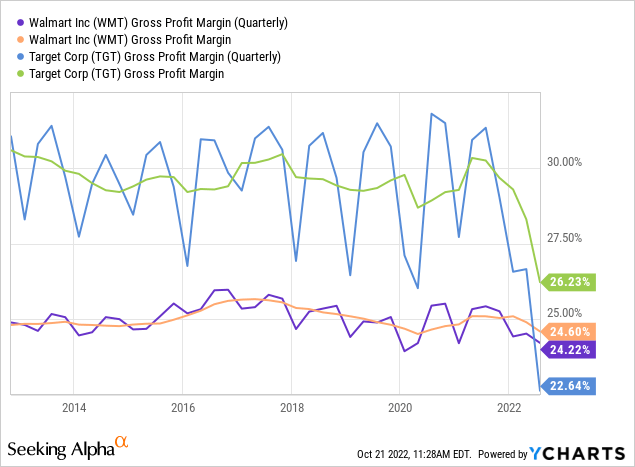

Unlike Kohl’s, Target performed very well over most of the past ten years. The company has built a more substantial online sales footprint, currently making up around 20-25% of its total sales. The firm also established itself as a “premium” department store, often viewed as having higher-quality products, and a more attractive shopping environment, than Walmart (WMT). Target operates at a higher gross profit margin than its competitor. To me, this factor is a double-edged sword. In good times, Target’s “luxury” business branding allowed it to grow more quickly and overcome competition from Amazon. However, as people look to reduce spending, Target’s higher price gives it greater downside exposure. This factor is made clear by comparing changes in each company’s gross profit margin:

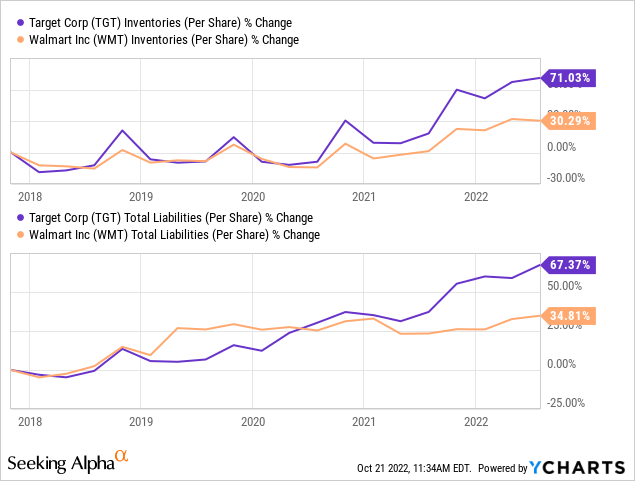

Historically, Target’s gross profit margin is around 29-30%, while Walmart’s fluctuates about 24-25%. Both retailers have seen their gross margins decline this year, but Target’s loss has been far more extreme than Walmart’s, so much so that its last quarterly gross margin fell below Walmart’s. The chief reason for the sharp decline in Target’s gross margin was an effort to reduce the company’s burgeoning inventory through significant discounts. Following 2021’s shortages, many companies were aggressive in growing inventories. Demand has waned since, leading to a substantial buildup in inventories for most retailers and creating pressure on margins. That said, Target has experienced a more significant inventory buildup than Walmart this year. Even more, its aggressive growth effort has caused it to face tremendous liability growth over the past five years. See below:

At the end of Q2, Target had a relatively high days inventory outstanding ratio of 69X compared to Walmart at 48X. Target also had a higher total liabilities-to-assets ratio of 80% compared to Walmart at 65%. For retailers, which mainly have lease liabilities, the debt ratio itself is not particularly important; however, the rapid growth in Target’s liabilities is problematic in light of its high inventories. To me, it seems Target was a bit too aggressive in pursuing growth over the past five years that it compromised its ability to withstand an economic recession. Now that the company faces recessionary dynamics (considering the traditional recession definition), those structural deficiencies are being realized.

Economic Deterioration Indicates EPS Declines

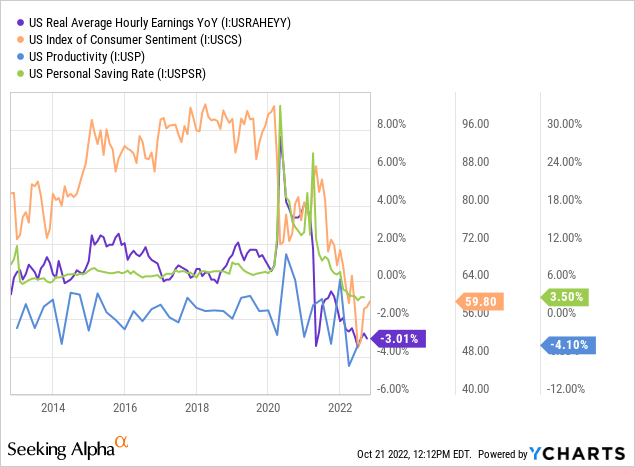

Target’s ability to withstand the economic shift depends on its business fundamentals and the breadth and depth of the economic storm. Thus far, the US economy has faced a relatively mild decline in GDP. There has been no increase in unemployment, but there have been significant declines in real wages, productivity, consumer confidence, and personal savings. See below:

These data do not point to immediate economic recovery. While the GDP has declined for two quarters, its losses have been relatively small. The decline in productivity is a primary culprit behind inflation as, although people are working, less is being produced per hour. Further, people receive less pay per hour compared to the cost of goods and services. This situation has led to a substantial decline in consumer sentiment and personal savings, indicating many will need to reduce discretionary purchases. Most of Target’s items fall into the “discretionary spending” category and are at greater risk due to the “luxury pricing” impact on price elasticity (people look for discount retailers more when financially strained.)

Given the lack of a rise in unemployment, the Federal Reserve’s efforts to tame inflation (through straining economic demand) will likely continue. The sharp decline in the financial spending power of many has been offset by a considerable rise in consumer credit. More recently, consumer credit growth has waned, indicating that many who were maintaining spending through consumer debt (credit cards, etc.) can no longer utilize this mechanism and, therefore, must reduce spending further.

To me, this situation makes it highly likely that Target will face a more substantial decline in demand over the coming year than it has over the past year. The current EPS outlook for TGT suggests the worst is over and that it will see a rapid reversal in EPS in Q3-Q4 that is sustained through the coming two years. However, US real retail sales continued to decline last month, indicating potential further EPS declines considering Target’s business model makes it disproportionately exposed to reductions in retail spending. Target’s inventory was still high in the previous quarter, so I believe it may face more sharp negative earnings surprises in Q3 and Q4 as economic declines weigh on the company. Further, I suspect Target will have negative EPS for most of 2023 unless economic trends improve.

While economic recovery in 2023 is possible, persistent inflation and deterioration in household financial stability imply that it is unlikely. Target is entering this storm with a quick ratio of 0.05, indicating it has very few liquid current assets compared to current liabilities. Thus, if it cannot sell its inventory at a high enough price, it may need to raise financial debt, or sell equity, to improve its working capital.

Following 2020’s changes, Target reduced its operating expense-to-sales ratio over the past two years from 23-24% to ~21%. Last quarter, the company’s gross margin was nearly as low as its operating expense-to-sales ratio, meaning its net profit margin was almost zero. Target’s margins may be strained further if its measures to reduce operating costs cannot be sustained. Even then, the negative pattern in its gross margins may sufficiently hamper its margins without a rise in Opex.

The Bottom Line

I believe Target is in a weak position, and it seems investors would be wise to take a very cautious view of the company. For now, its situation does not appear as dire as Kohl’s, mainly due to its diversified products and generally strong brand “inertia.” While many households will likely need to spend less this holiday season than in past years, I suspect many people will still prefer Target over Walmart on Amazon due to shopping preferences.

Target’s primary asset is arguably its intangible “premium brand” value, as its book value is around a seventh of its market capitalization. Problematically, however, as people look to reduce discretionary spending, Target may lose much of the luster it has gained over the past decade due to its higher prices. Fundamentally, it seems the overarching retail trend benefits ultra-low-cost retailers (like Amazon and Walmart) and niche small-business “brick and mortar” retailers for those looking for “high-quality, high-cost” items. Target has built a brand by operating in the middle of that spectrum. As recessions bring significant and permanent changes, the company may not have as substantial a foothold as many investors believe.

My long-term view regarding Target is likely more bearish than most due to my qualitative belief that the company does not have a strong moat and may soon (2-5 years) be overcome by competitive pressures. Given its relatively weak balance sheet, a prolonged decline in retail spending could quicken its downfall. That said, for now, it is far enough from that potential that I would not yet state outright that Target is at risk of bankruptcy.

Assuming Target’s profit margin returns to a base level of 3-4% (its normal range before 2020), I expect its EPS, after potential recovery, to be around $6.8 to $9. Since its deterioration risk loom, I believe TGT should trade at a “P/E” of ~10X. That level seems reasonable as riskier retailers like Kohl’s traded at such a valuation in years past when it faced stagnancy (but not bankruptcy risk). As such, I believe TGT is worth closer to $68 to $90 per share (44-57% below its current price) and may decline toward that range over the coming year. I have a very bearish view of TGT that may seem unreasonable to many. However, the stock was trading in this price range just three years ago, and one could argue it is in a weaker fundamental position today than it was then.

A Short Opportunity

While I have no plans to short the stock, TGT may be a short opportunity as I believe there is a high potential for its Q3 EPS to be below current estimates. The stock has a low short interest level of 2% (and no borrowing cost premium), giving it low short-squeeze risk as few are betting against it. That said, TGT is resting at its support level, attracting significant dip-buying activity that may cause it to rise. Further, while it seems likely to me that Target’s EPS will continue to slip (and may turn negative), an economic rebound, or an input-cost benefit from the strong US dollar, could improve its earnings, so discretion is advised. One could use a call or put option to hedge this risk, but considering TGT’s implied volatility is significantly elevated, I would not buy options on the stock today. Still, compared to most stocks I analyze, I believe TGT has a more attractive risk-reward balance for short-sellers than most.

Be the first to comment