billnoll/E+ via Getty Images

Solar energy stocks are set for a decade of growth as decarbonization momentum ramps up on the back of the Inflation Reduction Act. This single piece of legislation will radically change the short, medium, and long-term outlook of solar energy in the US. It’s likely the most impactful legislation for the solar industry ever with billions of dollars of investment tax credits earmarked to ramp up the rollout of solar energy across the US. Other developed countries will likely follow with their own mini versions of the IRA in the years ahead.

This places solar energy on the cusp of a golden decade under the sun. Expectations are now for US solar deployment to increase by around 62 GW over pre-IRA projections through 2027. Hence, the US power grid is set for its most marked period of decarbonization with solar’s contribution about to increase to about 10% of US electricity generation from all sources by 2030, up from 3% in 2020.

U.S. Energy Information Administration

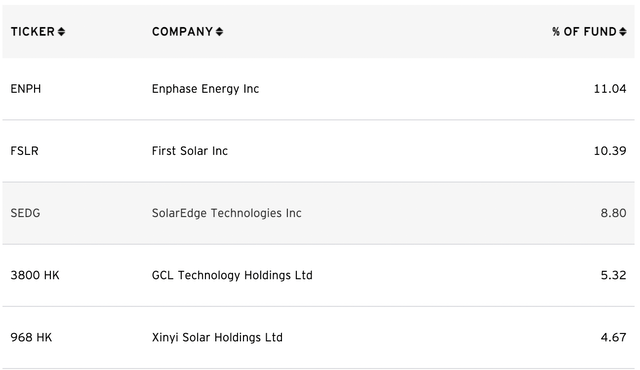

The golden decade ahead is being built by dozens of companies from solar microinverter manufacturer Enphase (ENPH) to utility-scale thin film solar PV company First Solar (FSLR). Both of these form the largest two positions in the Invesco Solar ETF (NYSEARCA:TAN). TAN, which tracks the performance of a basket of over 40 solar energy stocks, is one of the largest in its class with $2.2 billion in assets under management.

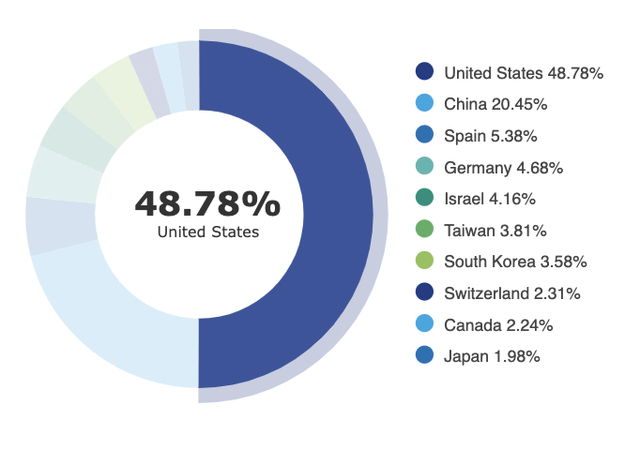

The ETF has a 49% allocation to the US with China, Spain, and Germany forming the next three countries. China is of course a huge solar manufacturing powerhouse and TAN’s geographical diversification provides true exposure to the global growth of solar power with a core positioning in the US.

The Golden Decade Ahead

The IRA will fully embed solar power in the US energy generation capacity and TAN represents one of the most direct ways to get broad exposure to the $370 billion US decarbonization push. There will be a dual 30% tax credit provided to homeowners who adopt rooftop solar systems, production tax credits will be provided to domestic solar manufacturers, and new utility-scale solar projects will be eligible for a 10% domestic content credit if any manufactured product that’s a component of their project was produced in the United States.

This sets the background for the macro backdrop TAN’s underlying holdings are set to operate in the year and decade ahead. However, the market has not been asleep and this is not an under-the-radar trade.

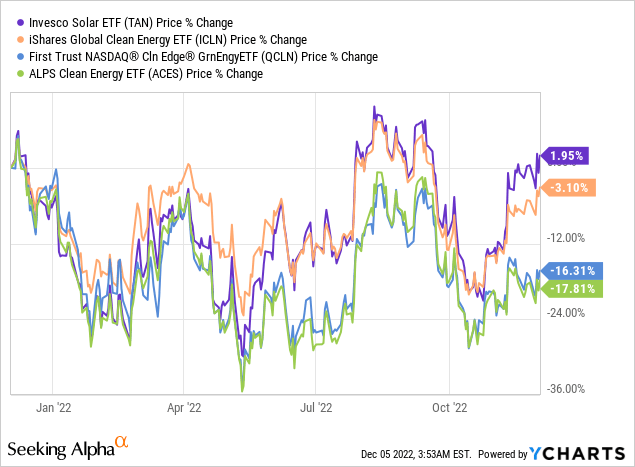

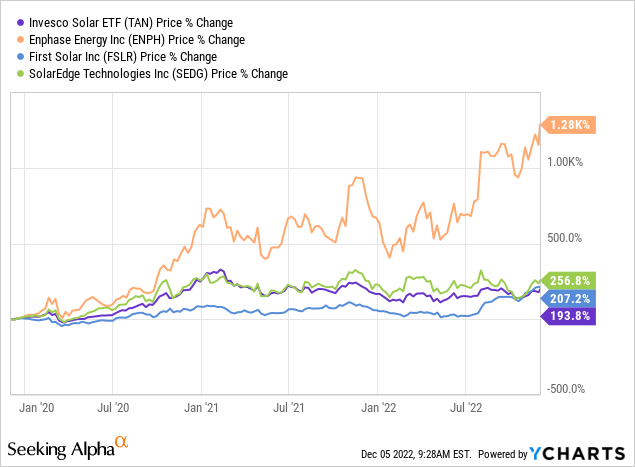

TAN is up 1.95% year-to-date in a year when high inflation and consecutive Fed rate hikes pushed the stock market to have its worst performance since the 2008 financial crisis. TAN is up an incredible 193% over the last three years. A move mostly driven by Enphase being up by more than 10x just over the last three years as a ramp in home solar demand caused a surge in demand for microinverters.

Some investors would be right to question whether such a run is sustainable and whether an investment in TAN at this level is setting the base for future underperformance. Indeed, the ETF rallied in recent months on the back of the IRA, which is set to come into force in the new year. But investors need to focus on the longer-term disruption story. The risk of a pullback is real.

The Longer-Term Disruption Story

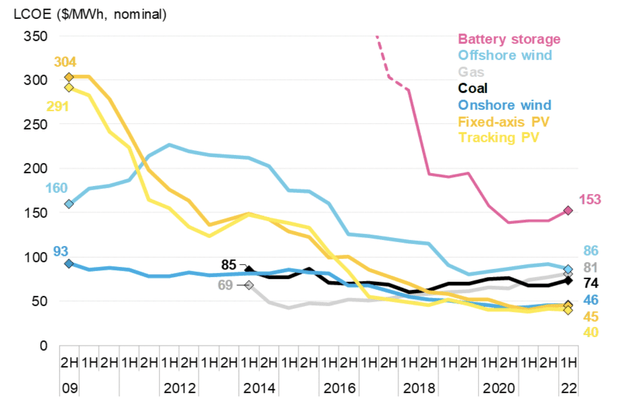

Tracking and fixed-axis and PV now both now have the lowest per MWh levelized cost of electricity versus other sources of energy after falling from $304 in 2009 to $40 and $45 respectively as of 2022.

This trend is set to keep on going with the core intention of the IRA being to drive the solar LCOE further down. The Boston Consulting Group has estimated that the incentives included in the IRA could increase the deployment of zero-carbon energy to up to 80% of electricity production as soon as 2030 with US solar and wind potentially set to be the cheapest in the world at less than $5 per MWh by 2029. These are undoubtedly too ambitious but underscore just how much growth is expected over the next decade.

Bears would be right to flag the current extensive valuation of TAN’s portfolio as a reason to stay away for now. Enphase is trading at a trialling 12-month price to earnings of 87.50x with most of TAN’s other positions trading well above their sector median. This increases the overall sensitivity and volatility of the fund and fundamentally exposes current common shareholders to capital loss on the back of the dissipation of current strong sentiment.

TAN is a buy for an investor looking to gain exposure to the sector but they will have to take a very long-term outlook, a decade perhaps.

Be the first to comment